Investors have decided that the Greenland issue will be resolved now that there is a framework for resolving it. So far this year, they seem to be looking for greener pastures, as evidenced by the broadening of the bull market in stocks. Booming economic activity has provided plenty of greener pastures. There was plenty of good economic news today that should continue to bolster earnings and stock prices. Nevertheless, a pullback is possible as bullish sentiment mounts. Meanwhile, nothing seems to be holding back precious metals prices from climbing to new highs.

Consider the following:

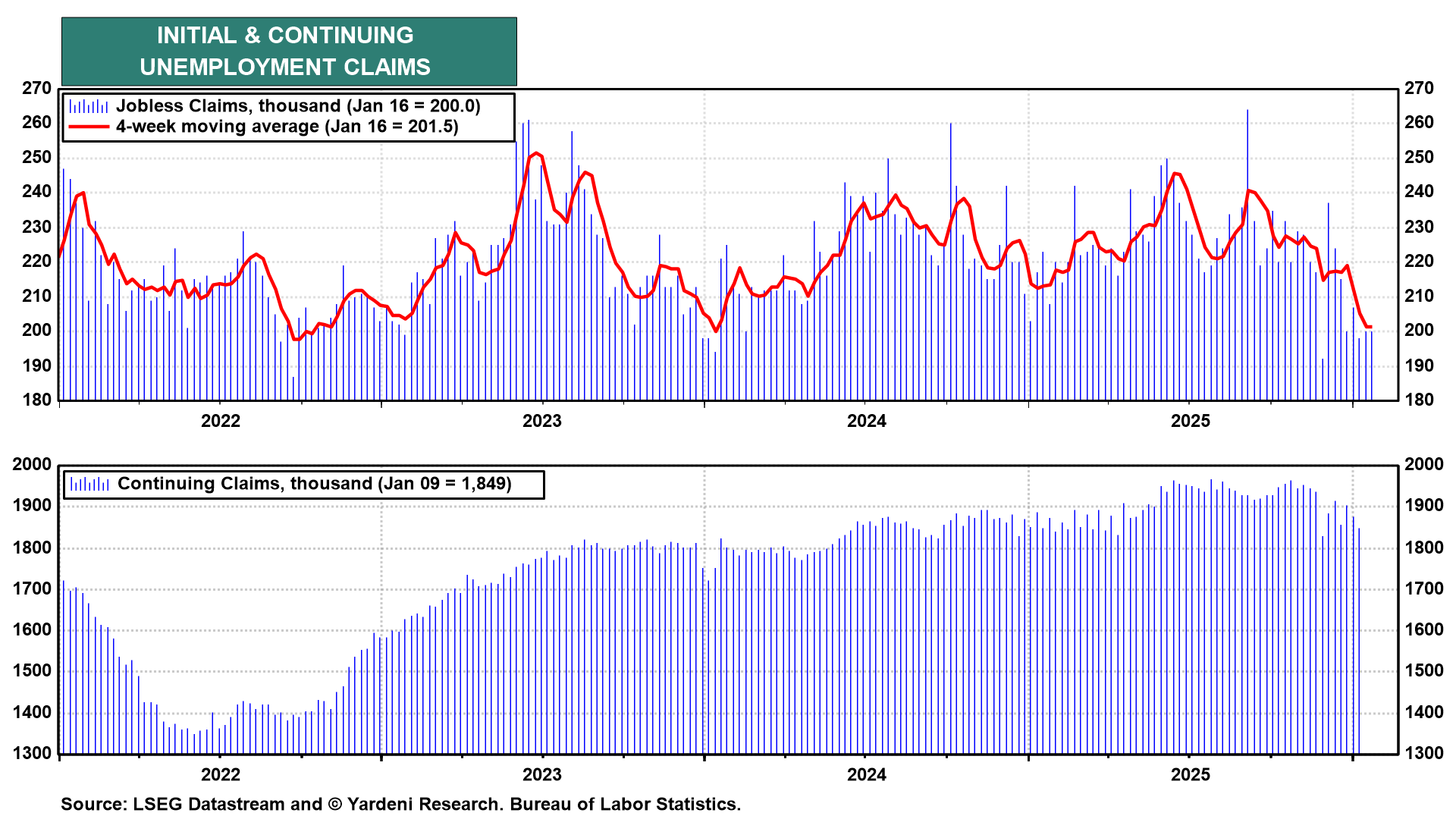

(1) Unemployment insurance claims. Our contrary instincts about the labor market have been triggered recently by the declines in both initial and continuing unemployment claims over the past few weeks (chart). Now that everyone agrees that the so-called breakeven payroll employment gain is around 50,000 per month, we think January's number might be more like 100,000. That would be a surprise for sure.

We are just thinking out loud here: At some point, companies will complete their assessment of AI and conclude that it isn't ready for prime time in many of their operations and that they need to hire more workers to keep up with booming demand.

