The Treasury's Quarterly Refunding Statement, released this morning, was a non-event. No unexpected policy shifts or drastic changes in issuance sizes were noted, so the announcement was largely as anticipated. The FOMC's decision in the afternoon to leave the federal funds rate (FFR) unchanged was widely expected, too. So was the fact that two Fed governors dissented from that decision for the first time since 1993. Today's fireworks occurred after the stock market closed when Microsoft and Facebook beat earnings expectations. So did Qualcomm. Tomorrow, Apple and Amazon report after the close.

Tomorrow should be a good day in the stock market. That's despite President Donald Trump's latest salvos in his trade war with the world. Trump signed executive actions today imposing a 50% tariff on Brazil and a 50% tariff on certain copper products as well as suspending a duty-free perk for all countries that export goods priced under $800 into the US. The President also said that India's exports to the US will face a 25% tariff in addition to a "penalty" for what he views as unfair trade policies and for India's purchase of military equipment and energy from Russia.

In any event, it has been a good month for the dollar index (DXY). It found support at the bottom of its rising channel on July 2 at 96.8, as we had anticipated (chart). It was back up to 99.8 today. We've been among the few fans of the dollar lately. Gold was weak today and continues to consolidate its gains in recent weeks. We are still bullish on gold.

The Fed is data-dependent, and today's Q2 real GDP report justified today's FOMC decision to leave the FFR as is. The FOMC's statement and Fed Chair Jerome Powell's press conference reiterated that, aside from the two dissenters, the other Fed officials are still in no rush to lower the FFR. We thought they might signal a possible rate cut in September, but they did not do so. We are sticking with our none-and-done stance for 2025.

