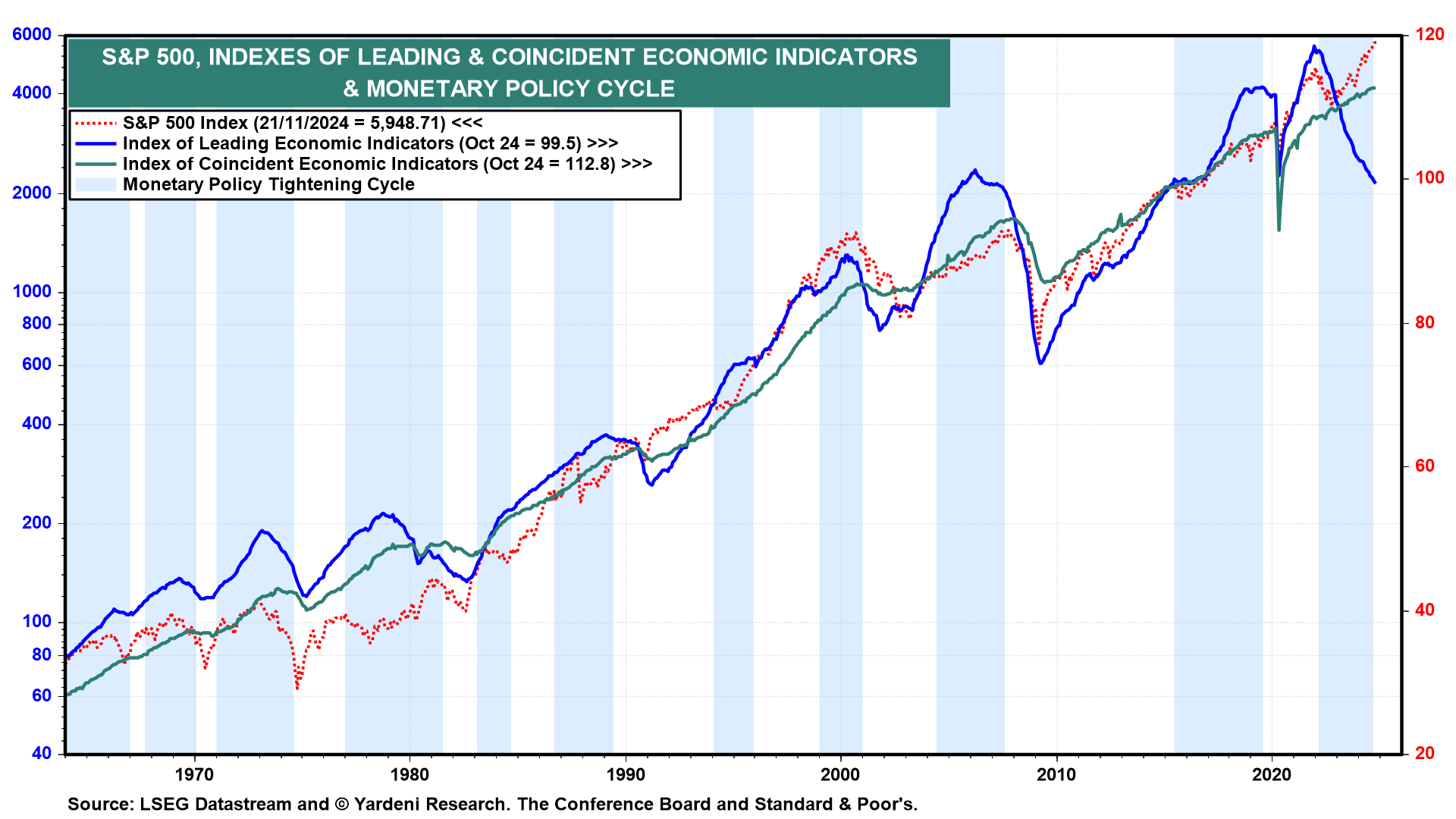

Fed officials may be cutting rates because they are worrying about the ominous "long and variable lags" of their monetary policy tightening from March 2022 through August 2024. But there are still no signs that those lags exist as the economy continues to chug along.

It's true that the Index of Leading Economic Indicators (LEI) fell yet again during October, but it has been a misleading indicator of a recession since it peaked at a record high during December 2021 (chart). The S&P 500 has been the most accurate of the 10 components of the LEI as it has been rising to new record highs since the start of this year. Even better has been the Index of Coincident Economic Indicators, which never flinched as it rose to new record highs while the LEI was diving.

