The DJIA, S&P 500, Nasdaq, and Russell 2000 all rose to record highs this past week. All were boosted by the Fed's decision to cut the federal funds rate by 25bps on Wednesday. Is the stock market back on the road to the same irrational exuberance that inflated the Tech Bubble of 1999, which was followed by the Tech Wreck of the early 2000s? Will the theme song for 2026 be "Party Like It's 1999!"?

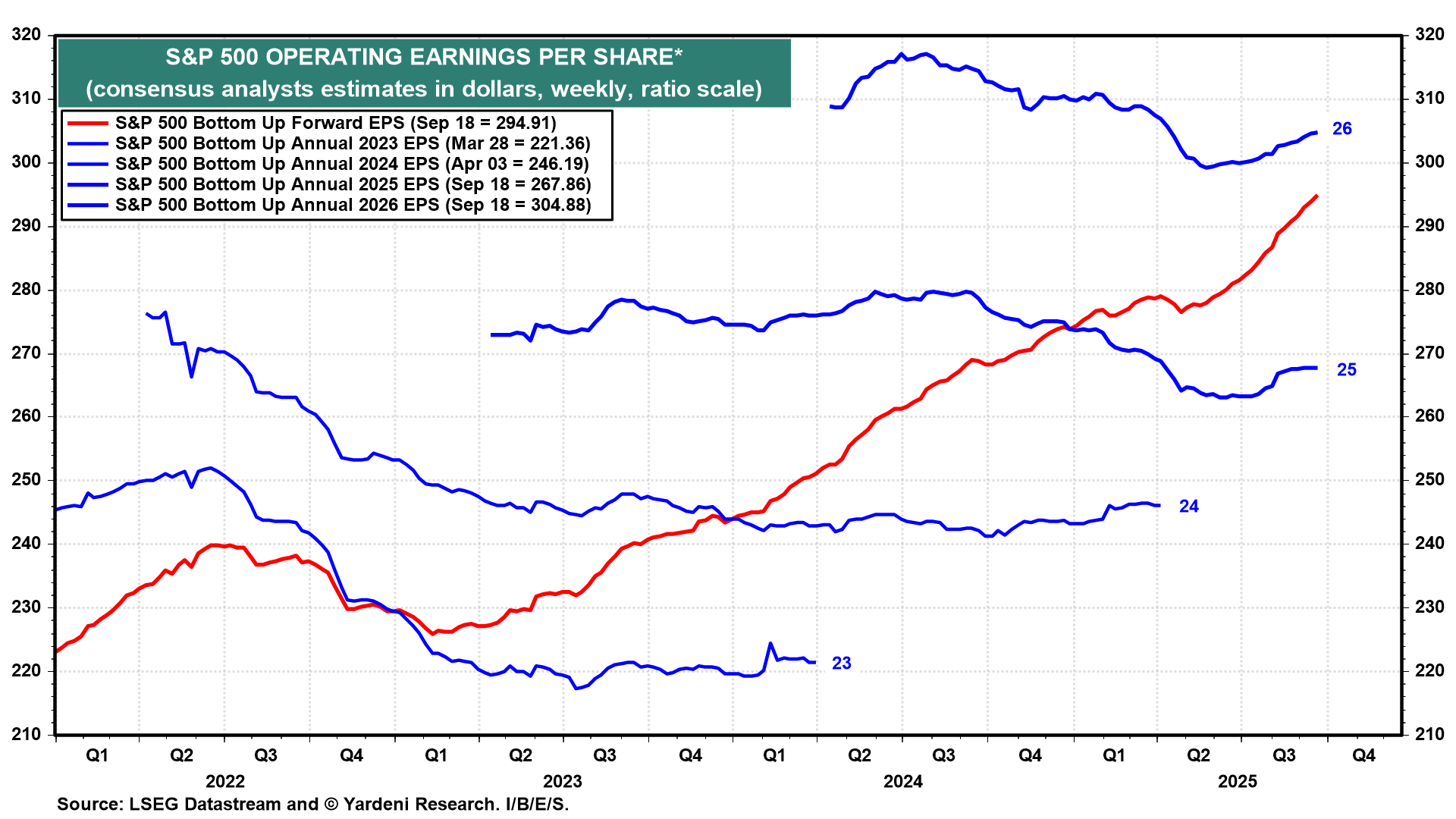

Perhaps. However, the S&P 500 has been driven to new highs this year by better-than-expected earnings. S&P 500 forward earnings per share rose to a record $294.91 during the September 18 week, on its way to converging at year-end with the analysts' consensus for 2026 (chart). The latter continues to rise, reaching $304.88 this past week. (FYI: Since forward earnings is the time-weighted average of analysts’ consensus estimates for the current and following years, it always matches the following year’s estimate at year-end.)

