The economy won't let us down. Despite numerous crises, real GDP has remained recession-resistant since the Covid lockdown during the first half of 2020. That's almost six recession-free years notwithstanding the pandemic, the Russian invasion of Ukraine, the tightening of monetary policy, the war in the Middle East, and Trump's Tariff Turmoil. Despite the five crises, it really has been the Roaring 2020s so far. Real GDP is at a record high and so is the stock market.

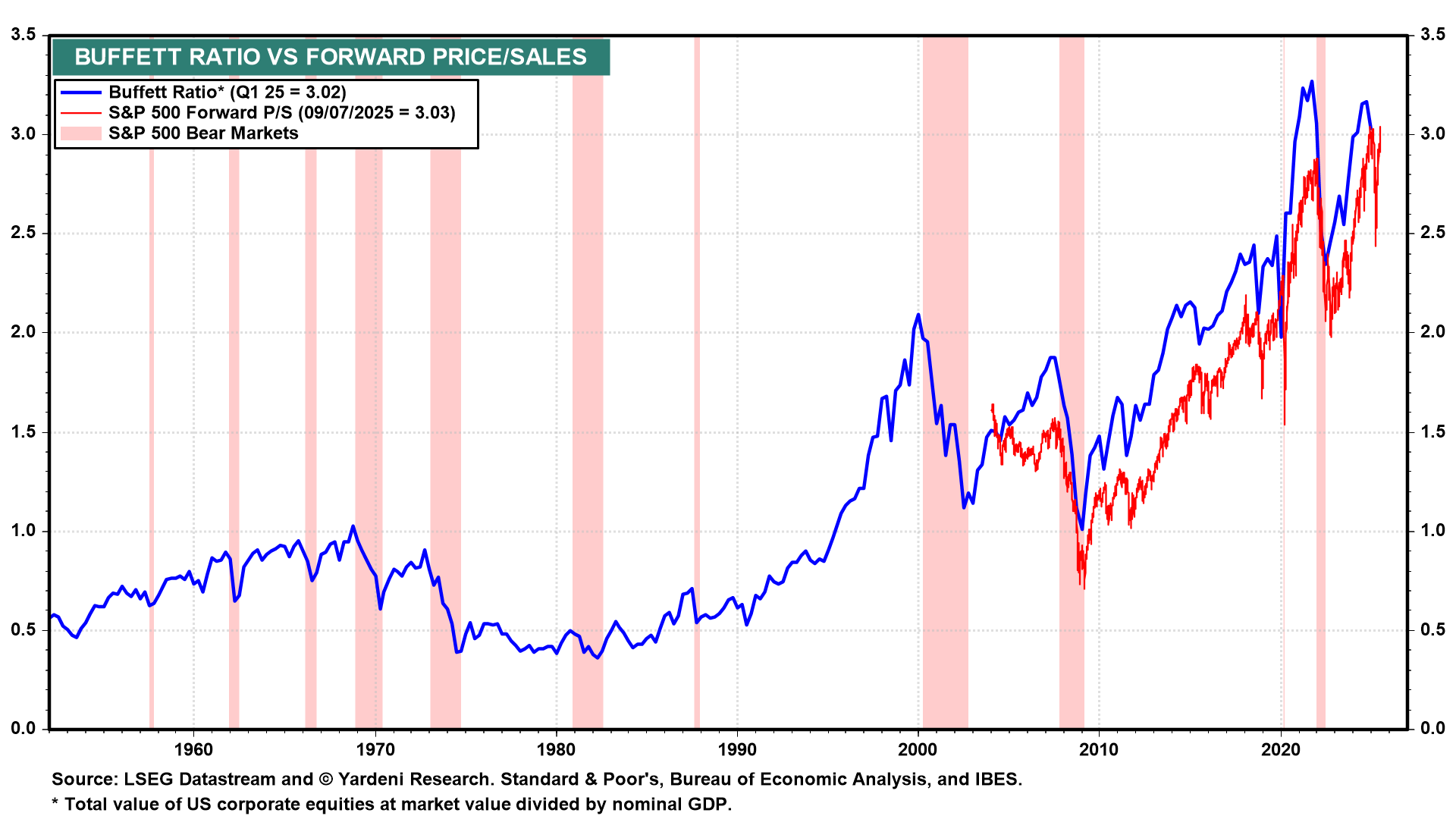

There doesn't seem to be much roaring (a.k.a., exuberance) in measures of consumer and business confidence. But there is plenty of it visible in the quarterly Buffett Ratio, which is equal to the total value of US corporate equities at market value divided by nominal GDP (chart). A useful weekly proxy for the Buffett Ratio is the S&P 500 stock price index divided by the S&P 500 forward revenues per share. It rose to 3.03 during the July 9 week matching the record high just before the latest correction started on February 19.