Fed Chair Jerome Powell spoke on Friday at an event at the San Francisco Fed. He repeated what other Fed officials have been saying recently. Solid economic growth gives the Fed "the chance to just be a little more confident about inflation coming down before we take the important step of cutting rates." Inflation continues to moderate on a "sometimes bumpy" path. So there's no hurry to cut rates.

We agree since that has been our view since the start of the year when the markets anticipated several rate cuts starting in March. We are anticipating two rate cuts at the end of the year (during November and December), though we won't be surprised by no cuts at all this year.

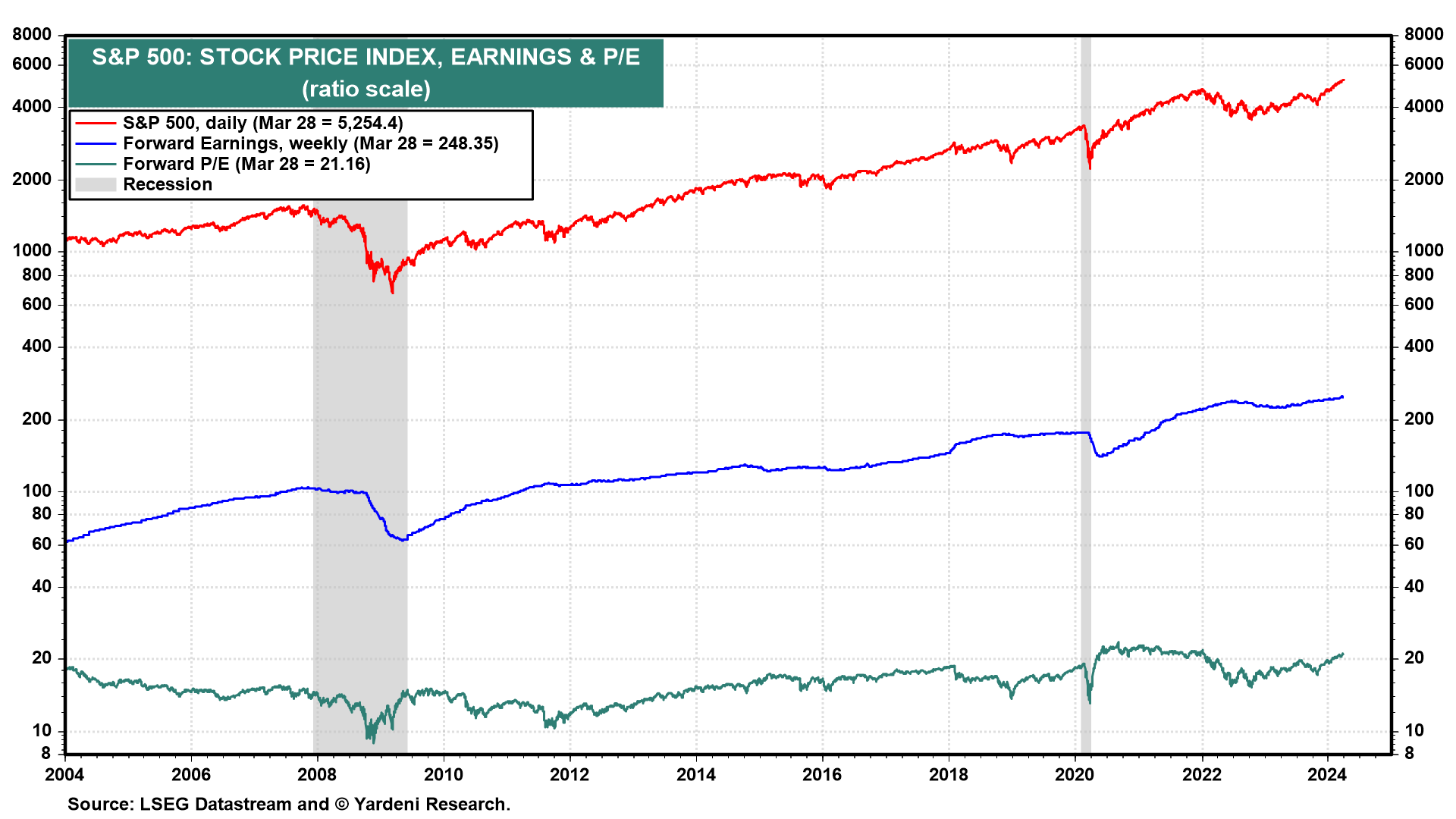

It's not a bad trade for the stock market. Instead of lower interest rates, which could propel valuation multiples to dangerously high levels, investors get better economic growth and earnings (chart).

