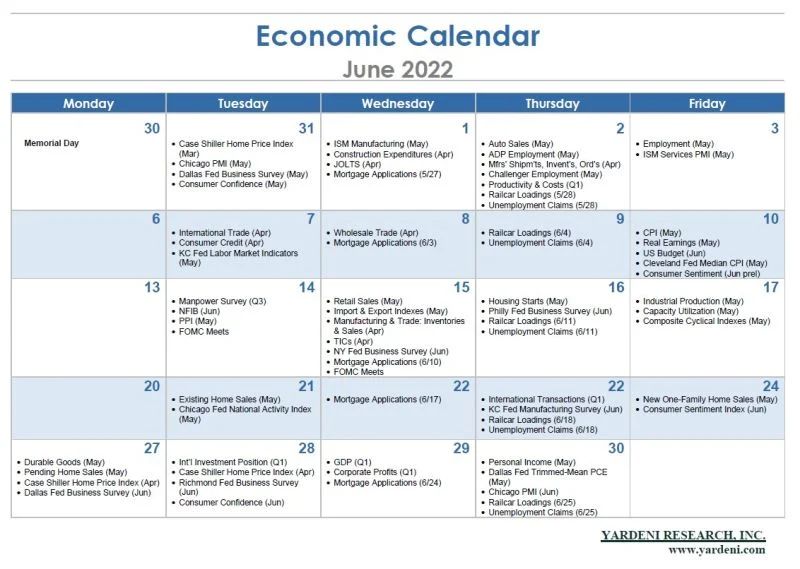

The week ahead is a big one for business surveys and for employment during May:

(1) The last of the five regional Fed banks’ business surveys will be released on Tuesday. The four available ones showed a sharp slowdown in business activity, suggesting that Wednesday’s M-PMI will also be weak even though the flash M-PMI estimate remained strong. The regional surveys also showed that prices-paid and prices-received indexes remained very high, suggesting the same for the M-PMI prices-paid index.

(2) On Wednesday comes April’s JOLTS report, which may show some cooling off in the labor market if hiring and quits edge lower. ADP reports private payrolls on Thursday, and the Bureau of Labor Statistics reports lots of employment indicators on Friday, including wages. Layoffs have started in the tech sector recently. Warehousing employment may start to reflect excess capacity issues. Companies may start pushing back against wage increases to maintain their profit margins.

(3) On Thursday, auto sales come out; they should show continued improvement, assuming fewer parts shortages for the industry. Also on Thursday, the revised Q1 productivity data will likely show an even uglier decline than the preliminary estimate, but we still believe that the trend is for higher productivity growth.