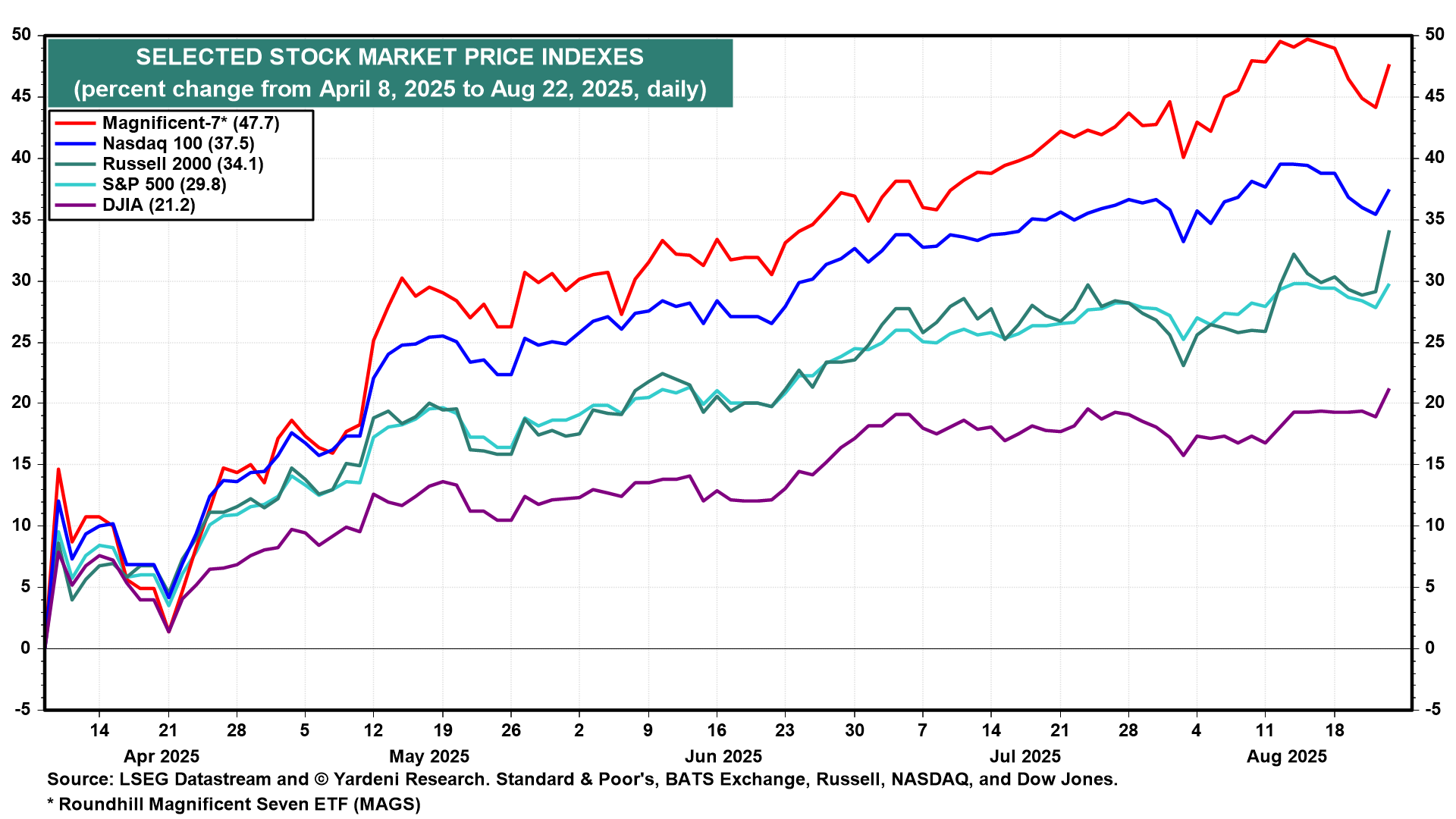

Ever since the release of the weaker-than-expected July employment report at the start of this month, stock investors have been betting that the Fed Put is back in play and that it will probably be implemented at the FOMC's meeting on September 16-17. Fed Chair Jerome Powell had been pushing back against this notion since early this year by saying that the Fed is in no rush to lower interest rates. However, he didn't do so in his Jackson Hole speech on Friday. Instead, he said, "Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance." In other words, the FOMC might cut the federal funds rate at the September meeting. As a result, stock prices soared on Friday (chart).

