Fed Chair Jerome Powell will testify on the Fed's semiannual monetary policy report to two congressional committees on Tuesday and Wednesday. He is likely to say that although there are signs of disinflation, inflation remains too high and the Fed still has lots of work to do to bring it down.

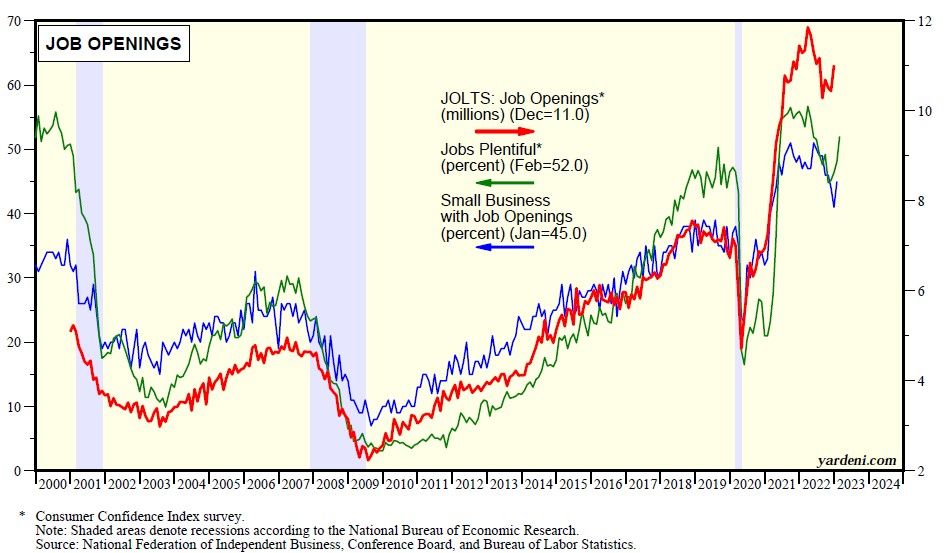

Powell's favorite labor market indicator, i.e., job openings, will be out on Wednesday for January. Similar indicators suggest it will be up for a second month in a row (chart). The Fed wants this series to go down, not up in order to moderate wage inflation.

Of course, the week's BIG event will be February's employment report (Fri). Payroll employment is expected to increase by half as much as January's 517,000 gain. It is widely recognized that mild winter weather and seasonal adjustment factors might have boosted January's result. Then again, February's weather was also relatively mild.

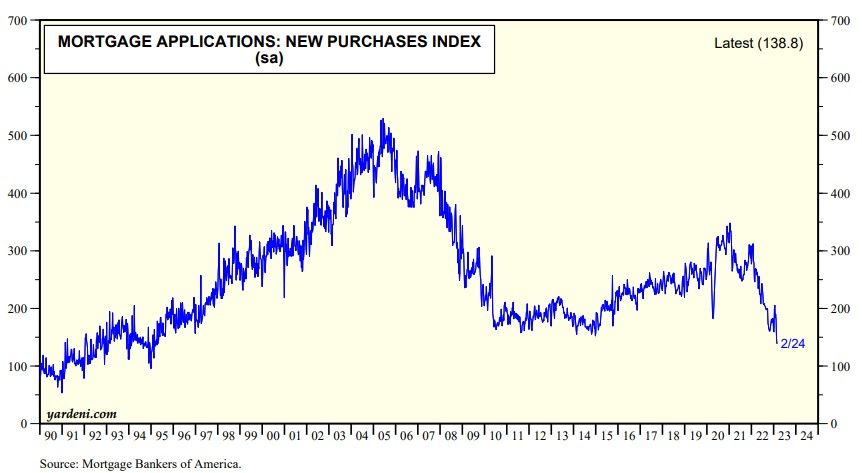

The week's housing indicators should show that housing affordability (Fri) improved during January, but the rebound in mortgage rates since then probably further depressed mortgage applications to purchase a house during the March 3 week (chart).

Stock and bond prices will fall if the week's employment reports are deemed to be too strong. Weak numbers would temper the Fed's monetary tightening, which would be bullish for stocks and bonds. The employment reports will signal whether the data coming out during the following week might be stronger or weaker than expected. Then the FOMC meets March 21 and 22 and will hike the federal funds rate by 25bps or 50bps depending on whether the batch of economic indicators over the next two weeks will be surprisingly strong or weak. We are in the 25bps camp for now.

Our hunch is that the data will be sufficiently mixed so that we all will be playing this same game again next month. Sideways volatility is more likely than a big move up or down, in our opinion.