Will today's widely feared AI crisis turn out to be a no-show, too, just like the most widely anticipated recession of all time, anxiously awaited over most of the past four years? We think so.

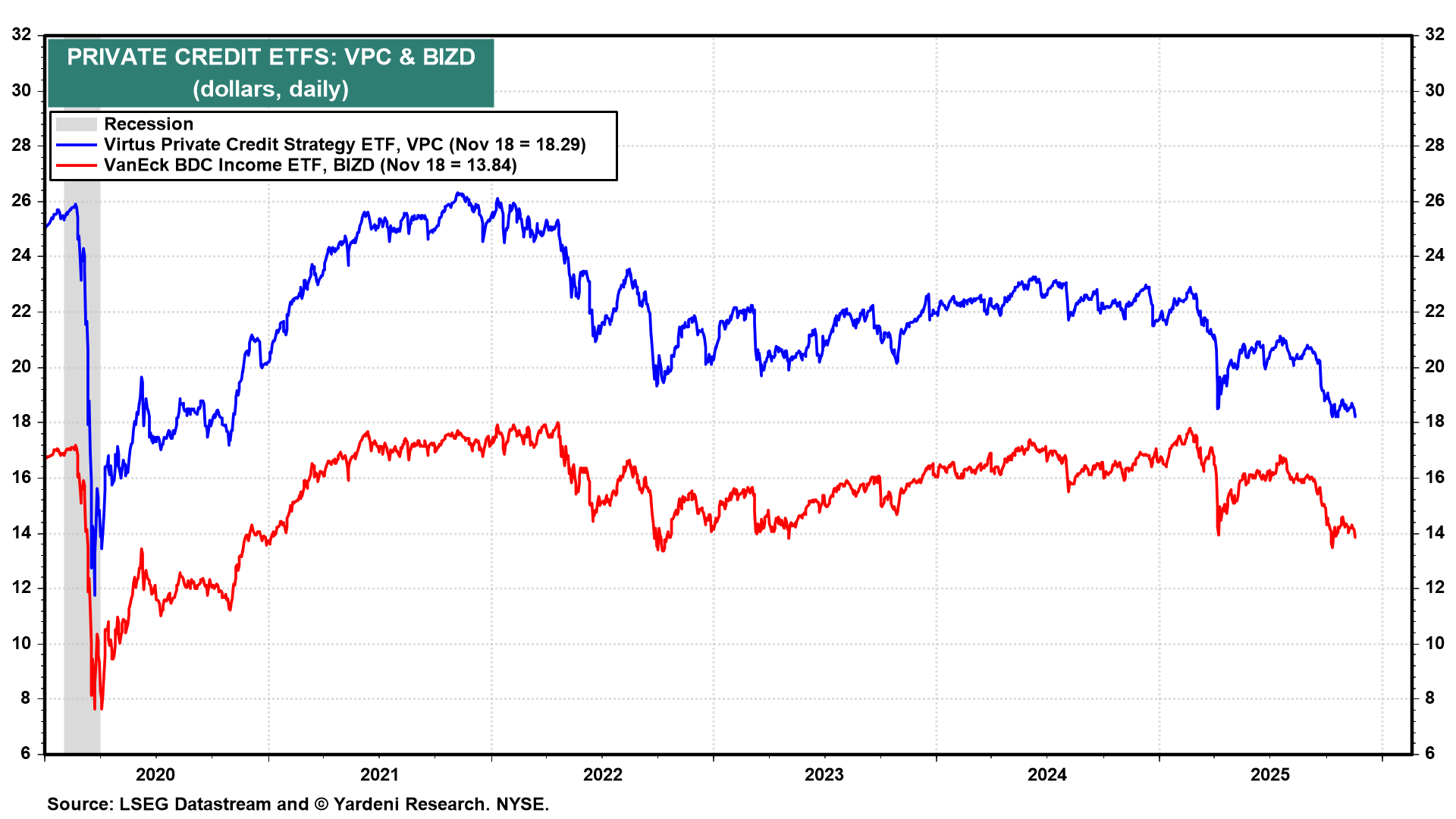

Stock investors are increasingly worrying about an AI-led Tech Wreck, like the one in 2000 after the 1999 Tech Bubble burst. Now, many of them believe the stock market is in an AI-led Tech Bubble that may already be bursting. The pessimists are also warning that consumers are stretched and may be retrenching. Furthermore, alarmists are seeing cracks in credit markets reminiscent of those during the Great Financial Crisis (chart).

