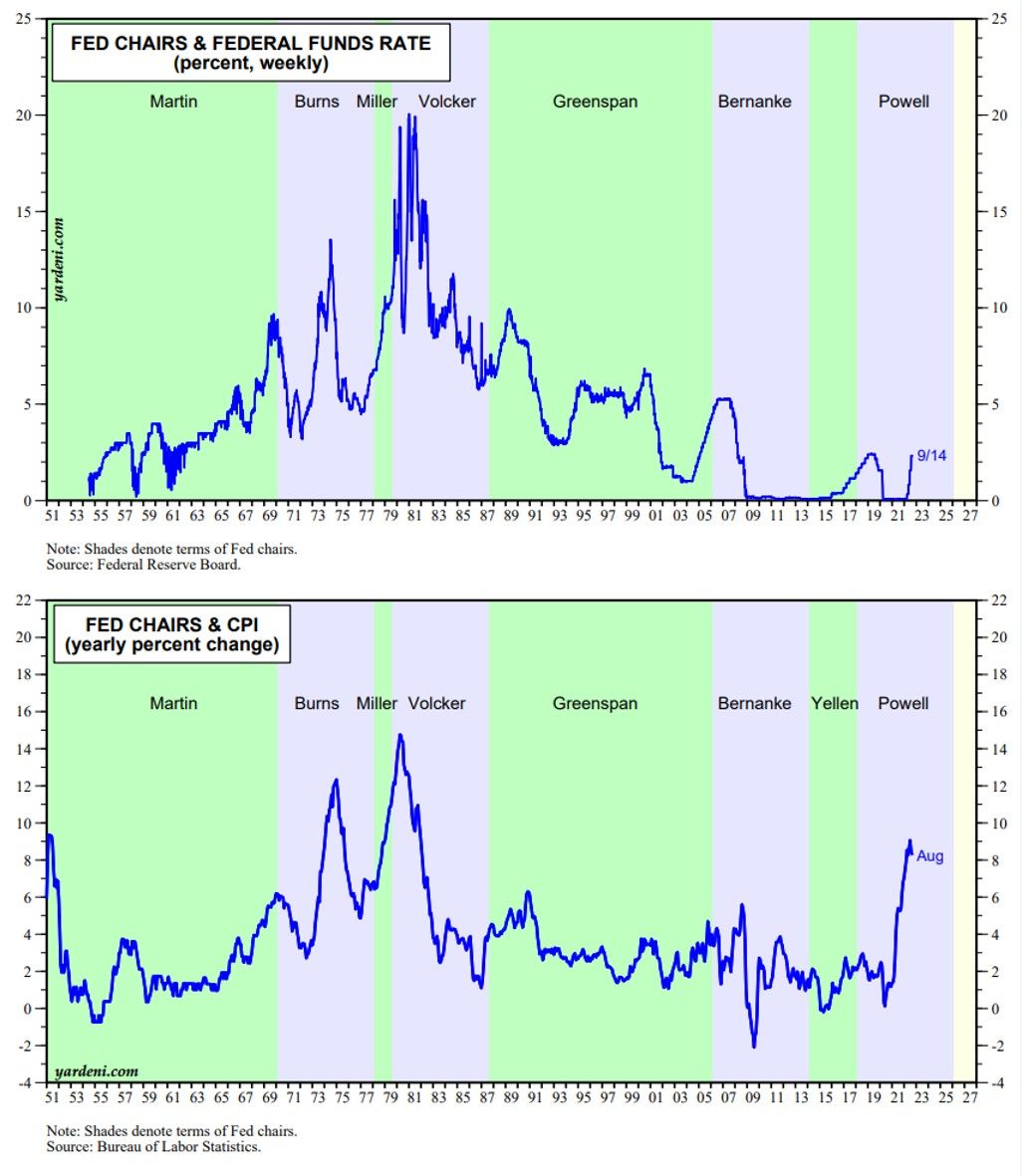

The financial markets seem to have concluded that Fed Chair Jerome Powell has decided to go Volcker on us. During 1979-1981, then-Fed Chair Paul Volcker let interest rates soar to levels that caused a recession. He did so to bring inflation down (charts below).

During his press conference on Wednesday, Powell unambiguously reiterated the hawkish message of his Jackson Hole speech on August 26. In other words, he strongly suggested that the only way to bring inflation down is with a recession. He mentioned the words "pain" or "painful" seven times in his presser.

Furthermore, in his presser, Powell mentioned the word "restrictive" 12 times as in the following three quotes that suggest he is channeling his inner Volcker:

(1) "And in light of the high inflation we're seeing, ... we think that we'll need to bring our funds rate to a restrictive level and to keep it there for some time."

(2) "As I mentioned, what we think we need to do and should do is to move our policy rate to a restrictive level that's restrictive enough to bring inflation down to 2%, where we have confidence of that.

(3) "But we're not at that level, clearly today we're just ... probably into the very lowest level of what might be restrictive and certainly in my view and the view of the Committee, there's a ways to go."

Meanwhile, commodity prices are falling, the dollar is soaring, and real GDP growth is running around zero. The economy is already in a growth recession. The yield curve spread has been negative for several weeks, signaling an outright recession. The odds of such an outcome have increased now that Fed officials seem to have concluded that's the only way to bring inflation down.

Nevertheless, we are sticking with our forecast that the growth recession will continue and bring inflation down significantly in coming months. Bond yields are certainly more attractive now. The S&P 500 should remain range bound with more downside risk than upside potential until the Fed's restrictive campaign is over, which should be before the end of this year at the rate they are raising interest rates.