Corporate profit margins always plunge during recessions. They aren't doing so at this time, thus raising doubts about the credibility of imminent-recession forecasts.

We can monitor the profit margins of the S&P 500 along with its 11 sectors and 100+ industries on a weekly basis using forward profit margins derived as the ratio of forward earnings to forward revenues, which are time-weighted averages of the consensus estimates of industry analysts for the current year and the coming year. These weekly series tend to be very good proxies for the actual quarterly results with one important exception: Industry analysts don't see recessions coming.

When recessions occur, the analysts scramble to slash their earnings estimates faster than their revenues estimates as evidenced by rapidly falling profit margin estimates.

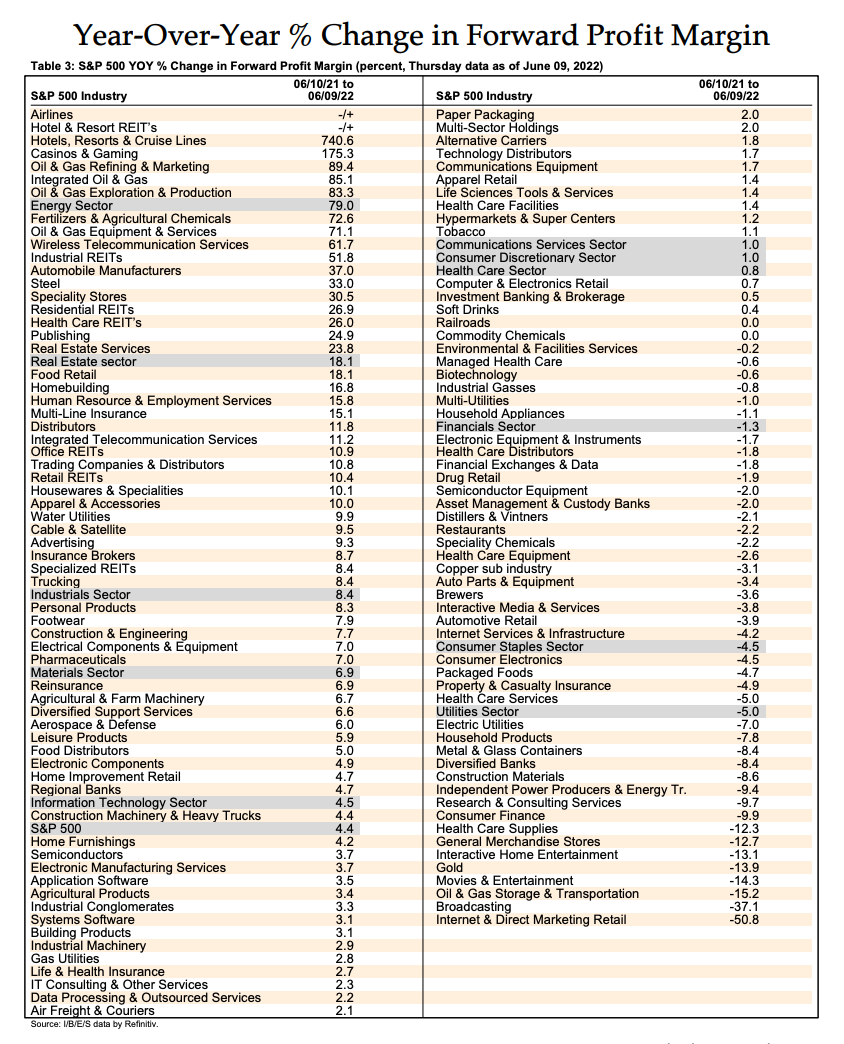

The table below shows that the forward profit margin of the S&P 500 rose 4.4% y/y through the June 9 week (to a record 13.4%). Only three of the 11 sectors are down over that period: Financials (-1.3%), Consumer Staples (-4.5), and Utilities (-5.0). Outpacing the increase in the margin of the S&P 500 have been Energy (79.0%) Real Estate (18.1), Industrials (8.4), Materials (6.9), and Information Technology (4.5).

That's impressive in the face of rapidly rising labor and materials costs, suggesting that most companies have been able to pass them through to prices and offset them with productivity.