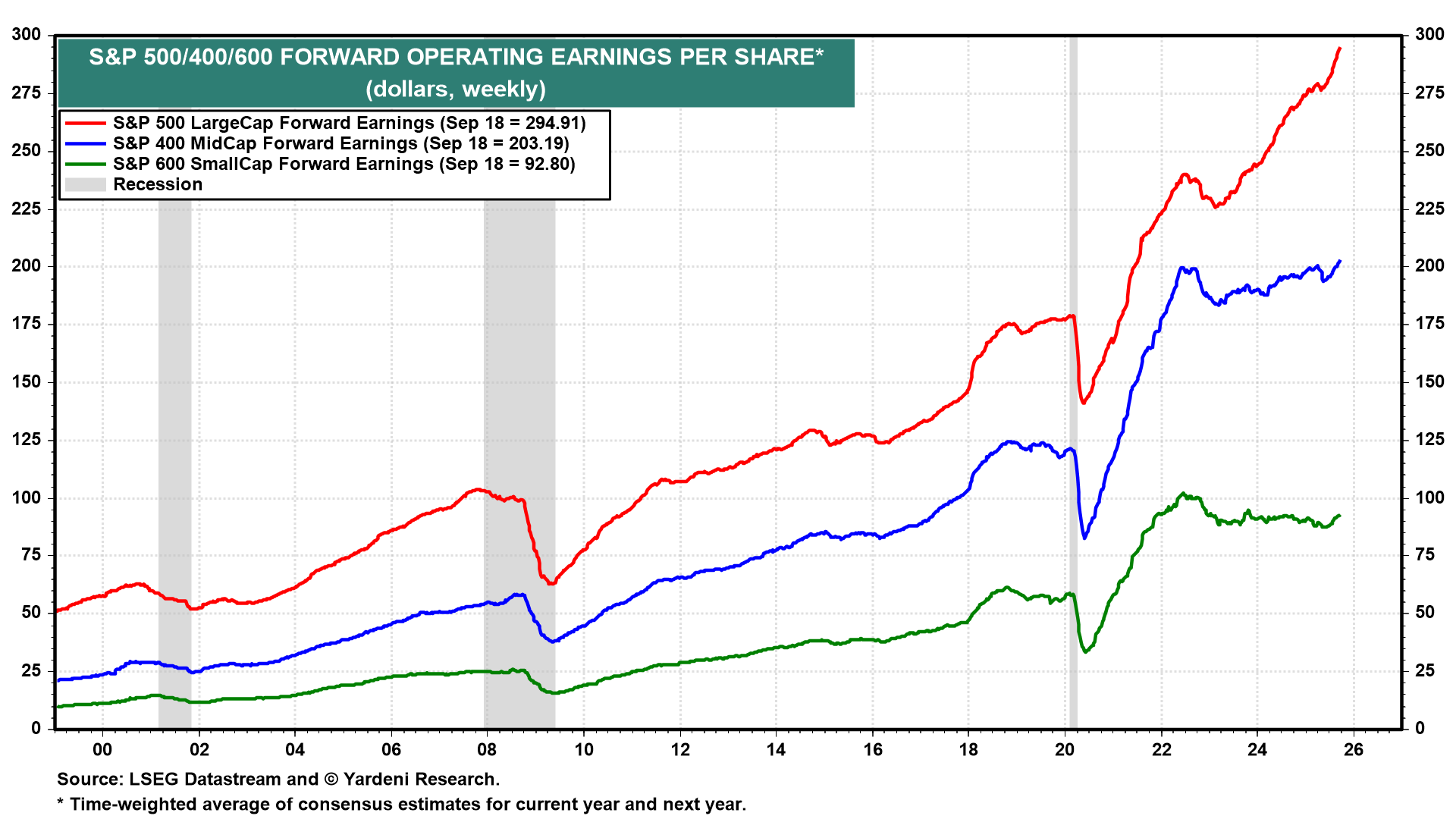

The rally in the S&P SMidCaps (i.e., S&P 400 MidCaps and S&P 600 SmallCaps) may finally be getting some support from those indexes’ forward earnings too (chart).

