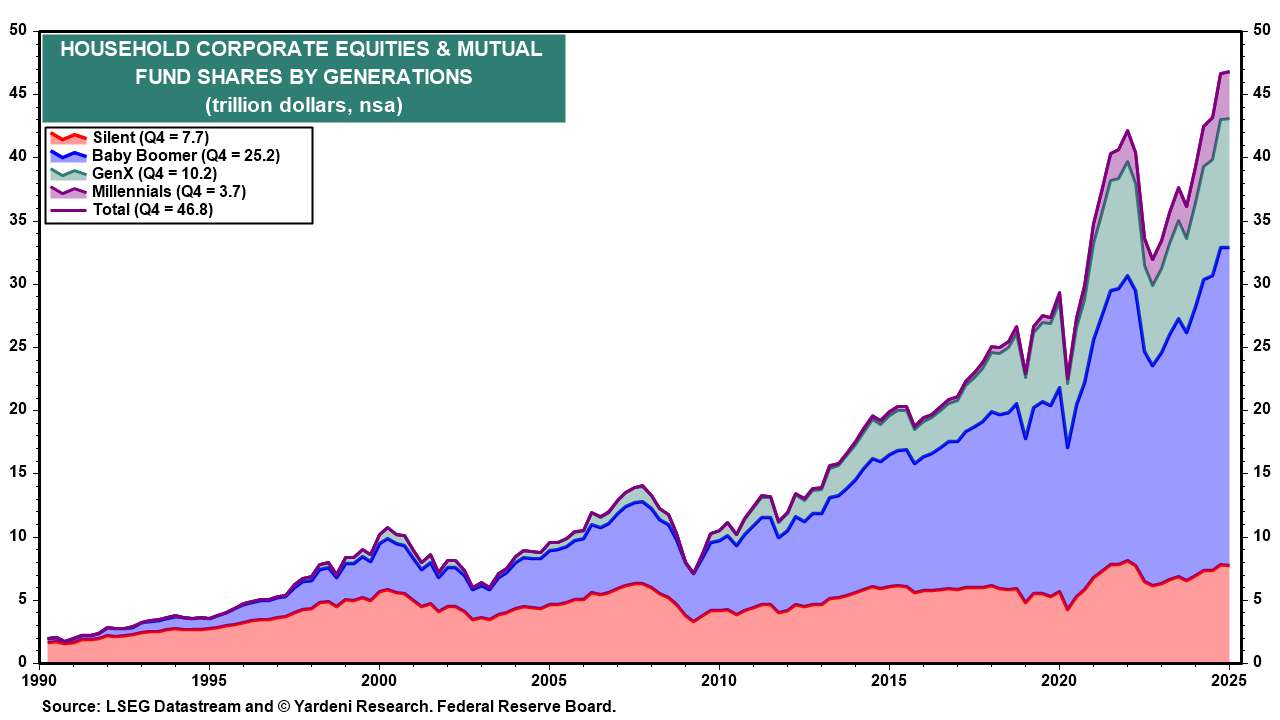

Among our main concerns about Trump's Tariff Turmoil was that the drop in stock prices would have a significant negative wealth effect on consumers, especially retired and soon-to-be retiring Baby Boomers, who collectively own about $25 trillion in corporate equities and mutual funds (chart). We raised our subjective probability of a recession this year from 20% to 35% on March 5, and from 35% to 45% on March 31 as stock prices tanked in response to TTT.

We didn't cross over to the dark side subsequently, i.e., forecasting greater than a 50% chance of a recession. Instead, we lowered our recession odds back down to 35% on May 4. Now we are lowering it again to 25%. After today's stock market rally, the negative wealth effect is probably insignificant. We are also raising our S&P 500 year-end target back up to 6500 from 6000. (BTW: According to Polymarket.com, the odds of a recession dropped from 51% on Friday to 41% today.)

