Monetary Policy I: Post-Modern Monetary Theory

Melissa and I received quite a few favorable reader comments on last Monday’s Morning Briefing discussing our “Post-Modern Monetary Theory” (P-MMT). Many of the comments included thought-provoking queries about our P-MMT, which I address below. In addition, the Financial Times is running my summary of our theory in an op-ed titled “The Fed should resist messing with success.”

The basic concept of P-MMT is that recessions are caused by a process that leads to such economic downturns. As an economic expansion proceeds, inflationary excesses build up in goods and services markets as well as in asset markets along the way. Typically, as confidence builds in the longevity of the expansion, borrowers borrow more to purchase goods and services as well as assets. As such purchases become more leveraged, they expose both the borrowers and lenders to more risk.

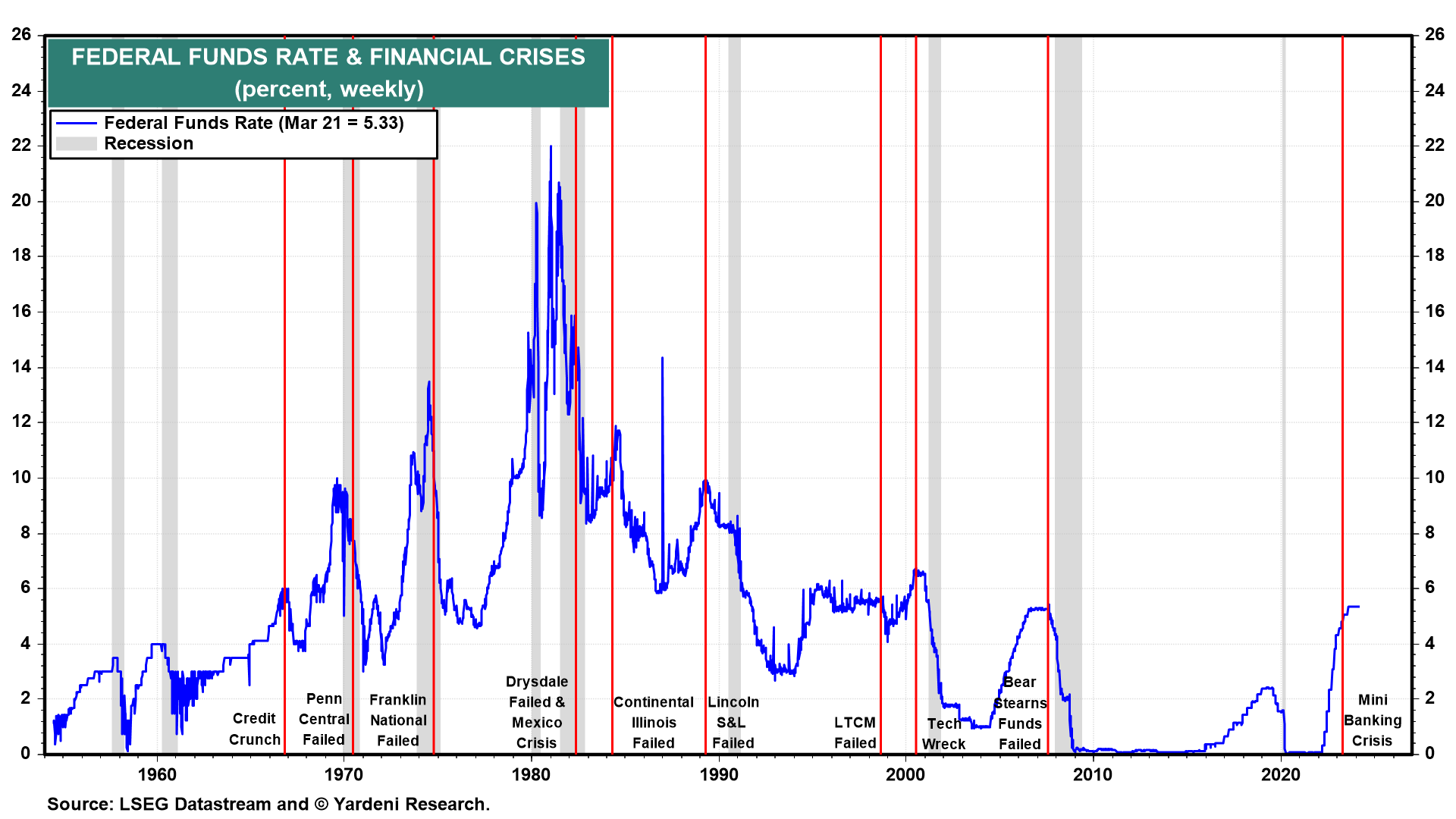

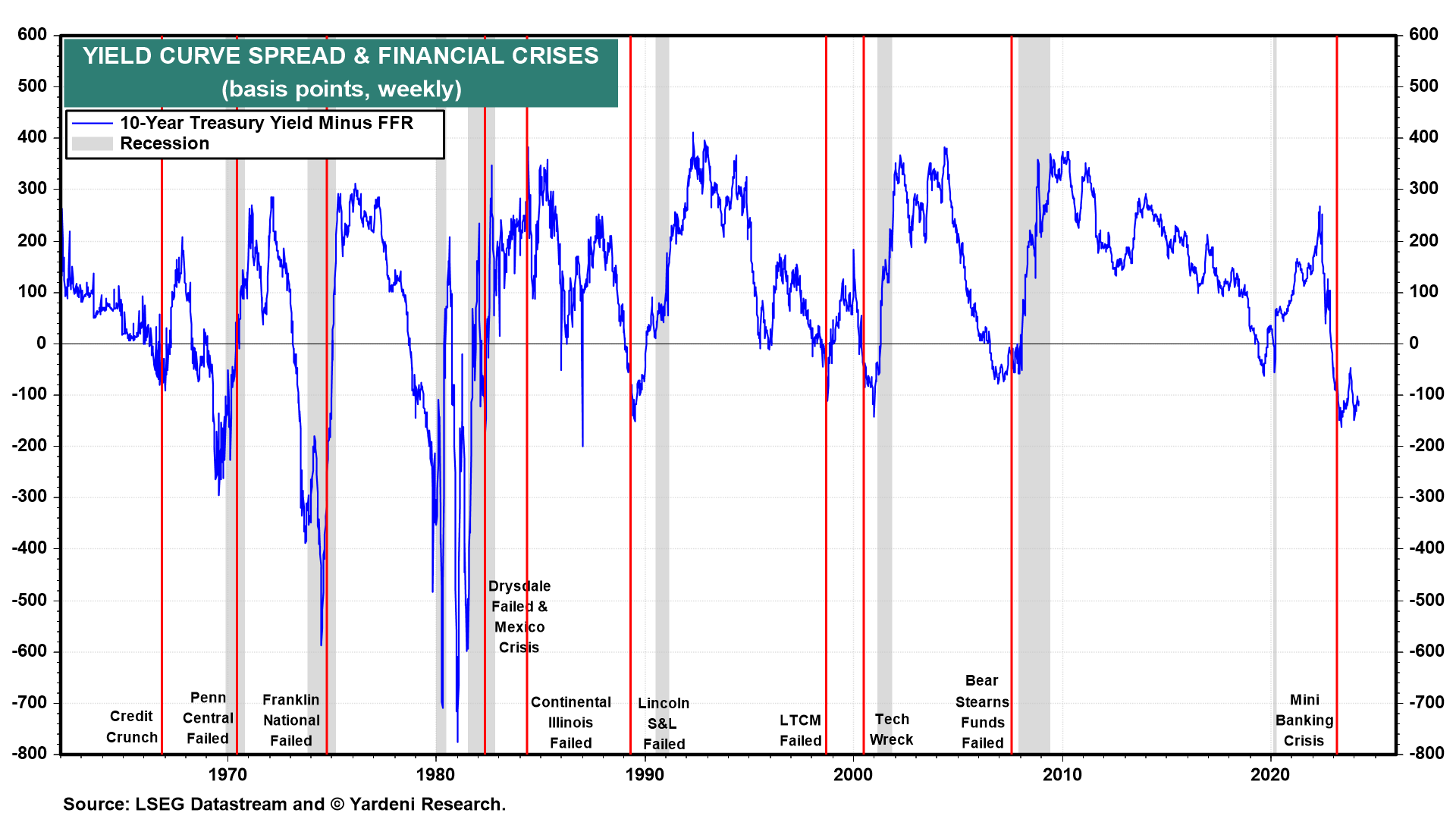

The buildup of such inflationary and speculative excesses forces the Fed to tighten monetary policy. Interest rates rise, but along the way short-term rates rise faster than long-term rates. This leads to an inversion of the yield curve signaling that bond investors anticipate that if the Fed continues to raise short-term interest rates, something will break in the financial system. In the past, they’ve often been correct: A financial crisis triggered by continued monetary tightening did ensue (Fig. 1 below and Fig. 2 below). Such crises often resulted from the collapse of financial institutions that had lent too much to borrowers who no longer could service their debts when monetary conditions became tighter than either the creditors or debtors had anticipated.