These are all legitimate concerns. Nevertheless, for now, we are not altering our 55% subjective probability that the S&P 500 should reach 7000 by the end of this year and 7700 by the end of next year. However, under the circumstances, we are lowering the odds of a meltup scenario from 25% to 15% and raising the odds of a bearish scenario from 20% to 30%.

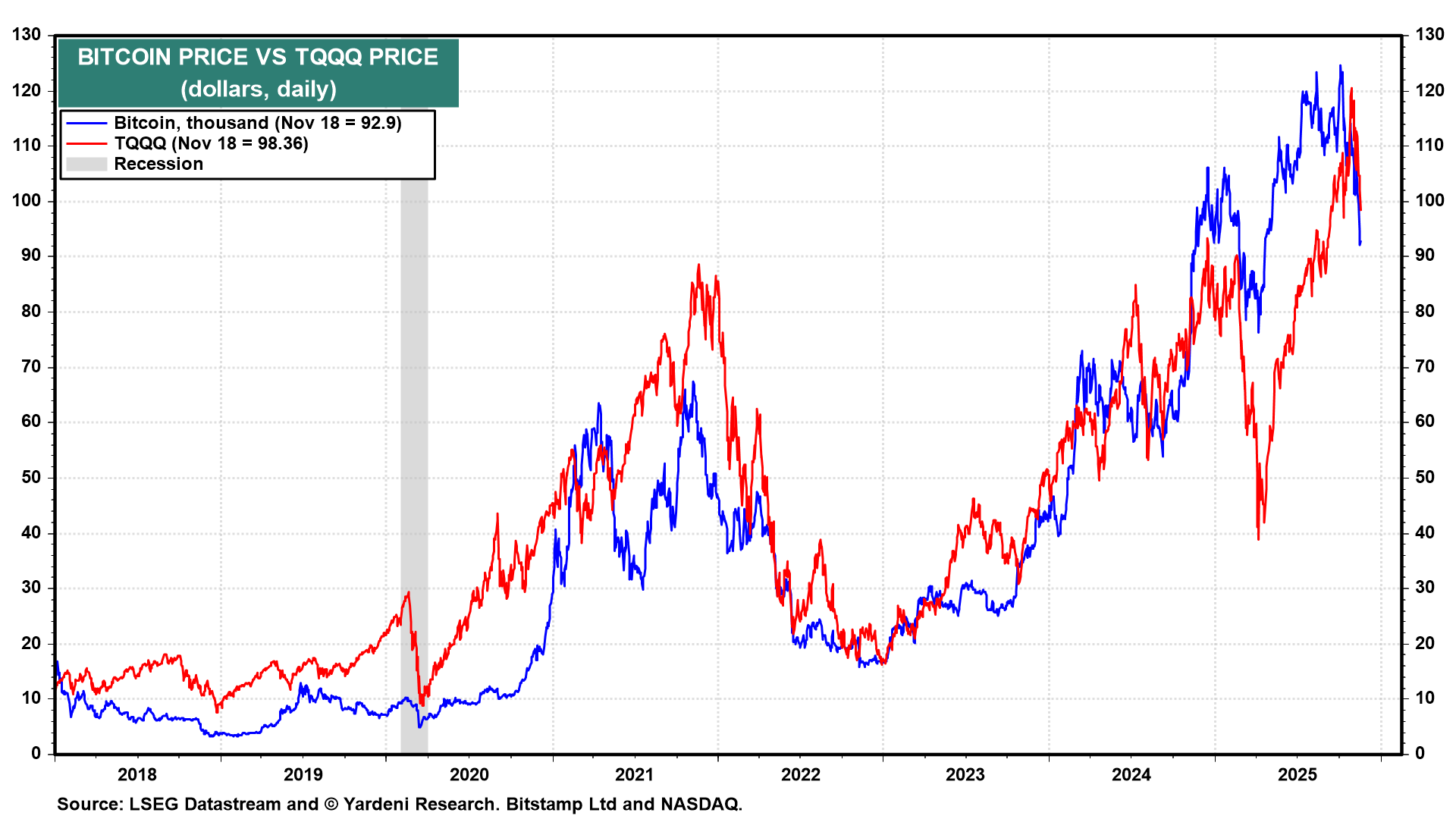

The S&P 500 and Nasdaq both closed below their 50-day moving averages today and are down 4.0% and 6.4% from their October 29 record highs. Bitcoin is down 26.8% from its record high on October 6. Some technicians warn that this is bad news for the Nasdaq. We've noted the high correlation between the cryptocurrency and the TQQQ before, but we believe they can and will probably diverge.

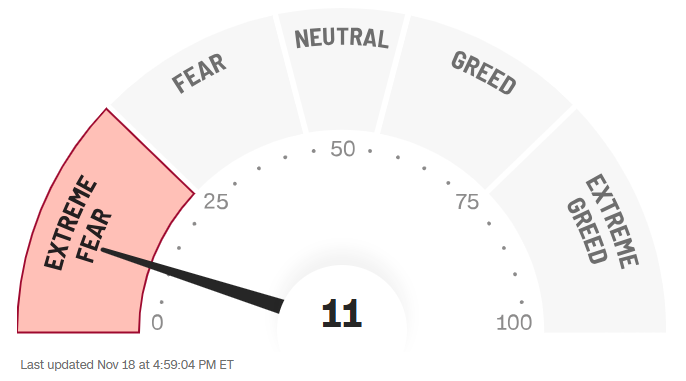

On November 1, we noted that the high reading of the Bull-Bear Ratio (BBR) was a short-term bearish signal of a pullback in the stock market. We will get this week's BBR tomorrow, and expect it to be down significantly. Today, CNN's Fear & Greed Index, which is a compilation of seven different technical indicators, signaled extreme fear, which often sets the stage for a rebound in stock prices (chart).

Today's stock market weakness was exacerbated by a 5% decline in Home Depot's share price after the company reported disappointing Q3 results. Management also provided a cautious outlook, indicating that the company faces external pressures from a soft housing market. Furthermore, consumers seem to be concerned about the economy, leading them to postpone or reduce spending on big-ticket, discretionary home improvement projects.

