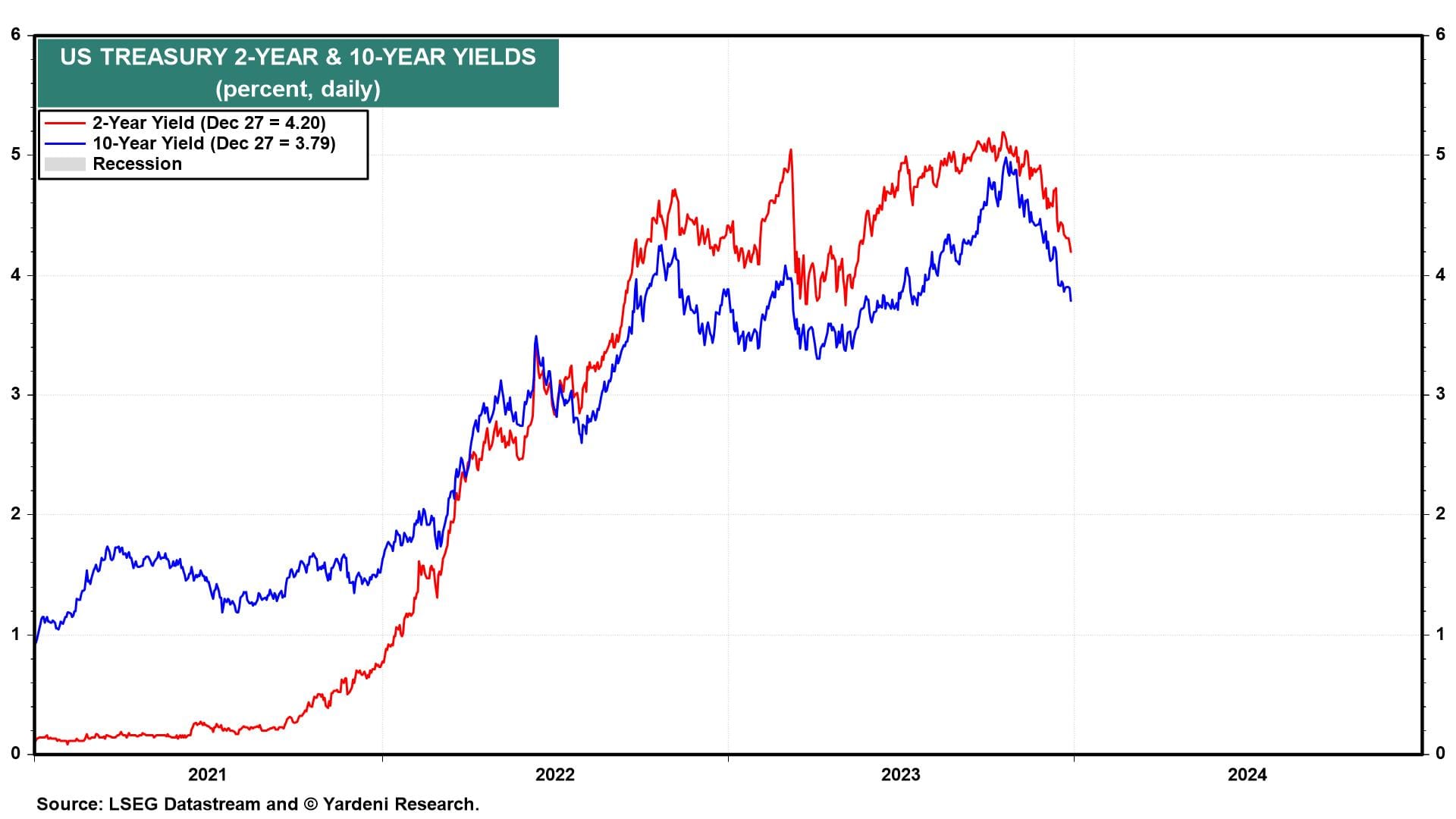

Bond yields continued to fall today on December's weak manufacturing regional surveys conducted by five of the 12 Federal Reserve district banks. Furthermore, on Tuesday, Mastercard SpendingPulse reported that retail sales during the holiday shopping season (from November 1 through December 24) were up just over 3% y/y. The increase was weaker excluding the 7.8% increase in restaurant sales.

We conclude that the rolling recession for goods producers and distributors may be bottoming, but it has yet to turn into a rolling recovery. As a result, today's auction of five-year Treasury notes was well received sending yields lower across the board (chart).

The average of the five regional business composite indexes has been in negative territory since May 2022. But it bottomed during May 2023 at -16.5 and then moved higher. It edged back down a bit to -9.3 during December. This suggests that December's national M-PMI remained below 50.0 for the 14th month in a row (chart). It will be released on Tuesday, January 2.