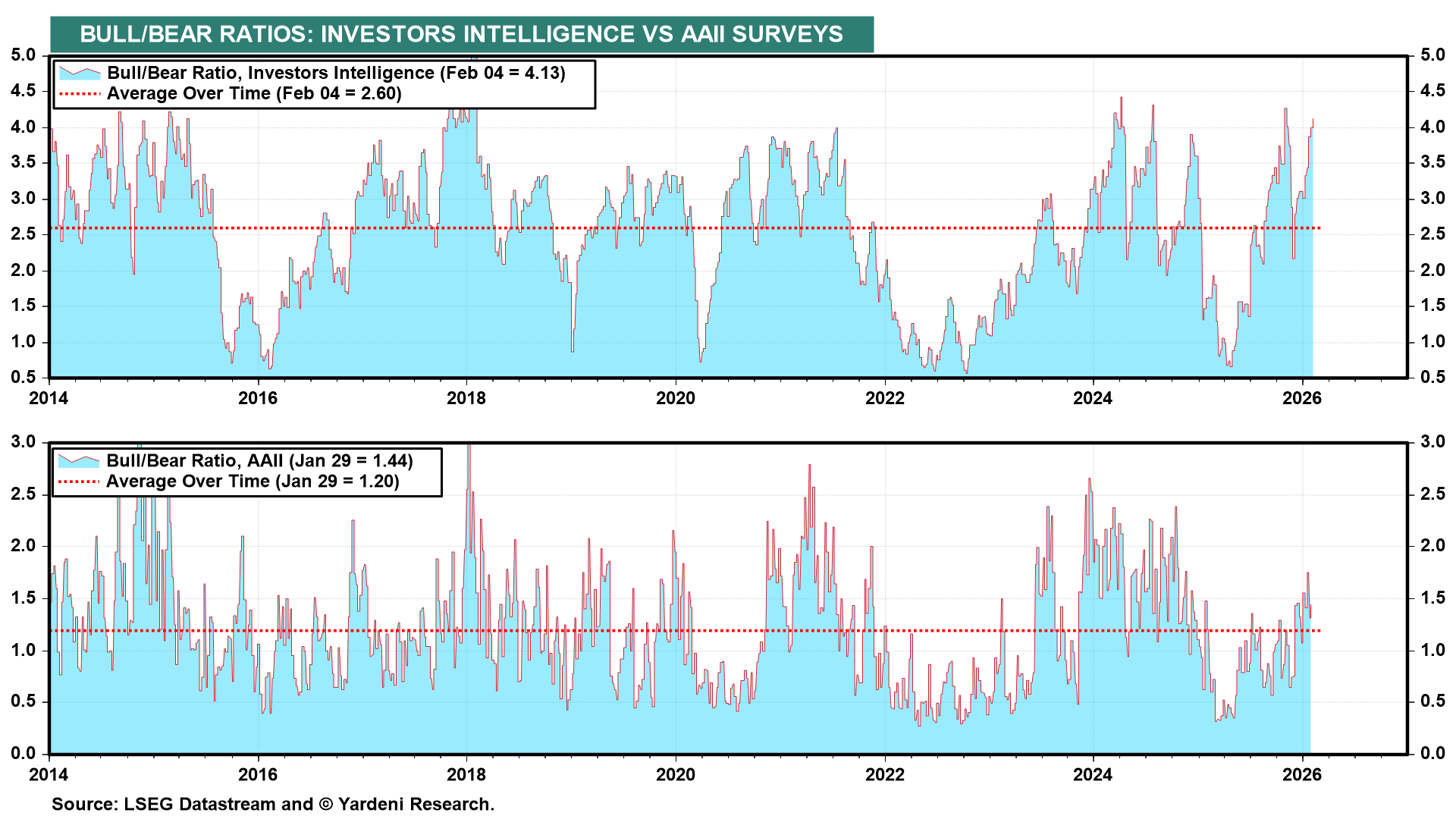

Last Thursday, we noted that the Investors Intelligence Bull/Bear Ratio of 3.99 suggested the market was vulnerable to a selloff. So far, so bad. What's worse is that the BBR rose to 4.13 this week (chart).There are still too many bulls from a contrarian perspective. But a few more days like yesterday and today would bring the BBR back down.

The good news is that the S&P 500 bull market is continuing to broaden. So far this week, the following S&P 500 sectors posted record highs: Communication Services, Consumer Staples, Energy, Industrials, and Materials. It might be another of many head-fakes, but the S&P 500 Value stock price index may be starting to outperform the S&P 500 Growth stock price index (chart), That's if technology stocks continue to underperform as a result of increasing AI-induced competition in the space and uncertainty about future earnings growth.