Relax: The AI bubble is the cover story in the latest BloombergBusinessweek (image). From a contrarian perspective, that's bullish because it signals that the bubble won't burst, if it even exists. We have AI Fatigue. We recently recommended underweighting the Magnificent-7 because their AI arms race is forcing them to spend heavily on AI infrastructure that could become obsolete quickly and that could be unprofitable as their competition squeezes their margins. We believe the air can be let out of the AI capital-spending bubble over time without it bursting and causing a recession.

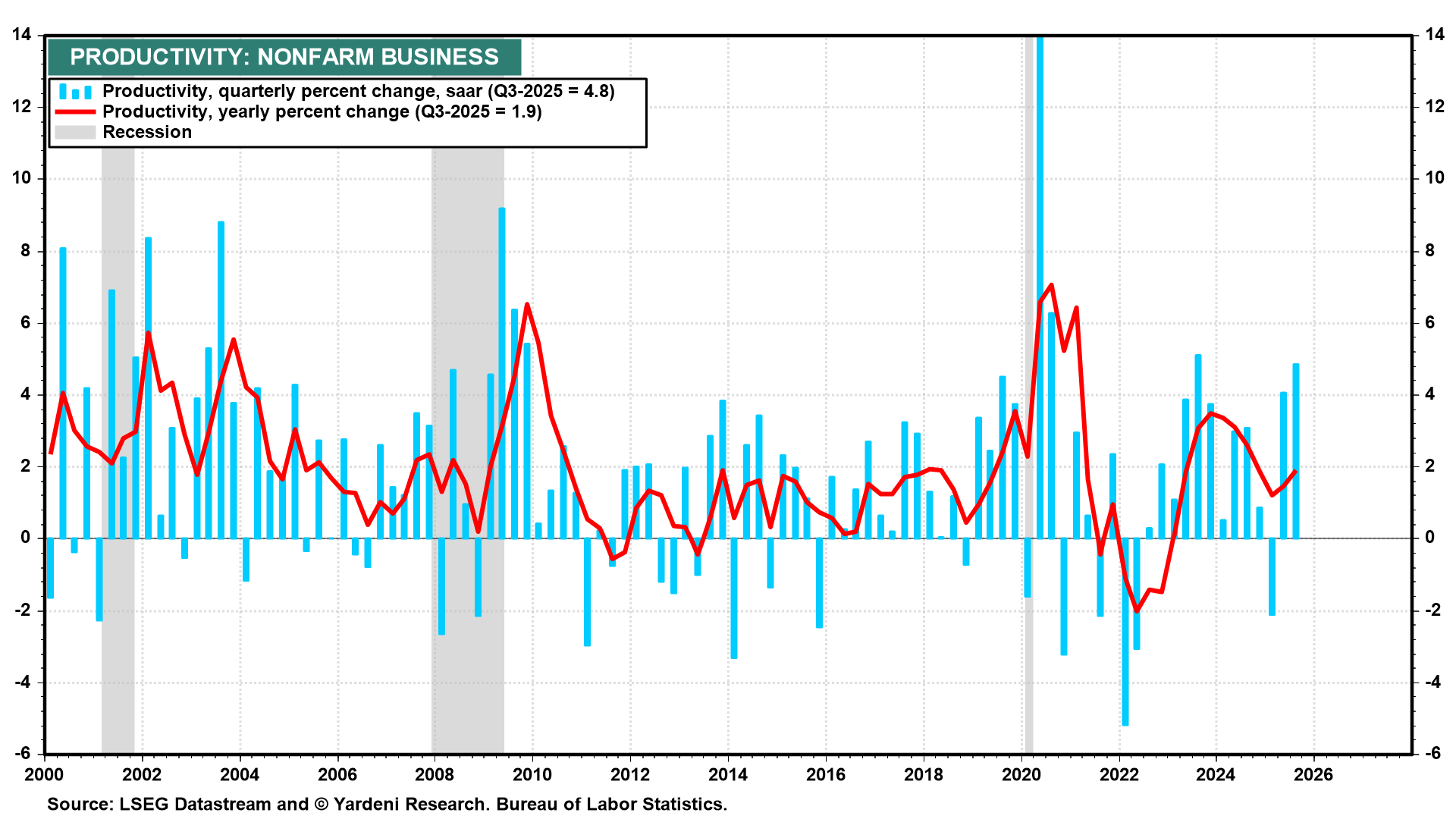

Meanwhile, AI may be starting to boost the productivity of the users of this technology, especially the S&P 500's Impressive 493. Nonfarm business sector labor productivity increased 4.9% (saar) in Q3-2025, as output increased 5.4% and hours worked increased 0.5% (chart). Q2-2025 productivity was revised up from 3.3% to 4.1% as output increased 5.2%, while hours worked rose 1.0%. These are awesome numbers!

