The Federal Reserve Bank of NY today released results from its 2022 SCE Housing Survey, which is part of the broader Survey of Consumer Expectations (SCE) and provides information on consumers’ housing-related experiences and expectations. The survey was fielded in February. It shows that households expect home prices will continue to rise, making them less affordable and pushing up rents:

(1) Households expect strong home price growth of 7.0% over the next 12 months.

(2) On average, households expect rent increases of 11.5% over the next 12 months, compared with 6.6% in February 2021. (Rents in new leases are currently up 12%-15% nationally.)

(3) Renters see a lower probability of ever owning a home; their reported average likelihood of owning fell to 43.3% from 51.6% a year ago—the first reading below 50% in the series’ history.

(4) Households expect rates on 30-year, fixed-rate mortgages to rise sharply in the future, to 6.7% on average a year from now and 8.2% in three years’ time.

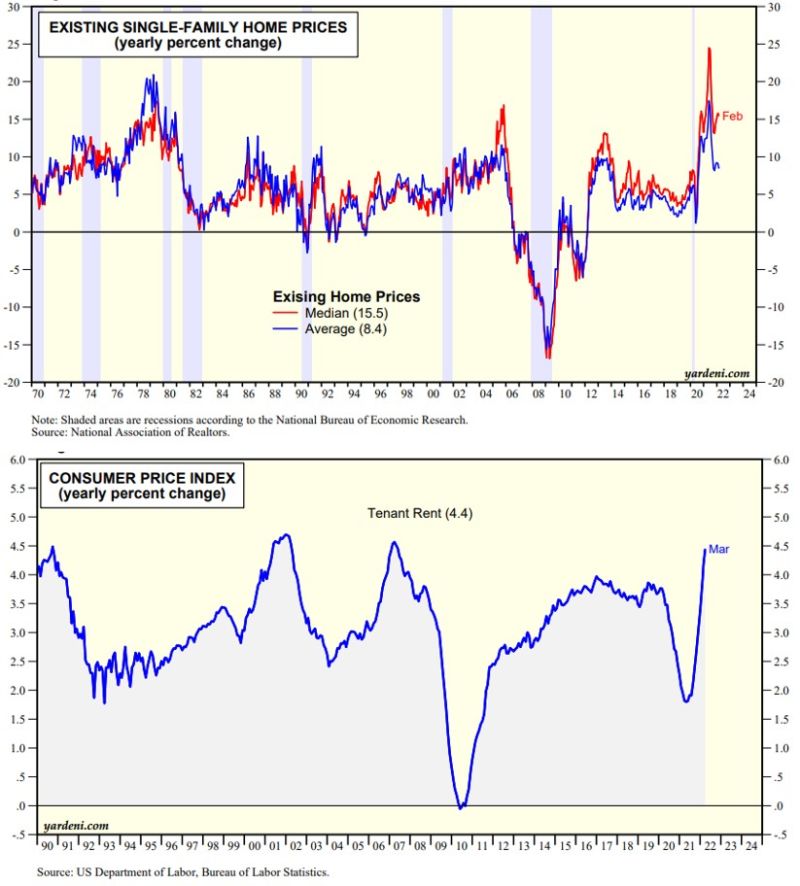

(5) Message to FOMC: You folks have created a serious rent inflation problem by fueling 15.5% and 33.4% increases in the median existing single-family home price over the past 12 and 24 months. Inflationary expectations are not "well anchored." Tenant rent in the CPI is up 4.4% y/y through March, but households expect them to increase 11.5% over the coming year.