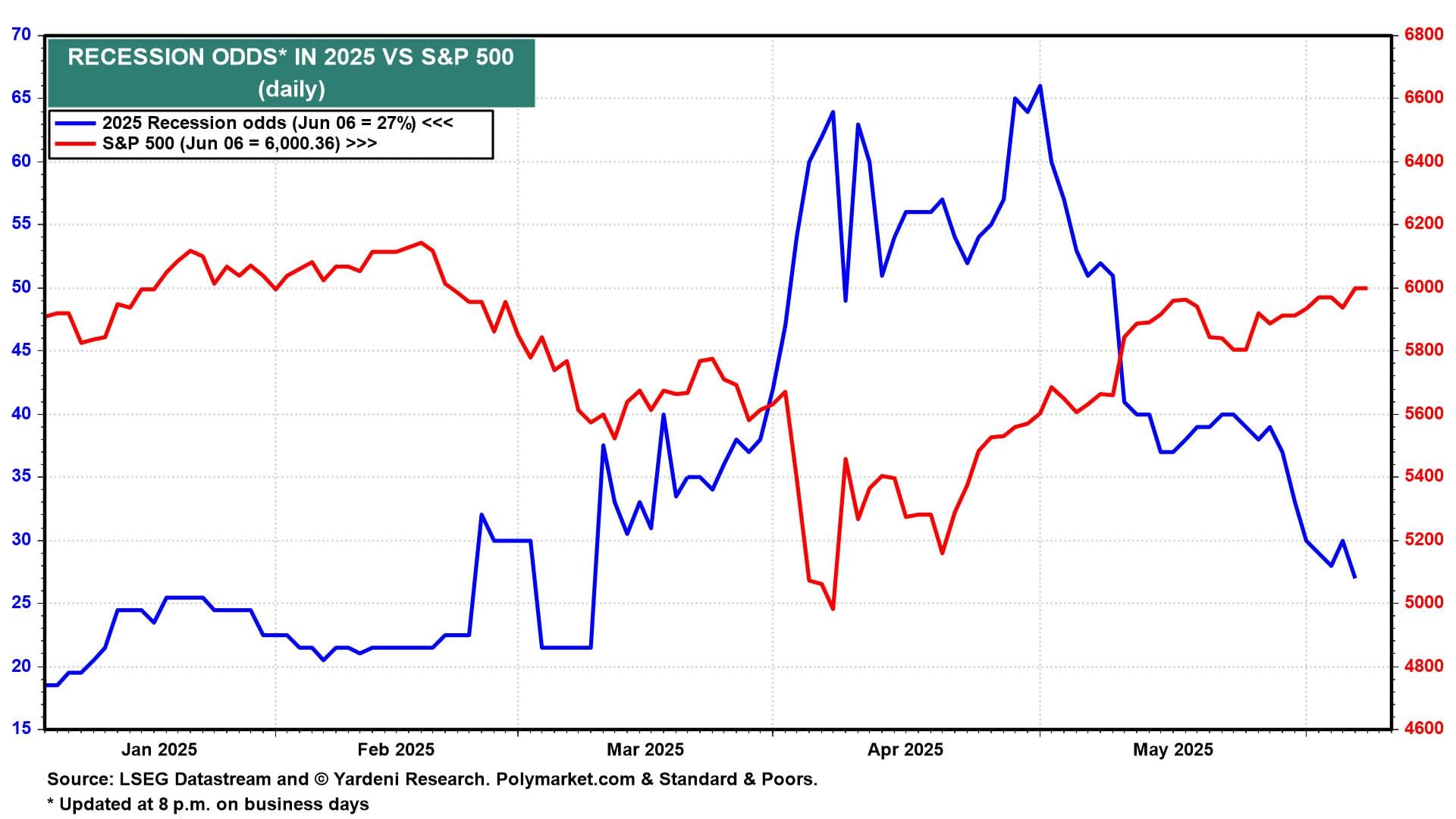

The stock market has become tariff-scare-proof now that the S&P 500 is only 2.3% below its February 19 record high despite Trump's Tariff Turmoil (TTT) since then. After Friday's better-than-expected employment report, the stock market has also become recession-scare-proof. According to Polymarkets, the odds of a recession were back down to 27% on Friday from a recent peak of 66% on May 1 (chart).

The stock market might become inflation-scare-proof on Wednesday, if May's CPI inflation rate turns out to be as subdued as estimated by the Cleveland Fed's Inflation Nowcasting, i.e., 2.4% y/y. On May 19 we wrote, "So the odds of our Roaring 2020s scenario is back up to 75%. In this scenario, the S&P 500 rises to 6500 by the end of this year. It could keep going to 7000 in a meltup."

So, do we have nothing to fear but nothing to fear? That would represent much to fear, as fearless investors create meltups, which then become meltdowns. But in fact, the stock market's sentiment gauges are showing plenty of fear, which is bullish from a contrarian perspective (chart).