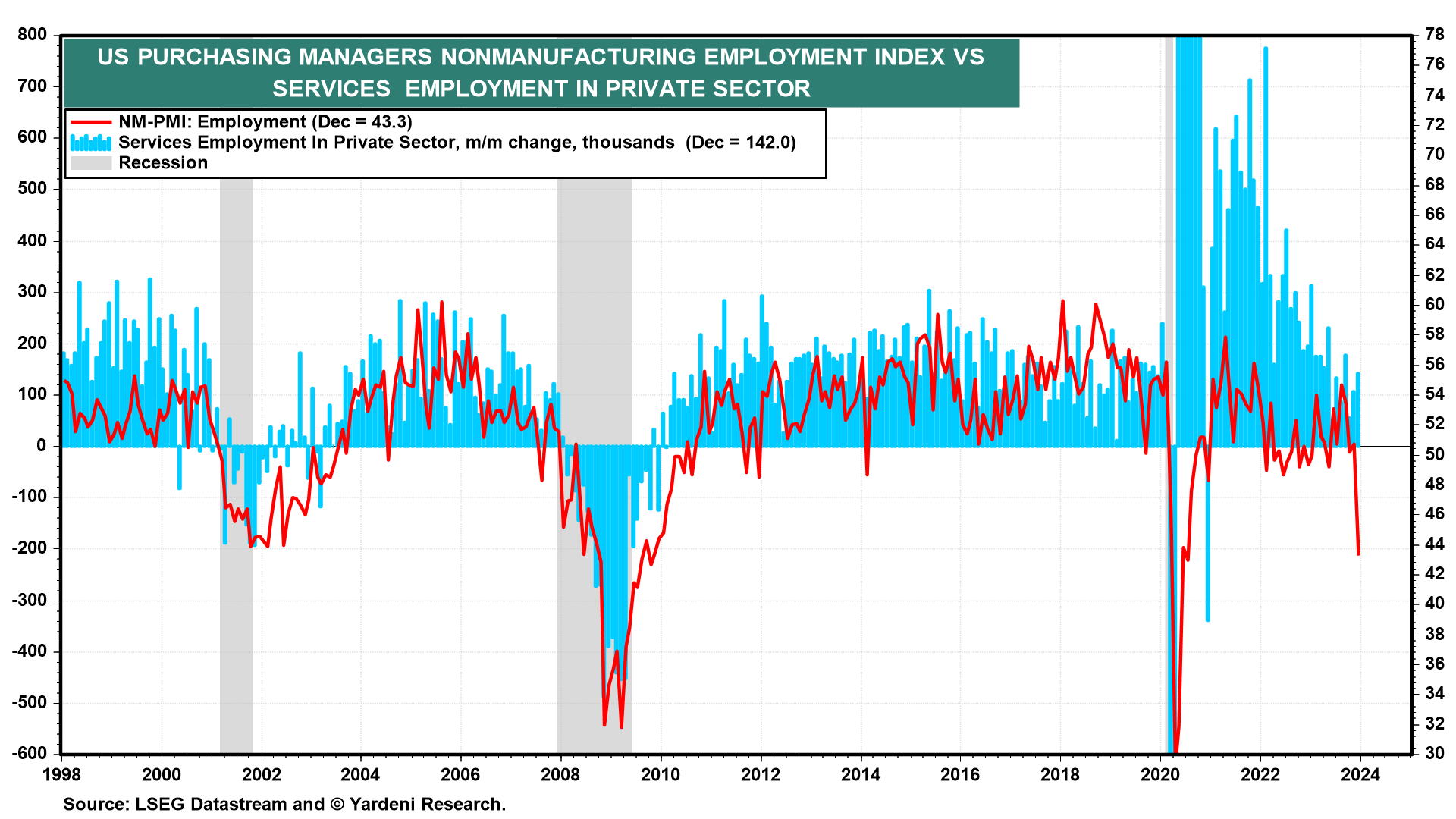

Both the bond and stock markets didn't do much on Friday following the release of December's employment report and NM-PMI. The former looked better-than-expected at first, but not as strong in the details (and downward revisions of the previous two months), and wage inflation was higher than expected. The NM-PMI was weaker than expected led by an unbelievable (literally) drop in its employment sub-index down to 43.3 (chart). The other NM-PMI components were much more solid (and believable): production (56.6) and new orders (52.5). Payroll employment in private services-providing industries actually rose $142,000 last month.

There was plenty for both hard- and soft-landers to support their outlooks in Friday's batch of economic indicators. The stock market rally may continue to stall while investors decide whether to root for weak economic indicators (so that the Fed will cut interest rates sooner rather than later), or for more signs of a resilient economy (implying a longer Fed pause) (chart).

