Stock prices were beat down today by three downbeat and hawkish Fed officials (Fed Governor Lisa Cook, San Francisco Fed President Mary Daly, and Atlanta’s Raphael Bostic). They all repeated the Fed's party line: Inflation is too high and the Fed must continue to raise interest rates to bring it down.

They reiterated what Fed Chair Jerome Powell said at his September 21 presser. He mentioned the words “pain” or “painful” seven times. He did so in the context that bringing inflation down with tight monetary policy might cause a recession, but the pain will only be worse later if the Fed doesn’t step on the monetary brakes now. His other remarks were uniformly just as hawkish.

Powell mentioned the word “restrictive” 12 times in his presser, in the context that, at 3.00%-3.25%, the federal funds rate is “probably into the very lowest level of what might be restrictive.” He warned that “there’s a ways to go.” He stated that the FOMC needs “to move our policy rate to a restrictive level that’s restrictive enough to bring inflation down to 2%, where we have confidence of that.” He said that once the federal funds rate is at a restrictive level, the FOMC will have “to keep it there for some time.”

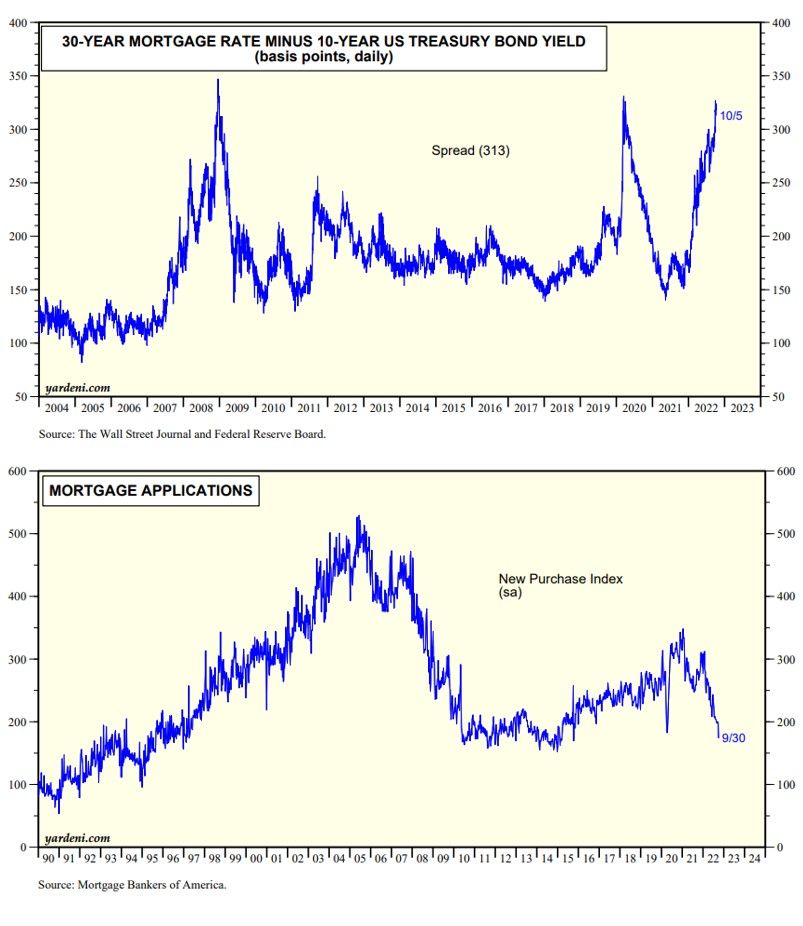

Have Powell and his colleagues been watching the housing and mortgage markets? Mortgage rates continued to surge higher this week, crossing 7% on the 30-year fixed to 7.08%. That is the highest rate in just under 20 years. They've soared faster than the 10-year Treasury bond yield because the spread between the two has been widening dramatically as a result of the Fed's QT2 (chart below). "Feddie" intends to get out of the mortgage business. Mortgage applications to purchase a home are plummeting. They are down 29% from the same week one year ago (chart below). Housing starts and home sales are heading south fast.