In the past, the financial crises quickly turned into economy-wide credit crunches. So even borrowers with good credit ratings were unable to borrow. The Fed would respond by lowering interest rates, which it often did before the recessions occurred, i.e., when the financial crises first hit. The federal funds rate typically peaked at the point when the financial crises started. The yield curve would “disinvert” before the recessions officially started.

This stylized rendition of the business cycle illustrates that inverted yield curves don’t cause recessions, as commonly thought. Inverted yield curves anticipate recessions and often correctly—though clearly not over the past two years, so far. The tightening of monetary policy sets the stage for recessions by bursting speculative bubbles inflated by too much debt—again with the clear exception of the past two years. The Fed often has been compelled by persistent inflation to cause a recession by tightening monetary policy to bring inflation down.

According to our P-MMT, there are no “long and variable lags” between the tightening of monetary policy and recessions. Instead, recessions occur rapidly after tighter monetary policy triggers a financial crisis that isn’t contained by the Fed and that therefore turns into an economy-wide credit crunch.

Again, the past two years have been exceptional. Inflation soared during 2022 through the summer of 2023 and then moderated significantly through early 2024. This time, as in the past, monetary policy was tightened to lower inflation, which is what happened—but without causing a recession, so far.

Why has the latest experience differed from the business, credit, and monetary cycles of the past? Here is what we wrote about that last week: