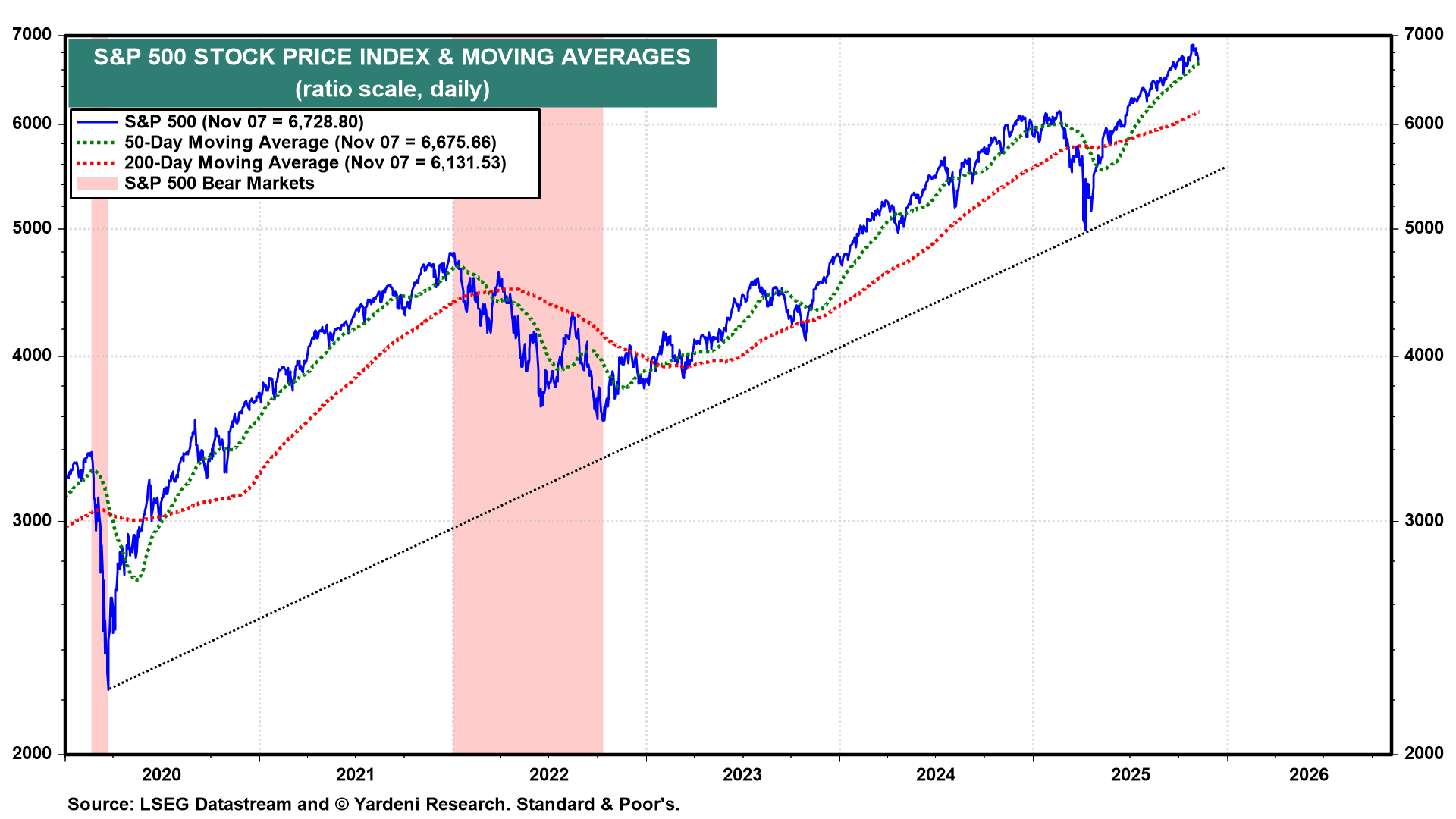

The S&P 500 peaked at a record high of 6890.59 on October 28 (chart). It is down 2.4% since then. It retested its 50-day moving average on Friday, falling slightly below it around noon. It then closed higher on the day on hopes that a compromise proposal from the Democrats might end the government shutdown. Negotiations are reportedly happening, but they remain tense and far from resolution.

