The US federal deficit reminds us of the 1958 science fiction horror classic, "The Blob." It stars none-other than Steve McQueen, in his first leading role. The blob is an amoeba-like alien creature that crashes to Earth from outer space and feeds on humans, getting bigger and bigger with every bite.

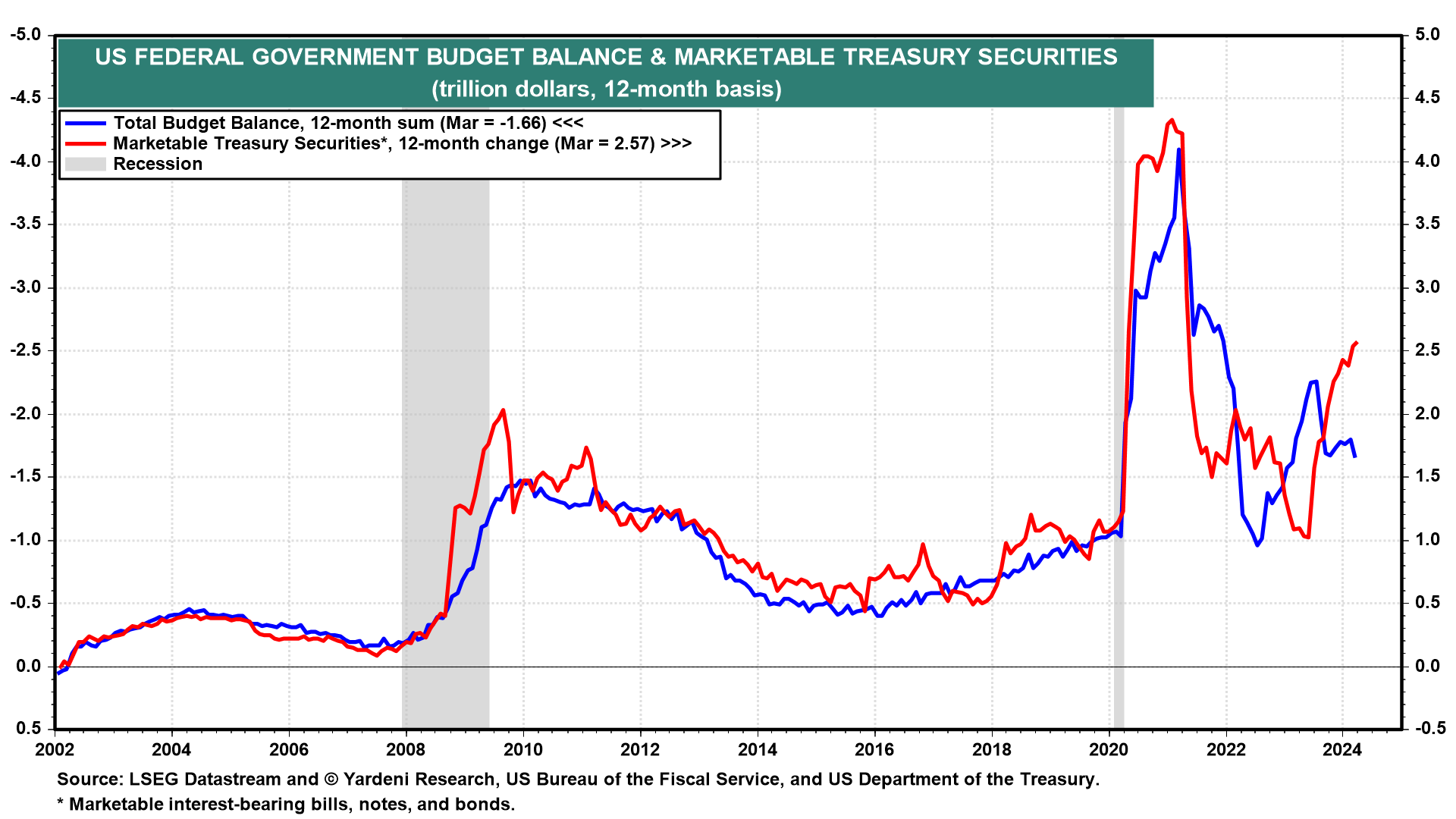

The federal deficit is getting bigger and bigger devouring more and more funds in the capital markets (chart). It hasn't killed anyone yet but it might one day if investors decide they don't want to keep feeding it. The resulting back up in bond yields could kill the economy and lots of investors.

