This could be a big week for the stock and bond markets. There will be lots of market-moving inflation indicators: Inflation expectations (Mon), small business pricing intentions (Tue), CPI (Wed), PPI (Thu), and import & export prices (Fri). There will also be a couple of business cycle indicators that could move the markets: retail sales (Thu) and industrial production (Fri). On balance, we expect that the inflation stats will confirm that it remains on a moderating trend, while the sales and output data should suggest that the strength in the Atlanta Fed's GDPNow model (with real GDP up 5.6% during Q3) is a temporary aberration from the soft-landing scenario that has prevailed since the start of last year.

The problem is that the markets may already be priced for this happy scenario. The unhappily surprising alternative would be higher-than-expected inflation and stronger-than-expected economic activity that would send both stock and bond prices lower. This week will be an important one for which scenario the markets will discount. Now consider the following:

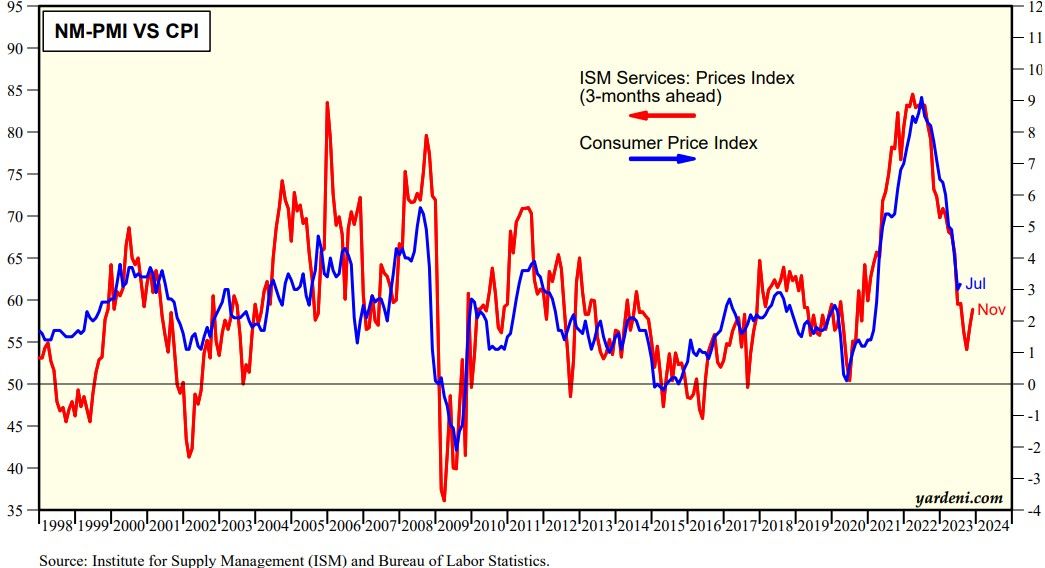

(1) Inflation. The rise in gasoline and meat prices during August will boost the headline CPI. Wholesale used-vehicle prices increased 0.2% m/m in August. The CPI's health insurance component is very volatile (and flawed). It plunged 29.5% m/m (not annualized in July!). It might have bounced back in August. We take comfort from the following chart which shows that the NM-PMI prices-paid index is a great 3-month leading indicator for the headline CPI inflation rate, and it suggests that both remain on disinflationary tracks:

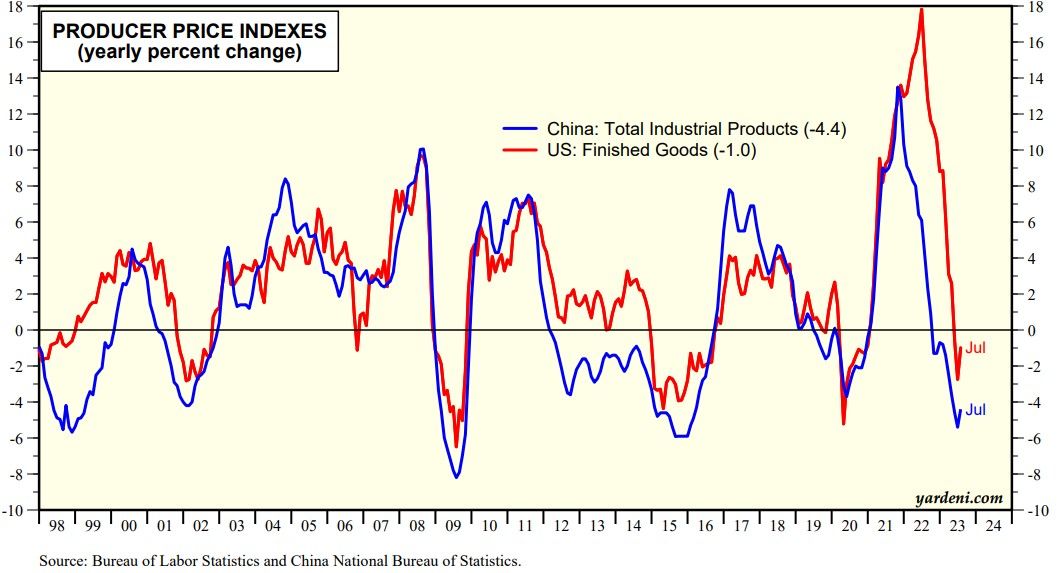

August's PPI inflation rate should remain weak reflecting its close correlation with China's (deflating) PPI inflation rate (chart). Also, an oddly big jump in portfolio management fees boosted July's PPI. It won't do it again in August.

(2) Growth. Retail sales rose 0.7% m/m during July partly because of Amazon's Prime Day. Nonstore retail sales rose 1.6% m/m. Another big jump came from a 2.3% increase in food services and drinking places--boosted perhaps by fans going to, or coming from, Taylor Swift's concerts. Retail sales were probably weaker last month, though August's employment report showed that wages & salaries rose solidly during the month. That report also showed a small 0.2% increase in aggregate hours worked in manufacturing, suggesting that production rose slightly last month.

(3) Deficit. August's federal budget release (Wed) will confirm that the fiscal 2023 deficit will be around $2 trillion. There is no way to put lipstick on this pig that Washington continues to feed.