A week ago, we warned: "While earnings are bullish, sentiment is bearish in the very short term. There are too many bulls." A quick test of the 200-day moving average is possible and would amount to an 11% correction. That would be a buying opportunity. We are still aiming for the S&P 500 to end the year at or closer to a record high of 7000.

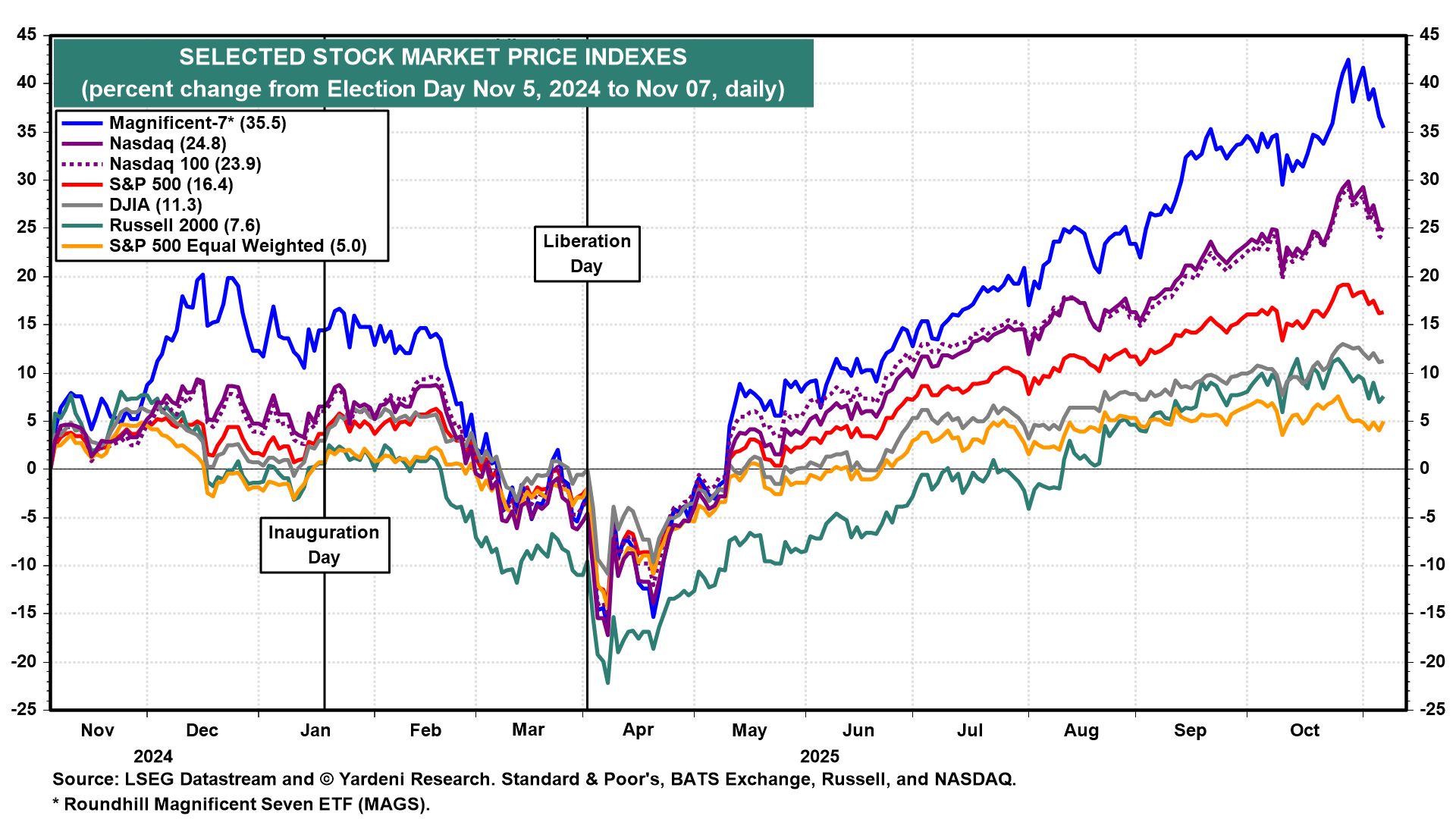

Investors are jittery about AI-related stocks, as evidenced by the 4.9% drop in the MAGS ETF since October 29 (chart). We are not in the AI bubble camp. The cash flow of the AI hyperscalers continues to exceed their rapidly rising capital spending, with a payoff manifest in the rapidly increasing revenues of the cloud providers.