We've often been asked why we don't worry more about this blob. Smart people such as Ray Dalio have warned that a horrible federal debt crisis is coming soon. They've been sounding the alarm for many years. They might eventually be right.

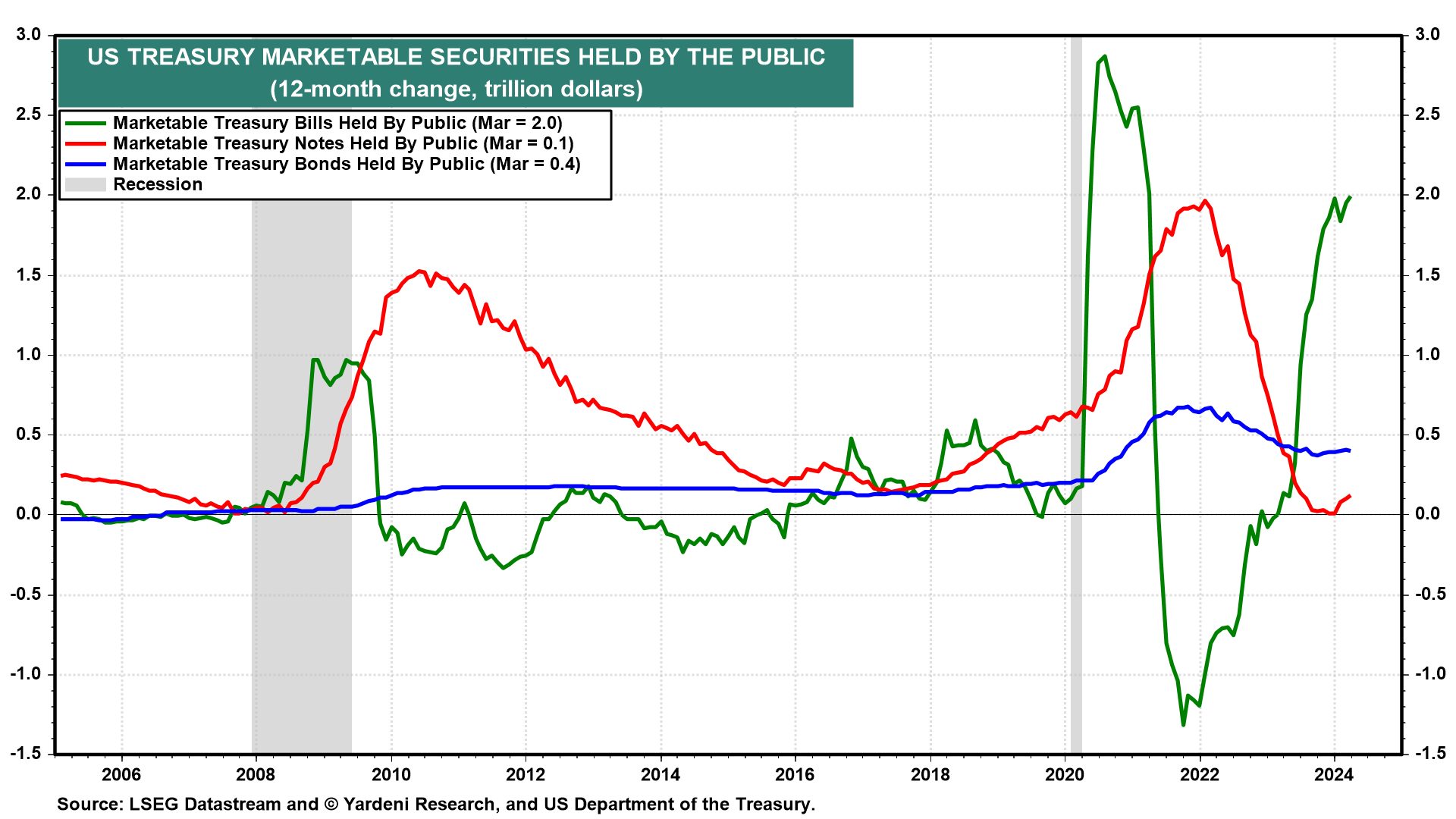

We've often said that we will worry about the deficit when the bond market does so. We were worried last year from August through October, when poorly received Treasury bond auctions pushed the 10-year Treasury yield up from around 4.25% to 5.00%. Then the yield came tumbling down on lower-than-expected inflation and the Treasury's decision to fund most of the debt with Treasury bills (chart).

Then the yield went back up this year on hotter-than-expected inflation. Yes, the 10-year yield might rise to 5.00%, but we expect that another round of better-than-expected inflation will avert even higher yields.

