The elephant is as good a metaphor as there is for the US government bond market. Its scale, power, memory, emotional intelligence, and tendency to live in complex family groups—just like the broad array of debt instruments—are right on the nose . . . er, trunk.

Yet this week, we saw that the room in which the bond market operates has more than one elephant. The other large mammal in question is the Republican Party, which may be picking a fight with the bond market. Just days after Moody's revoked Washington's AAA rating, the GOP in the House passed Donald Trump's "big, beautiful bill" today. The fact that it will add trillions of dollars to the primary federal deficit has agitated bond investors.

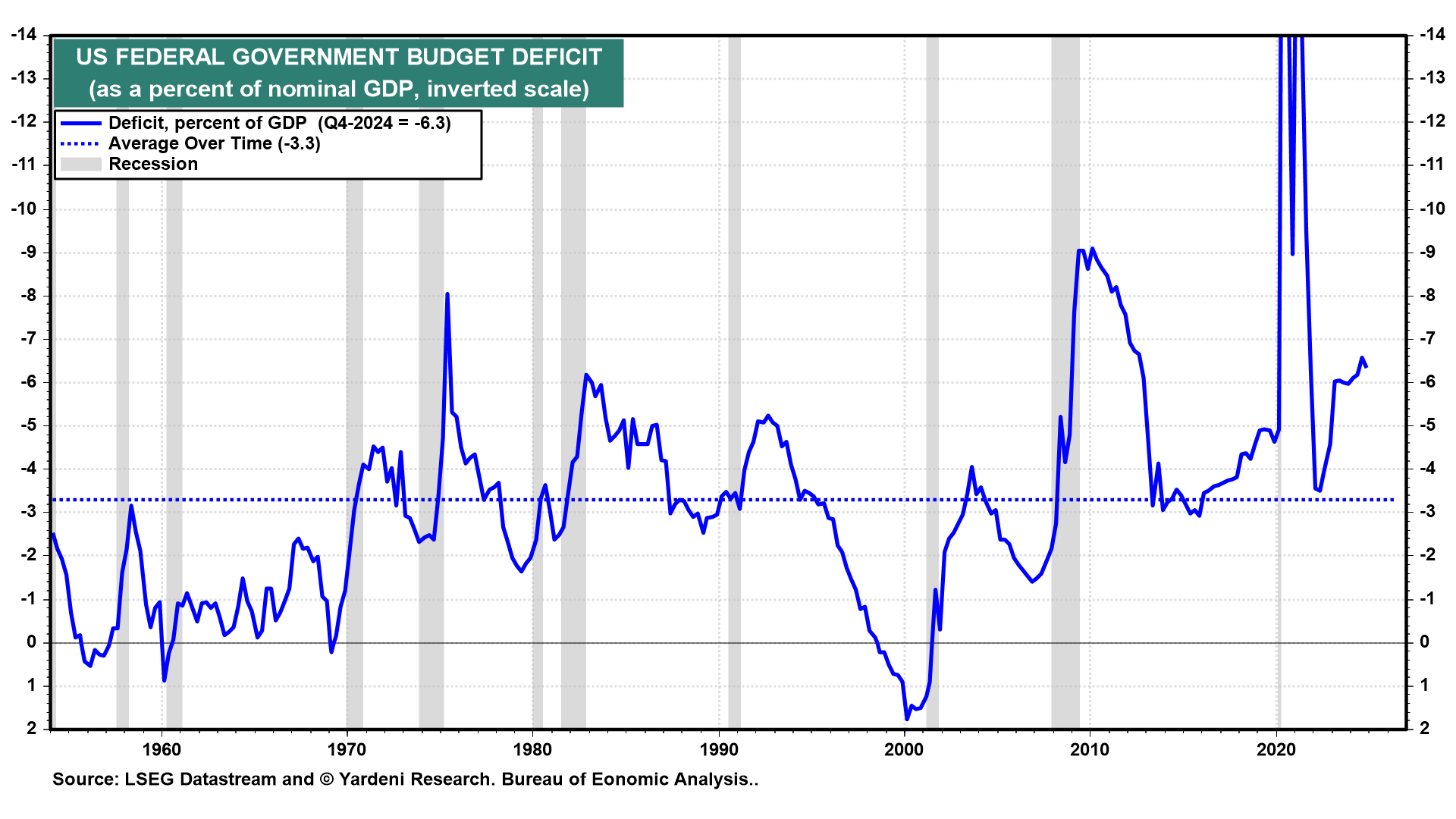

Suffice to say, Treasury Secretary Scott Bessent really has his work cut out as his boss, President Donald Trump, pushes his deficit-bloating bill through the Senate. If Bessent isn't careful, his 3% target for the ratio of the deficit to GDP—less than half what it was in the fourth quarter—will get trampled (chart).