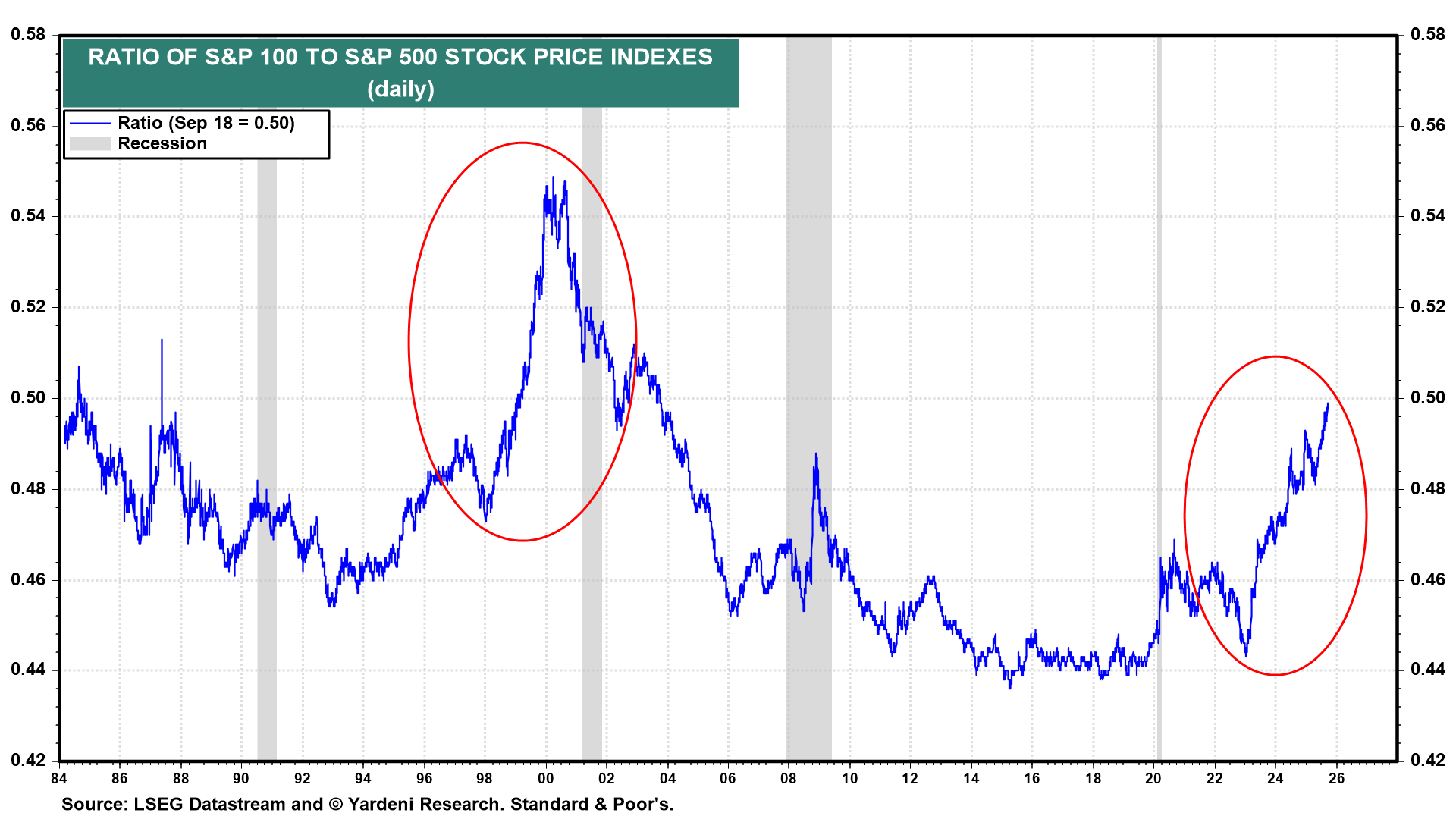

Meanwhile, the S&P 100 MegaCaps continue to outperform the S&P 500, as they did during the Party of 1999 (chart).