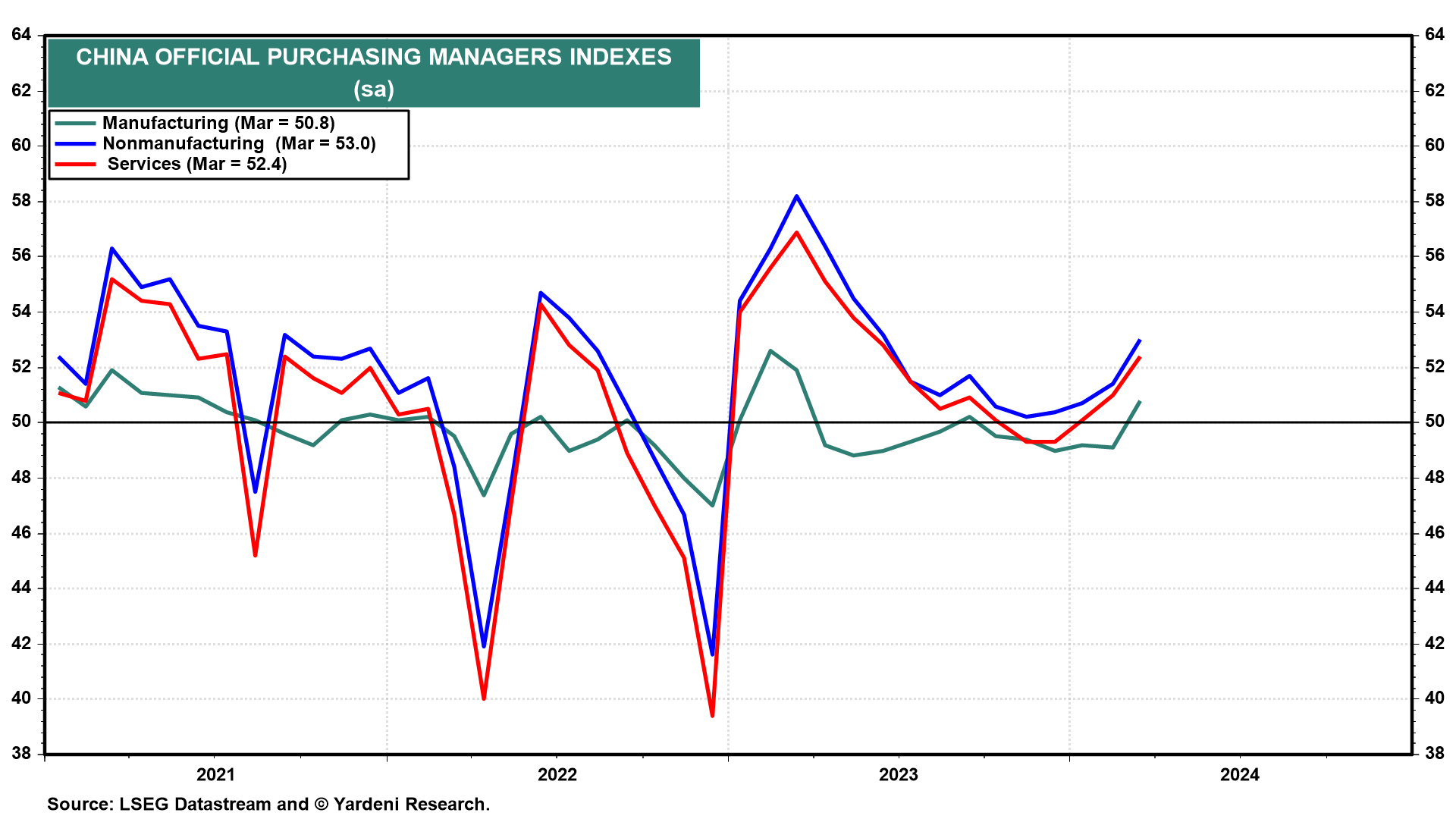

Over the weekend, we learned that China's official purchasing managers indexes moved higher in March (chart). The manufacturing index rose to 50.8, the first reading above 50.0 in several months. That could help to revive global economic growth and commodity prices. On the other hand, the Chinese government seems to be pushing factories to produce more to dump into global markets, thus triggering deflation, threatening foreign manufacturers, and raising trade tensions.

The rising price of a barrel of Brent crude oil suggests that either it is getting boosting by a rising geopolitical risk premium or by better global economic growth. So far, the CRB raw industrials spot price index isn't confirming the latter scenario (chart).