The stock market held up remarkably well yesterday despite Fed Chair Jerome Powell's warning that "there's more restriction coming" because the labor market remains too strong. He suggested that 25-bps rate hikes are still on the table for the next two meetings of the FOMC.

Powell spoke during a monetary policy session in Sintra, Portugal, which is famous for its huge crashing ocean waves that attract surfers from around the world. Yet, the waters remained calm in the stock market. The Nasdaq managed to edge up yesterday despite a 1.8% drop in Nvidia's stock price on reports that the Biden administration is considering new export controls on AI chips, as Washington increases its efforts to make it harder for China to obtain technology with military applications.

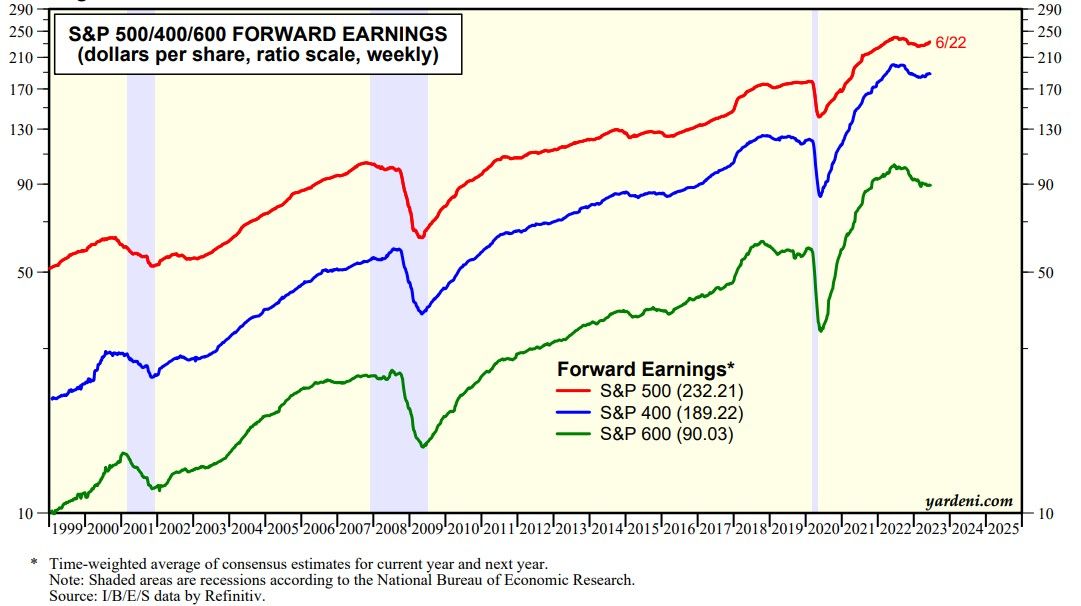

Helping support the market is growing confidence in the economy's resilience. Investors may be concluding that if the economy has avoided a recession so far in the face of a 500bps increase in the federal funds rate since last year, then another two 25bps won't make much difference. Meanwhile, industry analysts may be turning more constructive as evidenced by the upturn in the forward earnings of the S&P 500 and S&P 400 in recent weeks (chart).