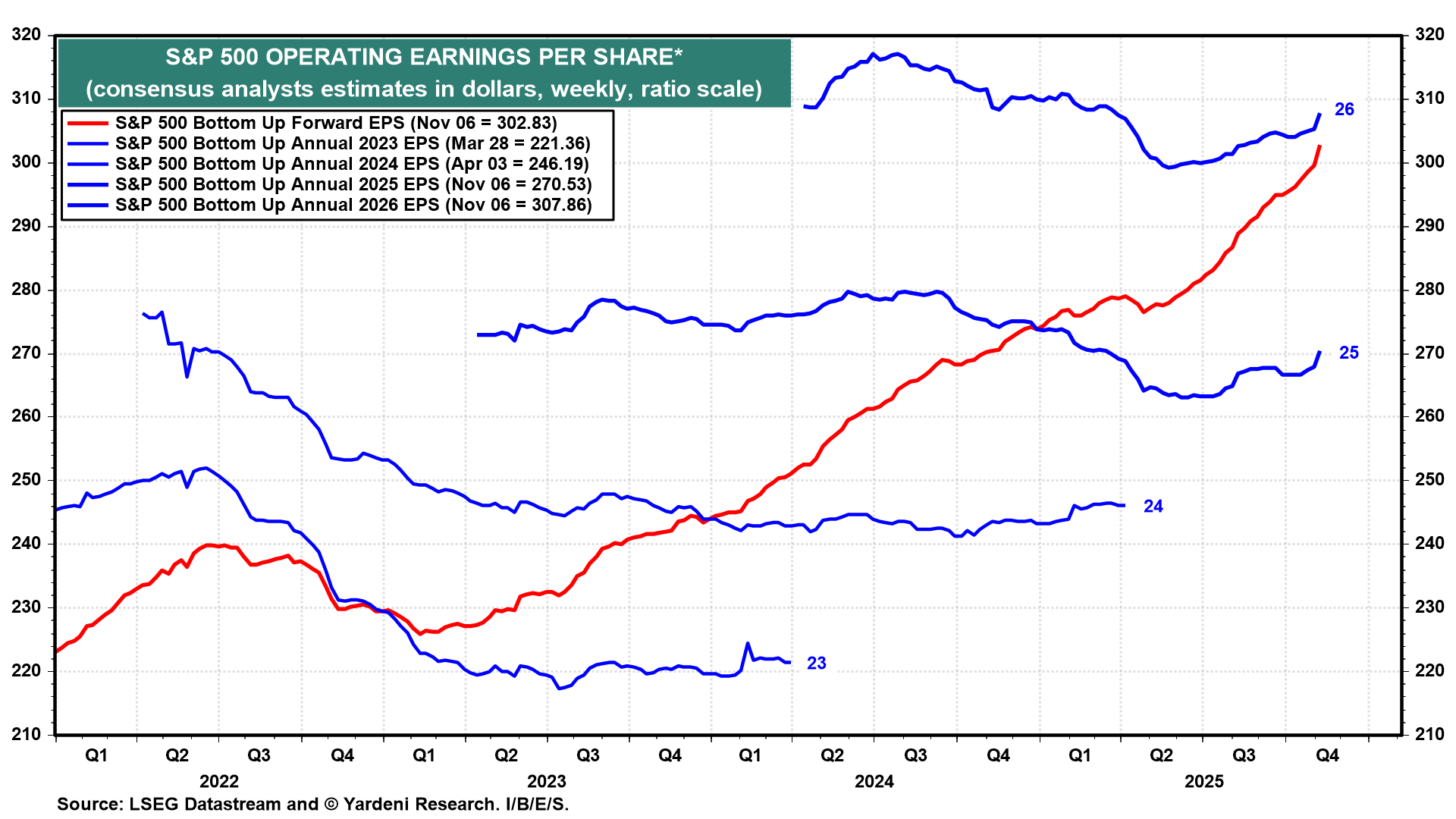

Still unambiguously bullish is that the S&P 500 forward earnings per share continues to soar to record highs (chart). It is now $302.83 with the forward P/E at 22.2.