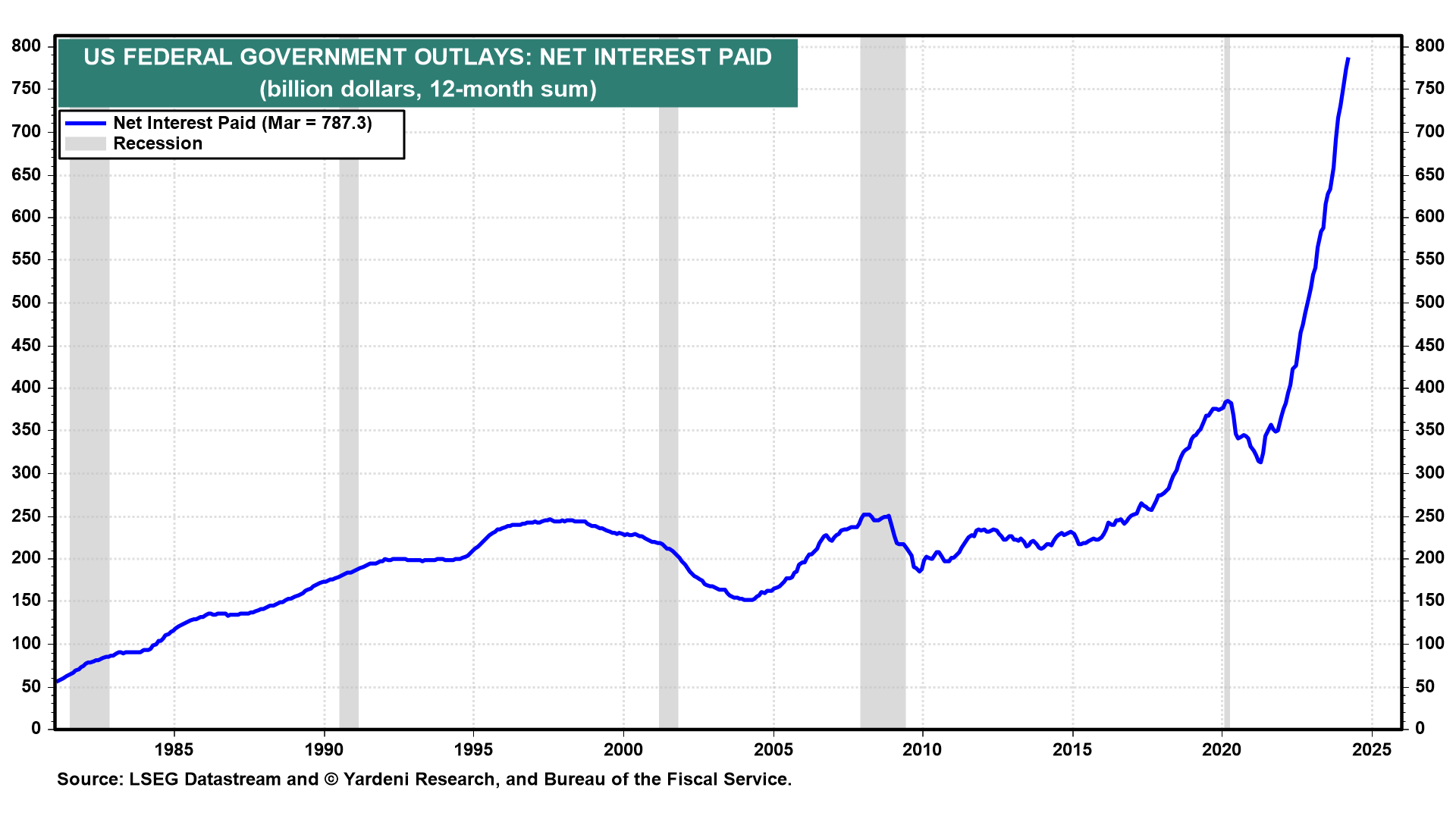

What about the vertical ascent in the net interest paid by the US federal government (chart)? It is alarming and certainly confirms that the federal debt blob is out of control.

The only way to put lipstick on this piggish blob is to recognize that it is a fiscal outlay that like most other outlays does stimulate economic growth by providing more income to households who hold some of the government's debt. So it helped to avert a recession over the past two years when the Fed tightened monetary policy significantly. We will turn more cautious on the bond and stock markets if and when the next poorly-received auction confirms that investors don't want to be devoured by the blob.