Today, Oracle disclosed that its AI cloud business—particularly server rentals using Nvidia chips—is yielding very slim profit margins. That news weighed on the stock market, especially on technology stocks. Oracle's stock price fell 2.5%. The Magnificent-7 declined 1.1%. Financial stocks also dropped today. They tend to have more leverage and cyclical exposure, so when sentiment sours, they often fall harder than some defensive sectors.

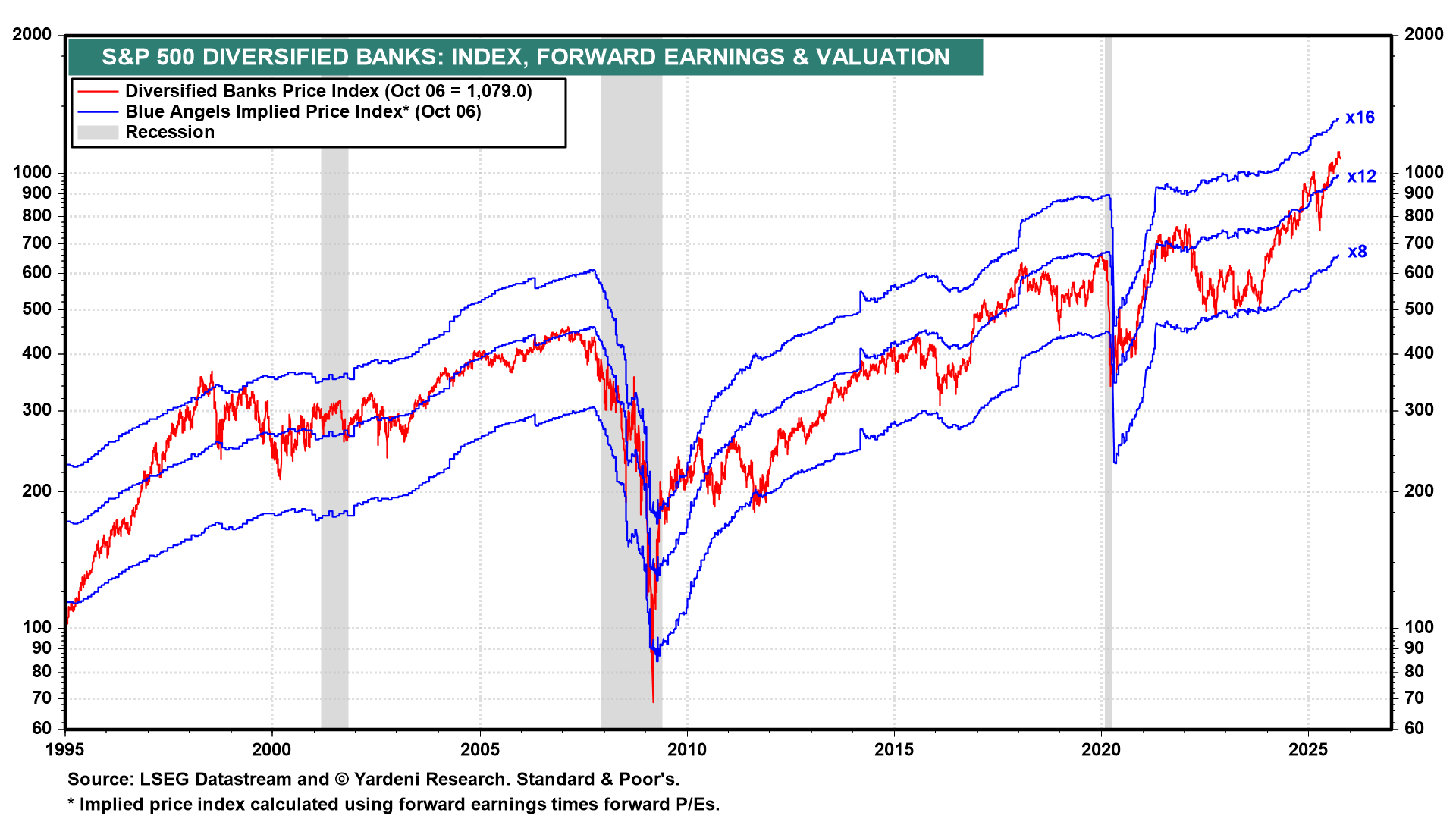

We expect the Q3 earnings reporting season, which is set to begin next week with the major banks, to calm investors' nerves. Cloud companies are likely to report that their business is strong, thanks to the growing demand for AI-related services. The banks should also provide good news. The S&P 500 Diversified Banks stock price index is at a record high for several compelling reasons (chart). For starters, the industry's forward earnings is at a record high.

Most importantly, the growth rate in commercial bank loans and leases is picking up (chart). They were up 4.7% y/y through the September 24 week, twice as fast as at the beginning of this year. This confirms our view that the pace of economic activity isn't slowing. It may actually be accelerating.