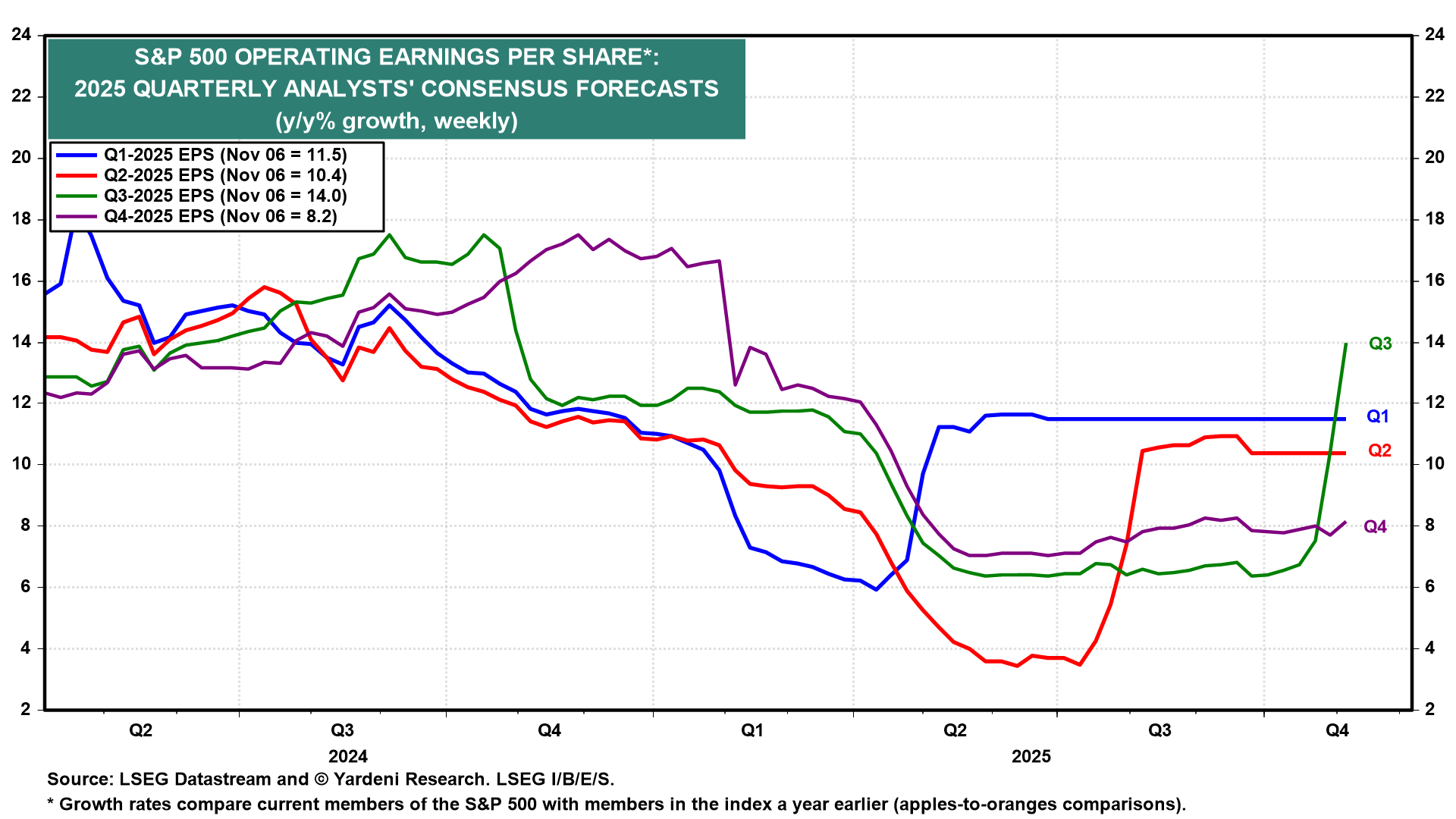

Earnings were much stronger than industry analysts expected in Q1 and Q2. The same can be said for Q3 (chart). At the start of the Q3 earnings season, they expected a 6.5% y/y increase in S&P 500 earnings per share. The quarter is currently on track to exceed 14.0%!

