Today we learned that July's survey of small business owners showed that inflation might have peaked. On the other hand, there was no peak in today's productivity and unit labor costs report for Q2:

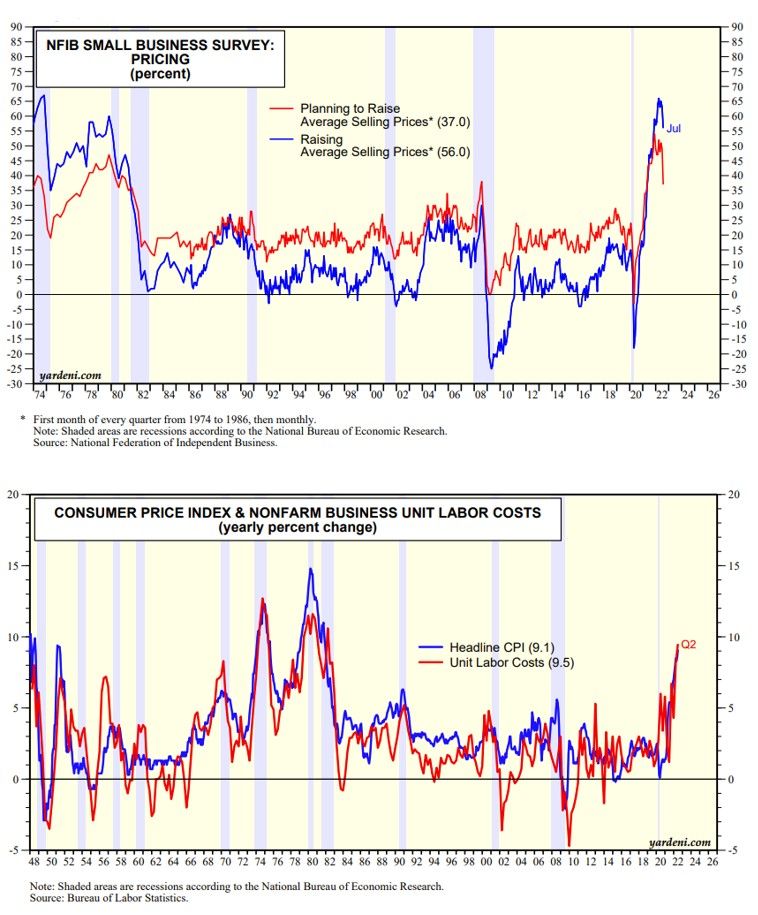

(1) The small business owners survey found that 56% of them are raising prices, while 37.0% are planning to do so. Both are down from their peaks earlier this year. However, they remain quite elevated and still in record high territory (chart).

(2) The Bureau of Labor Statistics reported that unit labor costs (ULC) jumped 9.5% y/y during Q2 as productivity plunged 2.5% and hourly compensation soared 6.7% (chart). The CPI inflation rate is highly correlated with ULC inflation, both on a y/y basis. The former was up 9.1% through June.

(3) Tomorrow, all eyes will be on July's CPI. The headline rate is expected to be moderated by falling fuel and food prices. In the core inflation rate, falling durable goods price are expected to be offset by rising rents.