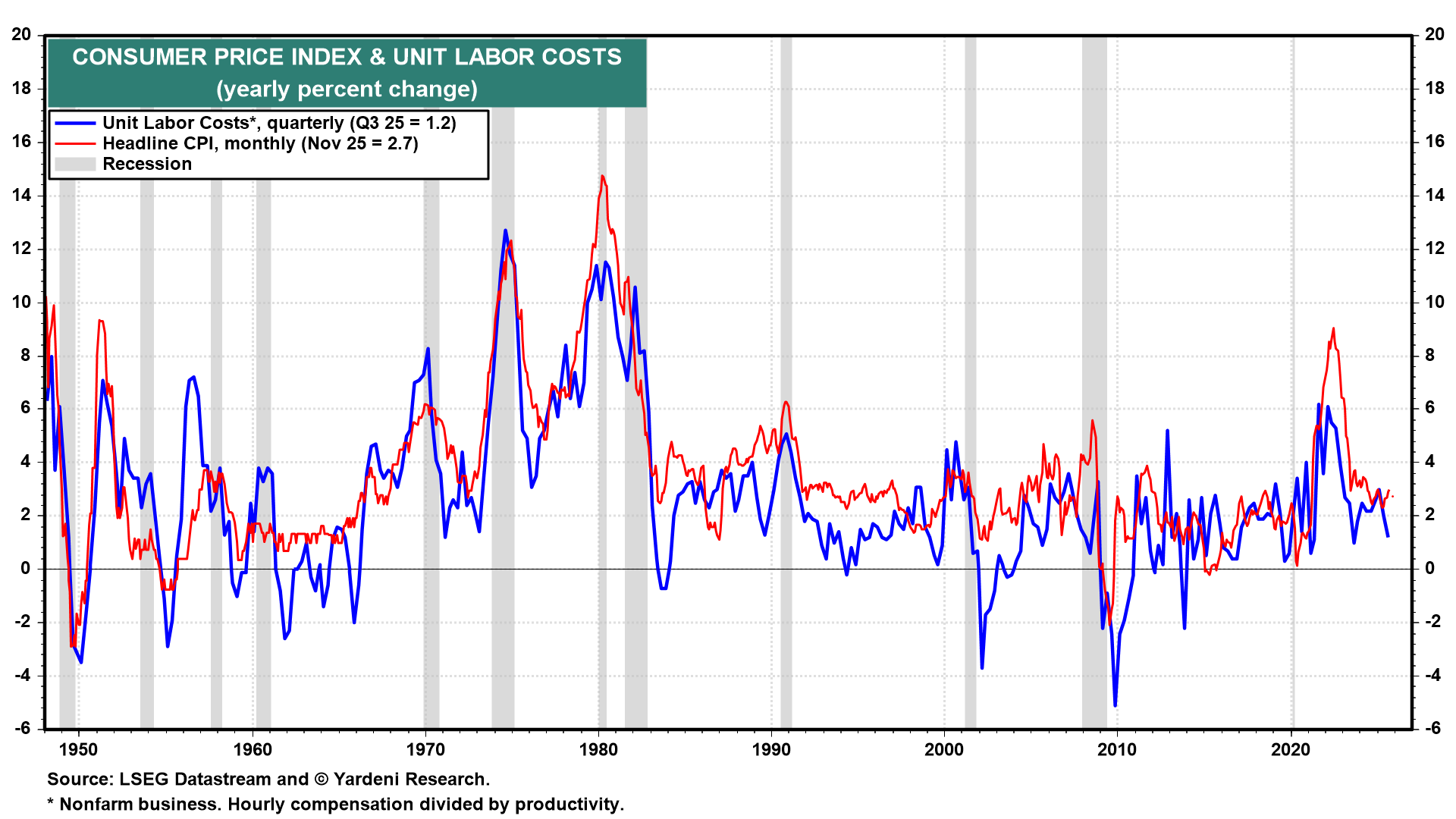

Unit labor costs (ULC) in the nonfarm business sector decreased 1.9% in Q3-2025,

reflecting a 2.9% increase in hourly compensation and a 4.9% increase in productivity. ULC during Q2-2025 was revised down from 1.0% to -2.9%. ULC increased only 1.2% (y/y) (chart). This confirms our view that CPI inflation should fall to 2.0% this year.