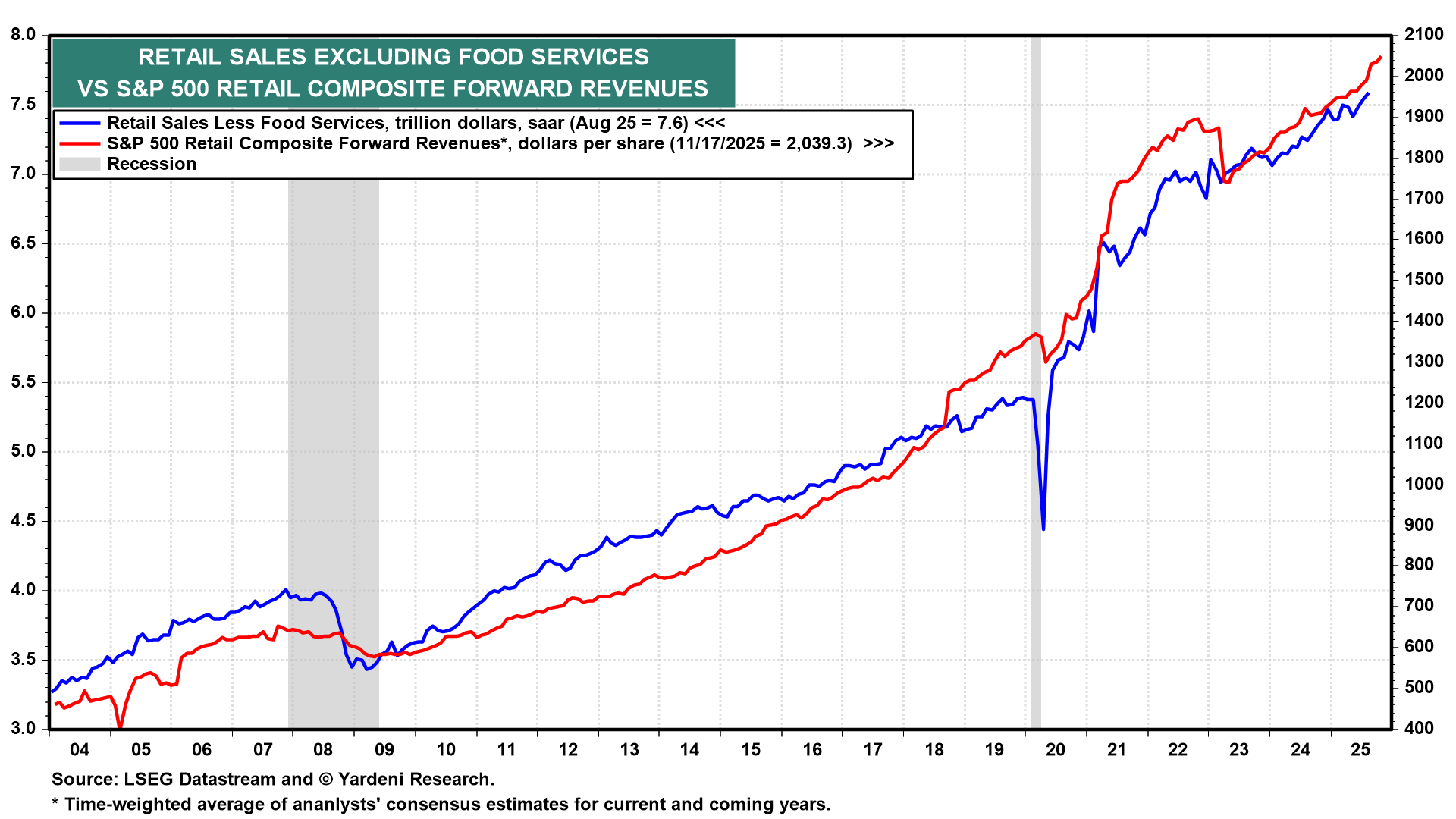

Then again, the forward revenues of the S&P 500 Retail Composite rose to another record high during the week of November 17 (chart). That augurs well for the monthly retail sales report from the Census Bureau.

