Dealmaking is in the air. American and Chinese delegations met this past weekend to discuss how they might deescalate their trade war. Russian President Vladimir Putin on Sunday proposed direct talks with Ukraine on May 15 in the Turkish city of Istanbul that he said should be aimed at bringing a durable peace and eliminating the root causes of the war. A fragile ceasefire was holding between India and Pakistan on Sunday. That's after hours of overnight fighting between the nuclear-armed neighbors. President Donald Trump said he will work to provide a solution regarding Kashmir. This past week, Trump announced an agreement with the Iranian-backed Houthi militias in Yemen to halt US airstrikes against the militants, who agreed to cease attacks against American vessels in the Red Sea. Trump is negotiating with Iran's government to stop Iran from developing nuclear bombs.

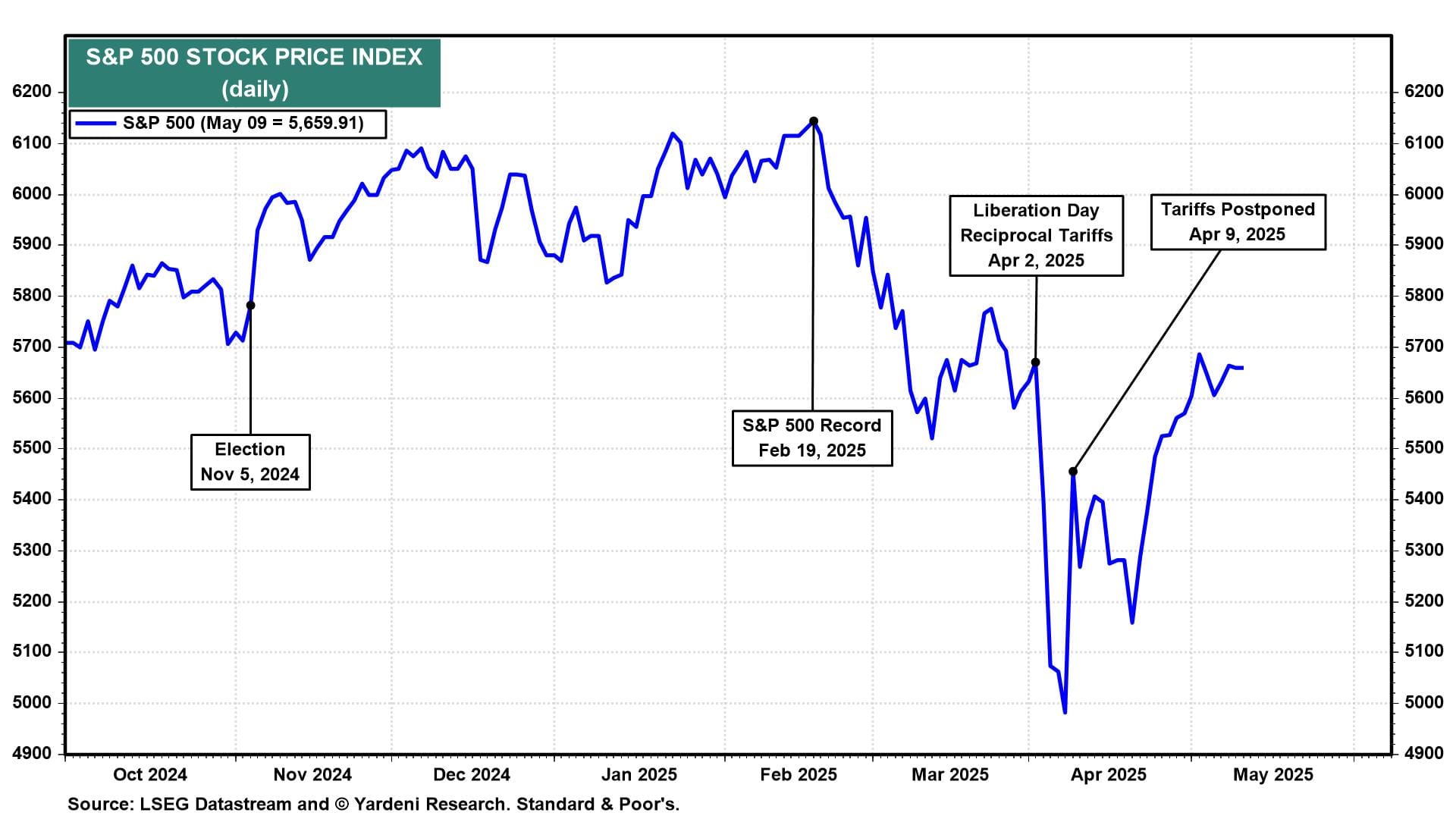

The stock market seems to have discounted the apparent simmering down of geopolitical tensions. It has been doing so since April 9. The S&P 500’s 18.9% correction since February 19 troughed on April 8, the next day, Trump postponed his April 2 Liberation Day reciprocal tariffs on April 9, except for China. The S&P 500 closed up 9.5% that day (chart). It is now up 13.6% since the trough and only 7.9% below its record high!

Wall Street's investment strategists are currently expecting the S&P 500 to end the year at 6,047 on average (chart). That would be essentially unchanged from last year. At the end of last year, the consensus expected the S&P 500 to rise to 6600 by the end of this year.