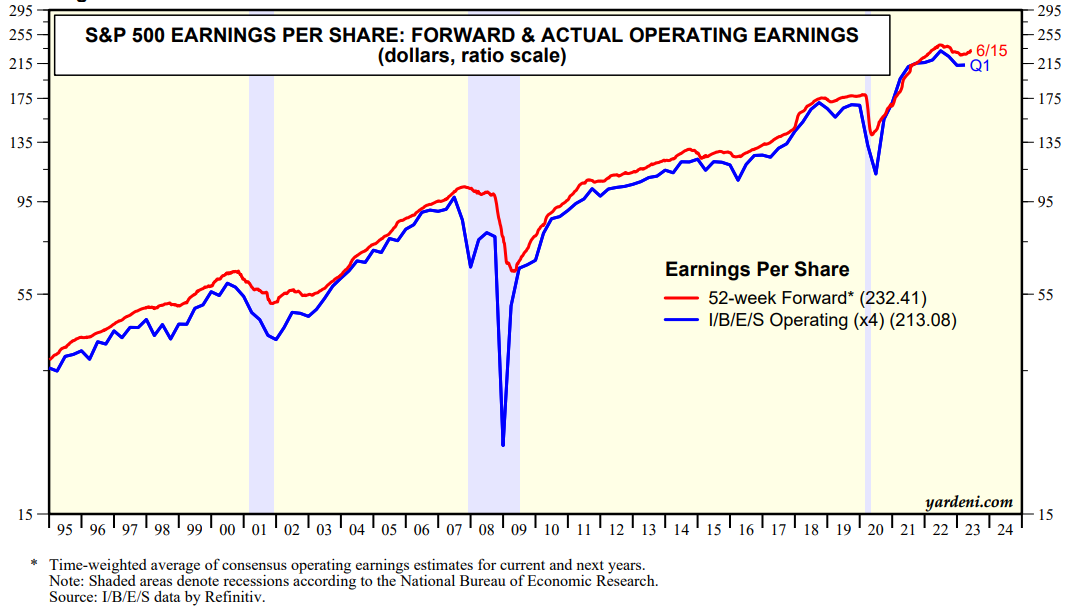

In our previous QT (The Week Ahead), we observed that this week's economic indicators should be good for the stock and bond markets, confirming that the economy is still growing while inflation is continuing to moderate. Industry analysts seem to agree with us as their S&P 500 forward earnings turned more optimistic on the outlook for S&P 500 earnings recently (chart). However, in coming days, Fed officials are likely to parrot Fed Chair Jerome Powell's comment last Wednesday at his congressional testimony: “Inflation pressures continue to run high, and the process of getting inflation back down to 2% has a long way to go."

The rally since October 12 has lifted forward P/Es especially of the MegaCap-8 stocks which have enjoyed a melt-up move. The S&P 500 has achieved making a third higher high in recent weeks establishing an uptrend of a rising channel (chart). Now it may need to make a third higher low to clearly confirm this channel. If so, that might put it down to around 4200 around its current 50-day moving average.