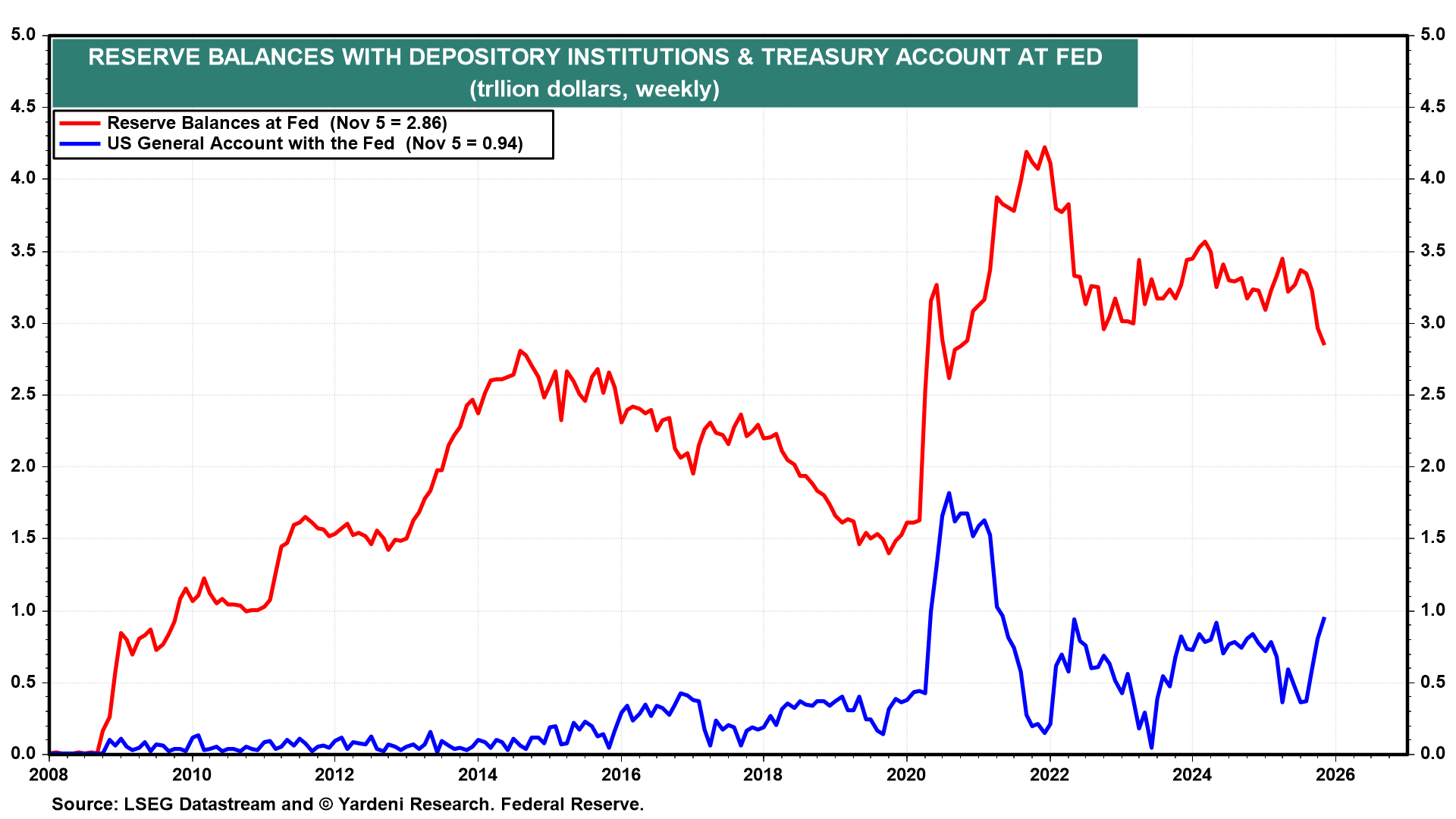

We expect that the government shutdown will end soon, and certainly before Thanksgiving. That should relieve some of the stress in bank liquidity. As a result of the shutdown, the US Treasury's cash balance has risen, leading to a decline in bank reserves (chart).