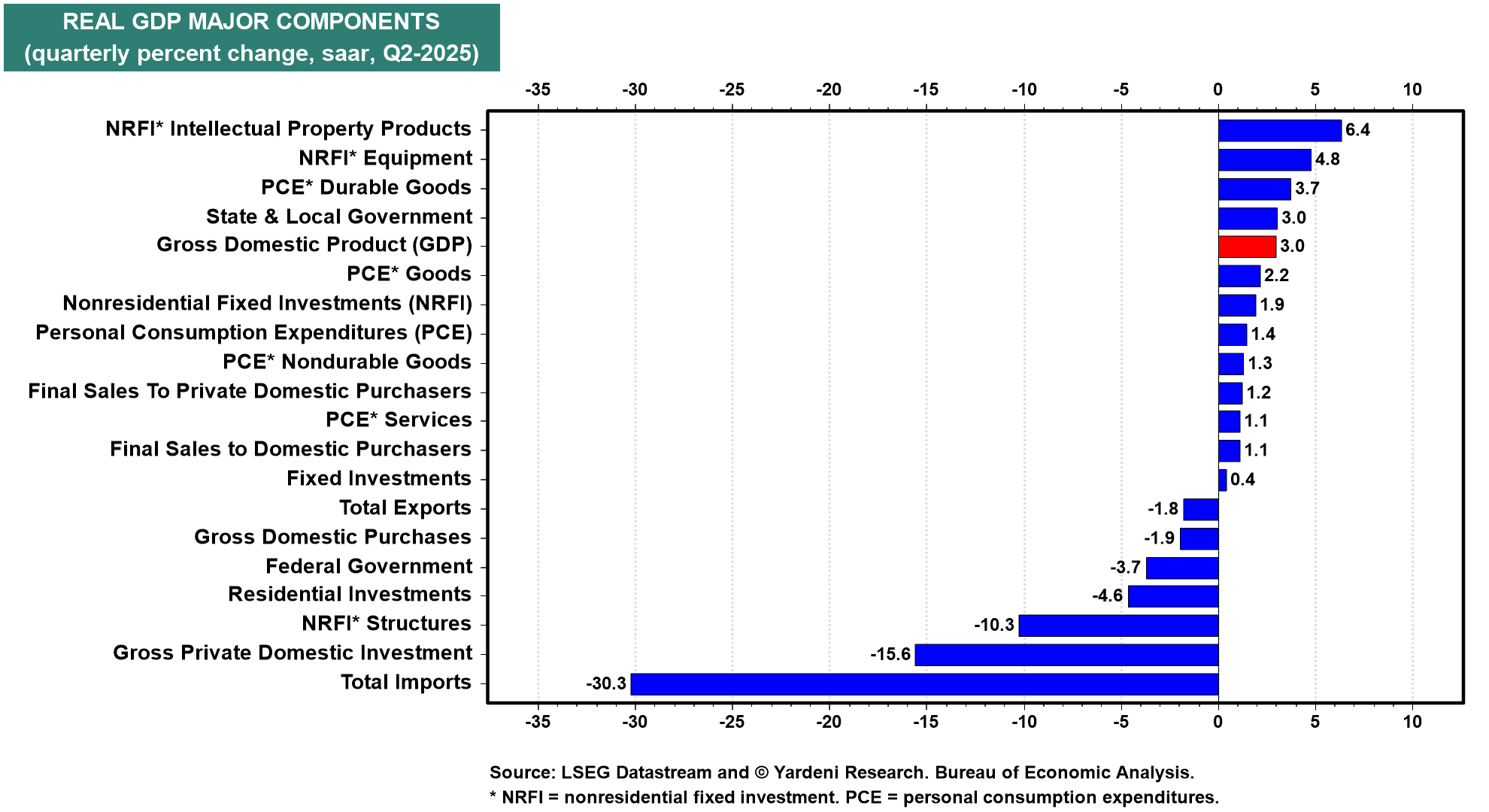

Real GDP beat expectations, rising 3.0% (saar) (chart). We've been using the word "resilient" to describe the economy for the past few years. We still are.

