It no longer makes much sense for us to continue recommending overweighting the Information Technology and Communication Services sectors in an S&P 500 portfolio, as we have since 2015. The same can be said about overweighting the United States in the All Country World (ACW) MSCI portfolio, as we have been since 2010. Consider the following:

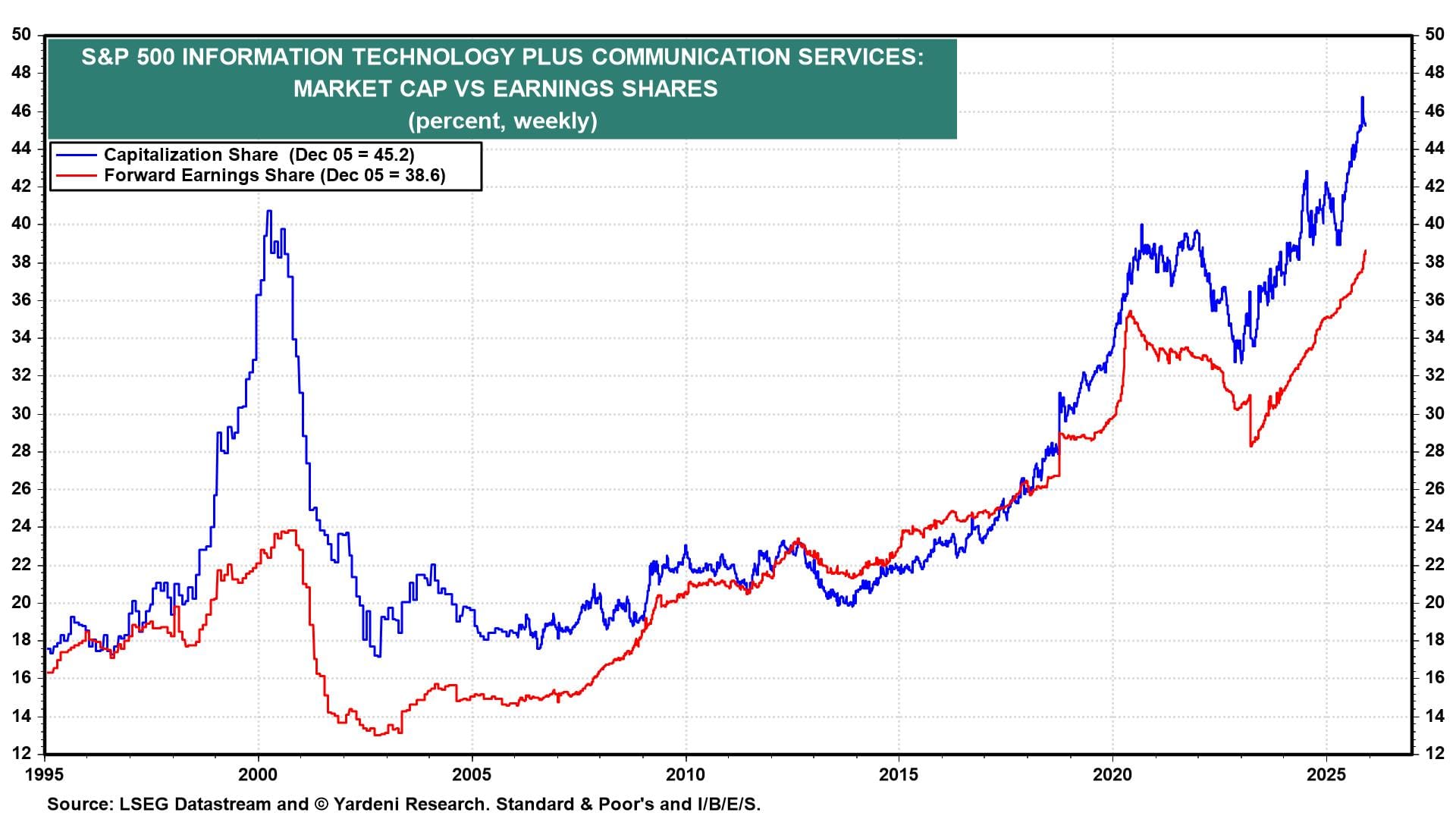

(1) Rebalancing S&P 500 portfolio. The problem is that the first recommendation has worked so well that the two S&P 500 sectors now account for a record 45.2% of the index's total market capitalization (chart).

