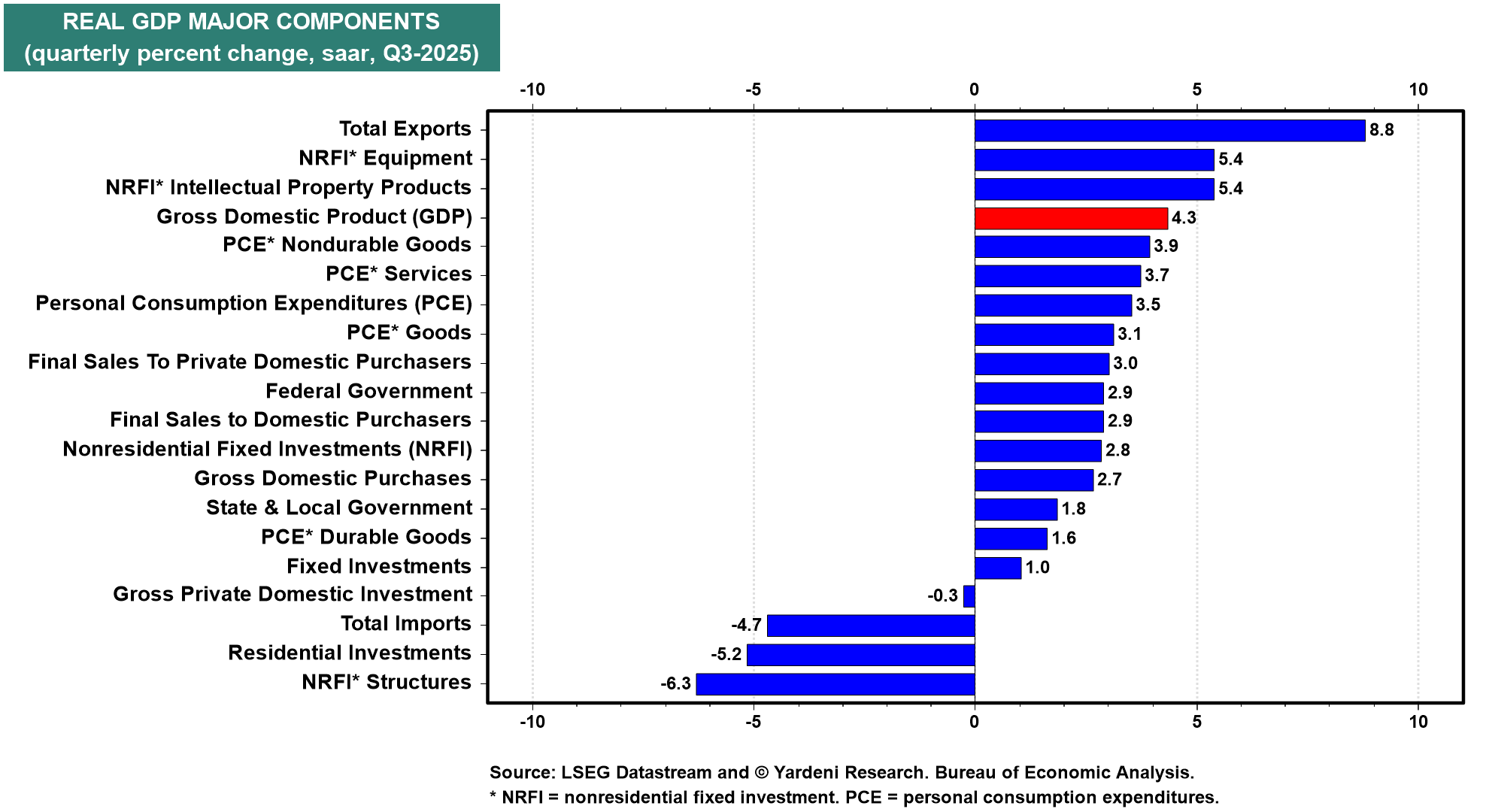

Productivity must be booming. Real GDP jumped 4.3% (saar) in Q3, following a 3.8% increase in Q2. Over the same period, aggregate hours worked in private industry was flat (saar). Productivity must have increased by more than 3.5% over the previous two quarters. That's consistent with our productivity-led Roaring 2020s scenario.