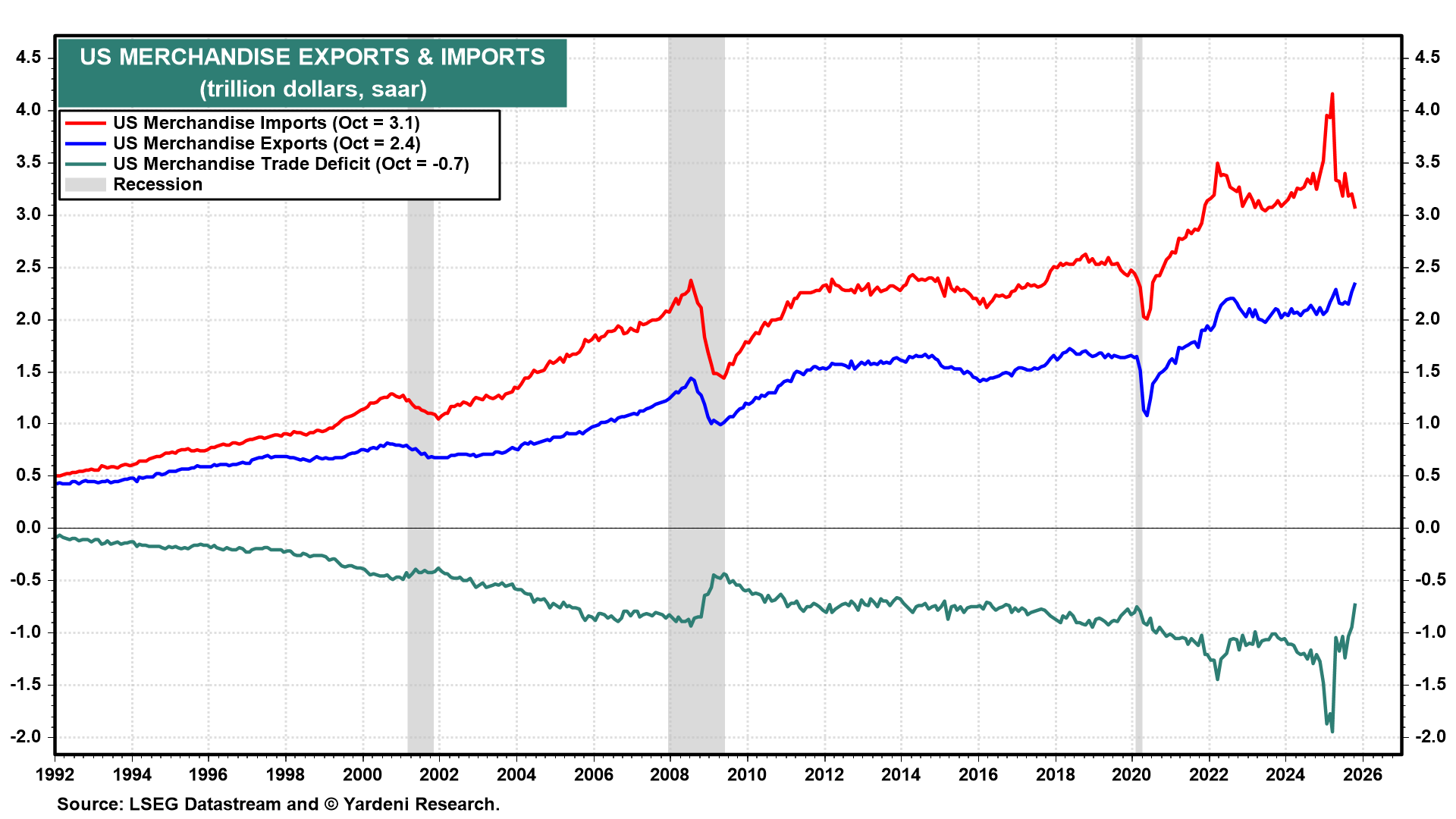

Following today's advance report on October's merchandise trade, which showed a significant drop in imports, the Atlanta Fed's GDPNow estimate for Q4 real GDP was revised higher from 2.7% to 5.4% (chart). That estimate will probably decline as more data become available. But it suggests that productivity growth might have continued to boom during Q4-2025, consistent with our Roaring 2020s scenario.

