While almost everyone (except us) has been waiting for a recession and debt crisis in the United States, we've observed that this calamity has been unfolding in China since early 2023 and will probably continue and worsen in 2024. Unlike the Great Financial Crisis, when the US debt crisis went global, China's debt crisis should remain local. However, China's recession is weighing on global economic growth and commodity prices. It is also helping to bring inflation down faster than widely expected around the world. It's doing so in the US, thus reducing the likelihood of a Fed-engineered recession.

This is all happening because the world's second largest economic engine is sputtering as a result of the bursting of China's property bubble. The negative wealth effect of falling property prices and stock prices is depressing Chinese consumer spending. Consider the following:

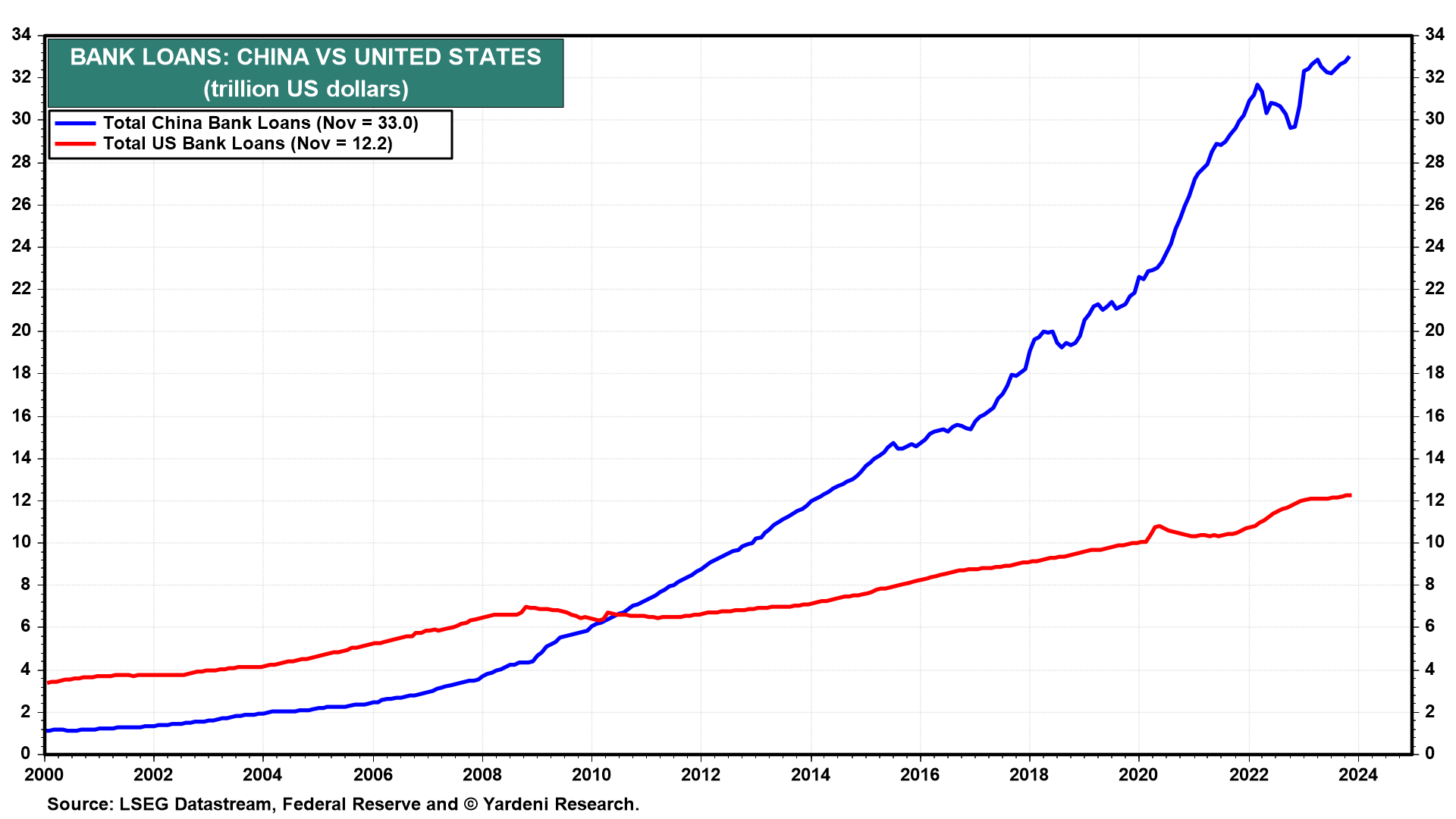

(1) China's bank loans rose to a record high of $33.0 trillion during November (chart). This series has more than doubled since the end of 2016. It exceeds US bank loans by $21 trillion. China's growth has been fueled by excessive debt creation by the banks as well as nonbank financial intermediaries, such as trusts. China's financial system may be at risk of contagion from a prolonged property market crisis and a rapidly slowing economy. China's real estate development industry accounted for about 20% of economic activity in recent years.

(2) The Chinese government unveiled its "three red lines" policy in August 2020 to tackle property developers' unbridled borrowing by restricting the amount of new borrowing they can raise each year. Since then, China's Shenzhen Real Estate stock price index is down 48.9% (chart). Construction activity has been depressed as evidenced by the weakness in the price of copper during most of 2023. The recent rally in the price of copper may not be sustainable given that the Shenzhen Real Estate stock price index is continuing to fall.