Powell didn't mention that between now and the next FOMC meeting, a few indicators, including August's CPI and employment reports, might convince the FOMC to hold off on easing if they are hotter than expected, as we think likely. That's still our base-case scenario.

That's why we are sticking with our associated targets for the S&P 500 of 6600 by year-end 2025 and 7700 at the end of next year. We assign that base-case scenario a subjective probability of 55%. We currently assign a 25% subjective probability to a meltup that lifts the S&P 500 to 7000 by year-end 2025 and 20% odds to a correction in the index by the end of this year. A meltup will be more likely if the Fed eases in September, as widely expected.

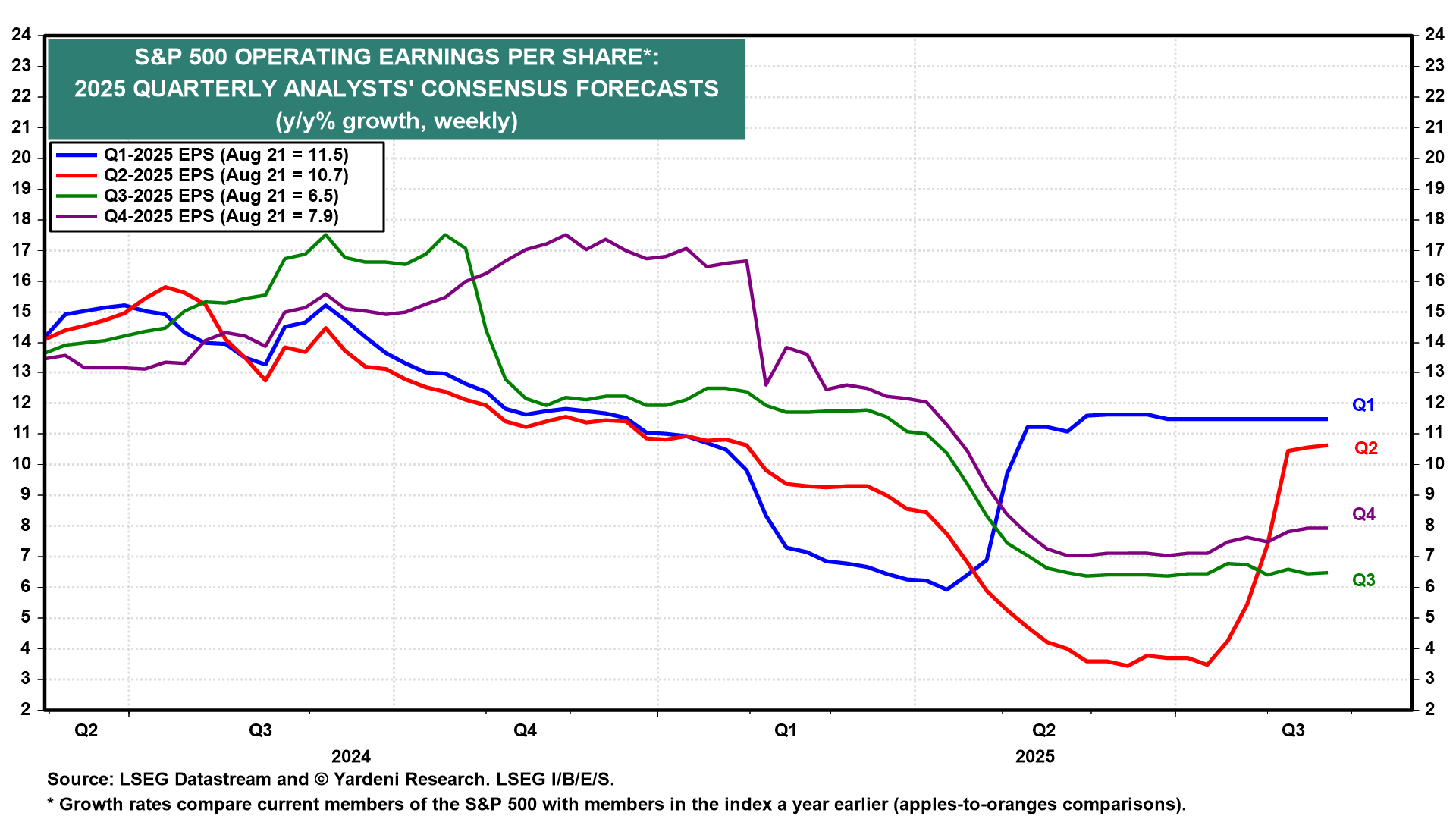

We expect that the bull market will be increasingly earnings-led rather than valuation-led through 2026. Both Q1-2025 and Q2-2025 S&P 500 earnings were much better than expected (chart).