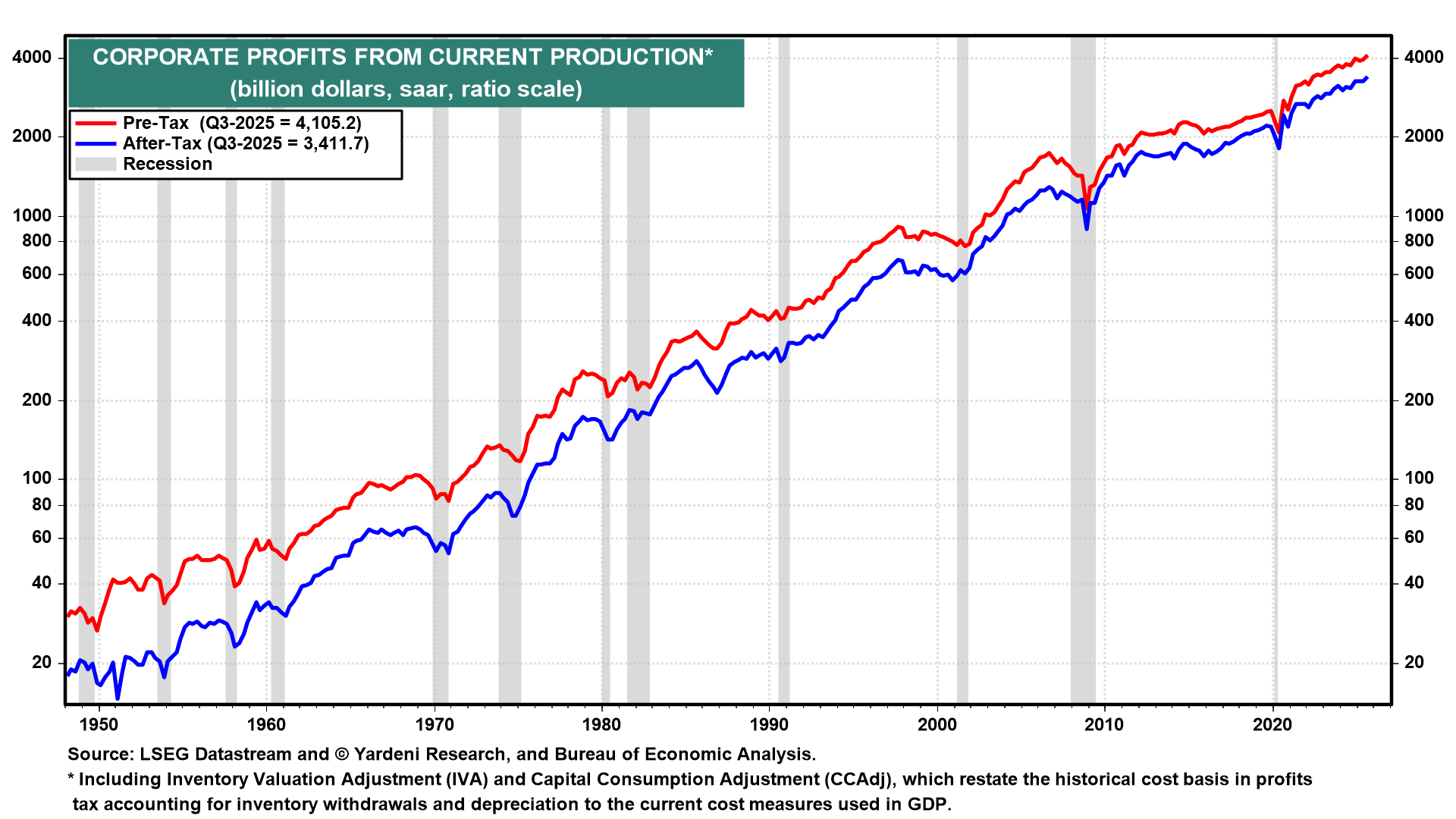

(2) GDP and profits. Demand is certainly booming, given that real GDP jumped 3.8% (saar) during Q2-2025 and 4.4% during Q3-2025. The Atlanta Fed's GDPNow model shows that real GDP is tracking at 5.4% during Q4-2025. Corporate profits has been rising to record highs along with GDP (chart). Corporate cash flow is also at a record high despite the boom in capital spending, which is fueled by rising profits.

