It's official: Fed Chair Jerome Powell confirmed today that he and his colleagues aren't convinced that inflation is coming down fast enough to consider cutting the federal funds rate (FFR) any time soon: "The recent data have clearly not given us greater confidence and instead indicate that it is likely to take longer than expected to achieve that confidence," Powell said at a moderated question-and-answer session in Washington.

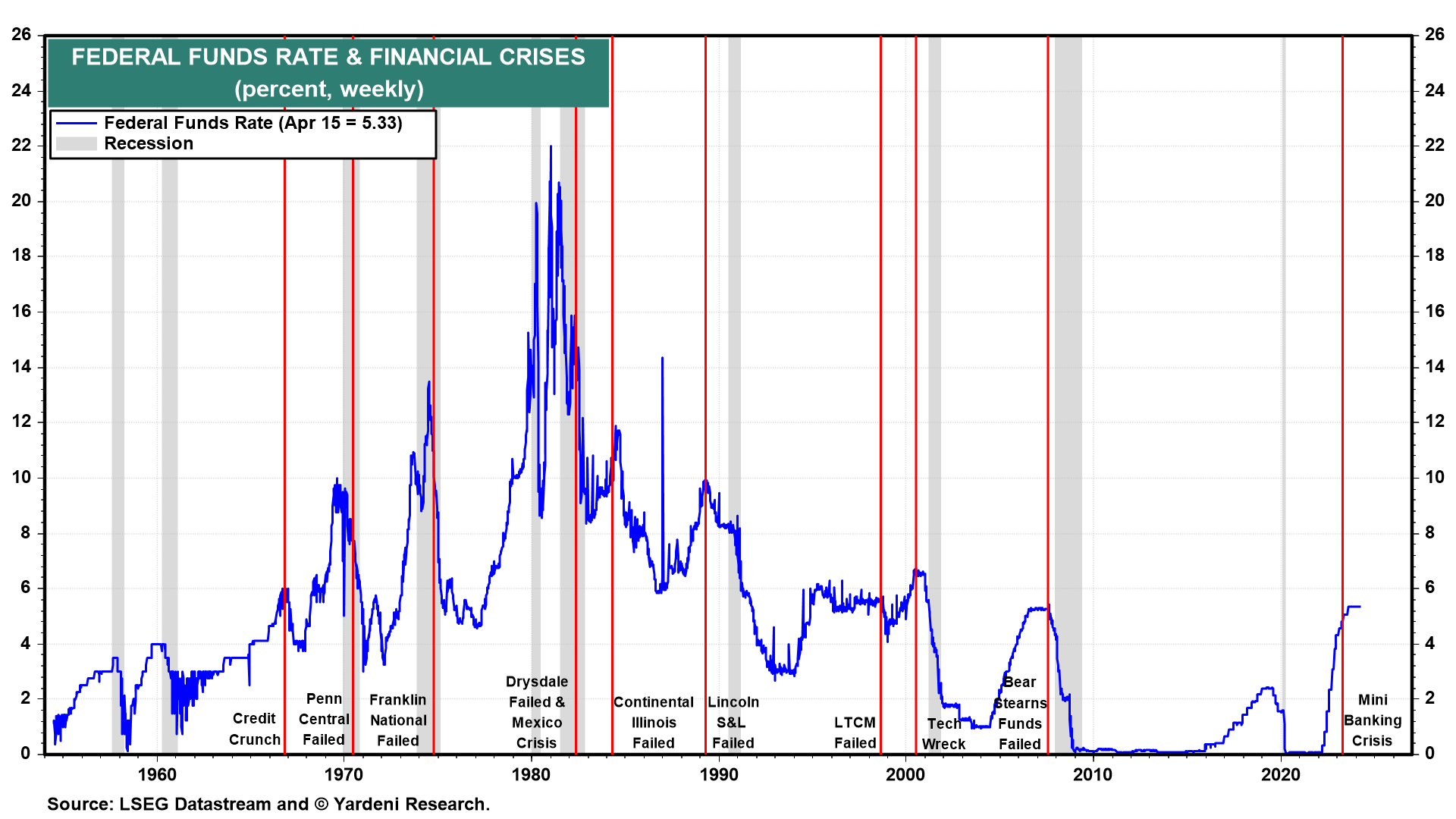

At the start of the year, market participants expected several cuts in the FFR this year based on the observation that once the Fed has stopped raising it, the rate was cut quickly or after a short pause in the past (chart). We've observed that in the past, the Fed cut rates in response to major financial crises, which haven't occurred so far.

Today, the 2-year Treasury note yield closed at 4.97%, while the 10-year yield rose to 4.67% (chart). The latter is likely to meet the former at 5.00% shortly. That level might mark the peaks in both for a while as long as a resumption in rate hikes is a remote possibility, as suggested by Powell today.