Trump Trade Turmoil hit the stock market hard on Friday as President Donald Trump raised the US tariff on Chinese imports from 30% to 130% in retaliation for China’s imposing severe export controls on its exports of rare earth minerals. This all happened ahead of a summit meeting between Trump and Chinese President Xi scheduled for later this month. On Friday, Trump said he might not attend, then changed his mind.

If neither side were to blink, the US and Chinese economies would lead the global economy into a deep recession, if not a depression. But we expect that both sides will blink very soon given the extremely adverse consequences of a trade war between the world’s two biggest economies.

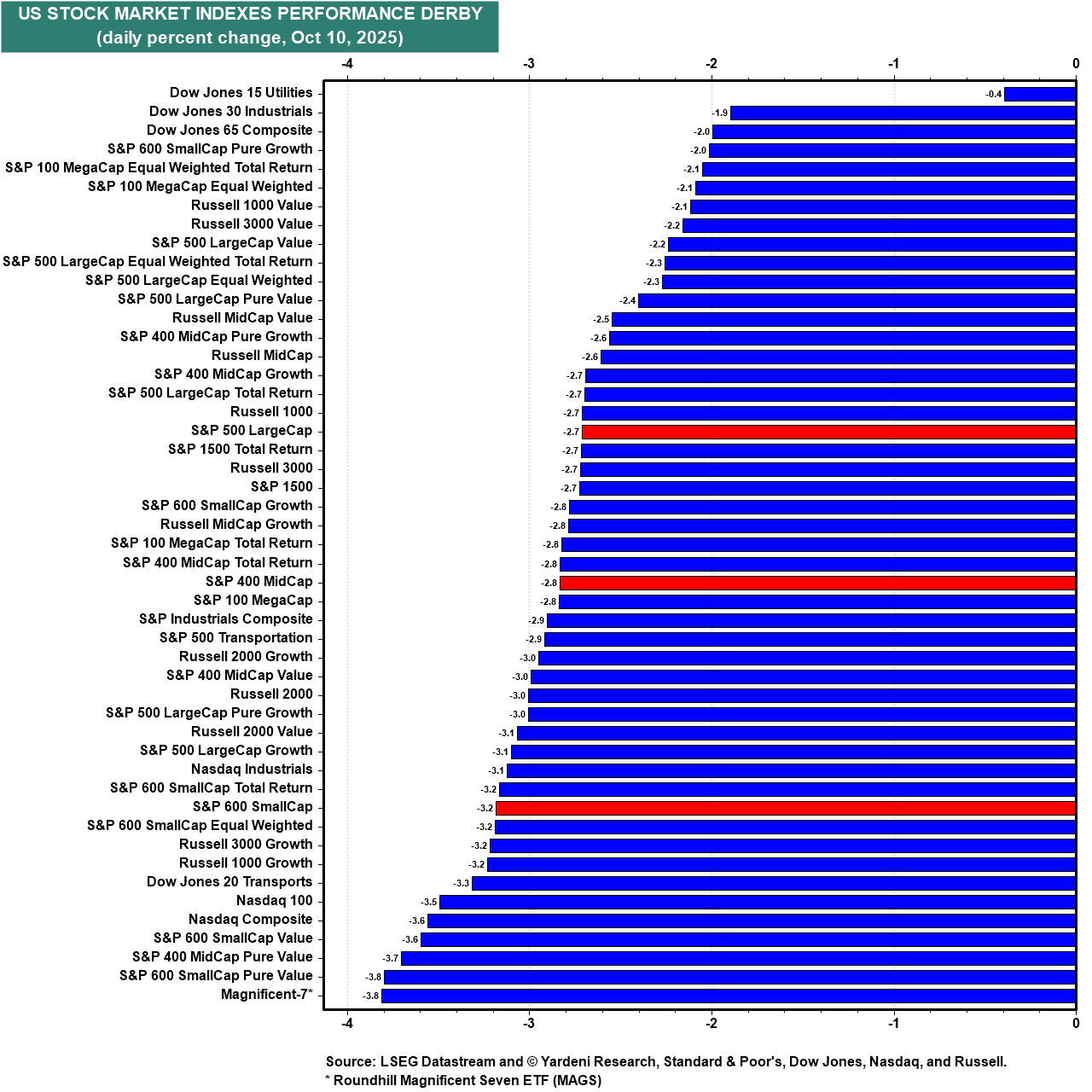

The S&P 500 dropped 2.7% on Friday, led by a 3.8% plunge in the Magnificent-7 (chart).