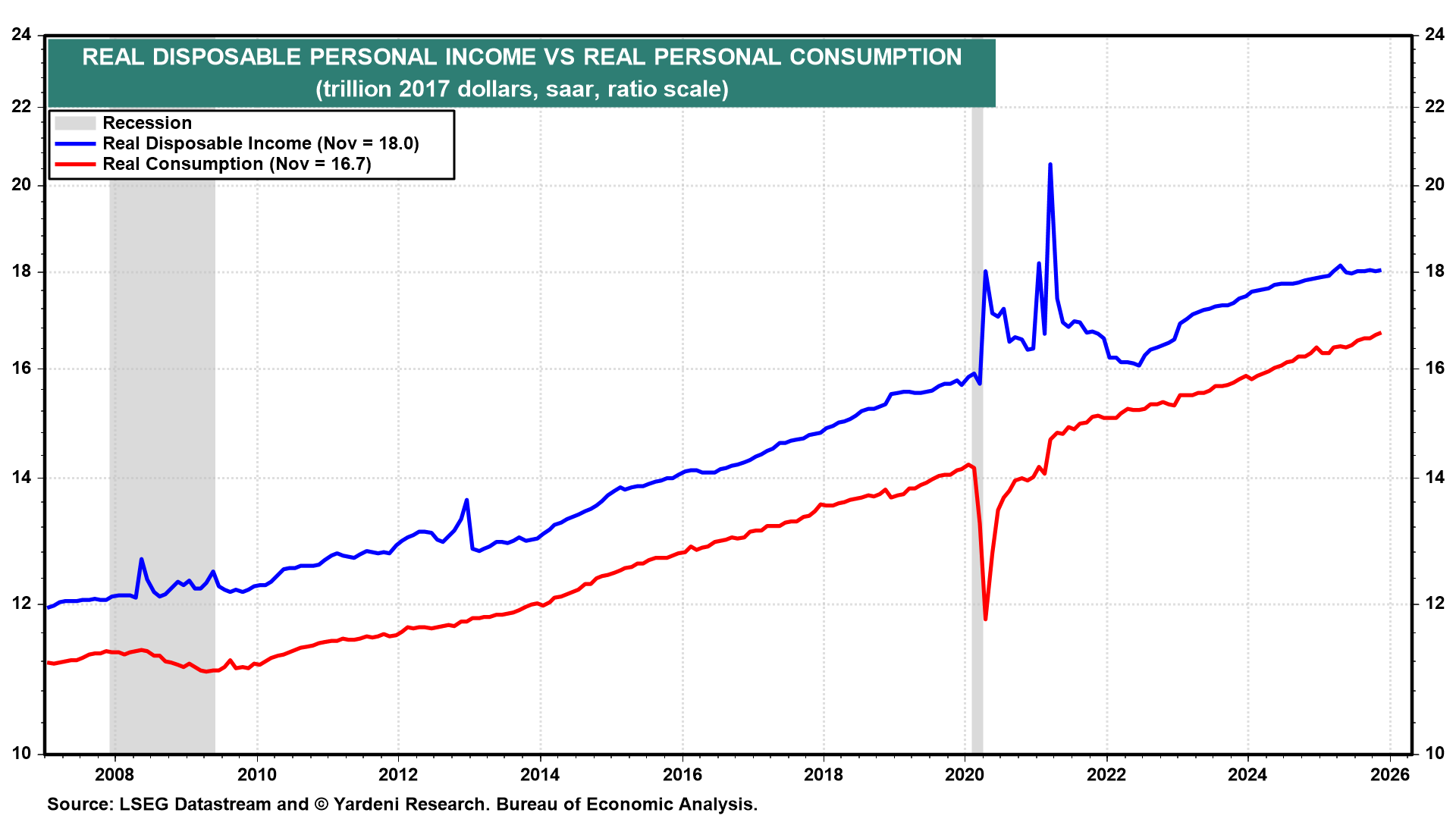

(3) Consumer income, spending, and saving. The nattering nabobs of negativity have recently noted that real disposable personal income was mostly flat last year, reflecting weakness in payroll employment and real wages (chart). They warn that this will force consumers to retrench. They are ignoring the fact that Baby Boomers, who tend to be highly paid because of their experience, are retiring. That's flattening disposable income.

