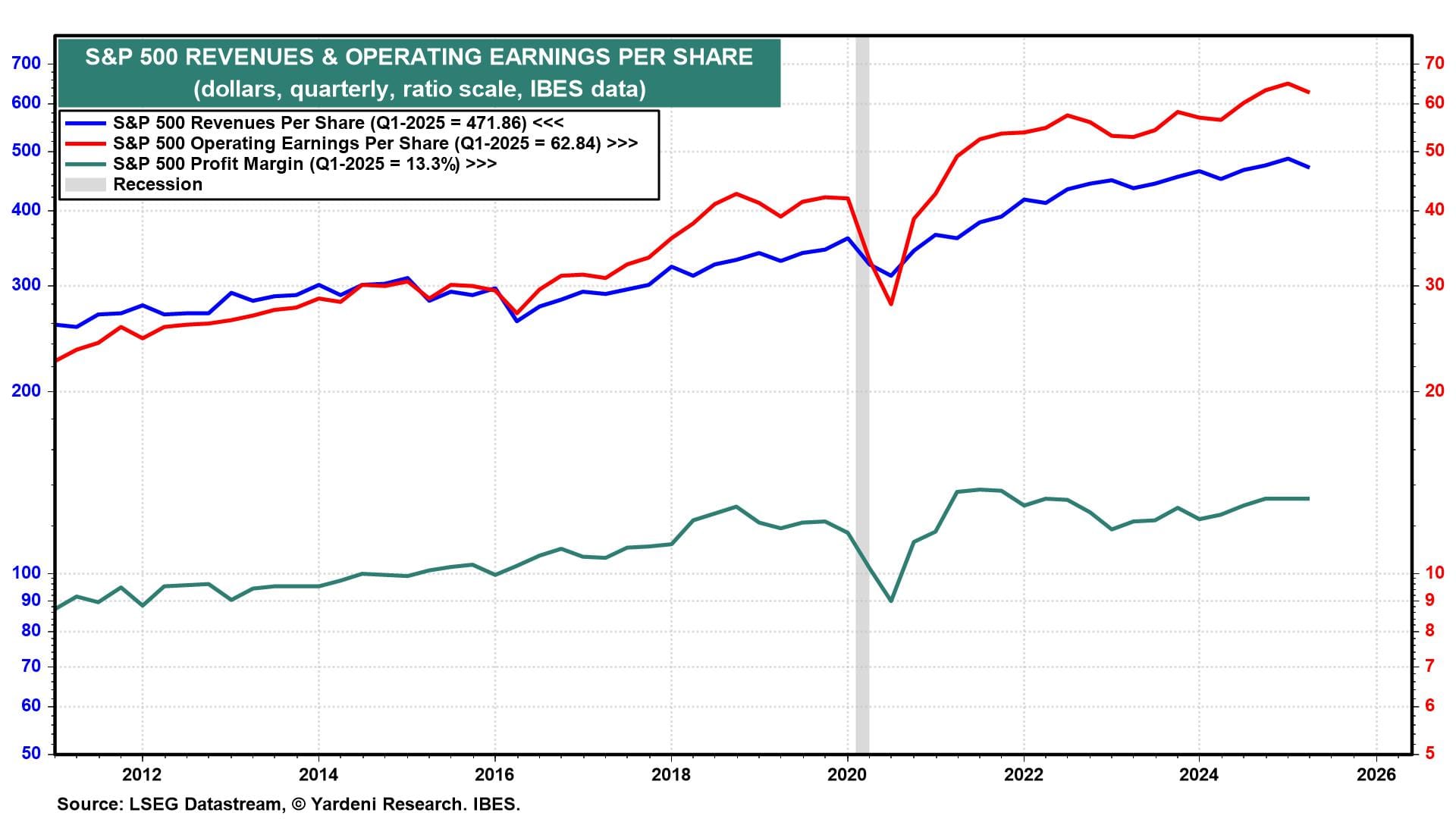

We now have LSEG’s I/B/E/S data for S&P 500 companies’ revenues per share and earnings per share during Q1. Both edged down on a q/q basis but showed solid gains on a y/y basis (chart). The profit margin edged up to 13.3%. Notwithstanding Trump's Tariff Turmoil (TTT), the economy remains resilient, supporting an upbeat outlook for revenues. Earnings should do well too. However, higher tariffs in effect are a corporate tax increase unless corporations can offset them by raising productivity or by passing the cost onto their vendors and/or customers.

