It's a light day for economic news. Stock prices are drifting higher today because the Q2 earnings reporting season is going well, with very few exceptions. Notwithstanding the weakness of the latest employment report and the two surveys of purchasing managers, in manufacturing and non-manufacturing industries, stock investors are still betting on the resilience of the economy since it is continuing to deliver solid earnings. We are betting the same way and recently explained why we didn't flinch following these three weak economic reports.

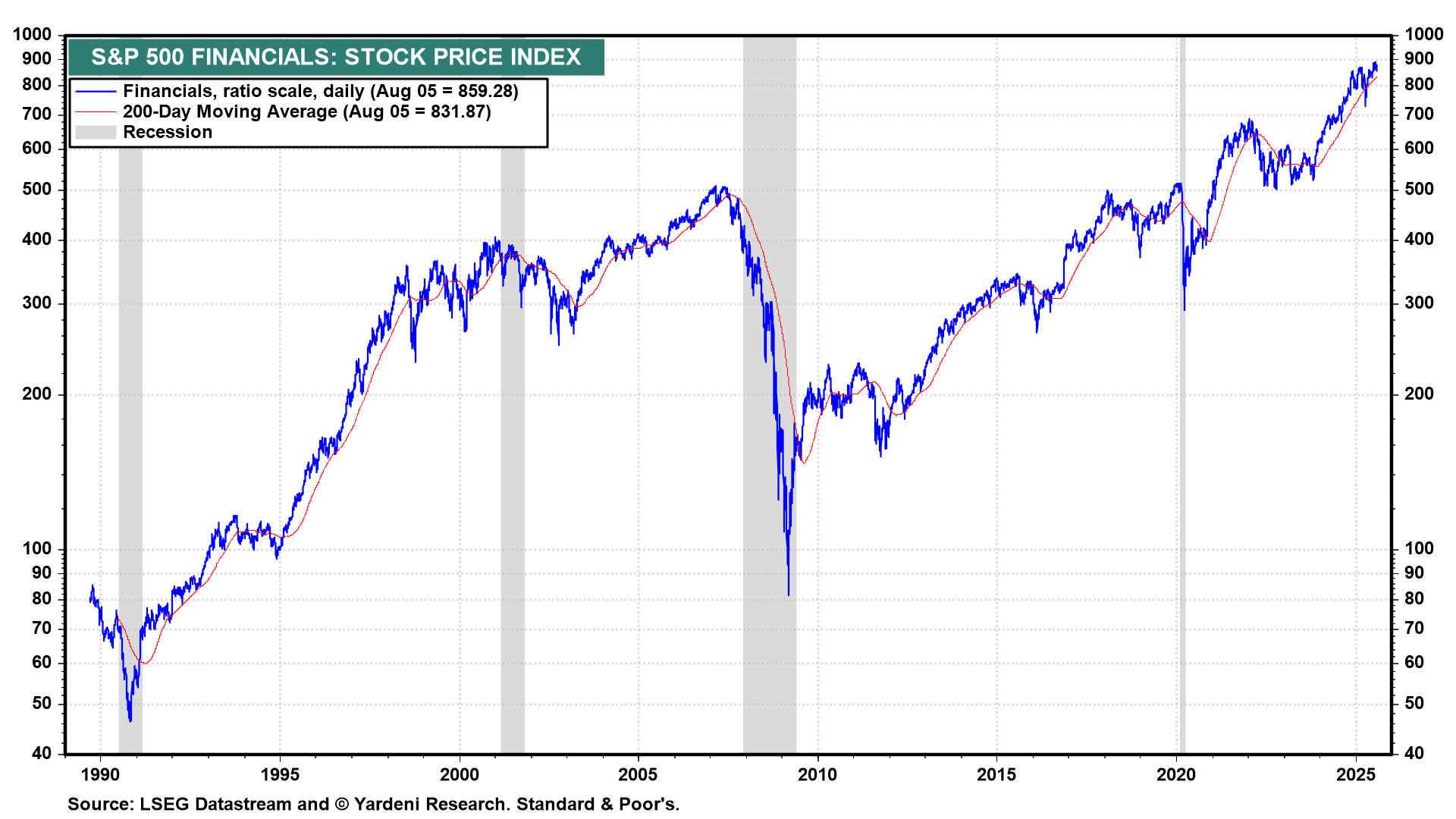

Boosting our confidence in the resilience of the economy are the weekly data series that the Fed compiles on the commercial banking industry's balance sheet. Loans are at record highs. In addition, the strength of the S&P 500 Financials stock price index since the start of the current bull market has been comforting, mainly because we've been recommending overweighting the sector (chart). Financials can be a canary in the coal mine. They tend to chirp when the economy is doing well and croak when it isn't.