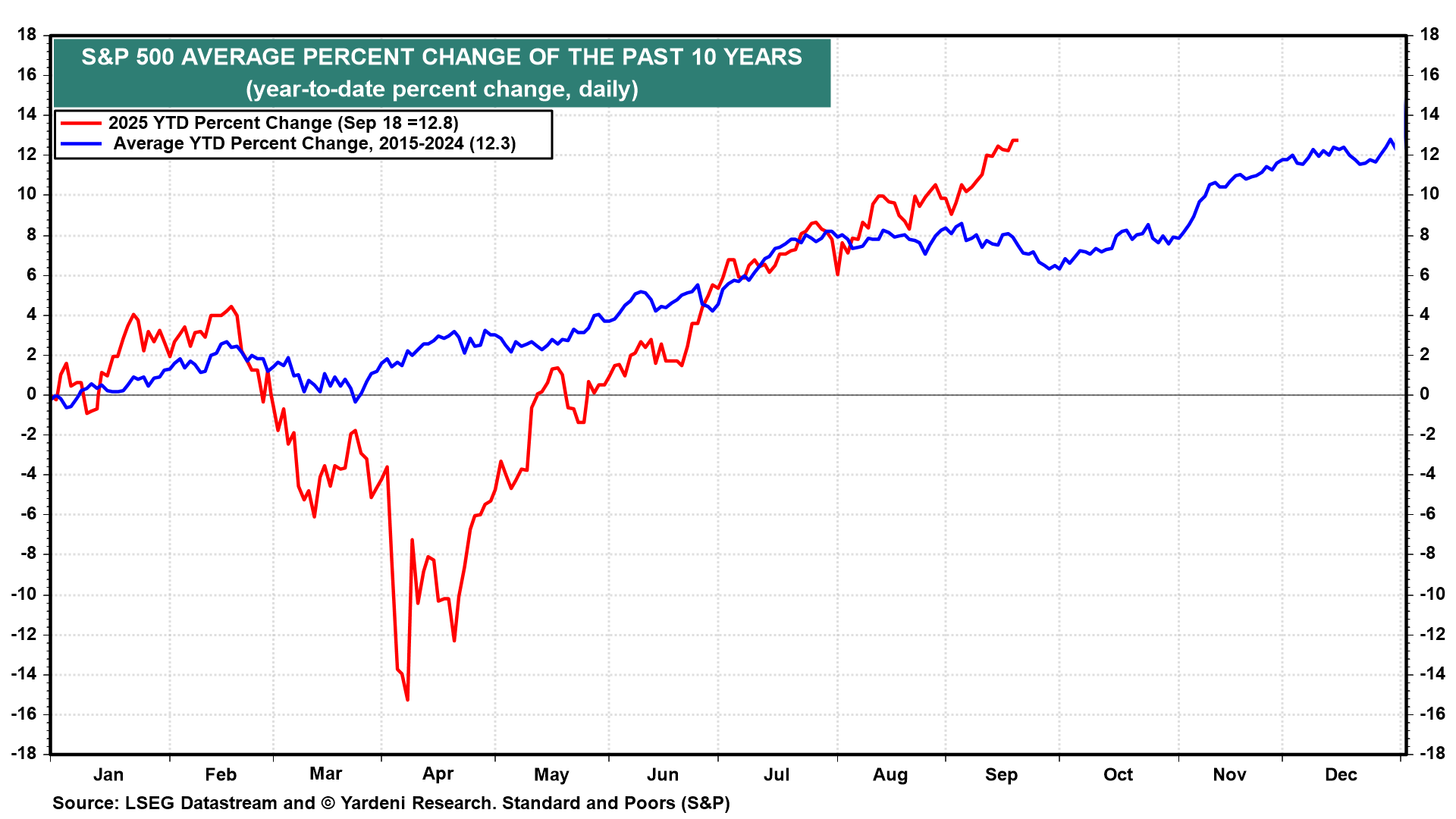

September, which has the worst track record for the S&P 500, isn't over yet, but the month is a winner so far this year (chart).