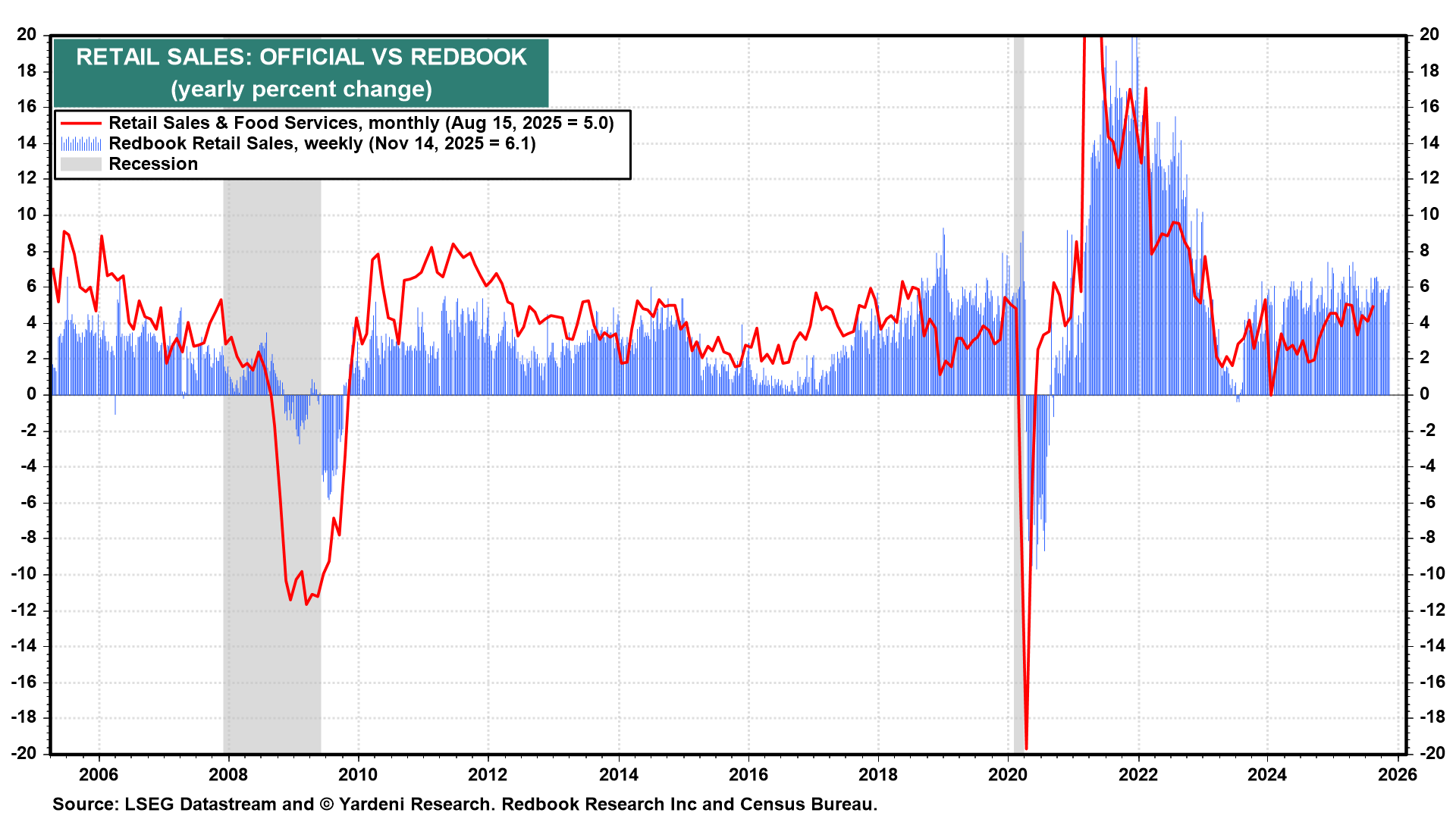

Also encouraging is that the Redbook Retail Sales Index rose 6.1% y/y during the week of November 14 (chart).

And, what about the great debate about how quickly data centers are depreciating their GPU assets? We side with the hyperscalers rather than Michael Burry, who started the depreciation debate. Data centers existed before AI caught on in late 2022, when ChatGPT was first introduced. In 2021, there were as many as 4,000 of them in the US due to rapidly increasing demand for cloud computing. Many are still operating with older chips that have been fully depreciated. The revenues and earnings of the hyperscalers continue to rise exponentially, while their depreciation expenses increase more linearly.

Finally, concerns about rising loan defaults in the private credit market are unlikely to trigger another Great Financial Crisis. The defaults are likely to represent small portions of large loan portfolios. Investors recognize the risk of defaults when they invest in the private credit market and won’t be surprised if the defaults reduce the rates of return on their investments. An economy-wide credit crunch is unlikely.