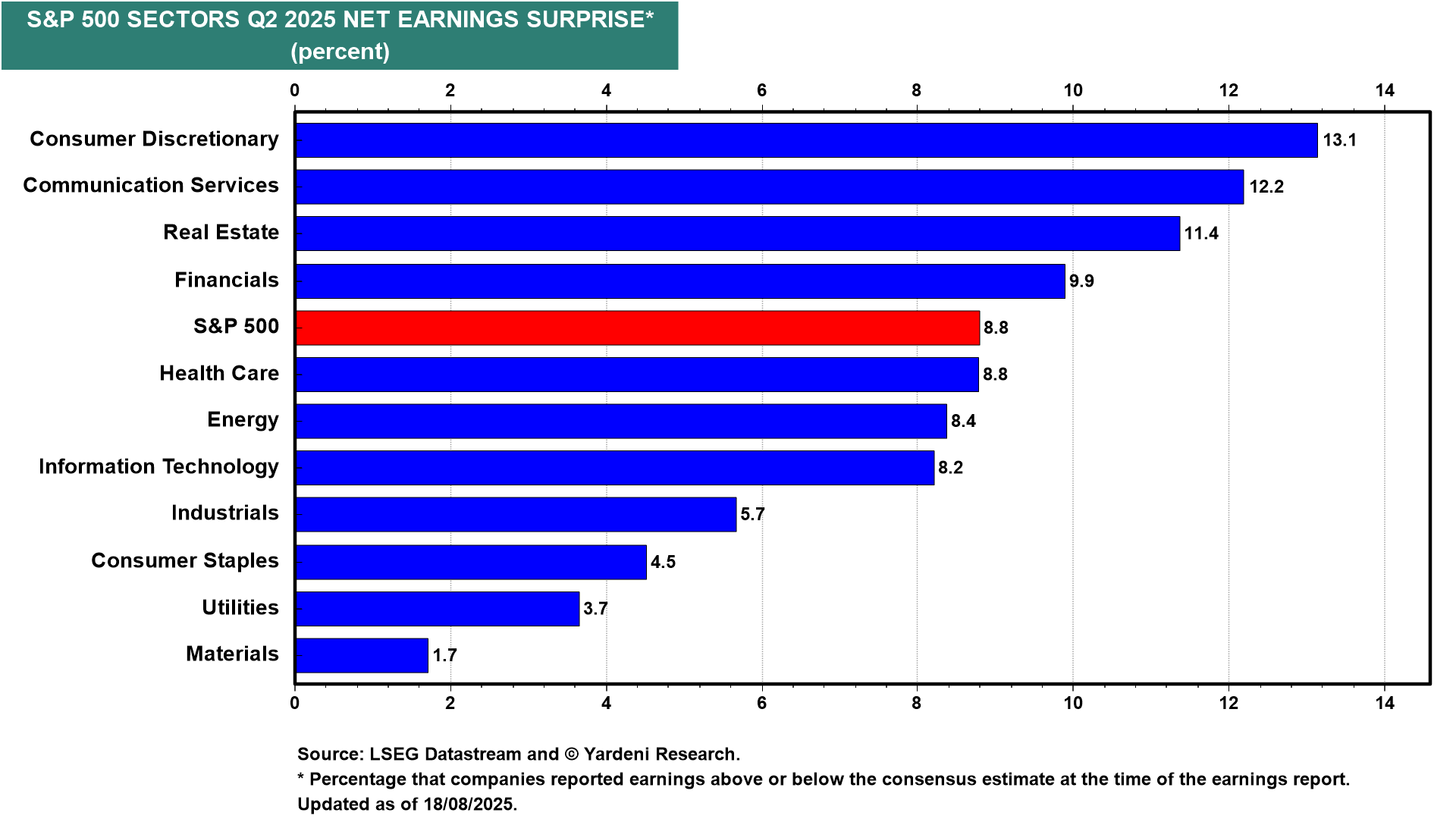

The S&P 500 net earnings surprise during Q2-2025 was very strong at 8.8% (chart). The best "beats" occurred in the Consumer Discretionary sector, which augurs well for a continuation of consumer-led economic growth.