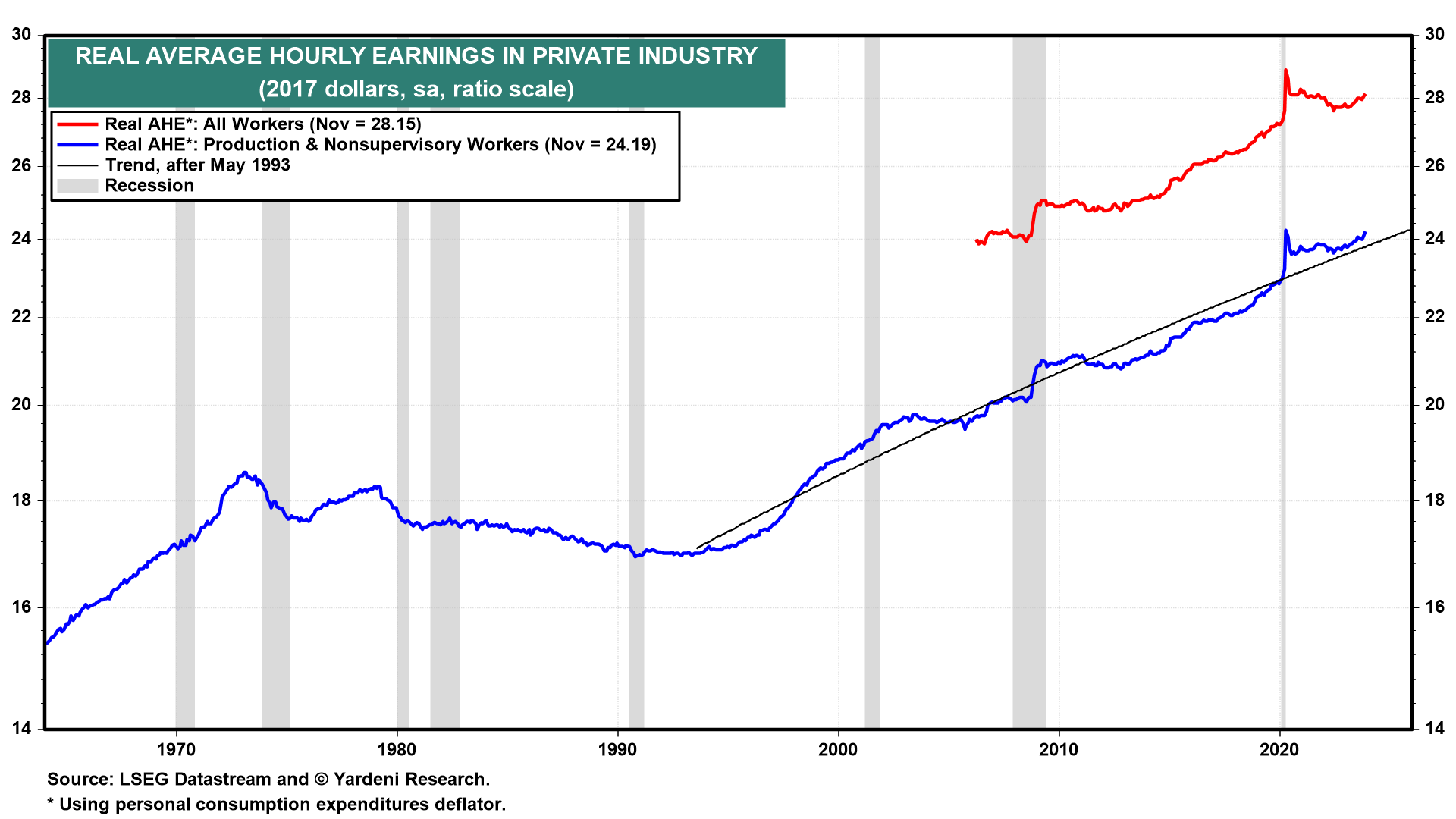

By the way, on balance, we think that Friday's employment report confirmed that real hourly pay and real total wages & salaries remain on uptrends (chart). December's average hourly earnings rose 0.4%, while the headline PCE deflator probably rose 0.1%. That means consumers' purchasing power is still rising and so should real consumer spending.

We asked Joe Feshbach for his latest thoughts on the stock market from a trading perspective: "In my last market update on December 17, I said that it was hard to envision much upside remaining with sentiment indicators at their current highly-bullish levels and that if the market held its ground on the upside in a seasonally strong period, some type of correction would be likely in the first quarter. That scenario materialized very quickly. My stochastic turned down on 12/29, and that signal carries more weight in an environment of bullish sentiment.

"While I do expect the correction to continue further into the new year, I'm not looking for any drastic decline, as breadth held up quite well during the rally. I'm just not thrilled that the MegaCap-8 is still 27% of the S&P 500's market cap; such concentration isn't usually a healthy market sign. Thus, I expect the correction to continue until the sentiment indicators turn less bullish, which hasn't happened so far during the first week of the year."