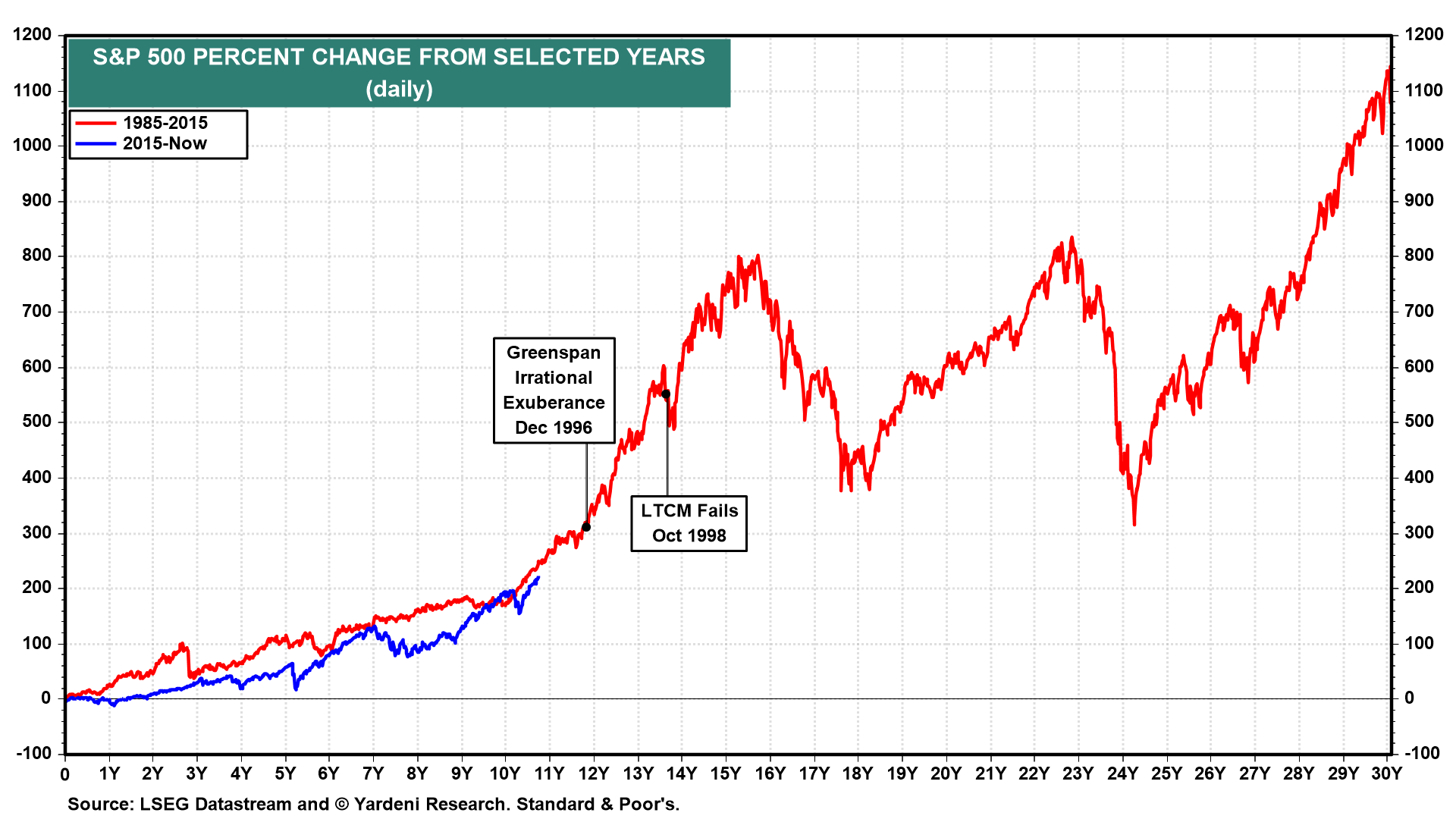

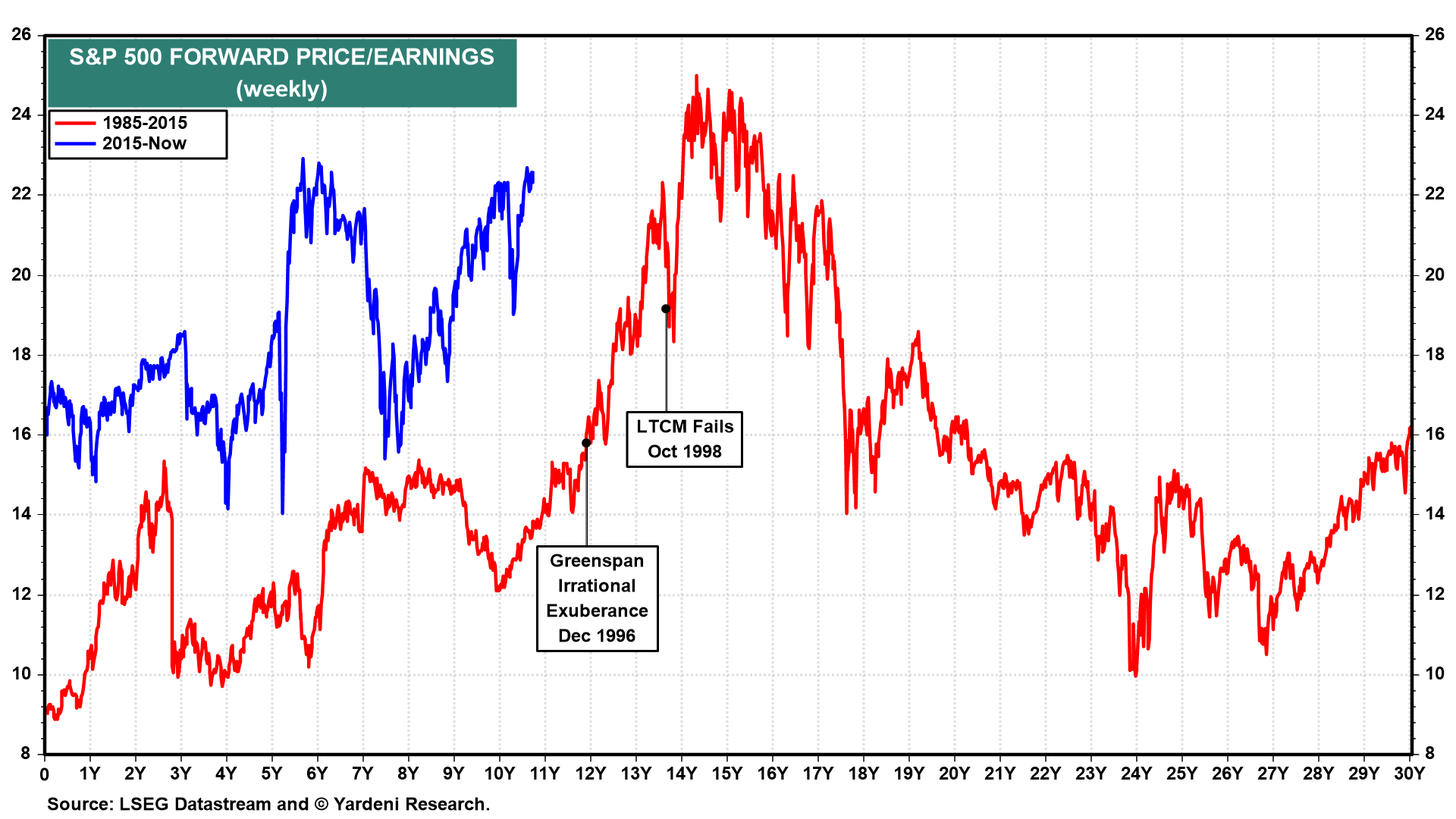

The S&P 500 may not be tracking its average seasonal pattern, but the 2015-now index is closely tracking the 1980-2010 index (chart).

One of the main differences between now and then is that the S&P 500 forward P/E has been significantly higher now compared to then (chart). It is currently 22.0, not much below the 25.0 peak of the 1999 Tech Bubble.

The Roaring 2020s remains our base-case scenario for the remainder of the decade. We are still targeting the S&P 500 to get to 7700 by the end of next year. If the stock market parties like it's 1999 in response to the Fed's monetary easing, then we might get there sooner as a result of a meltup that could be followed by a meltdown. If so, the hangover this time isn't likely to be as severe as the one that followed the Party of 1999, in our opinion.