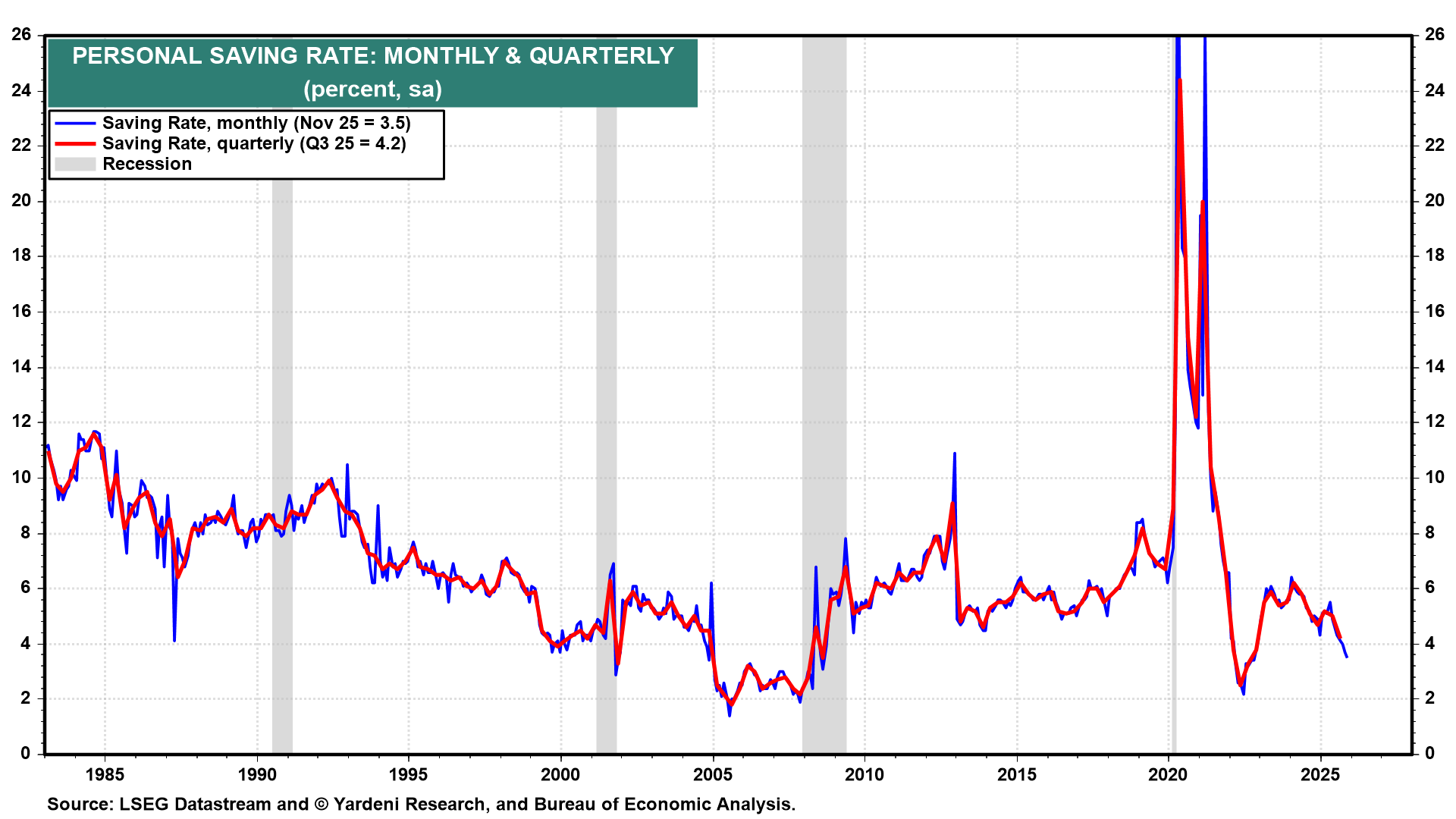

Retired Baby Boomers without earned income are still spending apace. The generation has more than $85 trillion in net worth. They are spending it down in retirement. As a result, the personal saving rate is falling and could turn negative over the next few years (chart)!

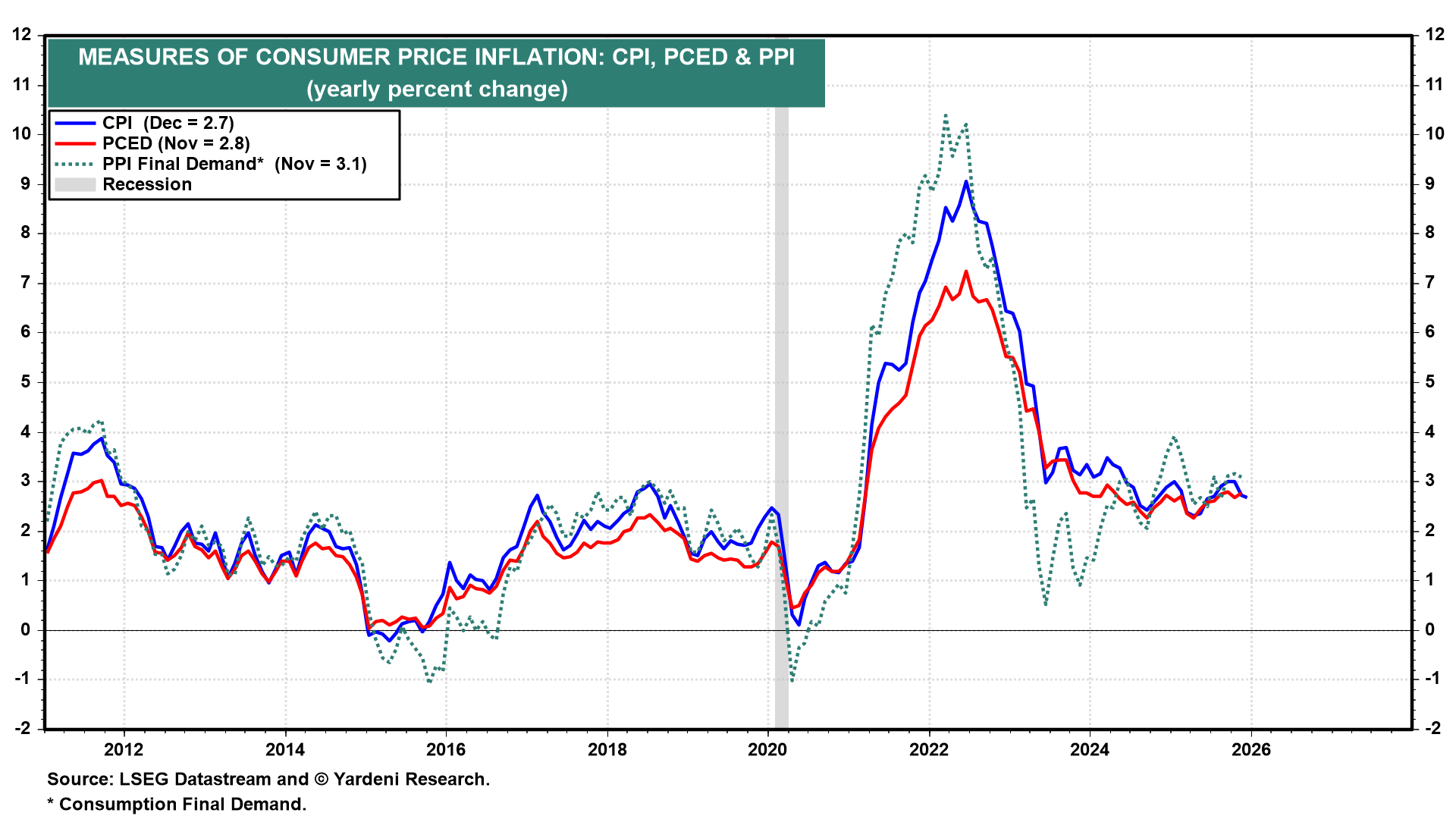

(4) Inflation. Inflation seems to be stuck around 3.0% y/y (chart). We still think that strong productivity growth this year will lower inflation to 2.0% y/y this year.

