As the world turns, so do risk-on and risk-off trades around the world. Some are for the short term and based on technical factors. Others are for the long term and based on fundamentals. Let's take a quick tour around the world:

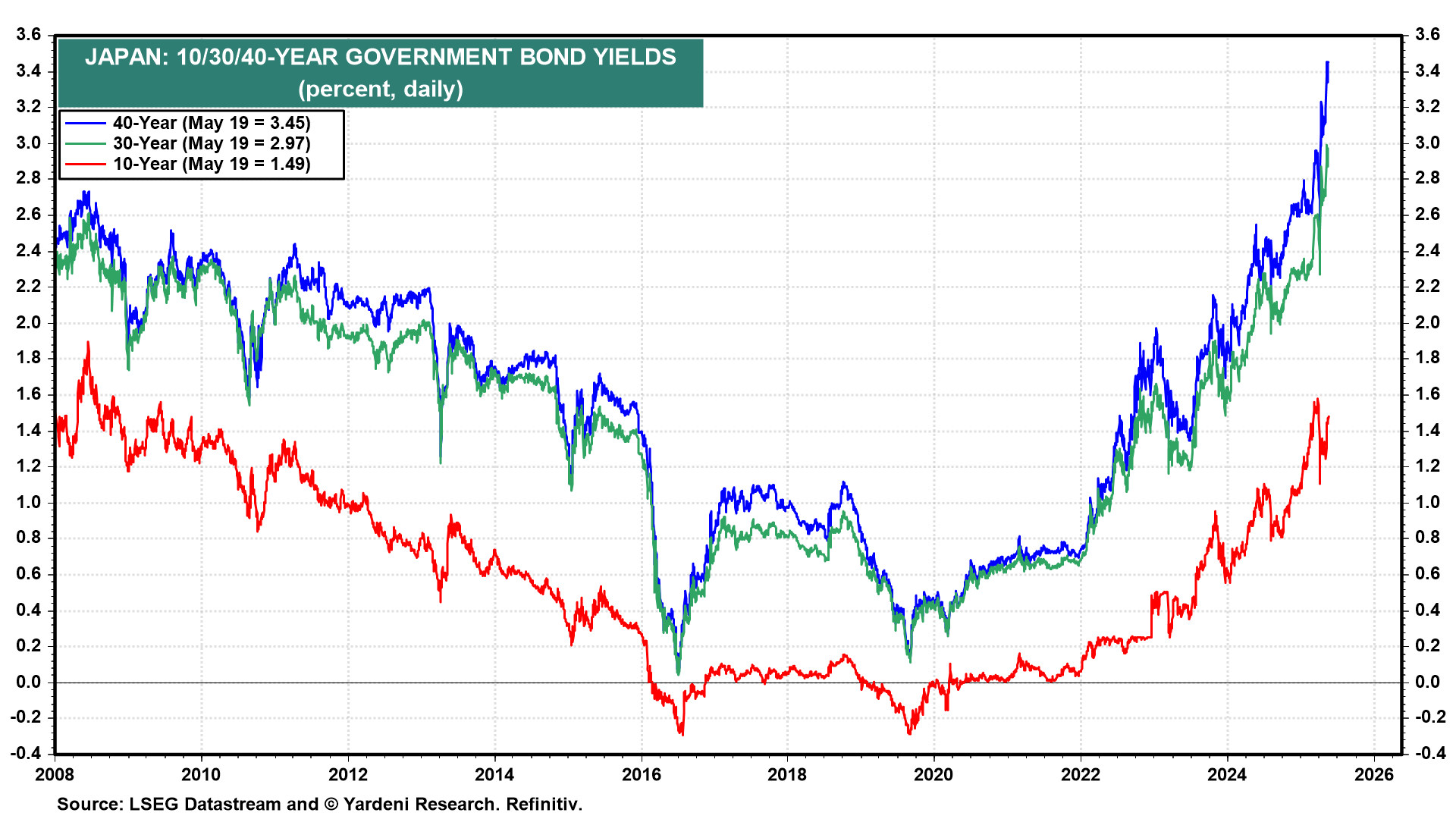

(1) Japan. While pessimists have been predicting an imminent sovereign debt crisis in the US, it seems to be unfolding in Japan currently. Amid a shrinking economy and growing mountain of debt, Prime Minister Shigeru Ishiba issued a harsh warning this week, "Our country's fiscal situation is undoubtedly extremely poor," adding, "worse than Greece's.” Japan's GDP shrank in Q1; and on Monday, the cost of borrowing increased after yields on its 40-year government bond reached highs last seen about 20 years ago (chart). The slump in Japanese bonds worsened today after the weakest demand at a government debt auction in more than a decade. The bid-to-cover ratio at Tuesday’s 20-year bond sale fell to the lowest since August 2012.