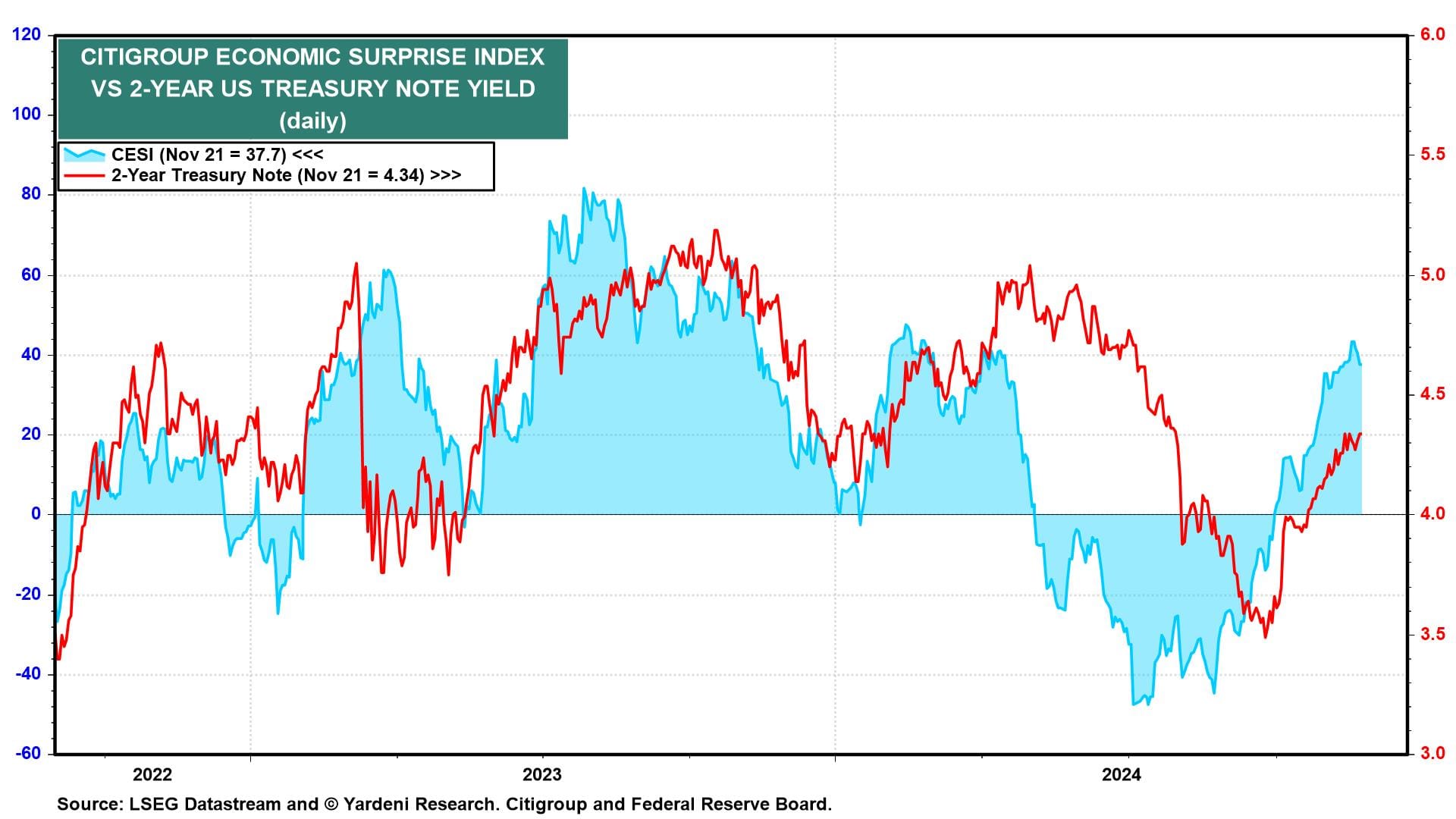

The upturn in US Treasury note and bond yields since the Fed started cutting the federal funds rate (FFR) on September 18 reflect the rebound in the Citigroup Economic Surprise Index (chart). In our opinion, this suggests that the neutral FFR is probably closer to the 5.25%-5.50% range (just before September 18) than the current 4.50%-4.75%. If so, then economic growth is getting an extra boost from easier Fed policy. Fed officials disagree with us. They think that the FFR remains restrictive and needs to be lowered closer to 2.90% though gradually rather than in a rush.