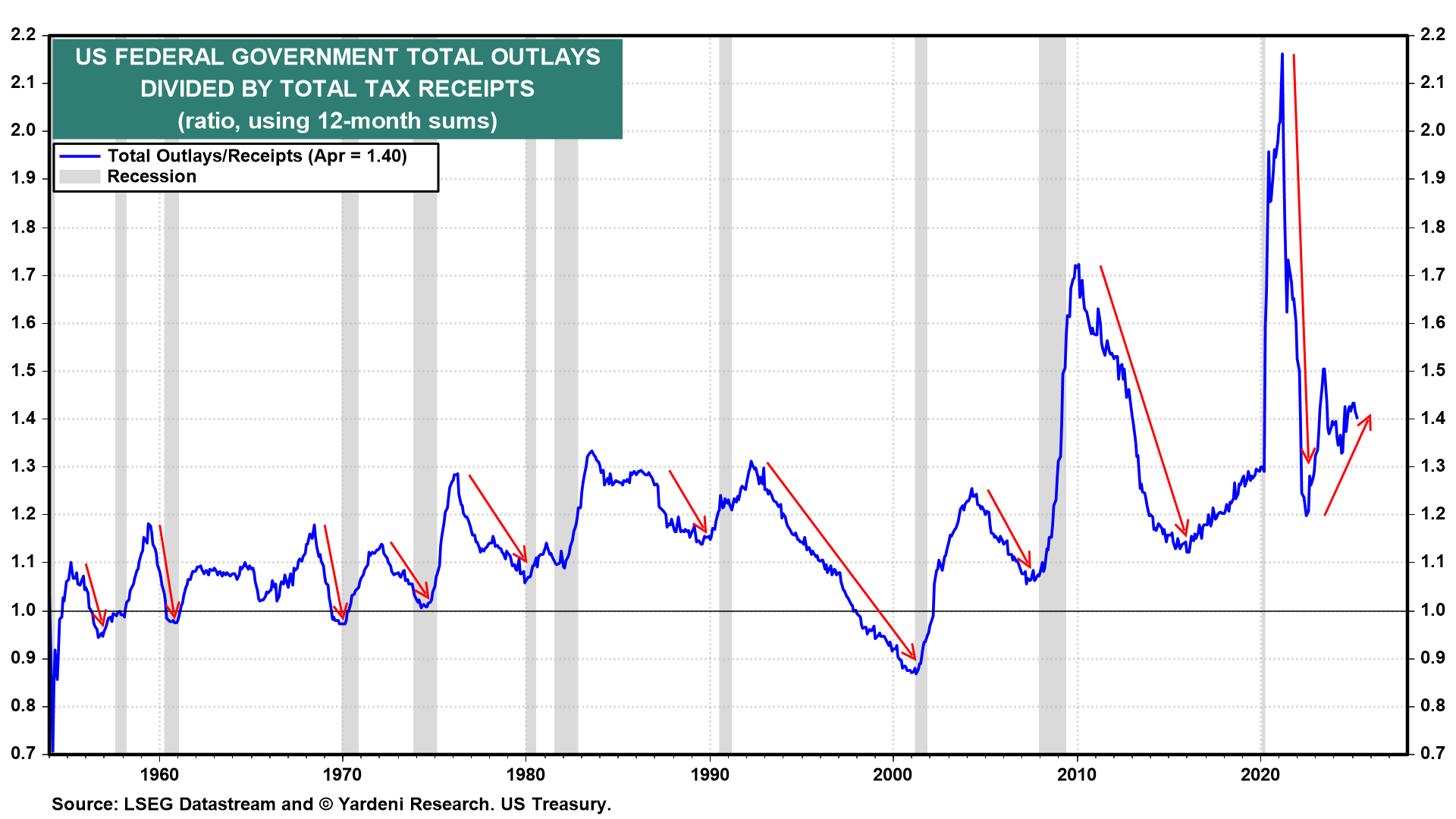

To regain credibility on Washington's fiscal trajectory, Bessent must stop outlays from stampeding faster than tax receipts while the economy is expanding (chart). Obviously, that feat would become even harder in the case of a recession.