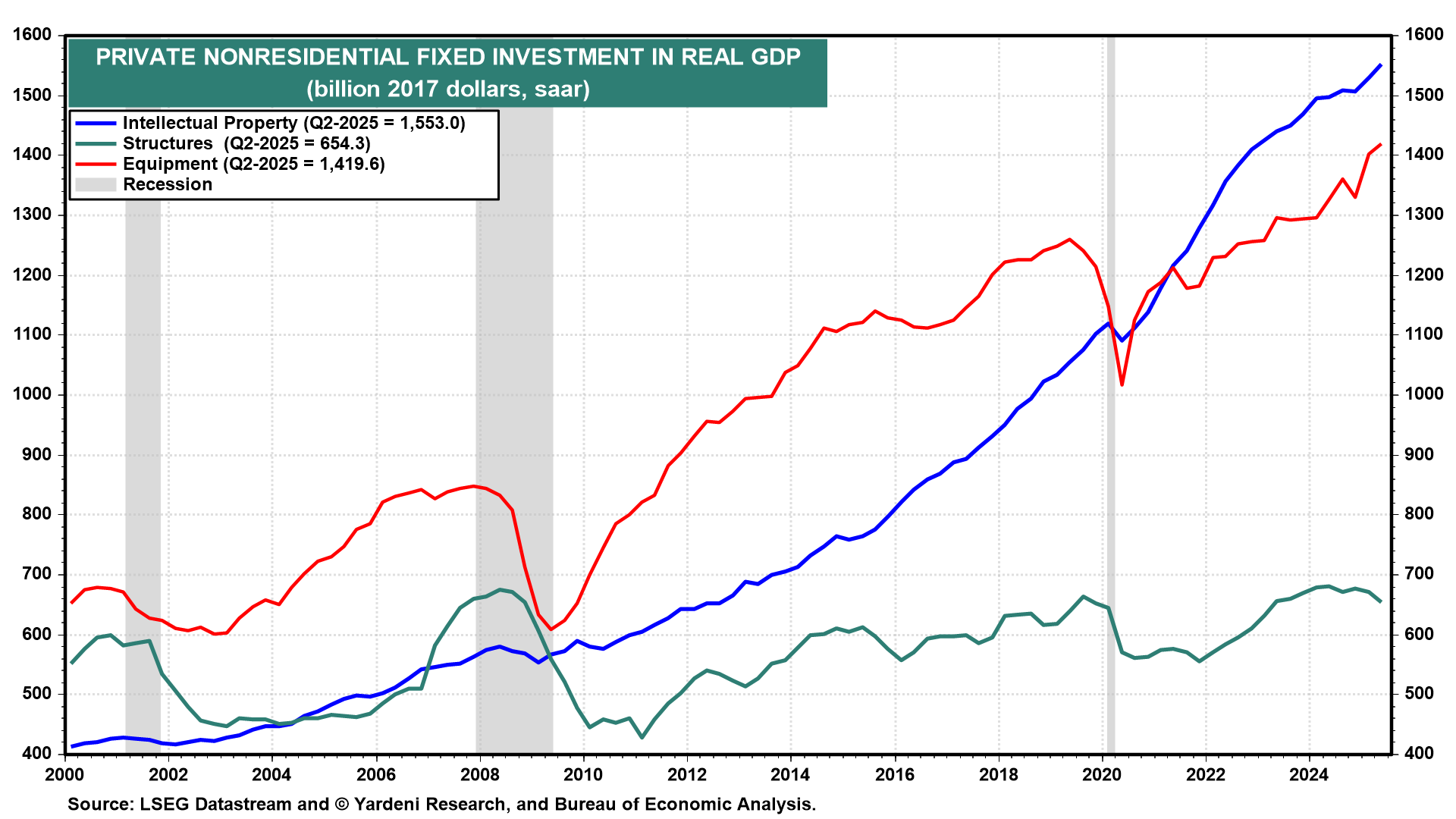

Among the strongest components of real GDP were capital spending on information processing hardware (included in business equipment) and software (included in intellectual property) (chart). The epicenter of the Digital Revolution is datacenters, which are where the Cloud resides. AI is creating lots more data to store and process in the Cloud. The sky is the limit.

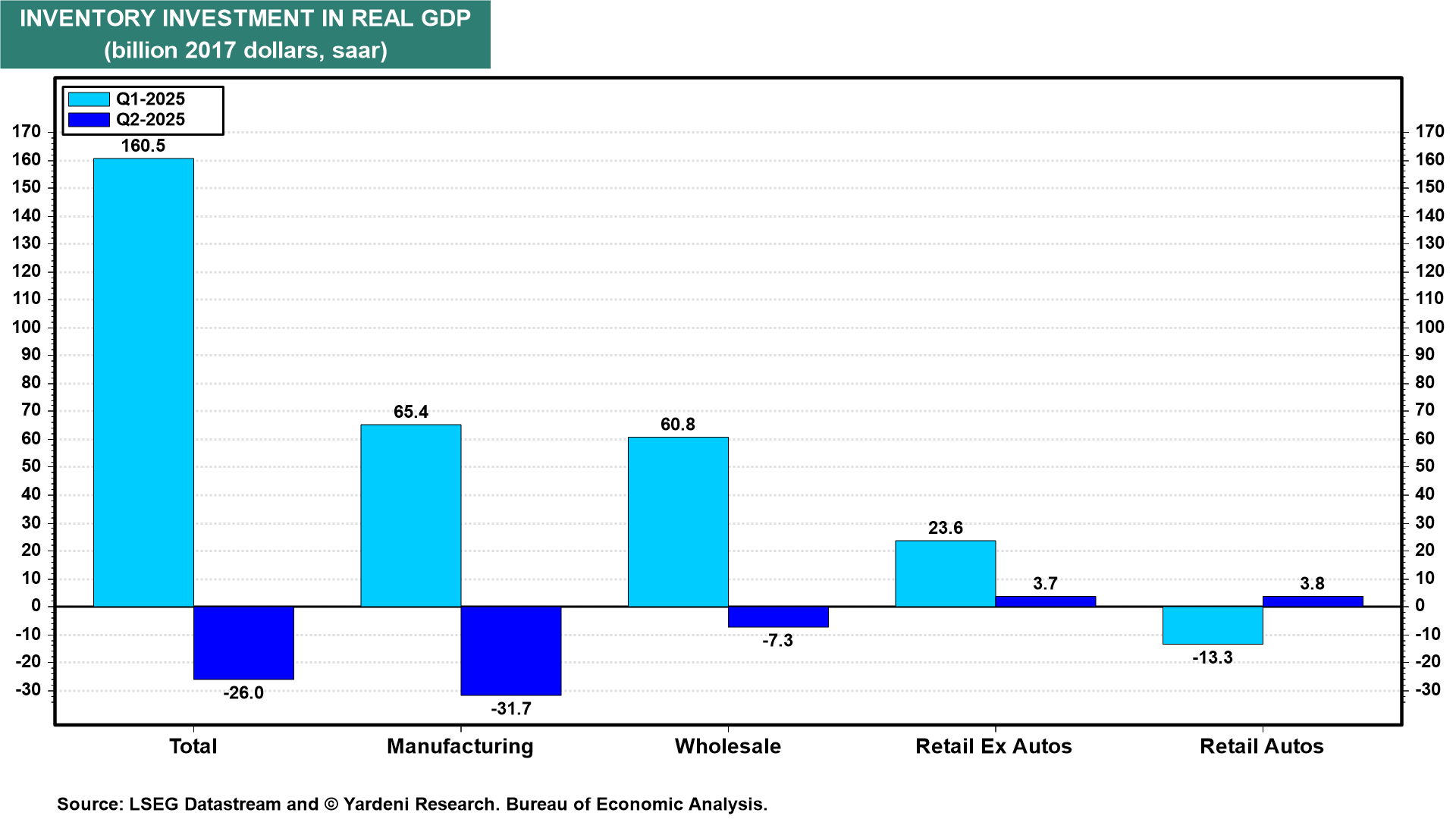

Weighing on real GDP was a big drop in inventory investment during Q2 compared to Q1 (chart). Inventory investment should be a positive contributor to Q3's growth rate.