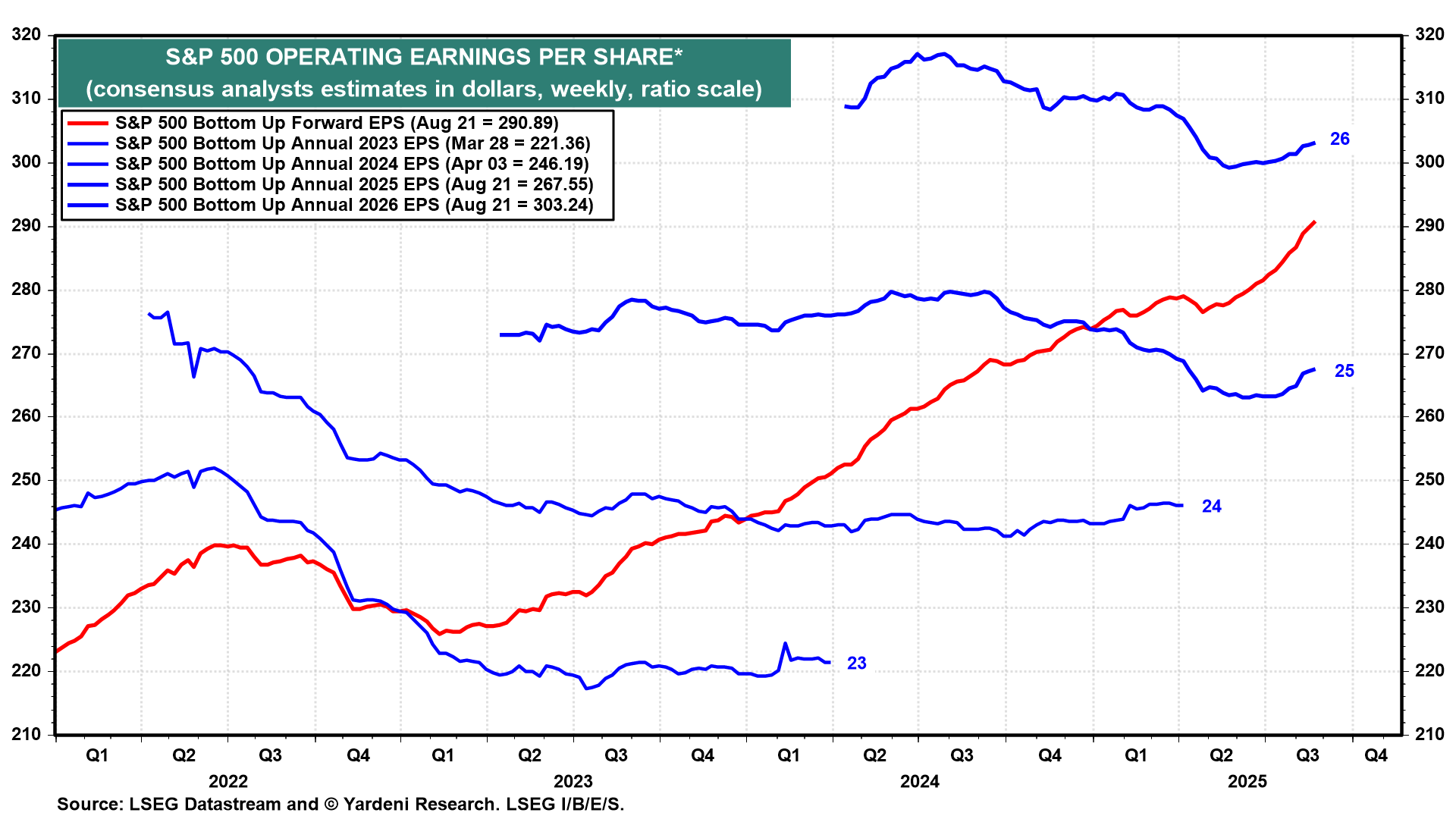

S&P 500 forward earnings per share rose to yet another new record high during the week of August 21 as industry analysts raised their 2025 and 2026 earnings estimates (chart).