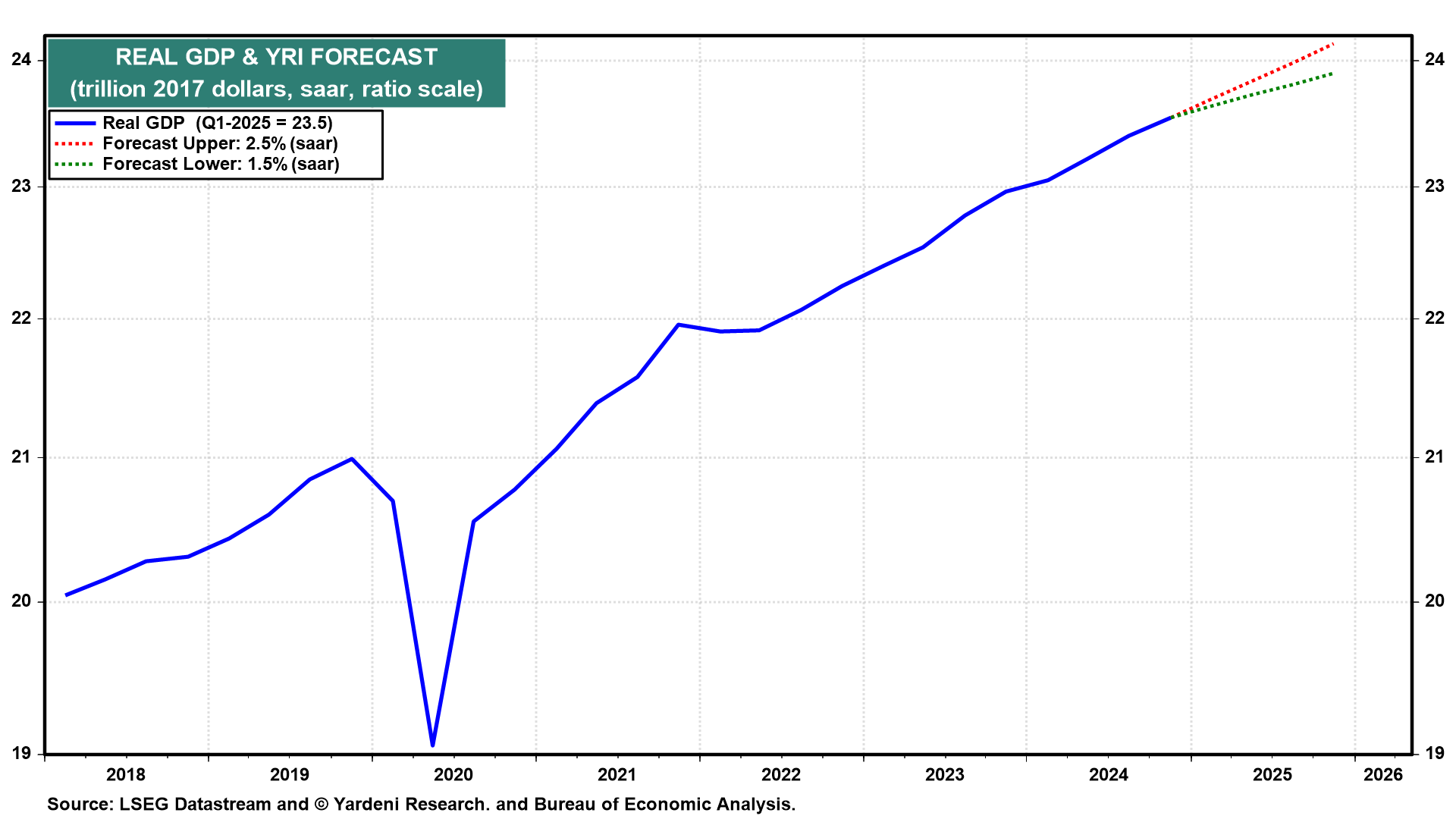

We are still predicting that S&P 500 forward earnings will rise to $300 per share at the end of this year. We now see the S&P 500 forward P/E at 21.6 at the end of the year rather than 20.0 as we previously had projected. We are raising our real GDP growth range to 1.5%-2.5% this year, up from our previous 0.5%-1.5% (chart).

In the April 7 Morning Briefing, we wrote: "We expected Liberation Day [April 2] to bring trouble. So for now, we aren't changing our outlook or our odds of a recession. Call us delusional optimists, but we aren't ready to bet against the resilience of the US economy in general or its consumers in particular. Of course, our big assumption is that Trump's tariff nightmare will go away sooner rather than later, one way or another." We predicted a V-shaped stock market recovery when that occurred, which it did two days later on April 9!

Now consider today's other developments: