We are declaring "Mission Accomplished" on our 7000-year-end target for the S&P 500. The index rose to a record high of 6901 on December 11. That's close enough for us and might be the high for this year. We aren't ruling out a Santa Claus rally over the remainder of the year. However, that is unlikely to happen if the S&P 500 continues to rotate away from the Magnificent-7 toward the Impressive-493, as we expect (chart). We also expect that this rotation will continue into 2026.

The Mag-7 may be undergoing a correction similar to the DeepSeek correction earlier this year. DeepSeek surprised the AI world on January 20, 2025, when it released its "R1" reasoning large language model (LLM), nearly matching the performance of top US closed models at a fraction of the cost. The Mag-7 rebounded after they reported robust Q1 and Q2 earnings and reiterated on their conference calls that they were committed to spending tens of billions of dollars on AI infrastructure.

In recent weeks, investors have started to fret that the spending is depleting the Mag-7s' cash flows and slowing profits growth. Before AI, the Mag-7 had lots of cash flow because their spending on labor and capital was relatively low. That changed once AI forced them to spend much more on both. They found themselves competing more with one another to win the AI race.

Most recently, Google introduced Gemini-3, which outperformed OpenAI's ChatGPT-5 and uses Google's TPU chips. Google's stock price soared on this news. But OpenAI responded quickly with a new version of its LLM. DeepSeek did the same. Amazon is reportedly negotiating with OpenAI to use its LLM if OpenAI uses Amazon's processing chips. That's putting downward pressure on the stock prices of both Nvidia and Google. It's all making investors' heads spin.

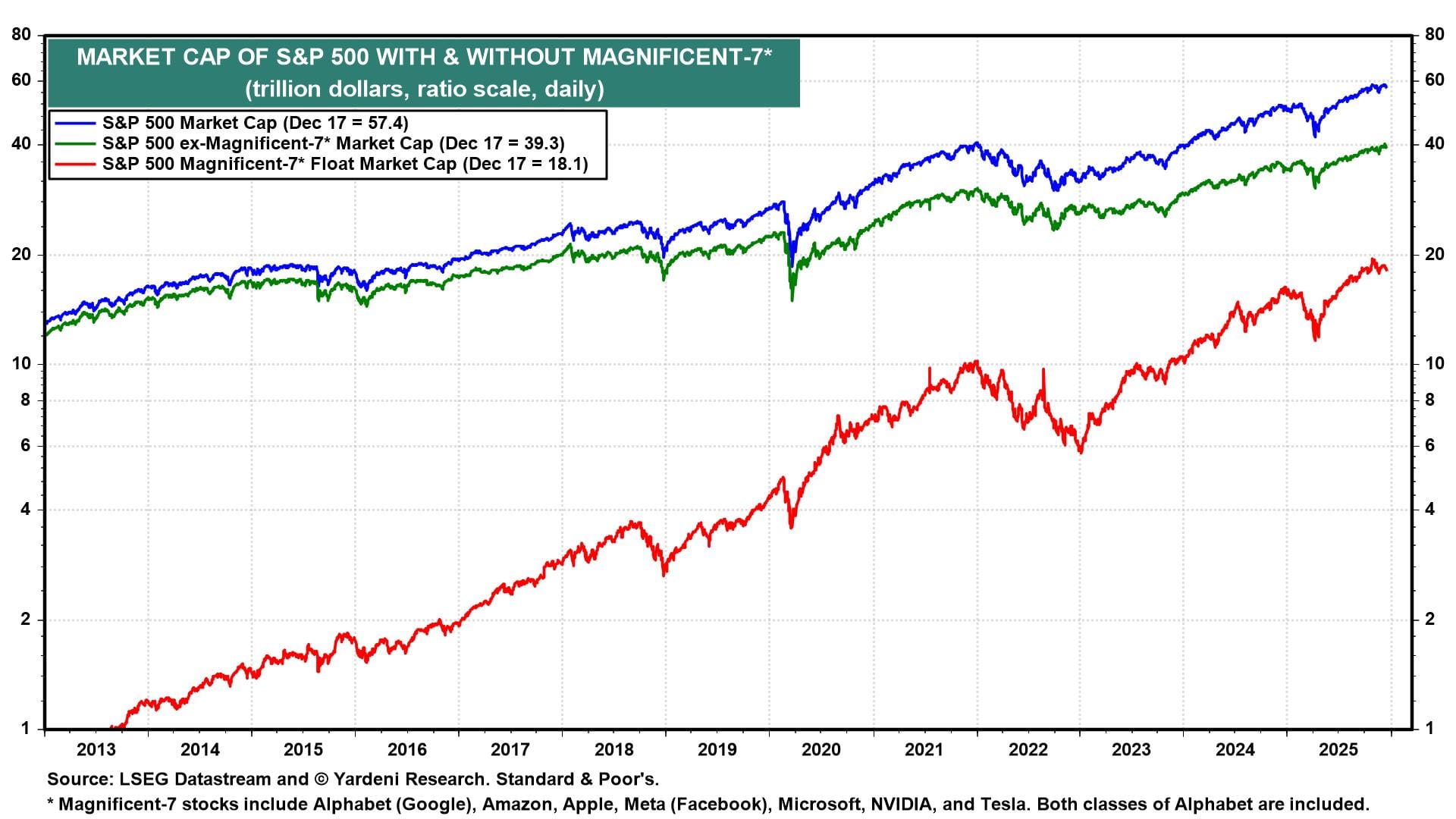

The Mag-7 market capitalization has doubled over the past two years from $10 trillion to $20 trillion (chart).

The Mag-7 currently has a market-cap share of 31.7% of the S&P 500. The shares of S&P 500 forward revenues and forward earnings are 24.4% and 12.7% (chart).