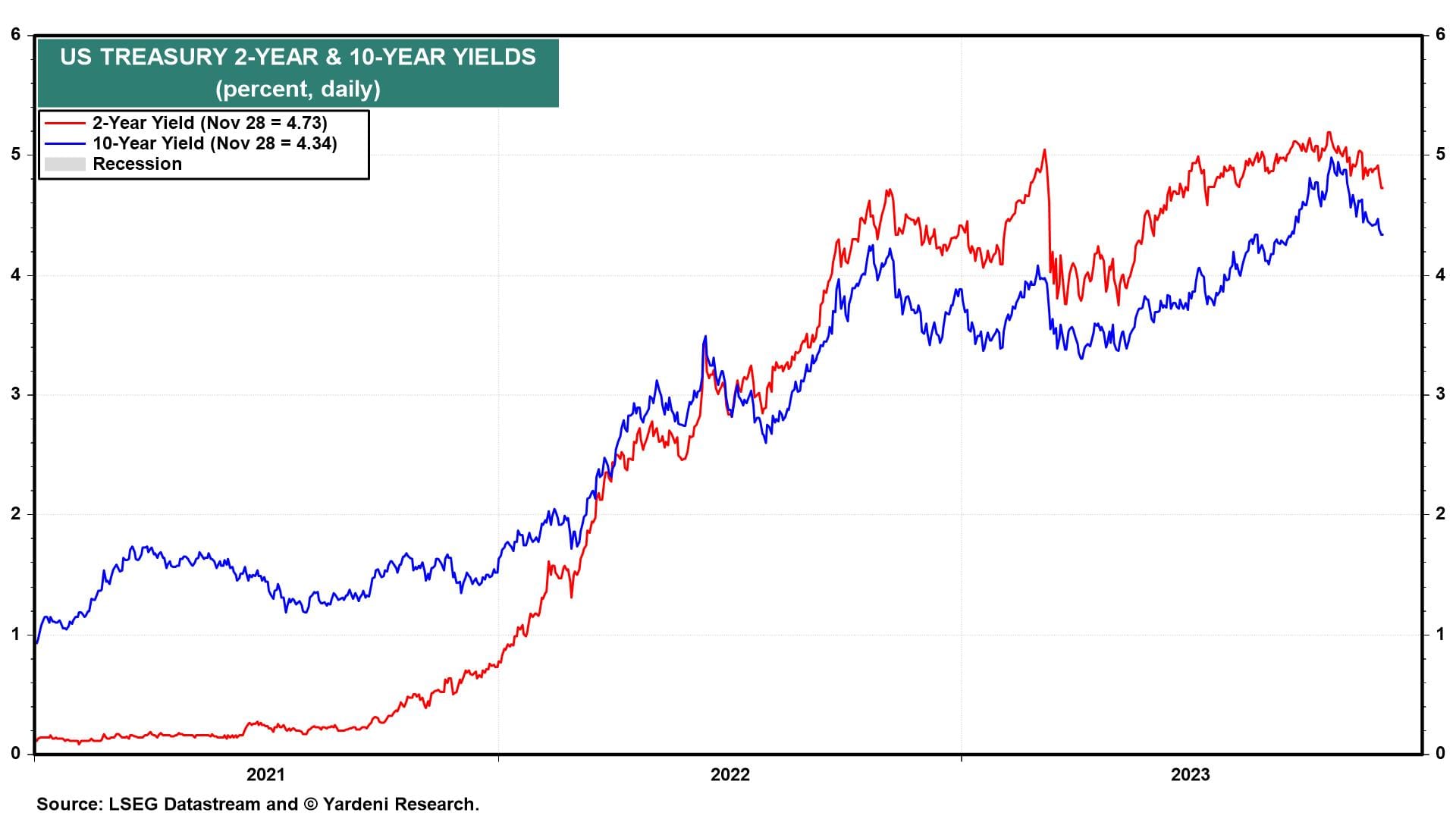

Not much happened in the stock market today even though the 10-year bond yield fell to 4.34% from a high of 4.98% on October 19 (chart). The 2-year yield sank to 4.73%, the lowest since July 17.

This morning, Fed Governor Christopher Waller warned that inflation is still too high. But he also said that if inflation continues to cool “for several more months—I don’t know how long that might be—three months, four months, five months—that we feel confident that inflation is really down and on its way, you could then start lowering the policy rate just because inflation is lower.” Waller said that in remarks at the American Enterprise Institute in Washington, D.C. “It has nothing to do with trying to save the economy or recession,” he added.

Also today, The Conference Board reported that November's Consumer Confidence Index edged higher. The "jobs plentiful" series ticked up, suggesting that there are still plenty of job openings (chart).