Today's data showed continued solid growth and an even brighter outlook for manufacturing:

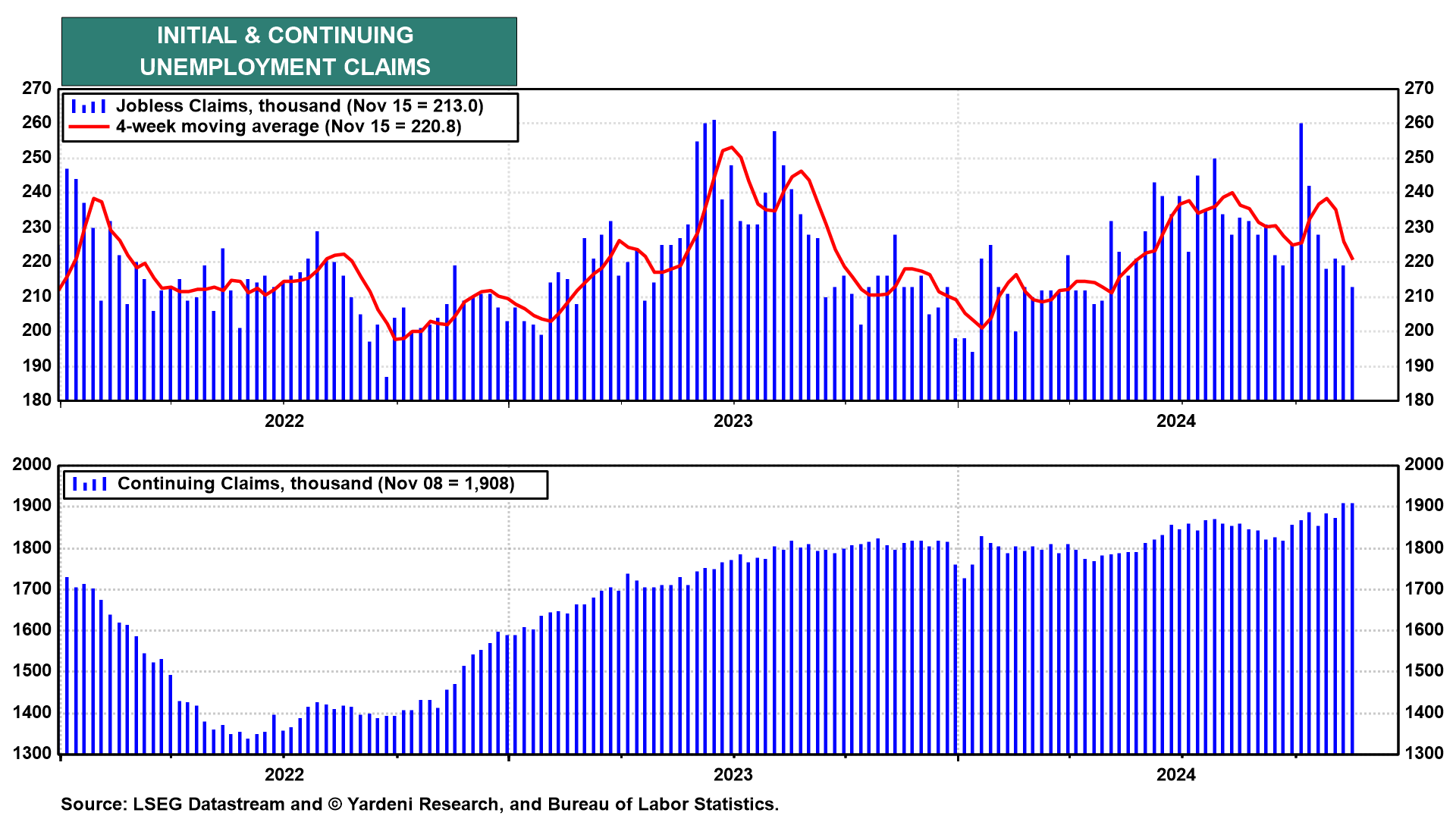

(1) Unemployment claims. The labor market remains in good shape. Initial jobless claims fell 4,000 to 213,000 (sa) in the week ended November 16, the lowest since April (chart). While continuing claims increased 35,000 to 1.908 million, the Veterans Day holiday likely affected both measures. Not seasonally adjusted data showed a larger decrease in initial claims and a smaller increase in continuing claims.

