The latest batch of leading economic indicators suggests that several coincident economic indicators might soon begin to fall. So we now place the odds of a mild recession at 55% (up from 45%), making it our base-case outlook.

Let’s review what we have so far for June’s Index of Leading Economic Indicators (LEI) and May's Index of Coincident Economic Indicators (CEI):

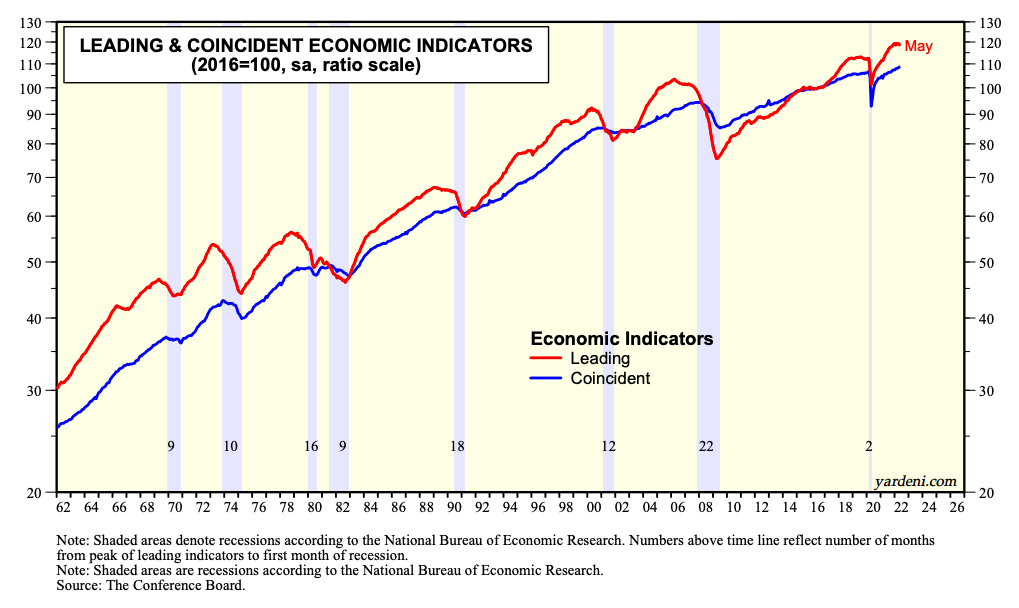

(1) While it is widely believed that the LEI tends to peak three consecutive months prior to recessions, the average lead time between the LEI peak and the CEI peak has been 12 months during the previous eight business cycles, with a range of 2-22 months. The CEI cycle has coincided with both the official peaks and troughs of the previous eight business cycles, as determined by the Dating Committee of the National Bureau of Economic Research.

The CEI tracks the growth rate of real GDP, both on a y/y basis, very closely. The former was up 3.0% during May, while the latter was up 3.5% during Q1.

(2) The LEI fell for the third month in a row in May, and that makes four declines in the last five months. We already know that three of the 10 LEI components were down in June, i.e., the S&P 500, the M-PMI new orders subindex, and the average of the CCI and CSI consumer expectations measures. Also weighing on the LEI during June was an increase in initial unemployment claims. Odds are that nondefense capital goods orders excluding aircraft lowered June’s LEI as well.

(3) So real GDP apparently fell two quarters in a row during H1-2022. The LEI has dropped for three consecutive months through May. The jury is out on whether this will turn out to be an official recession, especially since the CEI rose to a record high in May and since it peaked 12 months, on average, after the LEI peaked during the past eight business cycles, as noted above. For now, we are raising the odds of a recession from 45% to 55%. In any event, industry analysts are likely to be cutting their earnings estimates during H2-2022.