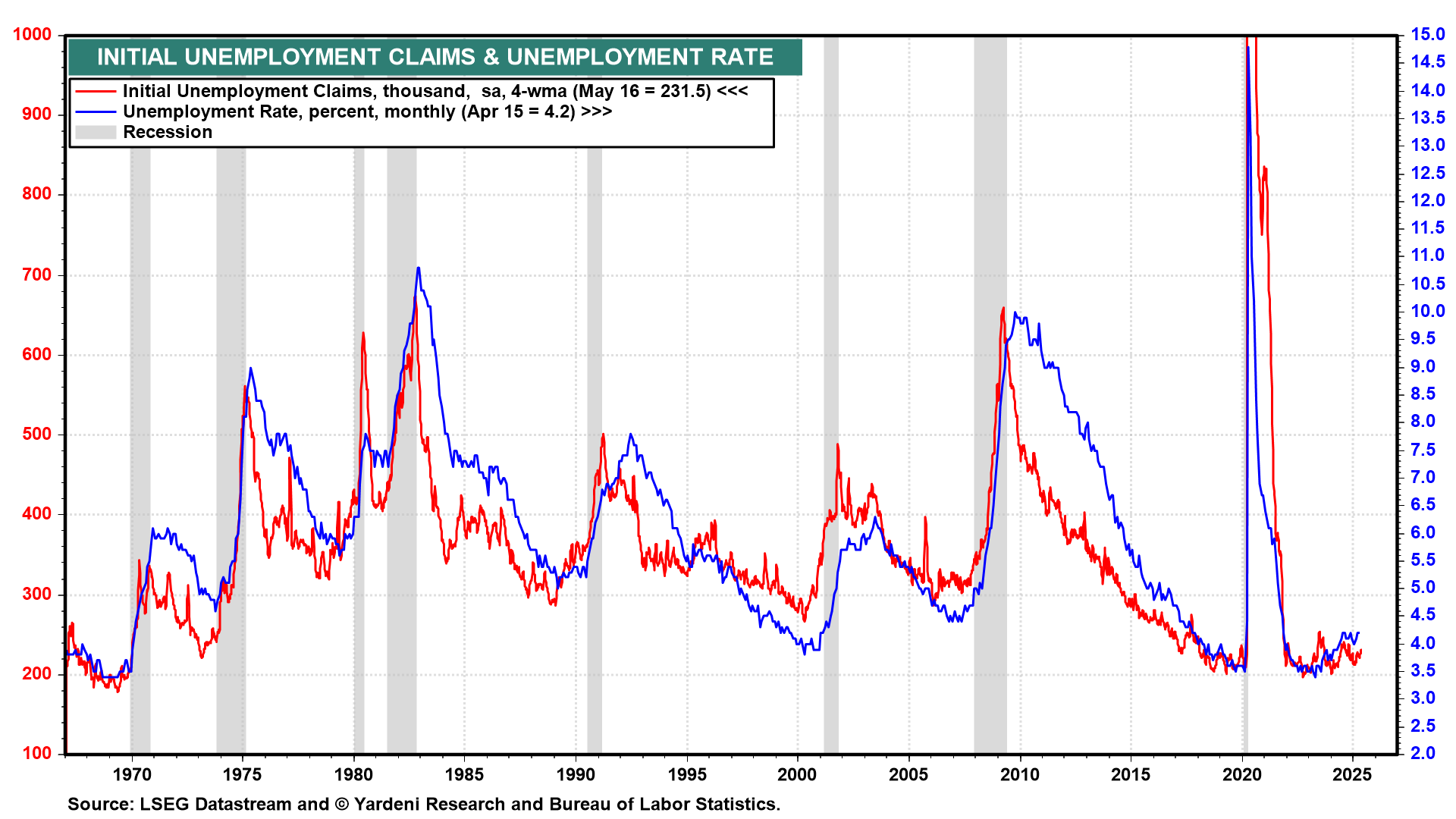

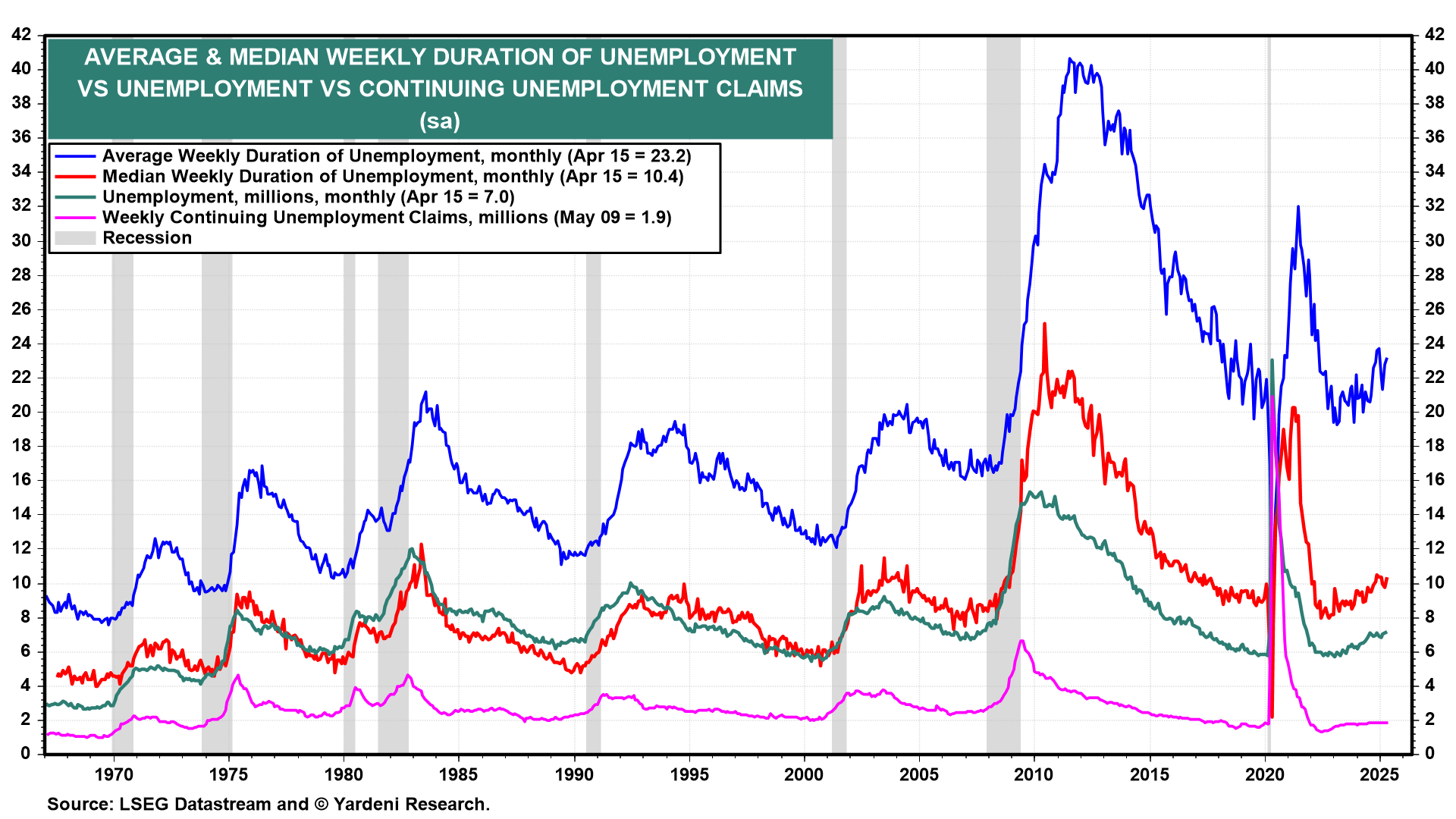

The good news is that another "elephant in the room" continues to behave very well: the US labor market. Applications for unemployment benefits just fell to a four-week low of 227,000. It's the latest reminder the job market remains healthy despite trade-war uncertainty and headlines about the bond market stumbling. And since these are data for the week ended May 17—the Labor Department's survey week—the employment report might confound the skeptics yet again (chart).

Likewise, continuing unemployment claims suggest that the unemployment rate isn't likely to rise much, if at all, and the duration of unemployment isn't rising (chart). Its increase in the latest week was to 1.9 million, a level that should allay recession fears. Despite job cuts at Amazon, Microsoft, Nike, and elsewhere, data suggest that a critical mass of companies are comfortable with their current staffing levels.

