On Saturday night, the US attacked Iran's three nuclear sites in Fordow, Natanz, and Isfahan. President Donald Trump announced this in a social media post at 7:50 p.m. EST. In a short speech at 10:00 p.m., he said that Iran’s key nuclear sites were "completely and fully obliterated" by the strikes. He noted that there are many more sites in Iran that could easily be destroyed if the Iranians retaliate.

The next move is up to the Iranians. Our bet is that they will sue for peace. We are assuming that while the Mullahs and their generals (those who haven't been killed by the Israelis yet) may be fanatics, they aren't crazy. If that's the case, then the price of oil should fall and stock markets around the world should climb higher. The price of gold is likely to fall in this scenario. But that should provide a good buying opportunity since many central banks around the world are diversifying their reserves into gold.

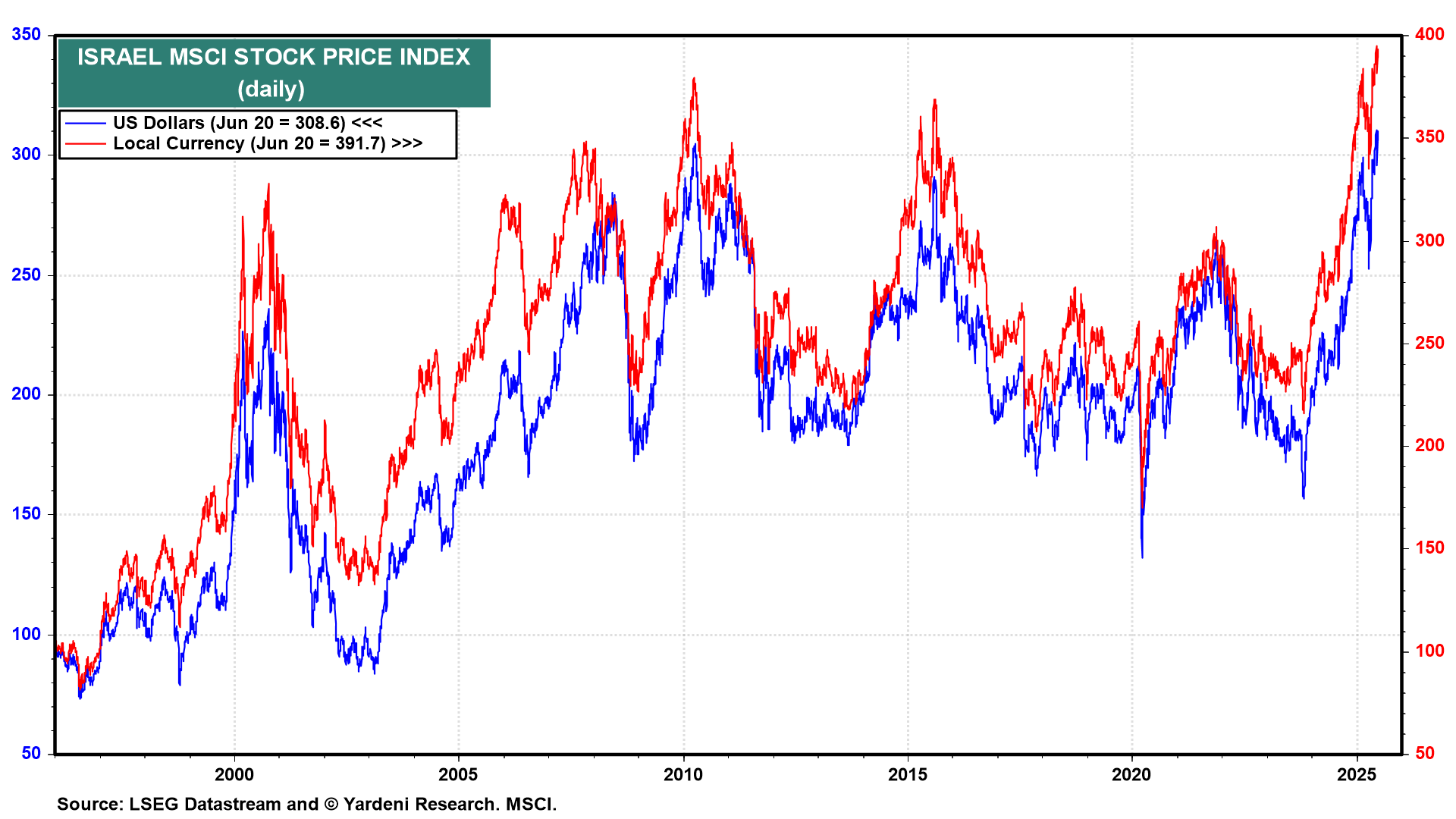

Interestingly, the Israel MSCI stock price index (in local currency) is up 2.6% to a new record high since Friday, June 13, when Israel launched a preemptive attack on Iran (chart). The index is up 79.9% since October 27, 2023, which was 20 days after Hamas attacked Israel, killing approximately 1,200 Israelis and taking about 250 hostages.

Predicting geopolitical developments in the Middle East is a treacherous exercise. However, the Israeli stock market suggests that we may be witnessing a radical transformation of the Middle East now that Iran has been de-nuked. Iran has been the biggest state sponsor of terrorism in the Middle East, often using its lethal proxies in Gaza, Lebanon, Syria, and Yemen to do its dirty work. Under the country's Mullahs, who seized power in 1979, Iran has been the sworn enemy of Israel, with a vocal commitment to destroy it, and has viewed the US as "the devil."