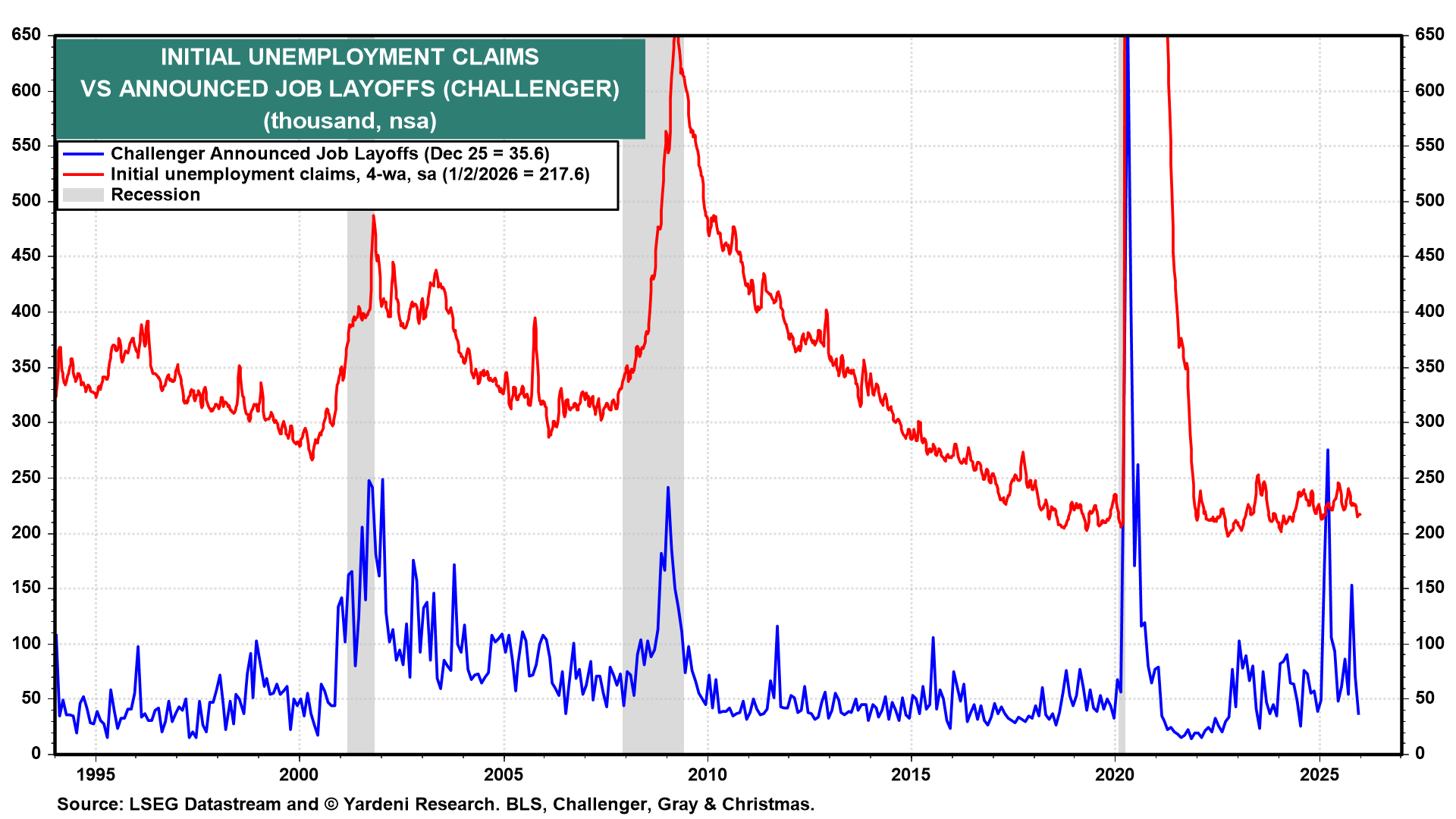

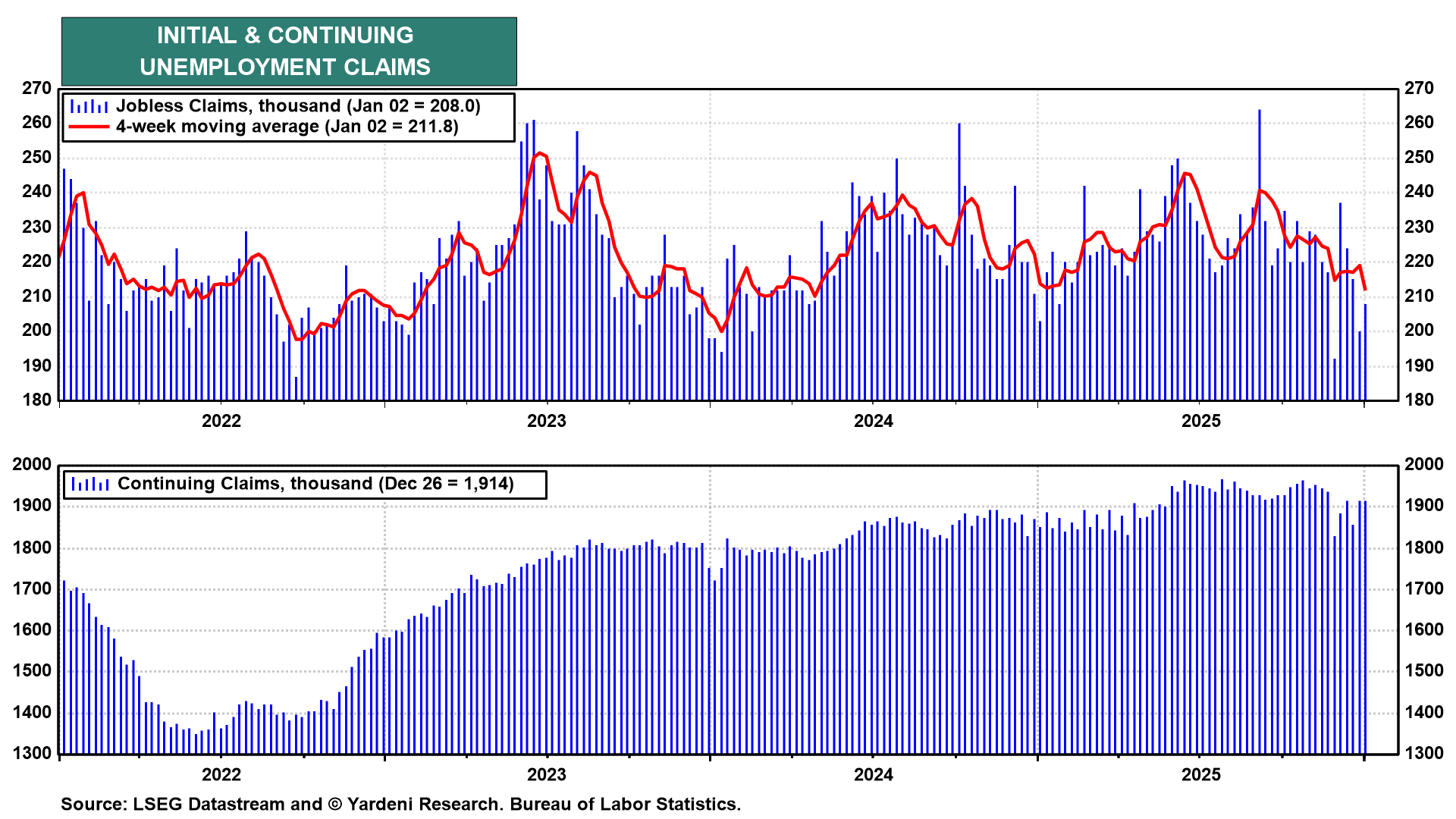

Meanwhile, today's labor market indicators showed that layoffs remained low, with initial unemployment claims rising modestly to 208,000 during the January 2 week (chart).

Challenger's report on announced layoffs was down to 35,600 during December (chart).