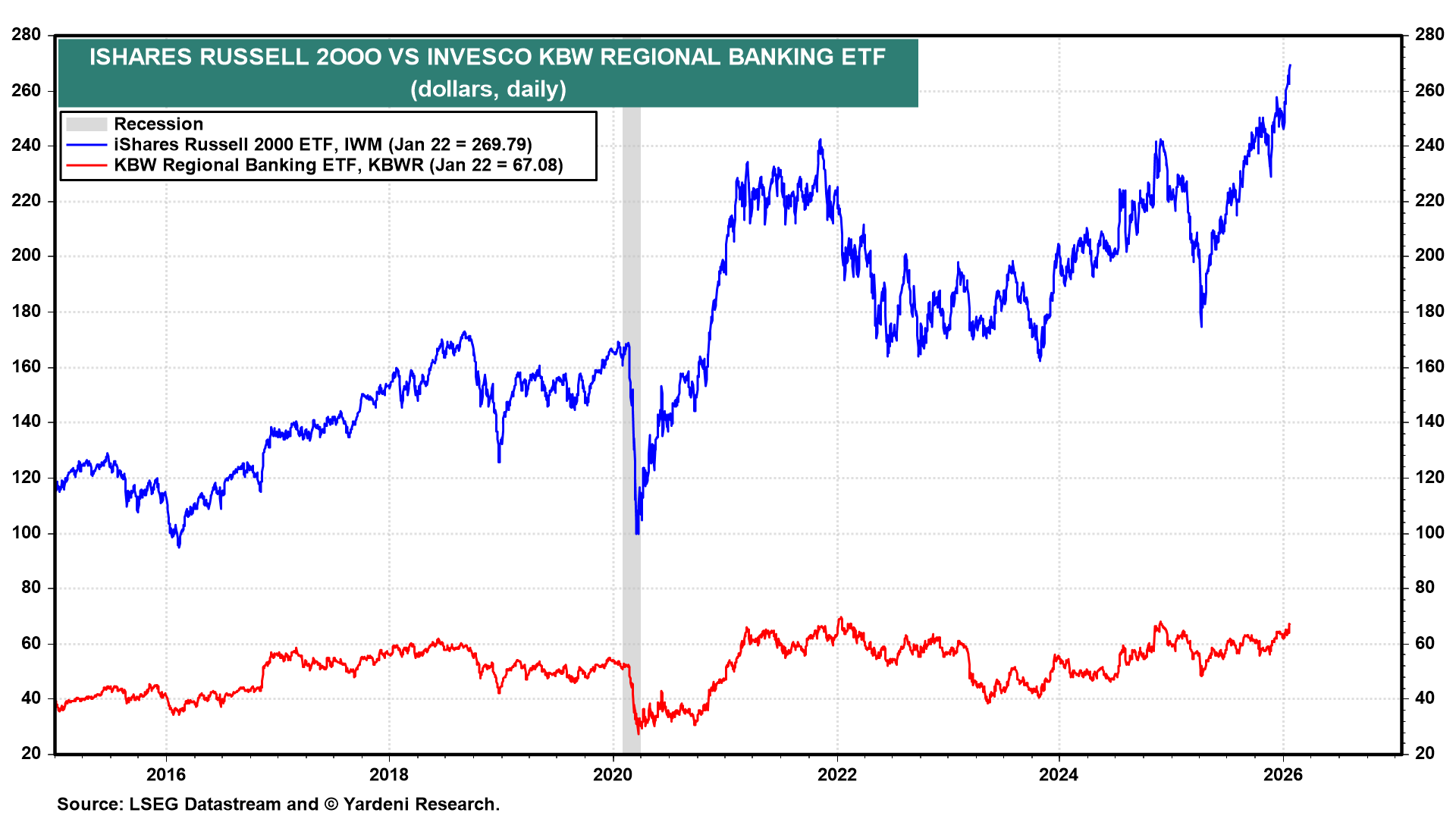

(5) Broadening bull market. The Russell 2000 is soaring to record highs (chart). Investors are increasingly betting on more M&A activity in the banking and biotech industries.