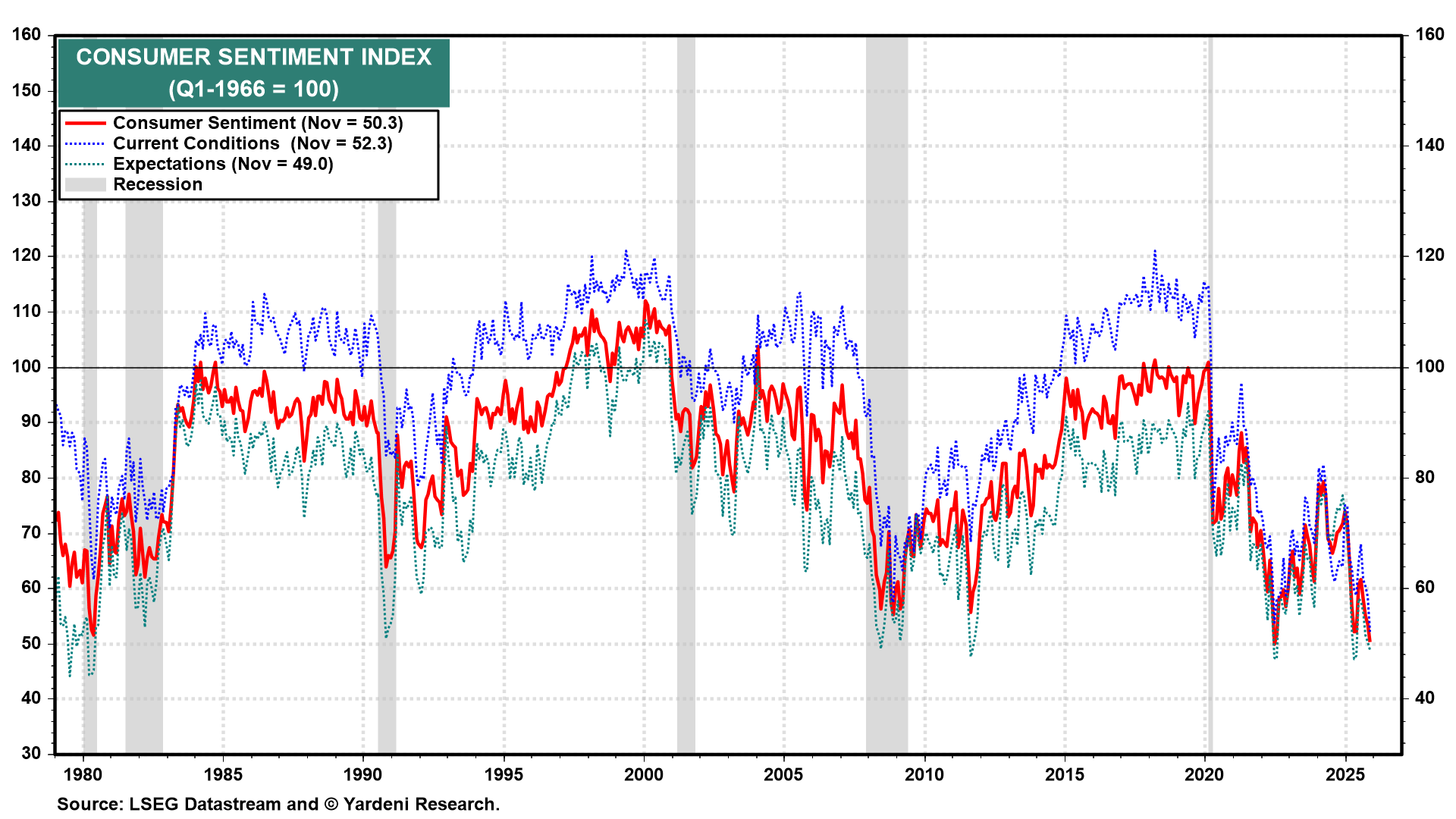

Meanwhile, on the economic front, investors' jitters were exacerbated last week by a jump in October layoff announcements and by the weakness in the preliminary November Consumer Sentiment Index (CSI) (chart). The layoffs were concentrated in technology and warehousing. They were not widespread and reflected the impact of productivity-boosting AI and automation advancements on these two industries.