Overweighting these two sectors combined has been justified by their forward earnings share soaring to a record 38.6% of the S&P 500's forward earnings. However, the riskiness of an S&P 500 portfolio has increased along with its concentration in the two sectors.

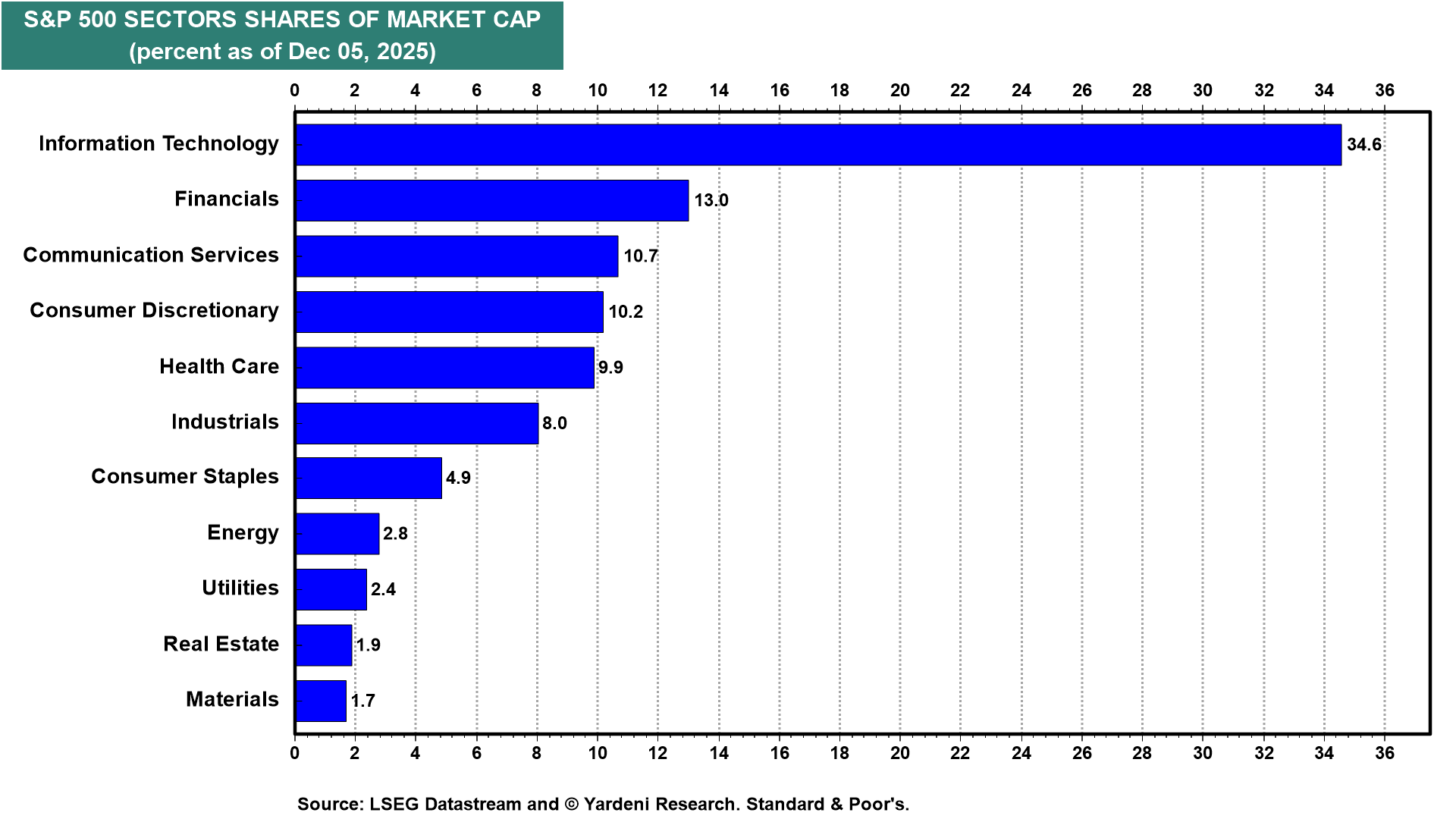

So we now recommend market-weighting the two sectors combined and rebalancing by adding to our overweights in the S&P 500 Financials (currently with 13.0% and 18.4% shares of market cap and earnings) and the Industrials (8.0% and 7.7%) sectors.

Now, we would also overweight Health Care (9.9% and 11.9%), which both managed and passive investment portfolios mostly have underweighted (chart).