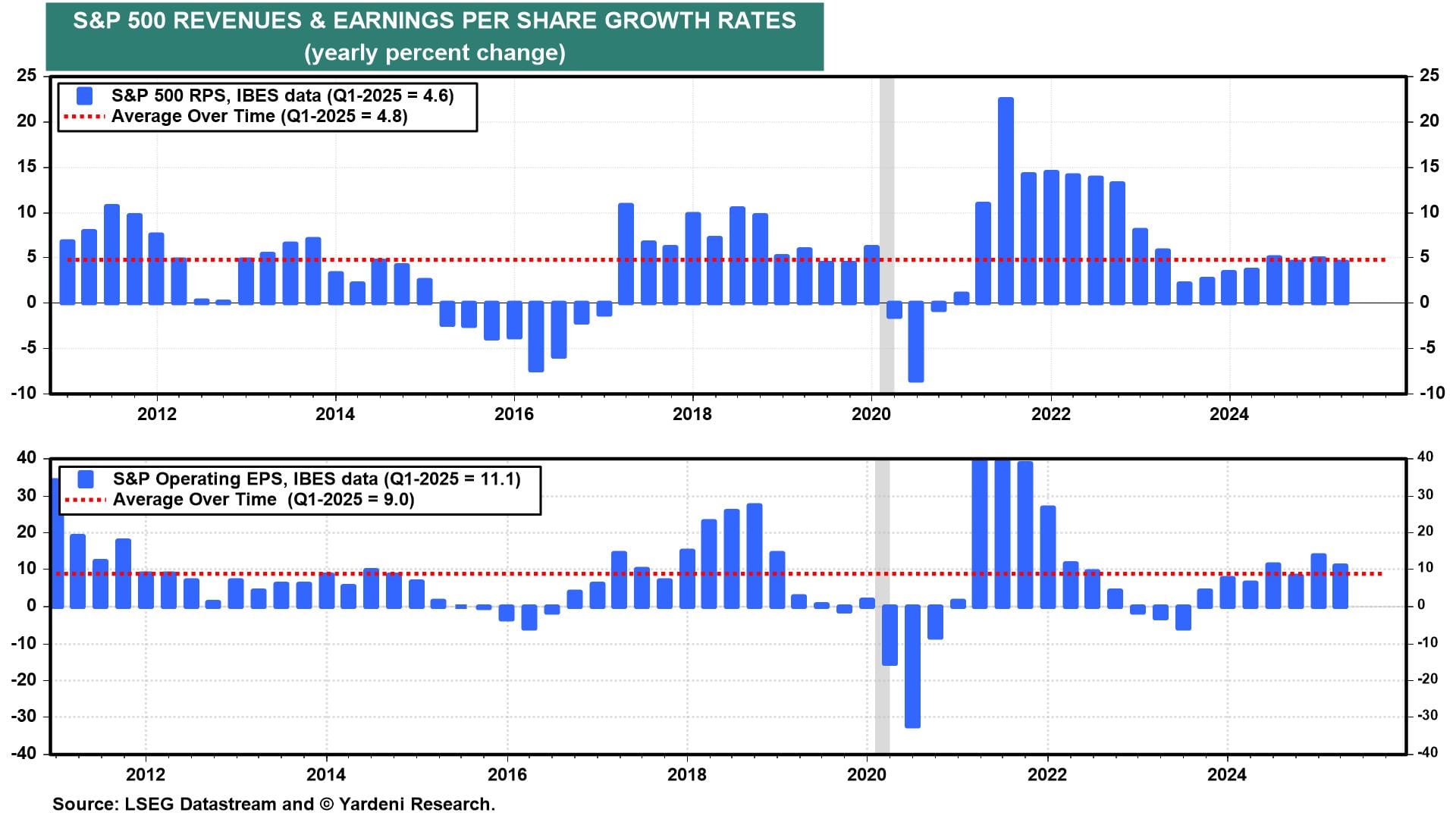

During Q1, S&P 500 revenues rose 4.6% y/y (chart). That was below the average over time of 4.8%. As long as TTT doesn't cause a global recession, revenues should continue to grow, though below that average.

During Q1, S&P 500 earnings per share rose 11.1%, well above its 9.0% average over time (chart). It should continue to grow over the rest of this year, though slightly below its average over time because many US-based corporations will have to send the US Treasury a check for the additional costs of Trump's tariffs.

So far, industry analysts still anticipate that S&P 500 revenues per share will continue rising to record highs, as evidenced by S&P 500 forward revenues per share, notwithstanding TTT (chart).