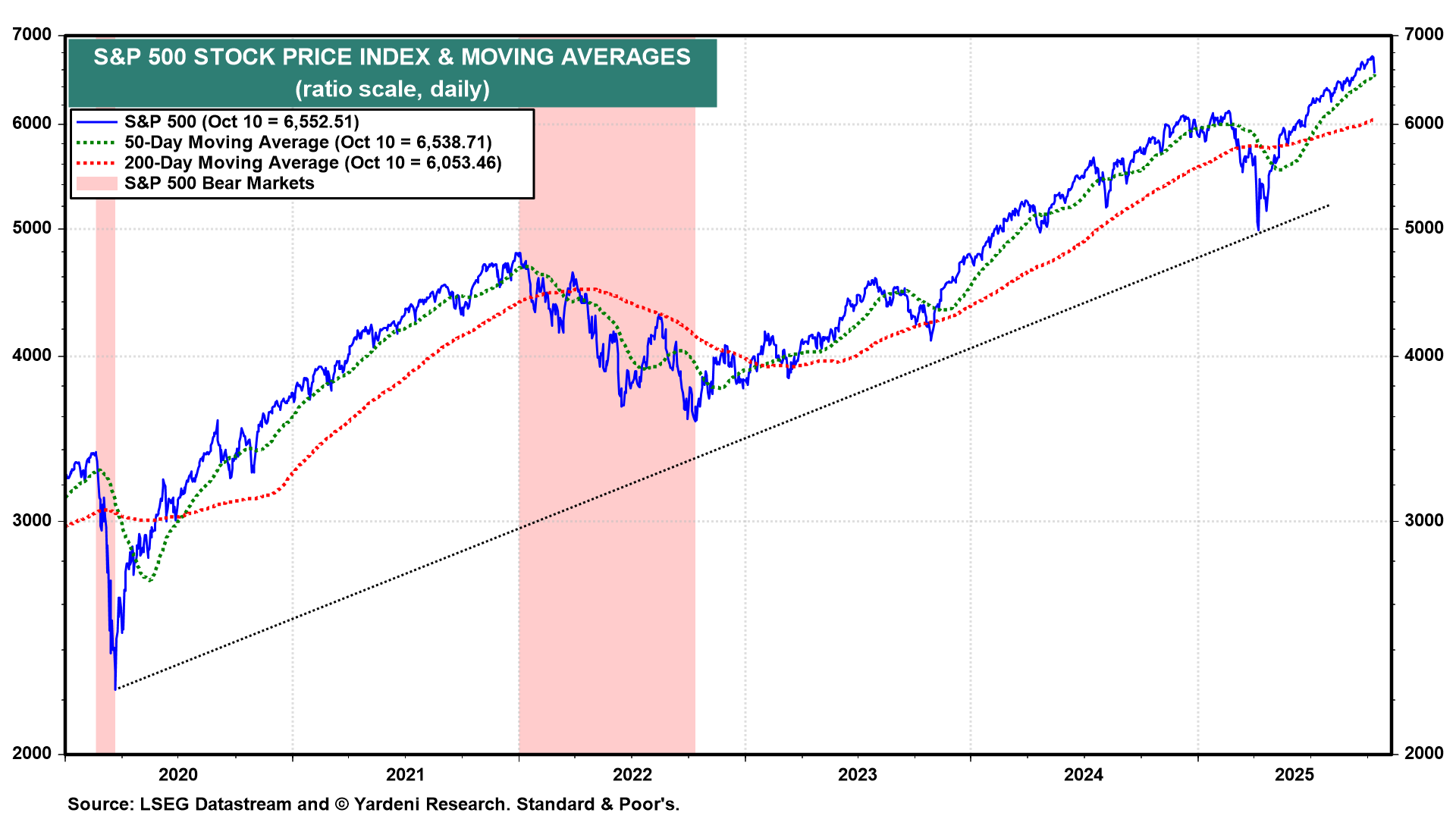

The S&P 500 fell close to its 50-day moving average on Friday (chart). If it doesn't find support there, it should do so at its 200-day moving average. That would mark a correction of roughly 10% from the indexes record high of 6753.72 on October 8.