Real final sales to private domestic purchasers, the sum of consumer spending and gross private fixed investment, increased 3.0% in Q3, compared with an increase of 2.9% in Q2. Consumer spending remained strong, rising 3.5%, up from 2.5% in the previous quarter. That's impressive considering that aggregate hours worked hasn't been growing.

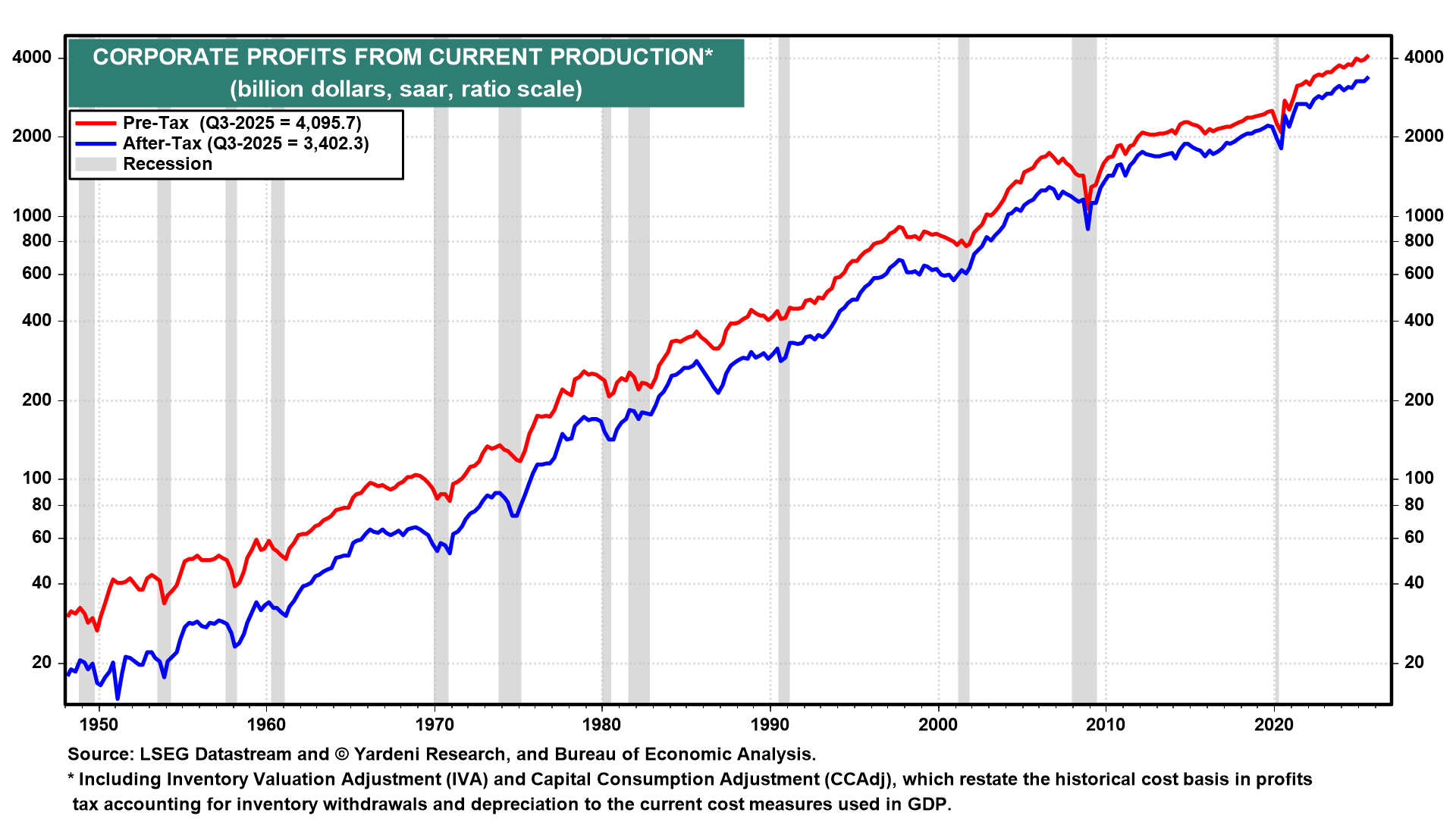

Profits from current production (corporate profits with inventory valuation and capital consumption adjustments) increased $166.1 billion (ssar) in Q3 to a record high (chart).