The CSI has been a useless economic indicator since the pandemic. Besides, when American consumers are happy, they spend money. When they are depressed, they sometimes spend even more, as long as they remain employed.

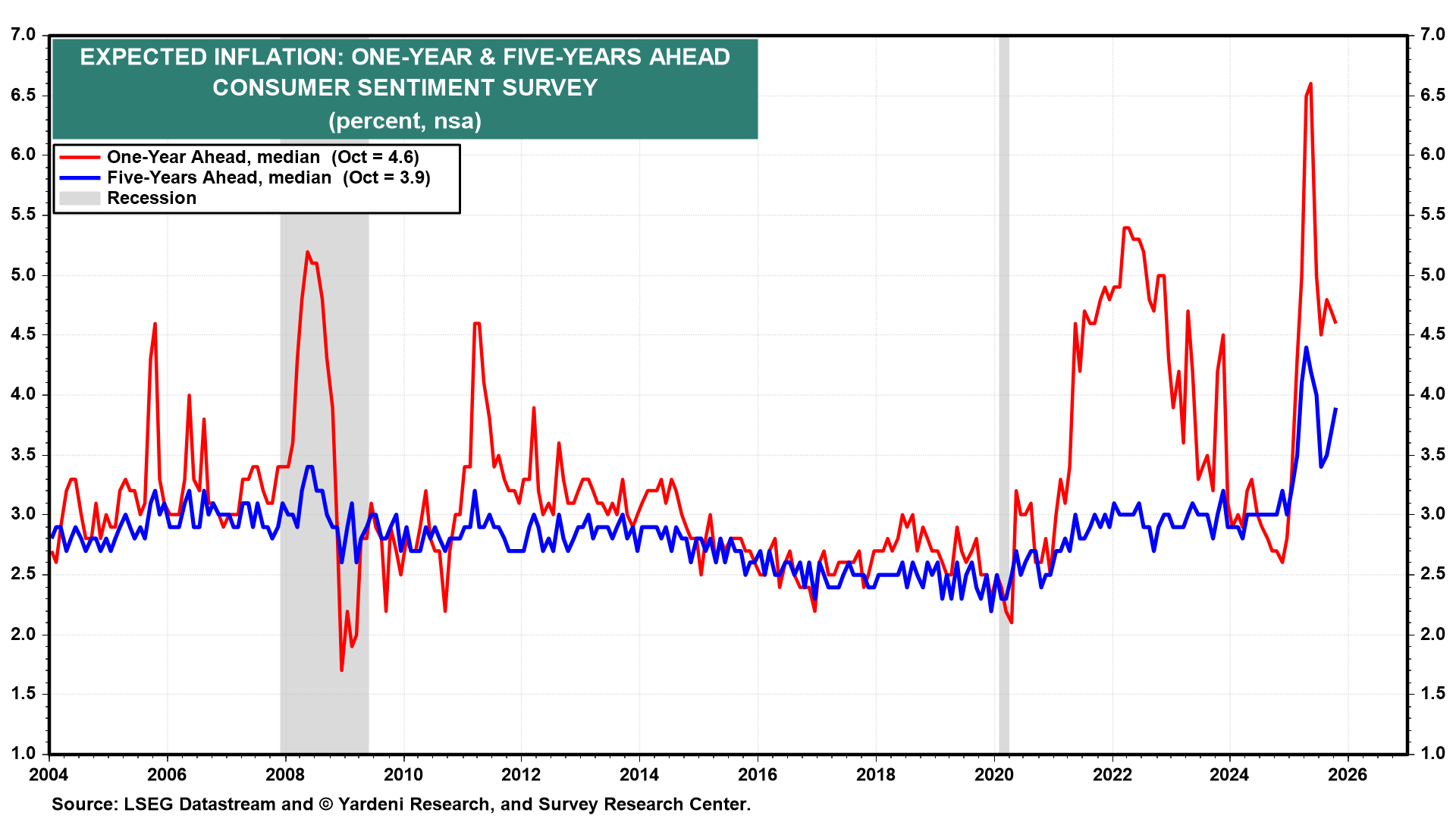

The signs of weakness in the labor market are unlikely to convince the majority of FOMC voters to cut the federal funds rate again in December, as actual and expected inflation remain elevated (chart).