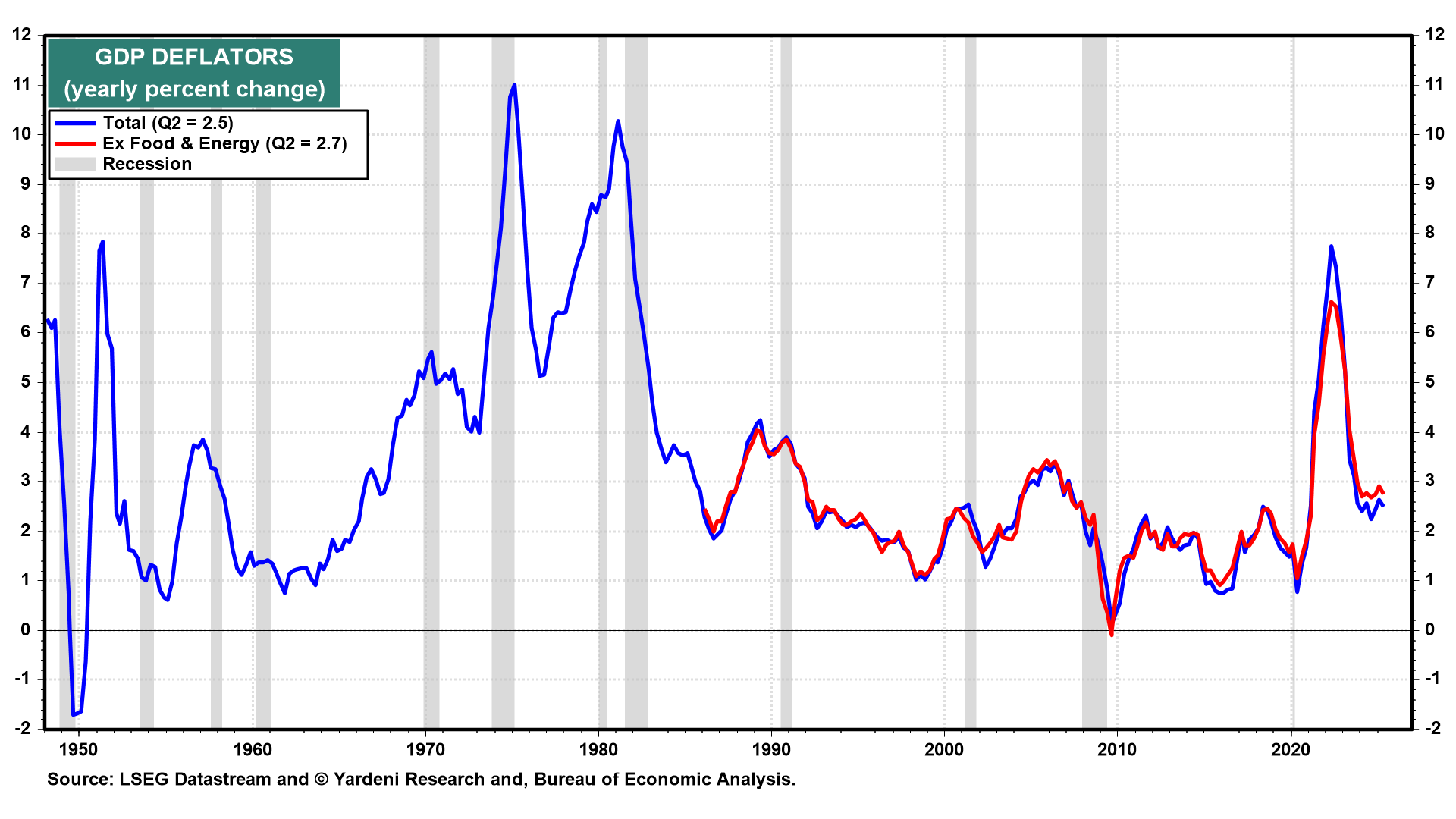

The broadest measures of price inflation in the US are the headline and core GDP deflators. They were up only 2.5% and 2.7% y/y during Q2 (chart). The Fed has achieved its dual mandate. So there shouldn't be any rush to lower the FFR. If Trump got his rate cuts now, the result would likely be higher bond yields and mortgage rates and a stock market meltup that would set the stage for a meltdown. Message to the President: Beware of what you wish for.