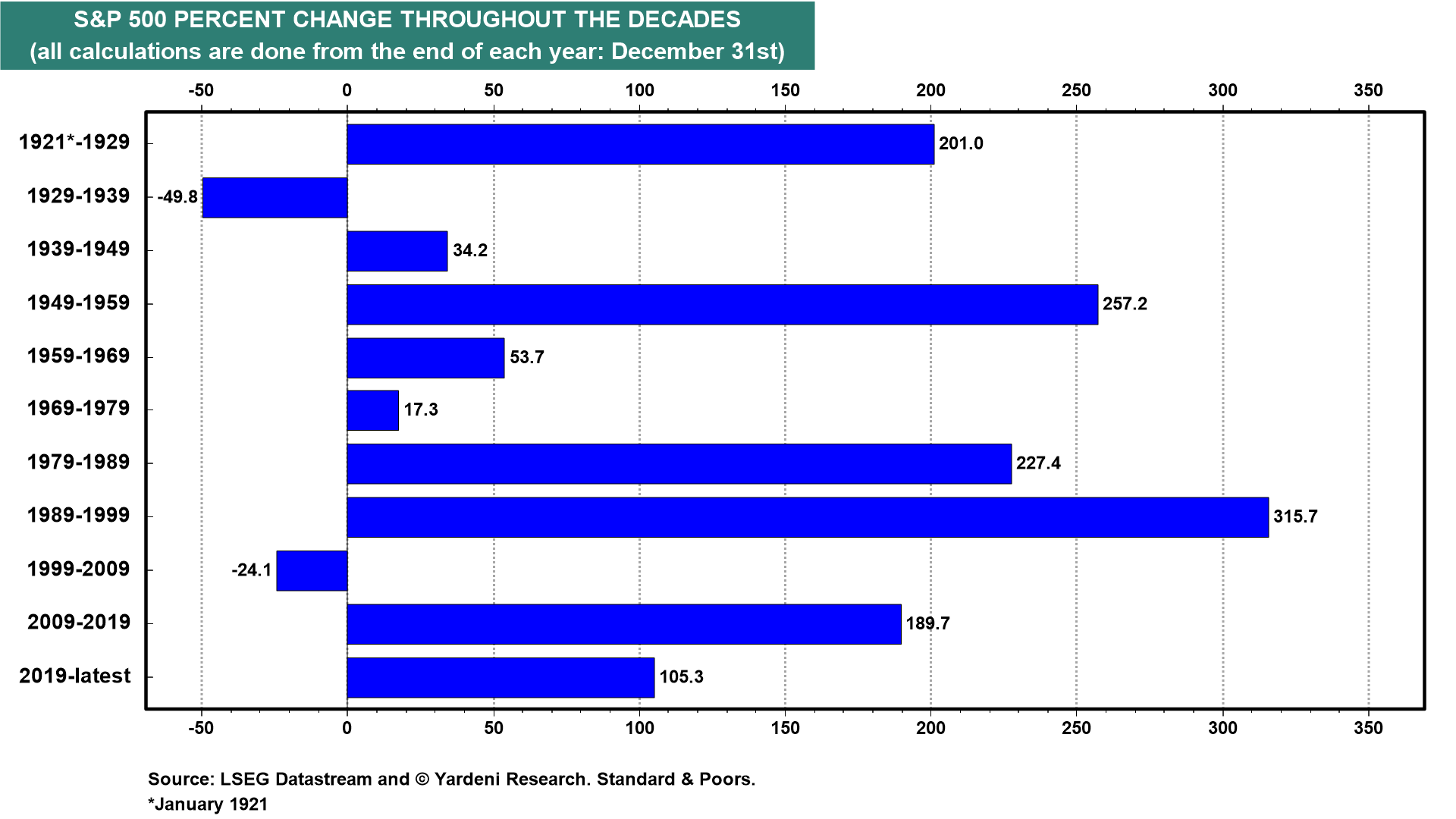

Indeed, we expect that the Roaring 2020s will be followed by the Roaring 2030s. Since the 1920s, there have been four Roaring decades, i.e., with the S&P 500 rising over 200% (chart). We may be in a fifth now, to be followed by a sixth during the 2030s.