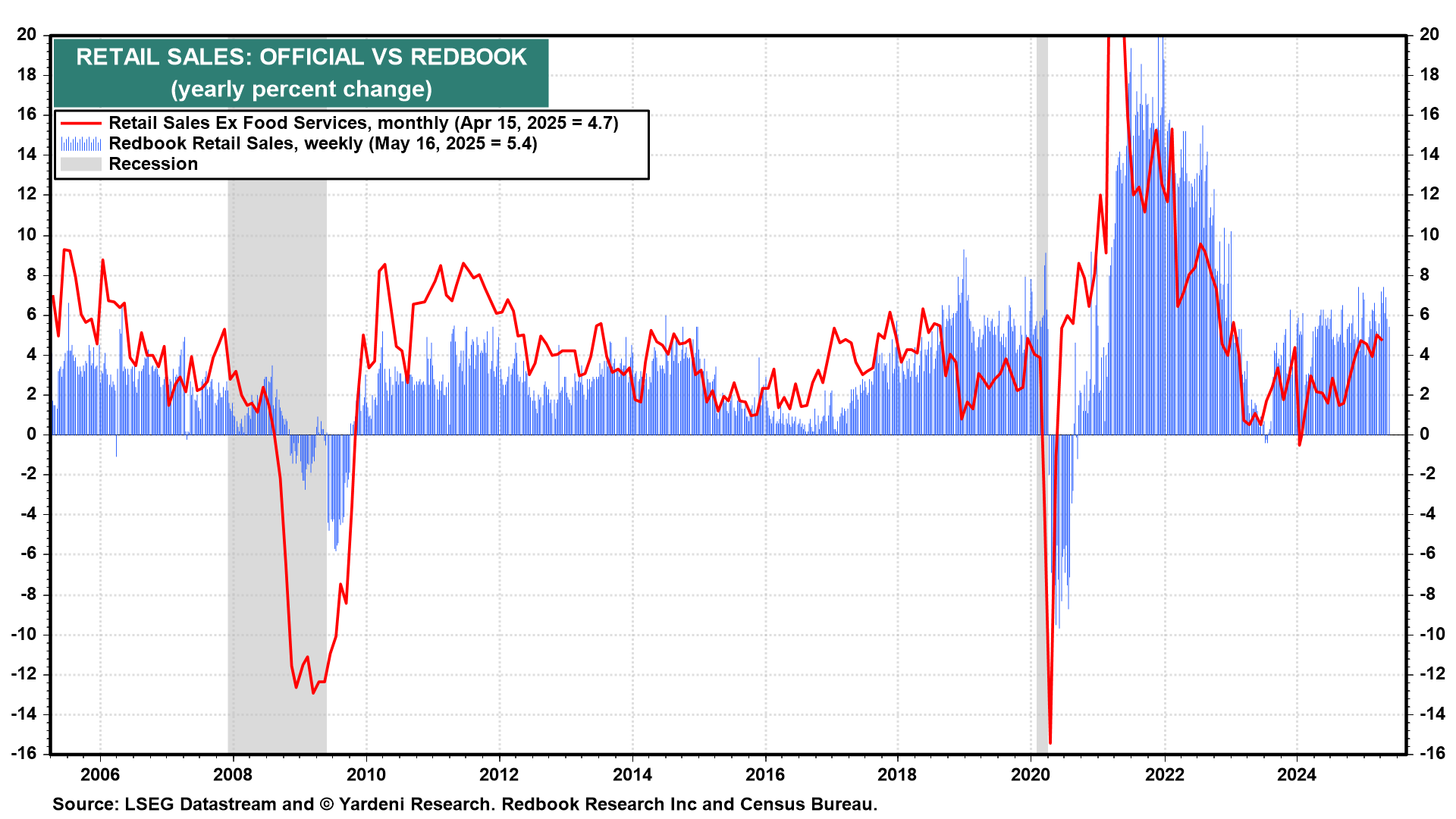

The consumer "elephant" continues to stand its ground, if the latest Redbook retail sales index is any guide. In May, it rose 5.4% y/y. Though that’s down from 5.8% in April, the big picture is one of resilience in the face of near-unprecedented levels of uncertainty and tariff-driven disruption. At a minimum, the report confirms our view that the Federal Reserve should be in no hurry to ease.