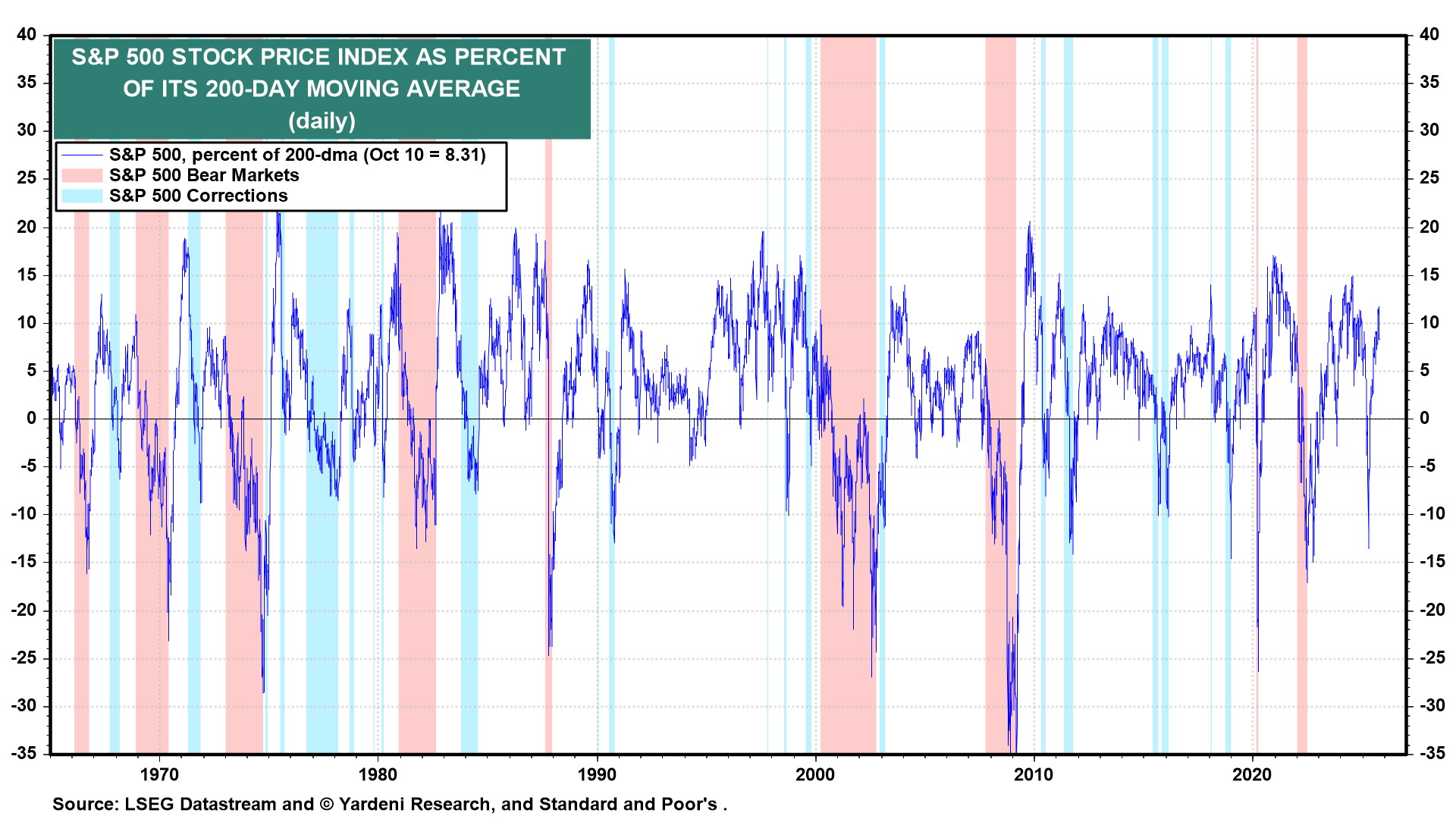

On October 8, the S&P 500 exceeded its 200-day moving average by 11.8% (chart). We doubt that the index will fall below this average during the current correction, assuming as we do that both sides will quickly negotiate a resolution of the trade conflict given the severity of the consequences to both.

The Information Technology and Communication Services sectors of the S&P 500 remain particularly extended relative to their 200-day moving averages (chart).