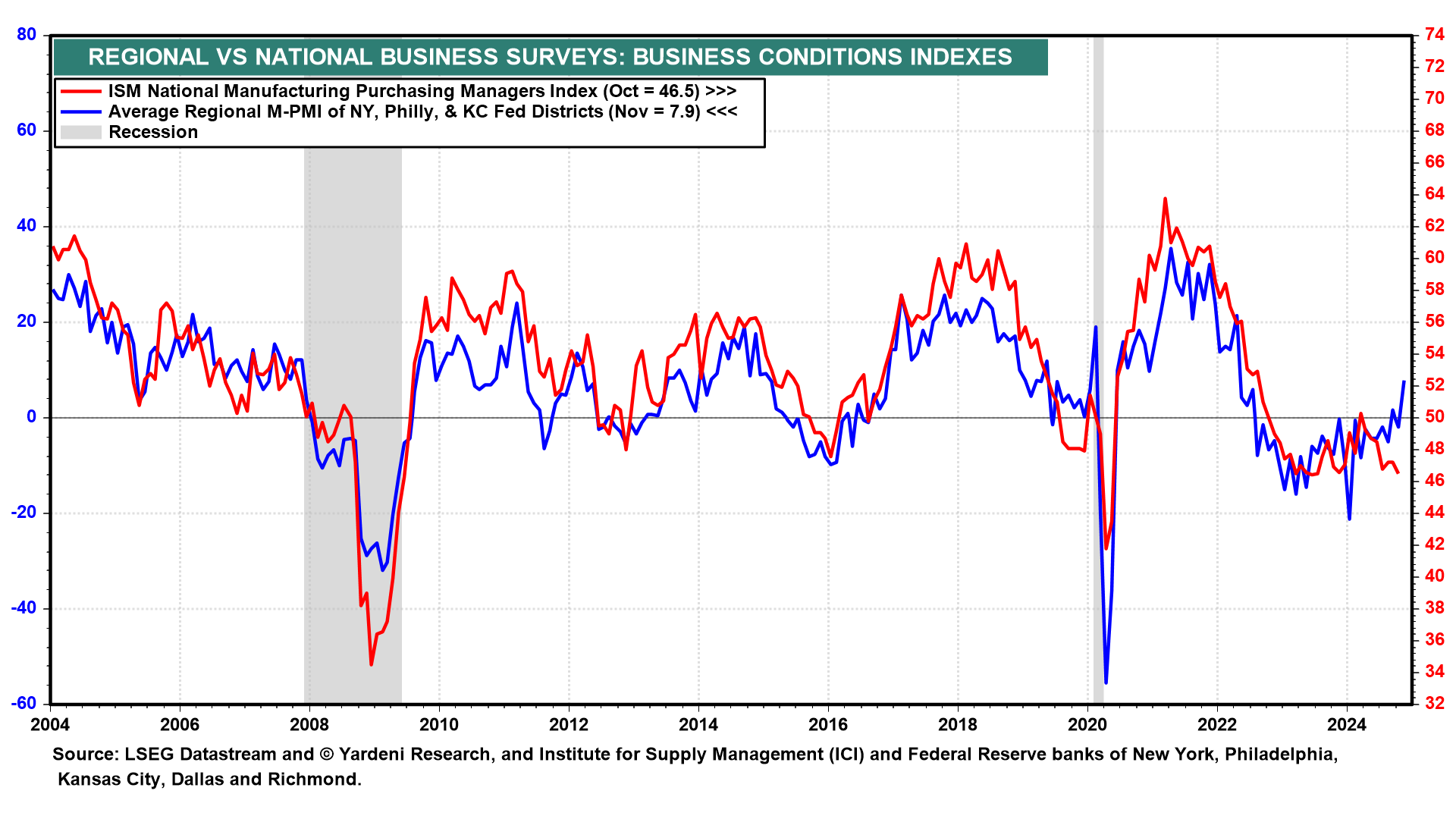

(2) Regional business surveys. The average of the M-PMIs from the regional business surveys conducted by the Federal Reserve Banks of New York, Philly, and Kansas City rose into positive territory in November, largely due to a surge in the New York index (chart). This suggests that the national ISM M-PMI may rise above 50.0 over the next couple of months.

