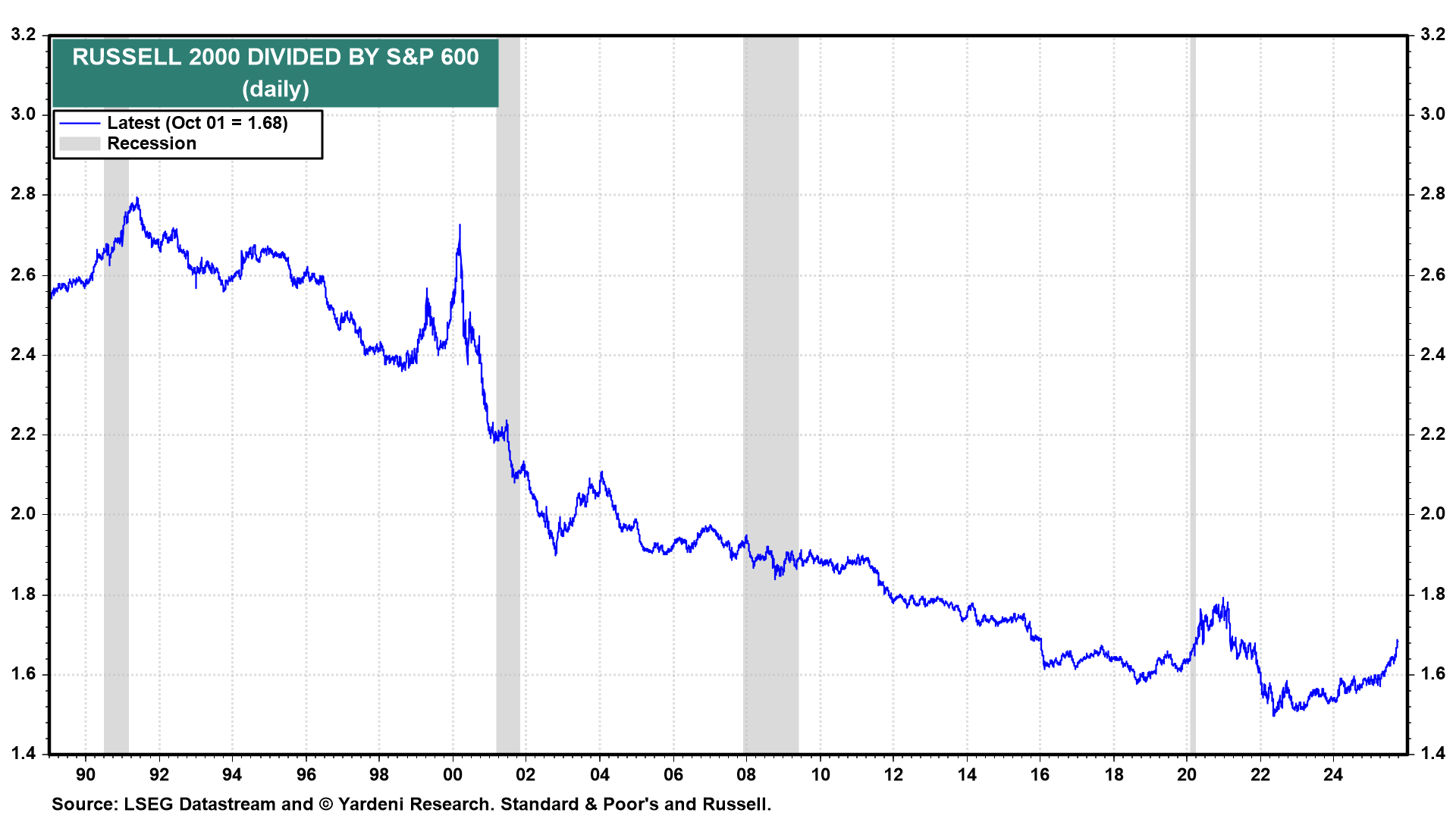

The Russell 2000 small-cap stock price index is outperforming the S&P 600, another small-cap index (chart). The former includes many more companies that are losing money than the latter. This is yet another sign of mounting speculative froth in financial markets in response to the Fed's 25bps cut in the federal funds rate on September 17.

The S&P 600's requirement that companies demonstrate positive earnings before being included acts as a screening tool, filtering out many of the most speculative or financially distressed businesses that are often found in the broader Russell 2000.

The percentage of companies in the Russell 2000 Index that lose money has generally been quite high in recent years, often hovering around 40%. The similar percentage for the S&P 600 is closer to 20%.