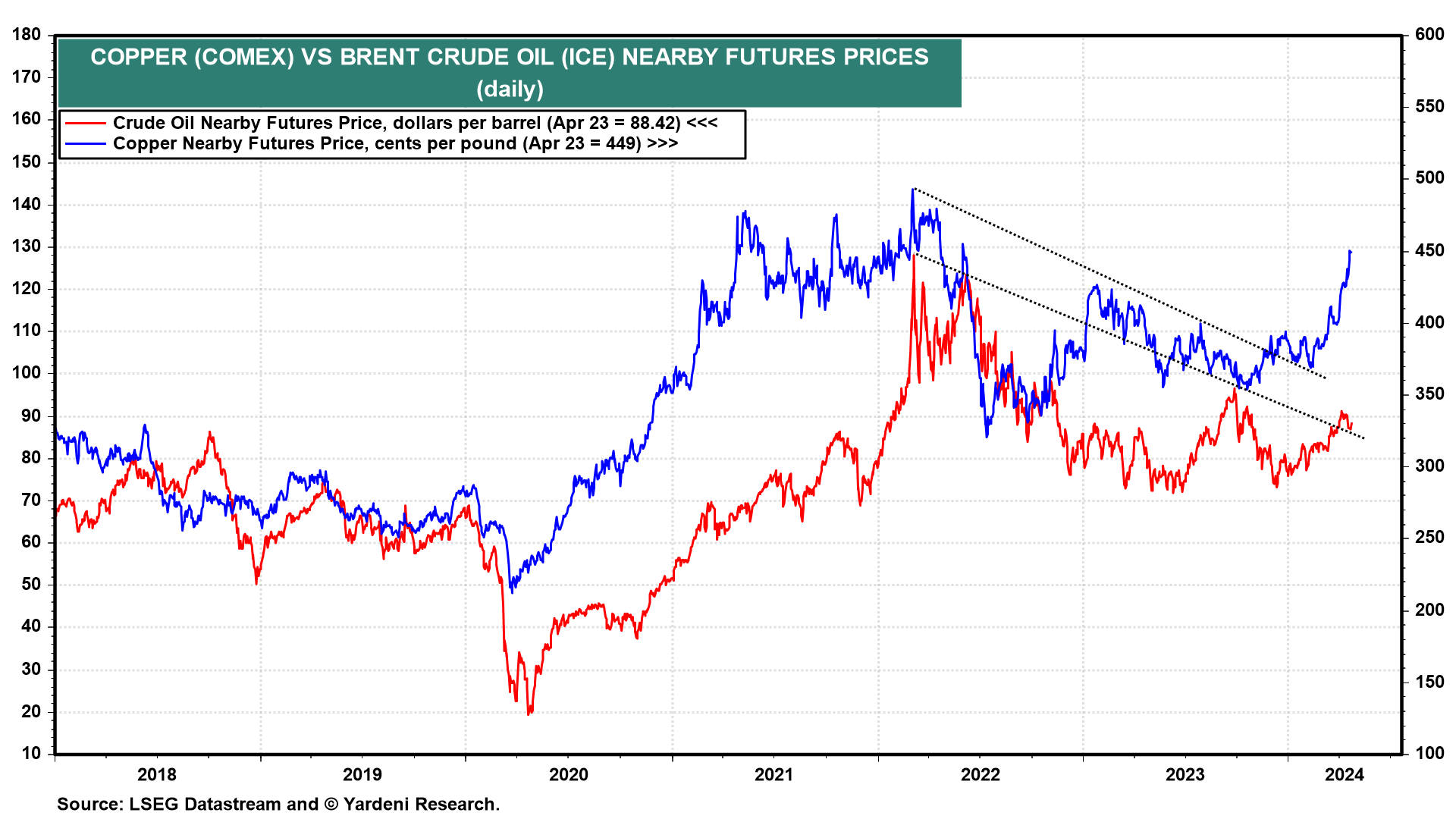

Is the global economy suddenly taking off? It seems that way given the sudden vertical ascent of several metals prices, particularly those of copper, aluminum, tin, and zinc. On the other hand, the price of a barrel of Brent crude oil has slipped recently, suggesting that its recent advance had more to do with a rising geopolitical risk premium than a resurgence of global growth (chart).

Our thesis is that the overall global economy is still muddling along, and almost certainly not suddenly booming. So the demand for oil isn’t booming either, and meanwhile there is plenty of excess capacity among oil producers that is currently weighing on oil prices now that Iran and Israel seem to be done retaliating against each other--until their next round.

China’s stock market remains weak, which is another divergence with the price of copper (chart).