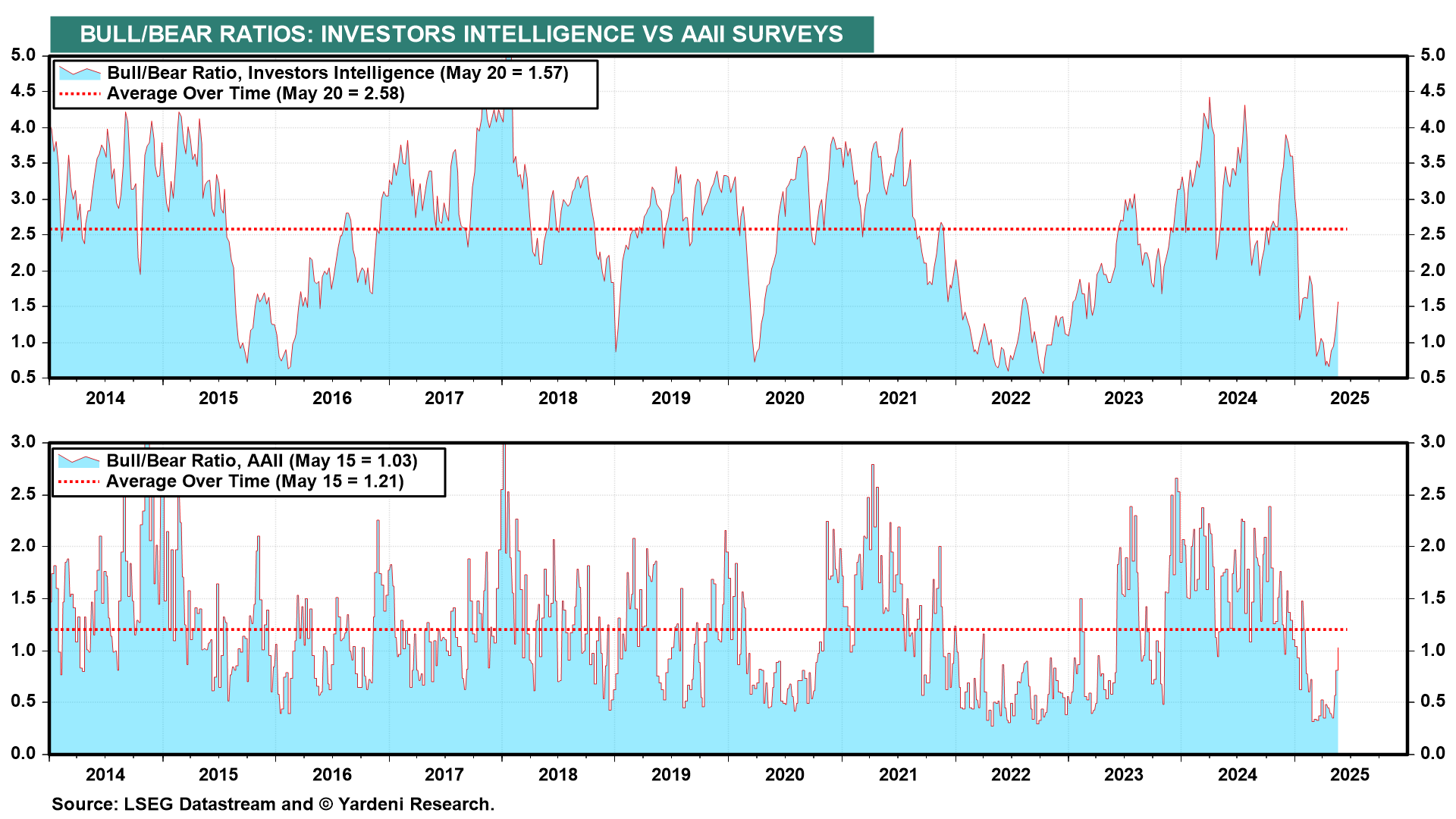

Even as bond-market strains get the headlines, optimism toward stocks is rebounding, but remains relatively low still. At 1.57, the latest bull/bear ratio (BBR) measured by Investors Intelligence is well below the 2.58 average (chart). The same with AAII's BBR: Its latest reading is 1.03, below the 1.21 average over time. From a contrarian perspective, those are bullish readings, especially if Trump (another big elephant) retreats from his trade war by declaring victory.