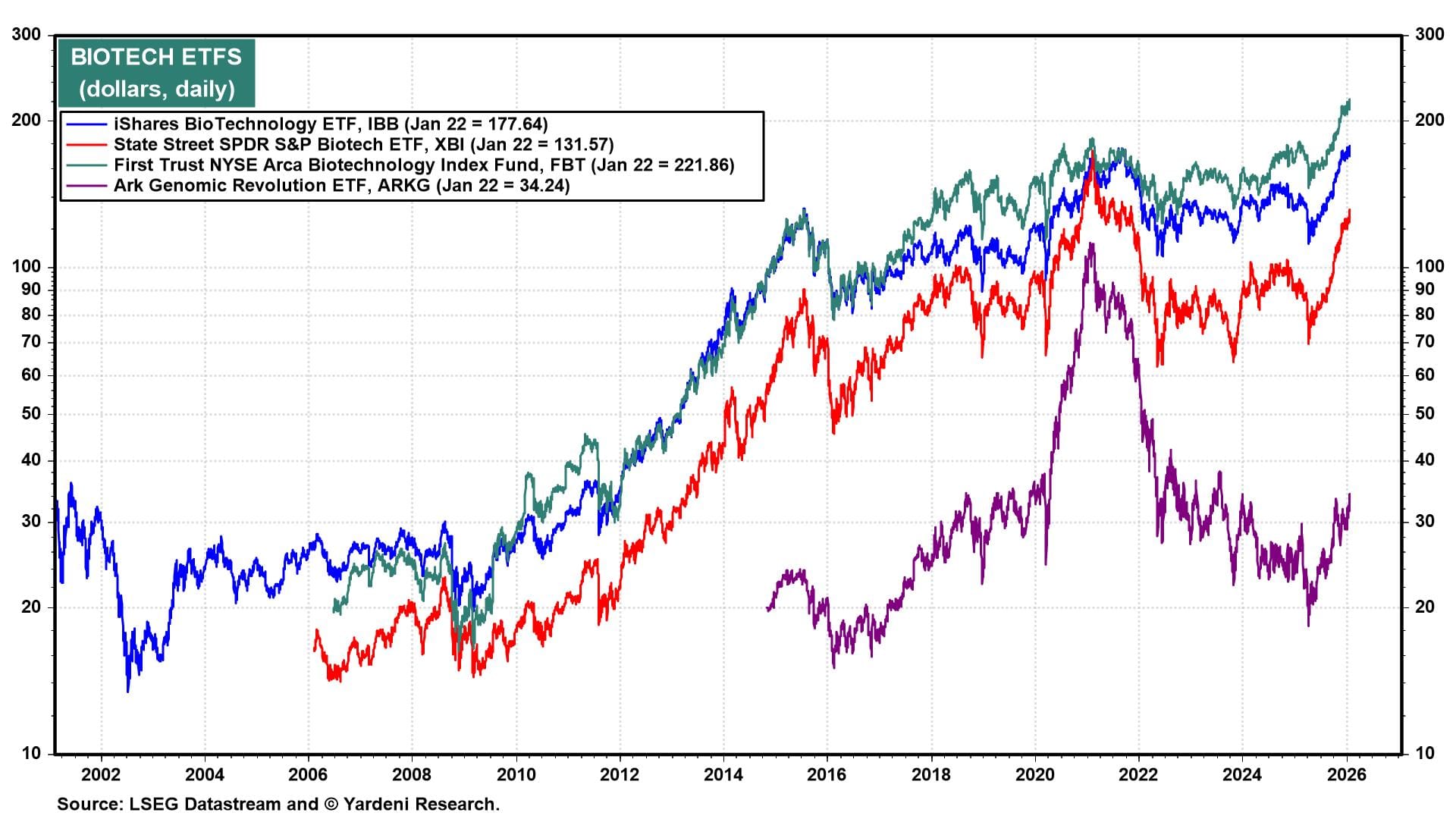

Biotech stocks are anticipating more takeovers as large pharmaceutical companies scramble to fill their pipelines with new drugs (chart).