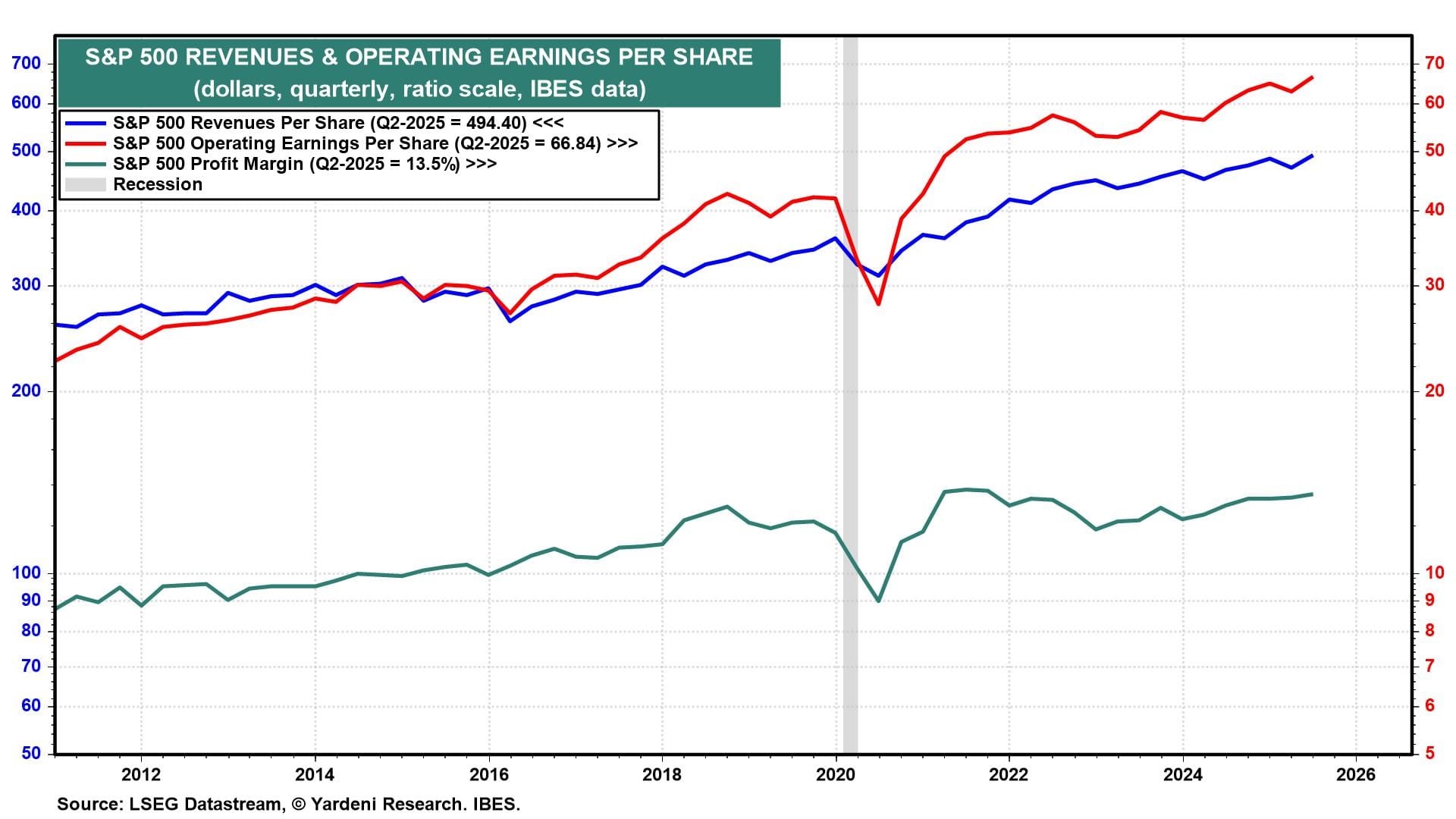

Both S&P 500 revenues per share and earnings per share rose to record highs during Q2-2025 (chart). The profit margin edged up to 13.5%, which is impressive considering that the tariff-related costs of doing business increased during the quarter.