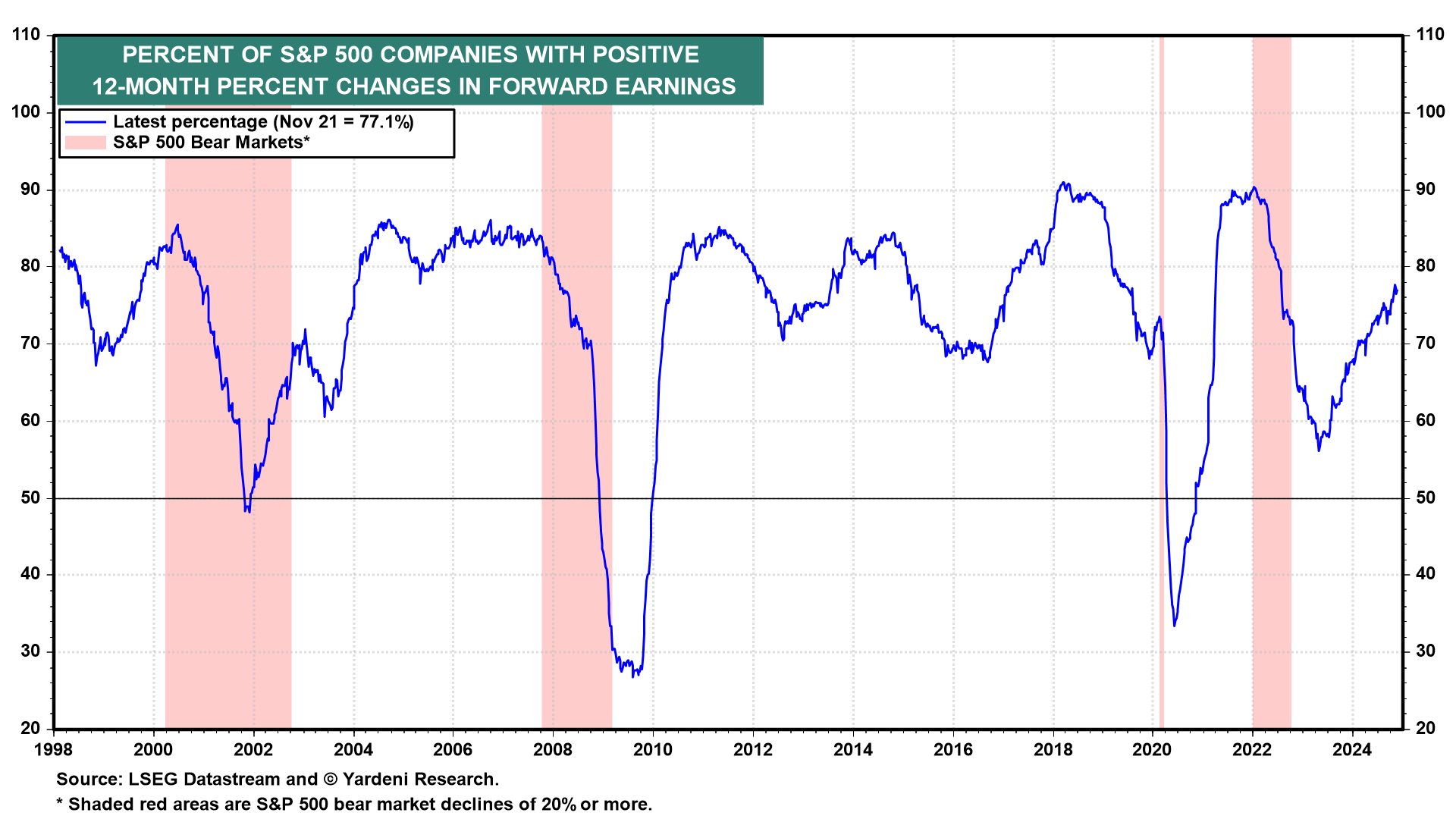

The rally in the S&P 500 should continue to broaden as the percent of S&P 500 companies with positive 12-month percent changes in forward earnings continues to rise (chart). That's what typically happens during recoveries from bear markets as the economy continues to grow.