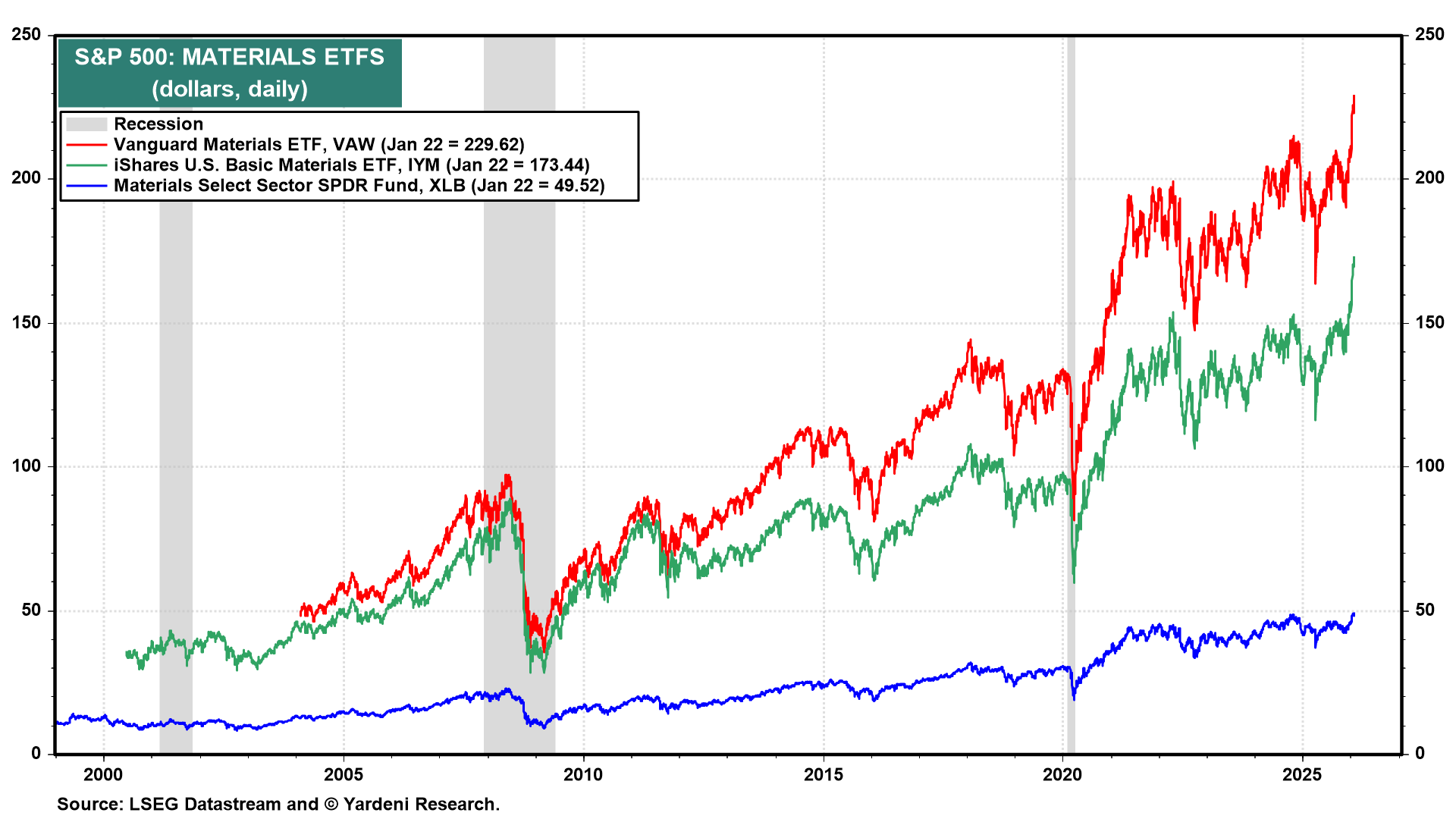

The materials sector of the stock market is following the lead of soaring prices for precious metals, base metals, and rare-earth minerals (chart). All these materials are important in the production of semiconductors and defense equipment.

