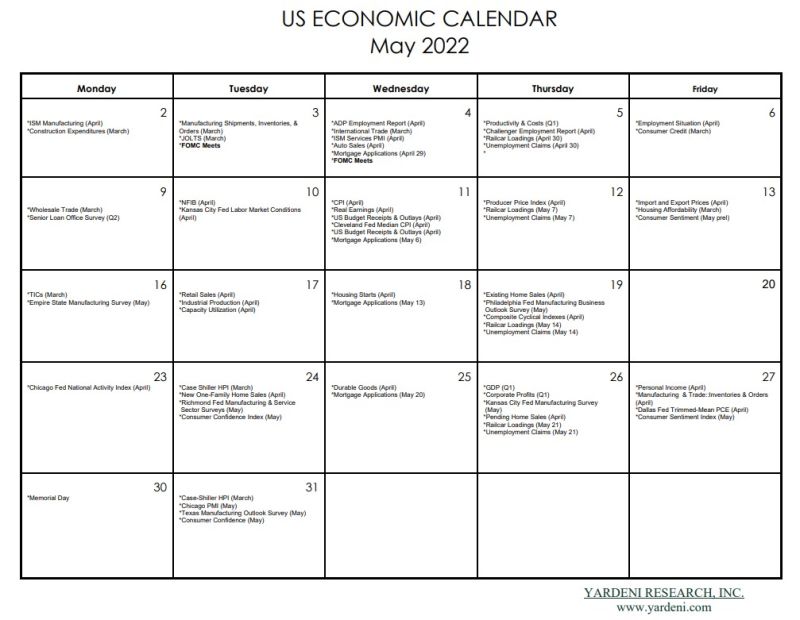

The surveys for NY and Philly released last week showed slower economic growth and persistently elevated prices-paid and prices-received indexes. Collectively, May's five regional business surveys (with the Dallas survey released on May 31) are likely to paint a stagflationary picture of the economy, and foreshadow a similar picture painted by May's M-PMI, which will be released on June 1.

We will also learn more about the consumer this week. Both the Consumer Confidence Index and Consumer Sentiment Index probably weakened during May as inflation clobbered the purchasing power of lots of consumers. April's inflation-adjusted personal income should show a slight increase, based on our Earned Income Proxy for wages and salaries. Nevertheless, real spending on consumer goods may be surprisingly resilient as reflected in April's retail sales report last week. Also, spending on services should be strong.

The week's big number will come out on Friday. Along with personal income, April's PCED will be released. It should show some signs of peaking for goods inflation, but higher inflation for air fares and rent.