Now, President Donald Trump may succeed in expanding his 2020 Abraham Accords, in which several Arab nations recognized Israel, to include Saudi Arabia and other Arab nations. It currently includes the United Arab Emirates, Bahrain, Morocco, and Sudan. In an ideal outcome, the Mullahs' regime would be overthrown in Iran, replaced by a new government that focuses on promoting domestic and regional prosperity rather than terrorism.

Iran could still be a spoiler if the Mullahs manage to stay in power or are replaced by a military dictatorship, either way resulting in a government that remains bitterly hostile to Israel and the United States. Such a government could prolong the war and create lots of havoc by attempting to close the Strait of Hormuz and by continuing to attack Israel and starting to target American interests in the Middle East. That would cause oil prices to continue spiking higher, raising the odds of a global recession (chart). Iran would still lose the war, in our opinion.

The bottom line for us as investment strategists is that the bull market in the S&P 500 that started in October 2022 remains intact. We are still targeting 6500 by the end of this year and 10,000 by the end of the decade. We think that the latest developments in the Middle East will end well for our "Roaring 2020s" scenario in the US sooner rather than later. Geopolitically, we think that Trump has just reestablished America's military deterrence capabilities, thus increasing the credibility of his "peace through strength" mantra.

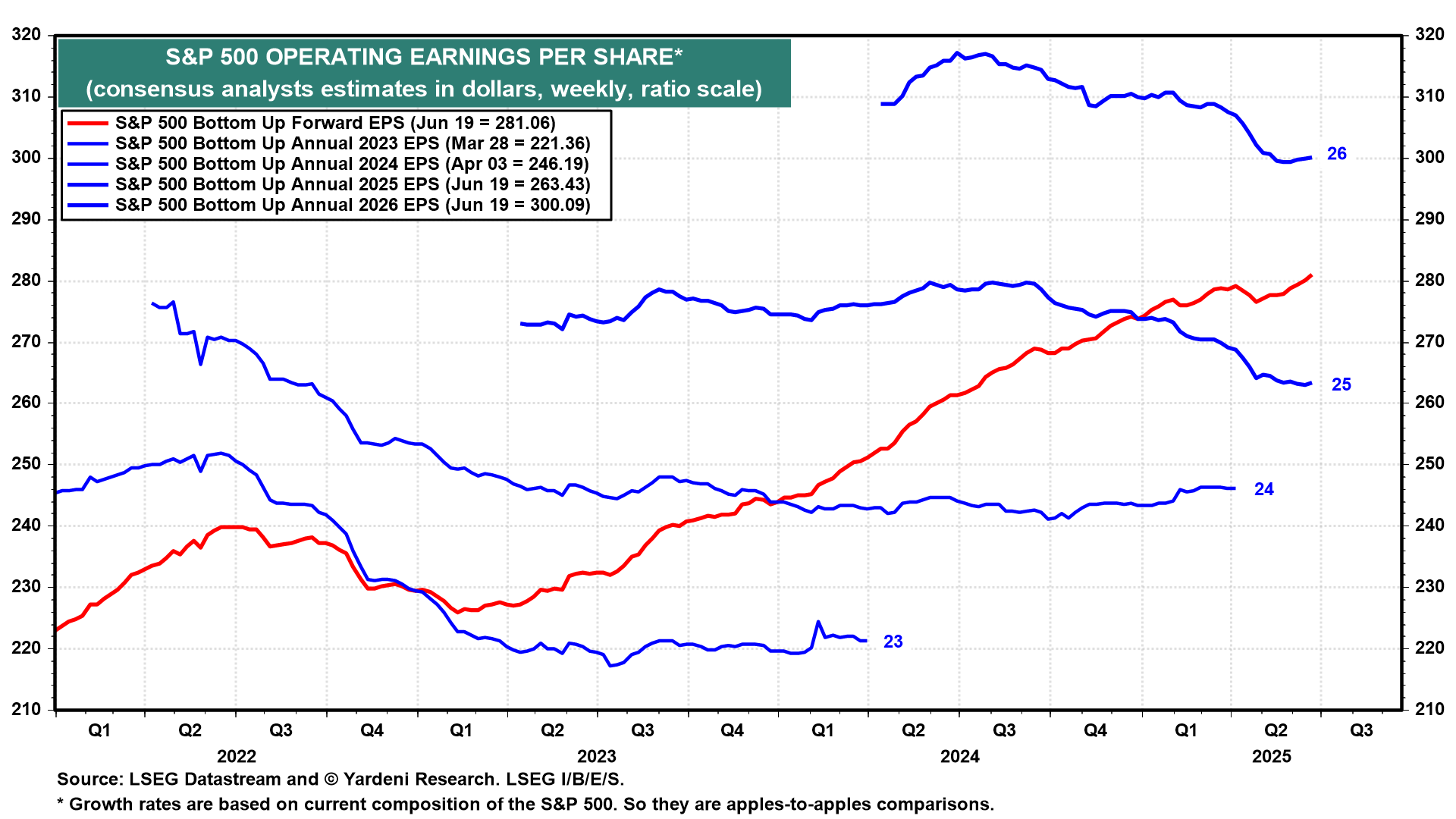

We note that the consensus of industry analysts is turning more optimistic on the outlook for S&P 500 forward earnings per share, which rose to a record high for the third week in a row through the June 19 week (chart). There had been a slight dip in forward earnings during the spring on concerns about Trump's tariffs. But now, industry analysts seem to be thinking that tariffs won't weigh much on profits (and profit margins), if at all.