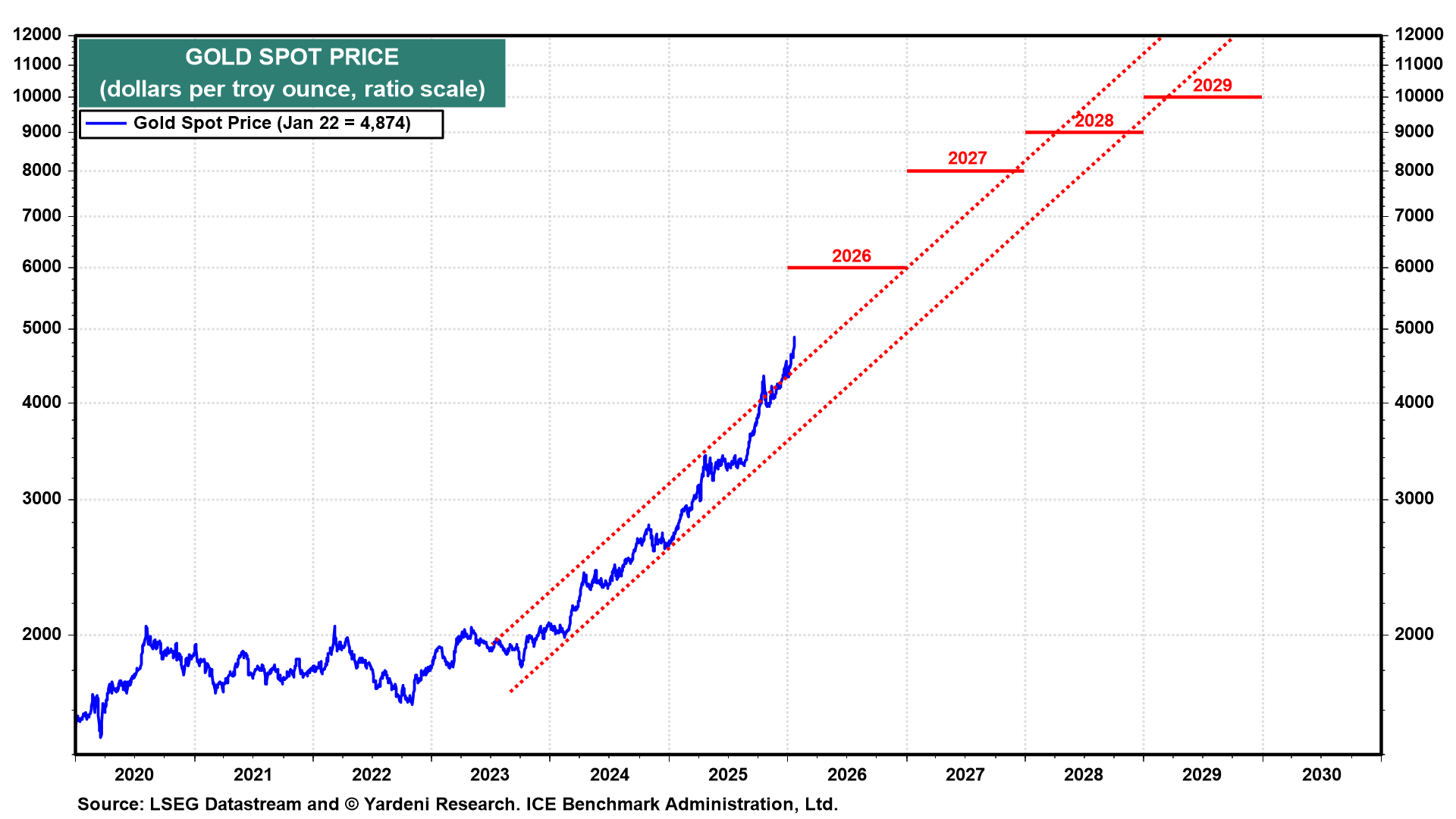

The rally in precious metals shows no signs of slowing. When the price of gold rose above our $4,000 per ounce target at the end of last year, we raised our 2026 year-end target from $5,000 to $6,000 (chart). Tonight, it is within striking distance of $5,000!

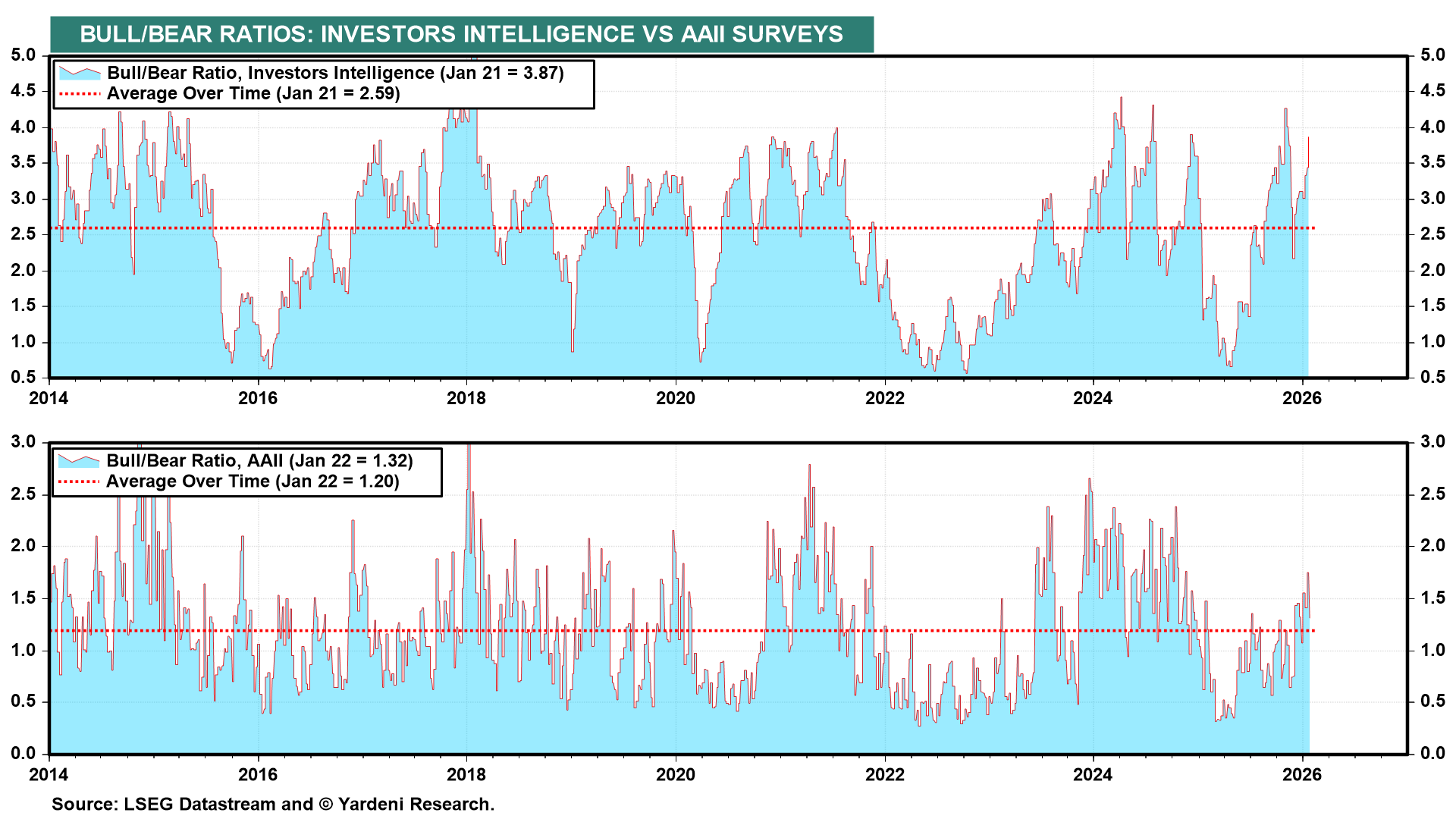

(6) Sentiment. So we have nothing to fear but nothing to fear (other than Greenland and other geopolitical risks). The Bull/Bear ratios suggest that too much good news is boosting bullishness, which may be bearish from a contrarian perspective (chart). Then again, we might have to raise our 20% subjective odds of a meltup/meltdown scenario. Stay tuned.