The April 2 Liberation Day reciprocal tariffs were postponed on April 9 to July 9 and again to August 1. The S&P 500's latest correction bottomed on April 8. The rebound to new record highs has been extraordinary. Today's selloff on mostly good news suggests that investors and traders might be starting to take profits before going on their August vacations. They might also be betting that September could be a weak month for stocks, as it often has been in the past.

In addition, they may be coming around to our none-and-done forecast in 2025 for the federal funds rate, given the resilience of the economy and above-target inflation. Fed Chair Jerome Powell sounded more hawkish than widely expected during his presser yesterday. On the tariff front, Trump seems intent on using them as a revenue-raising and foreign policy tool. However, the courts might soon rule that he doesn't have the legal authority to impose them in the first place. Sure, reciprocal tariffs will be imposed on all America's trading partners tomorrow. But that doesn't mean that they won't be changed again.

Today's economic indicators are consistent with our view of the economy:

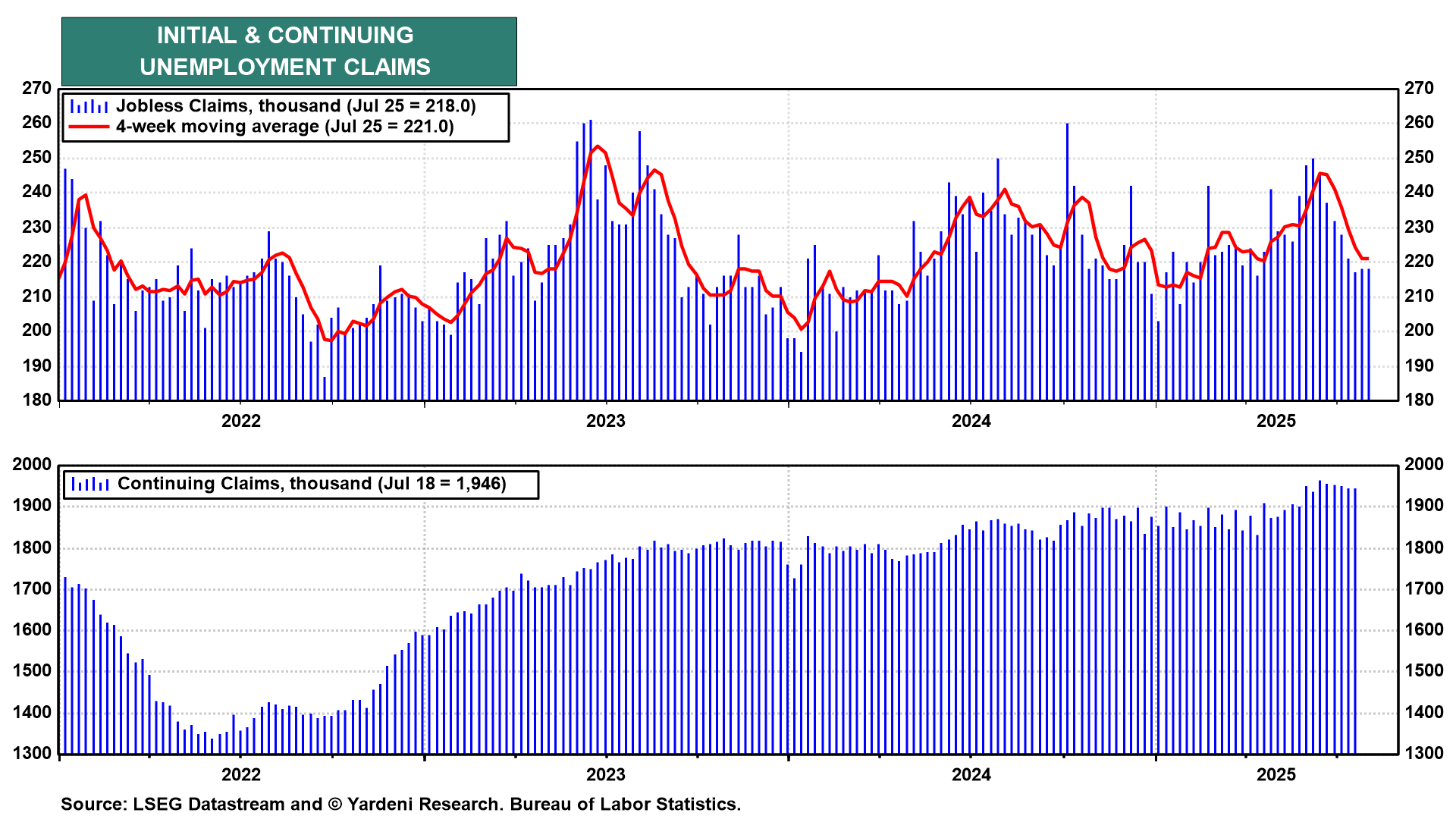

(1) Initial unemployment claims. Both initial and continuing jobless claims remained low in today's report (chart). The former remains consistent with an unemployment of around 4.0%, which is consistent with the notion that the economy is at full employment.