In our April 7 Morning Briefing, we anticipated the bottom in this year's S&P 500 correction and a V-shaped rebound. The bottom occurred the very next day. The V-shaped recovery started the following day on April 9, when President Donald Trump postponed his Wednesday, April 2, Liberation Day tariffs. We wrote:

"Trump's Liberation Day last Wednesday triggered Annihilation Days on Thursday and Friday, with the Stock Market Vigilantes giving a costly thumbs-down to Trump's Reign of Tariffs. .... [H]e might get the message that hurting Main Street's stock portfolios can cause a recession and jeopardize the GOP majority in Congress. If so, he might postpone the reciprocal tariffs, giving trade negotiations time to work. Also, the courts might block Trump's tariffs. An early end to Trump's tariff nightmare would result in a V-shaped stock-market bottom. We’re counting on that; the alternative is just plain ugly.”

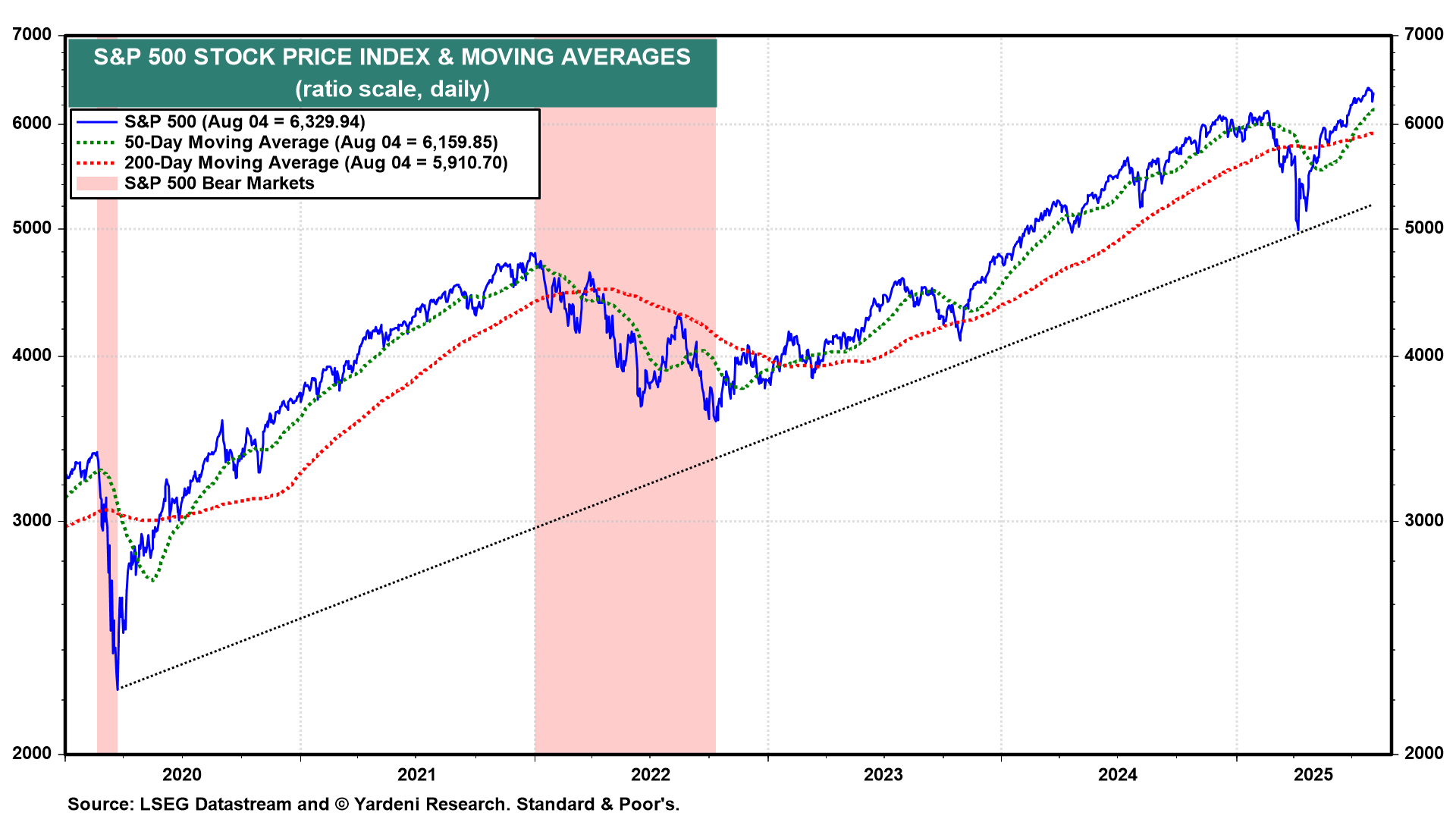

The V-shaped rebound in stock prices that started on April 9 drove the S&P 500 to a record high of 6389.77 on July 28 (chart). It dropped sharply on Friday and bounced back up to 6329.94 today.