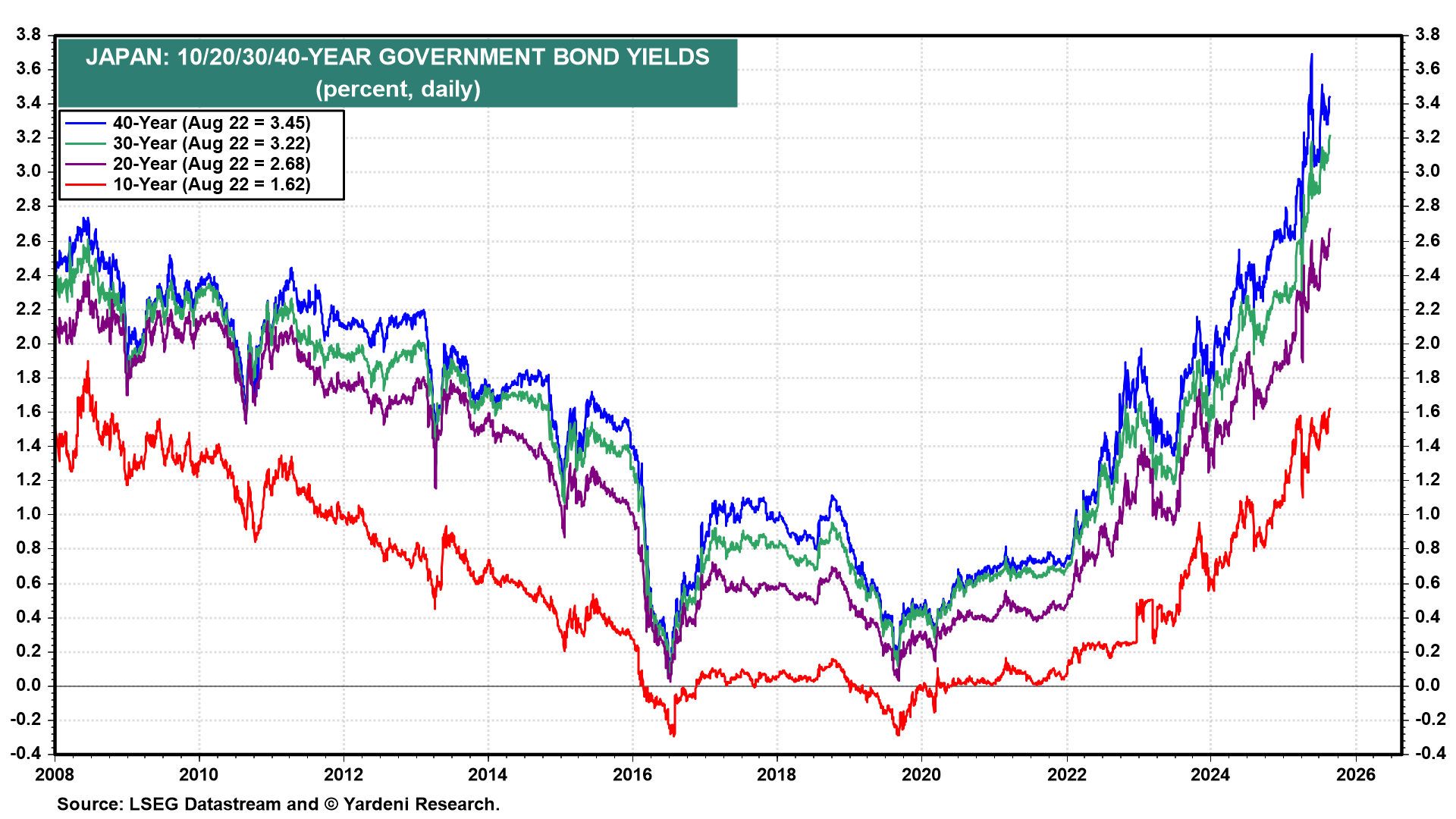

There's not much to worry about in the coming weeks other than a meltup in the stock market if the Fed eases or a pullback if the Fed doesn't do so. Trump's tariffs might be invalidated in court in the coming weeks, with an unpredictable market impact. Overseas, we are watching Japanese government bond yields soaring again (chart).