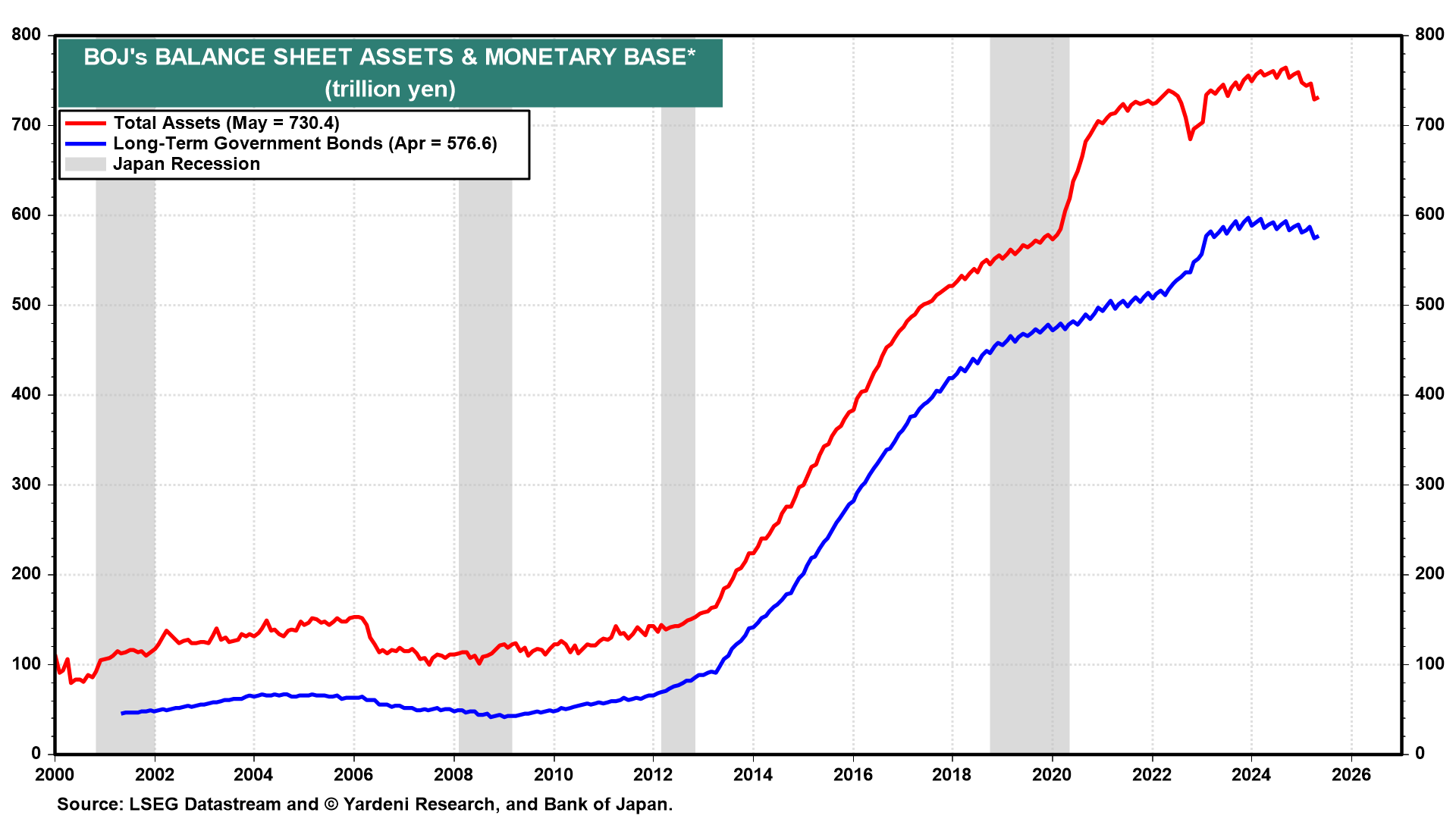

The Bank of Japan has stopped increasing its holdings of Japanese government bonds over the past two years (chart).

(2) China. On Monday, official data showed that China's industrial output in April grew 6.1% y/y, while inflation-adjusted retail sales increased 5.4% (chart). The data followed firmer-than-expected exports last month. In other words, China continues to export its excess production, which is exacerbating global trade frictions and deflation around the world. China cut its key lending rates by 10 basis points on Tuesday.