The S&P 500 nearly matched its July 28 record high on Friday. The Nasdaq did rise to a record high. Once again, the Magnificent-7 stocks collectively are leading the pack. That's because these remarkable companies continue to deliver magnificent earnings, which are increasingly being driven higher by the demand for cloud computing as AI increasingly powers the Digital Revolution.

The sky seems to be the limit for the cloud providers. More and more of us are using AI's large language models, like GROK, ChatGPT, Claude, and Copilot, as tools to do research, to write software, to create content, and to work more productively. These AI tools are all processing and storing our interactions with them in the cloud and learning from these interactions to become more useful to us. As the tools become more useful, the cloud companies earn more, and they must spend more to expand their data center capacity. Our collective ability to process more data leads us all to create more data to process. And so on. So the sky really is the limit!

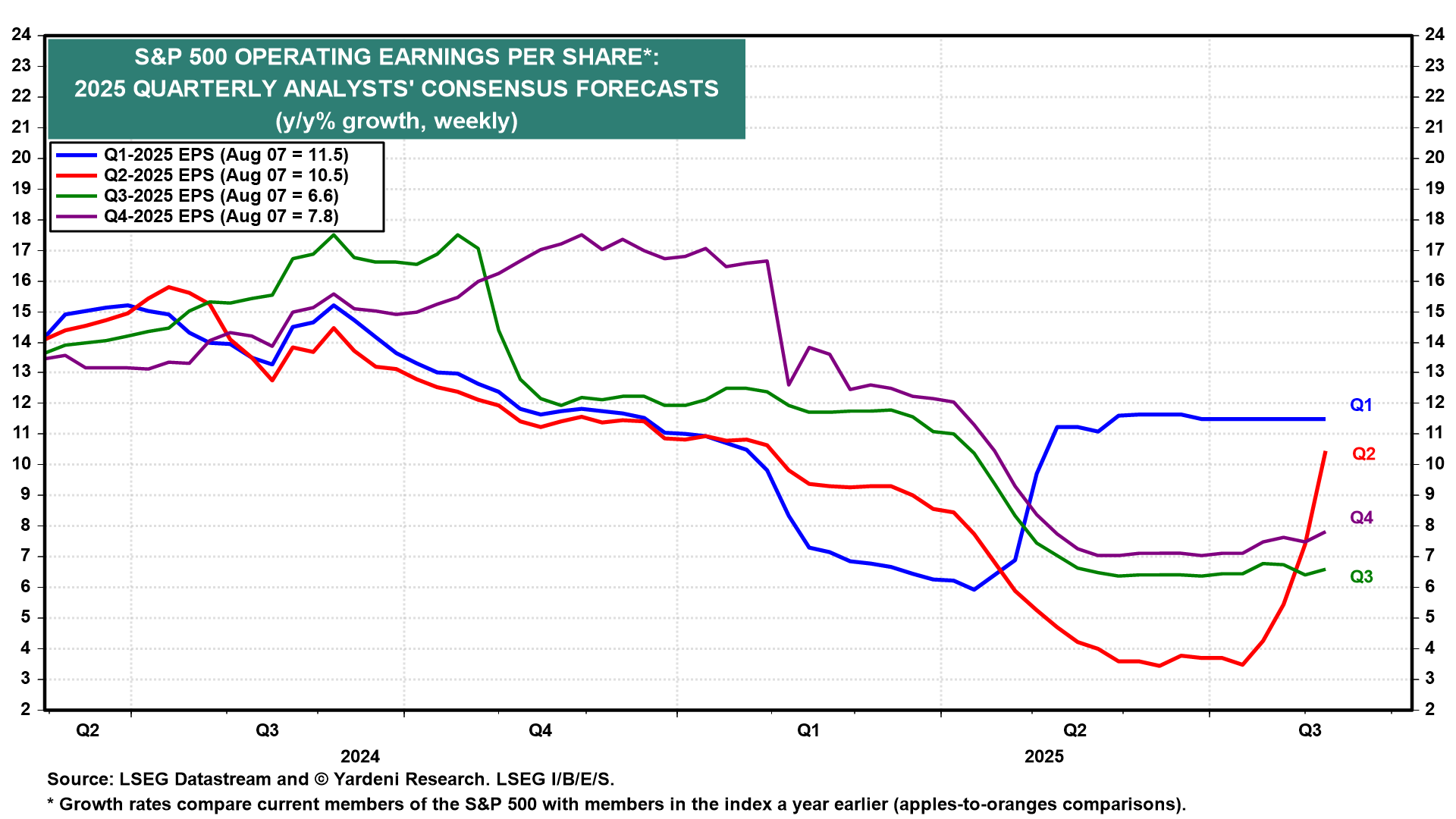

Better-than-expected earnings reported by the Magnificent-7 contributed to the better-than-expected earnings results of the S&P 500 companies in aggregate during Q1 and Q2 (chart). Q1's earnings rose almost twice as fast as was expected just before the earnings reporting season. Q2's growth rate may be on track to be three times greater than expected.