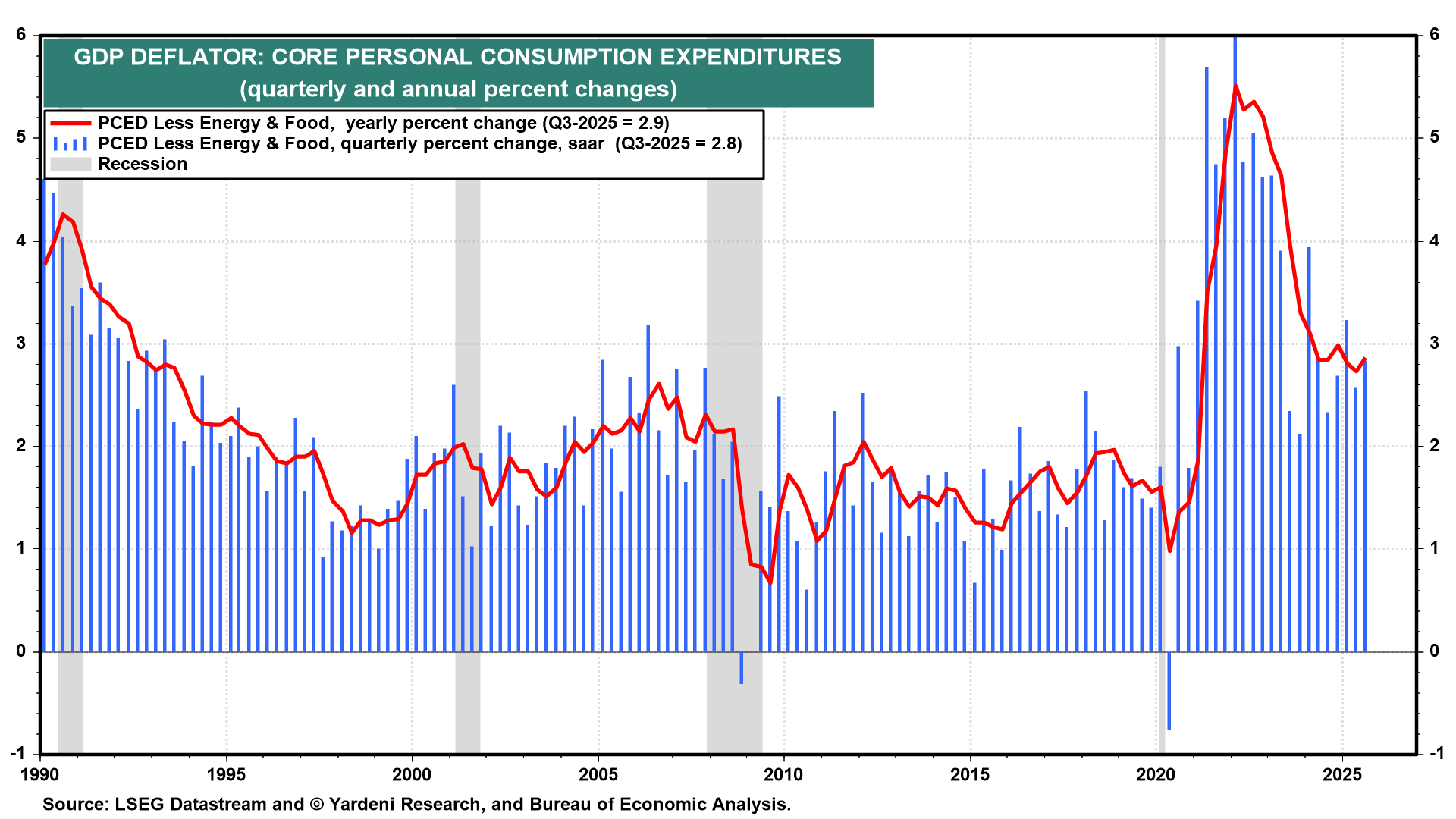

In Q3, the core PCE price index (deflator) rose 2.8% (saar) and 2.9% y/y (chart). Inflation pressures picked up slightly from Q2.

The above raises the question of why the Fed lowered the federal funds rate by 75bps since September. That's after cutting the rate by 100bps late last year. The 10-year Treasury bond yield remains above 4.00% despite the Fed's efforts to ease credit conditions, particularly in the mortgage market. Fed officials have largely ignored the strength of GDP and the persistence of inflation at around 3.0% y/y, which is above their 2.0% inflation target.