The current consensus in the financial markets seems to be that the FOMC is done hiking the federal funds rate (FFR) after having raised it today by 25bps to 5.00%-5.25%. Furthermore, markets seem to be anticipating that the FFR will be falling soon. That's consistent with the widely held view that a recession is coming soon. It isn't consistent with Fed Chair Jerome Powell's press conference today. He acknowledged the possibility of a "mild recession," but he reiterated that inflation remains too high and that the FFR needs to remain restrictive enough to bring it down. If Powell and his colleagues conclude that 5.00%-5.25% is restrictive enough to do the job, then they intend to keep it there until it is clearly doing the job.

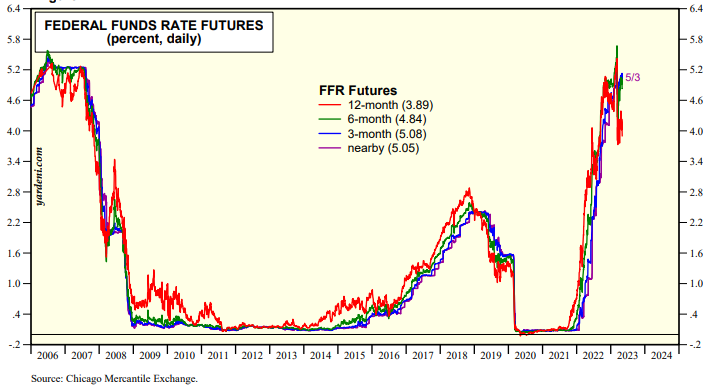

The FFR futures today showed the nearby contract at 5.05%, the three-month at 5.08%, the six-month at 4.84%, and the 12-month at 3.89% (chart). The two-year Treasury note is down to 3.84% from the year's high of 4.06% on March 2.

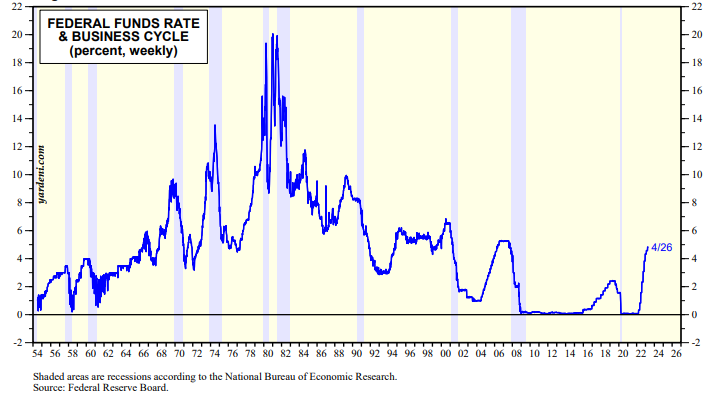

In the past, the FFR tended to peak right before recessions and fall rapidly during the downturns (chart). The past three FFR cycles saw the rate plateau for 8, 14, and 7 months before it plummeted.

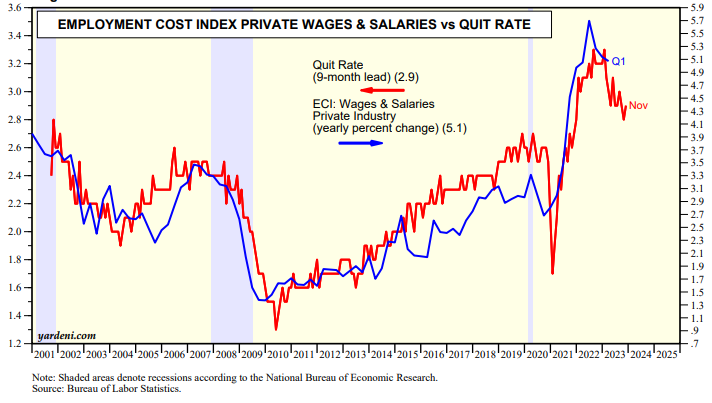

Powell's concern is that the labor market remains too strong as evidenced by March's JOLTS report showing 1.6 job openings for every unemployed worker and April's ADP private payrolls report showing a gain of 296,000. As a result, the ECI measure of wage inflation remains too high according to Powell, though the quits rate suggests it will moderate over the next nine months (chart).

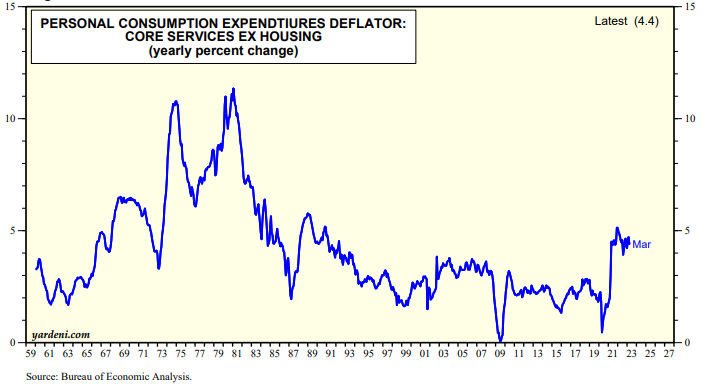

Powell also mentioned that the core services PCED ex housing inflation rate has remained stubbornly high around 4.5% over the past year (chart).

Powell & Company are trying to lower inflation without causing a major recession, which in the past was the sure way to bring inflation down. Can they do it? We think they might succeed by keeping the FFR at the current level for the foreseeable future until we all see inflation heading lower. That's been our forecast since last summer and it still is.