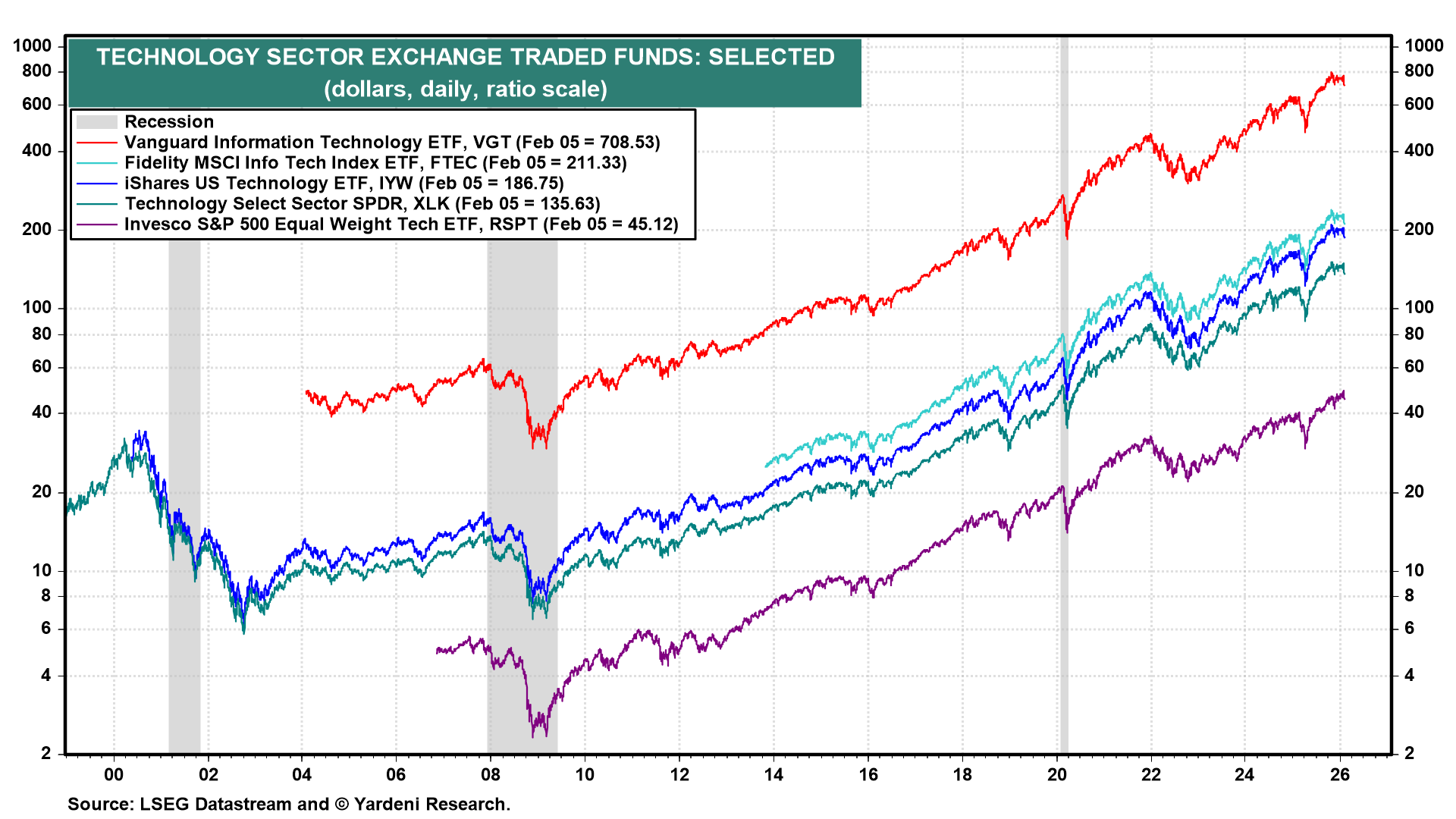

Is the sharp selloff in technology stocks this week the beginning of a Tech Wreck comparable to what happened from 2000 through 2002, when the tech bubble of the late 1990s burst and caused a recession (chart)? We doubt it because this time, the industry has many more profitable companies benefiting from the enormous capital spending on AI infrastructure by hyperscalers, including Alphabet, Amazon, and Microsoft. Collectively, these three companies are projected to spend approximately $490 billion on AI in 2026. Including Meta, the "Big Four" hyperscalers are forecast to spend roughly $650 billion.

That's freaking out investors, who are worrying that such massive spending might not pay off. However, all that spending in just this year will certainly provide lots of revenues and earnings to the companies that are vendors to the hyperscalers. The economy will also get a big boost from so much capex. Some of this spending might be delayed into next year if the data center projects are constrained by power and semiconductor availability.

Microsoft alone now carries roughly $625 billion in contracted but unrecognized revenue (RPO), reflecting unprecedented multi‑year AI and cloud commitments. Other hyperscalers also report rapidly expanding long‑term cloud contracts, though their RPO disclosures are not directly comparable.